Boosting Capital Market Cooperation: Pakistan, Sri Lanka, And Bangladesh Collaborate

Table of Contents

Strengthening Regional Investment Flows

Currently, investment flows between Pakistan, Sri Lanka, and Bangladesh remain relatively limited. Several obstacles hinder greater cross-border investment, including:

- Regulatory Differences: Variations in investment regulations, corporate laws, and tax policies create complexities and uncertainties for investors.

- Political Risks: Political instability and security concerns in certain regions can deter foreign investors.

- Lack of Information: Insufficient information on investment opportunities and market conditions in each country hinders informed decision-making.

To facilitate cross-border investments, several measures are crucial:

- Establishing a regional investment promotion agency: A dedicated agency could actively promote investment opportunities and provide support to investors.

- Harmonizing investment regulations and procedures: Standardizing regulations would simplify the investment process and reduce uncertainties.

- Improving information sharing and transparency: Creating a centralized platform for information on investment opportunities, market data, and regulatory frameworks would improve investor confidence.

- Promoting investor confidence through policy stability: Consistent and predictable policies are essential to attract long-term investment.

Developing a Unified Securities Market

The creation of a unified or integrated securities market across Pakistan, Sri Lanka, and Bangladesh holds immense potential. A unified market would offer several benefits:

- Increased Liquidity: A larger pool of investors would lead to improved liquidity, making it easier to buy and sell securities.

- Reduced Transaction Costs: Streamlined trading processes would lower transaction costs for investors.

- Diversification Opportunities: Investors would have access to a wider range of investment options, allowing for greater portfolio diversification.

However, integrating these markets presents challenges:

- Differences in trading platforms, clearing and settlement systems, and regulatory frameworks: Harmonizing these disparate systems will be crucial.

Steps towards market integration include:

- Developing a common regulatory framework: A harmonized regulatory environment will ensure fair and efficient market operations.

- Creating a regional stock exchange or a linked trading platform: This would facilitate cross-border trading and enhance market liquidity.

- Harmonizing accounting standards and disclosure requirements: Consistent standards would improve transparency and comparability of financial information.

- Implementing robust investor protection measures: Strong investor protection mechanisms are crucial to build trust and confidence in the integrated market.

Enhancing Regulatory Cooperation and Harmonization

Regulatory cooperation is pivotal for fostering capital market development. Establishing consistent regulatory standards across Pakistan, Sri Lanka, and Bangladesh is crucial for:

- Preventing Market Abuse: Collaborative regulatory oversight can effectively combat market manipulation and fraud.

- Promoting Investor Confidence: Consistent regulations and transparency build confidence among both domestic and international investors.

Mechanisms for enhanced regulatory cooperation include:

- Regular meetings and dialogue between regulatory bodies: Facilitating information exchange and joint problem-solving.

- Joint technical assistance programs: Sharing expertise and best practices to strengthen regulatory capacity.

- Development of common regulatory guidelines and best practices: Establishing a common set of rules and standards for market operations.

- Establishing a regional regulatory forum: A dedicated forum would provide a platform for regular discussions and collaboration on regulatory matters.

Leveraging Technology for Capital Market Advancement

Technology plays a crucial role in modernizing and integrating capital markets. Fintech solutions can significantly improve efficiency, transparency, and accessibility:

- Blockchain for securities settlement: Blockchain technology can streamline settlement processes, reducing costs and improving efficiency.

- Artificial Intelligence (AI) for fraud detection: AI-powered systems can help identify and prevent fraudulent activities, enhancing market integrity.

However, realizing the full potential of technology requires:

- Development of robust digital infrastructure: Reliable and secure digital infrastructure is fundamental for the adoption of fintech solutions.

The Future of Capital Market Cooperation in South Asia

Enhanced capital market cooperation among Pakistan, Sri Lanka, and Bangladesh offers significant potential for economic growth and regional integration. Addressing the challenges outlined above – through harmonized regulations, improved information sharing, and leveraging technological advancements – is essential. The creation of a unified securities market and strengthened investment flows will attract FDI, stimulate economic activity, and improve the lives of citizens. We urge policymakers, regulators, and market participants to actively pursue initiatives that strengthen capital market cooperation, leading to enhancing capital market integration and ultimately boosting regional capital markets, resulting in stronger and more integrated regional economies. The future of South Asia's prosperity hinges on seizing this opportunity.

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025 -

Chief Justice Roberts Account Of Being Mistaken For John Boehner

May 10, 2025

Chief Justice Roberts Account Of Being Mistaken For John Boehner

May 10, 2025 -

Is Trumps Transgender Military Ban Fair An Objective Analysis

May 10, 2025

Is Trumps Transgender Military Ban Fair An Objective Analysis

May 10, 2025 -

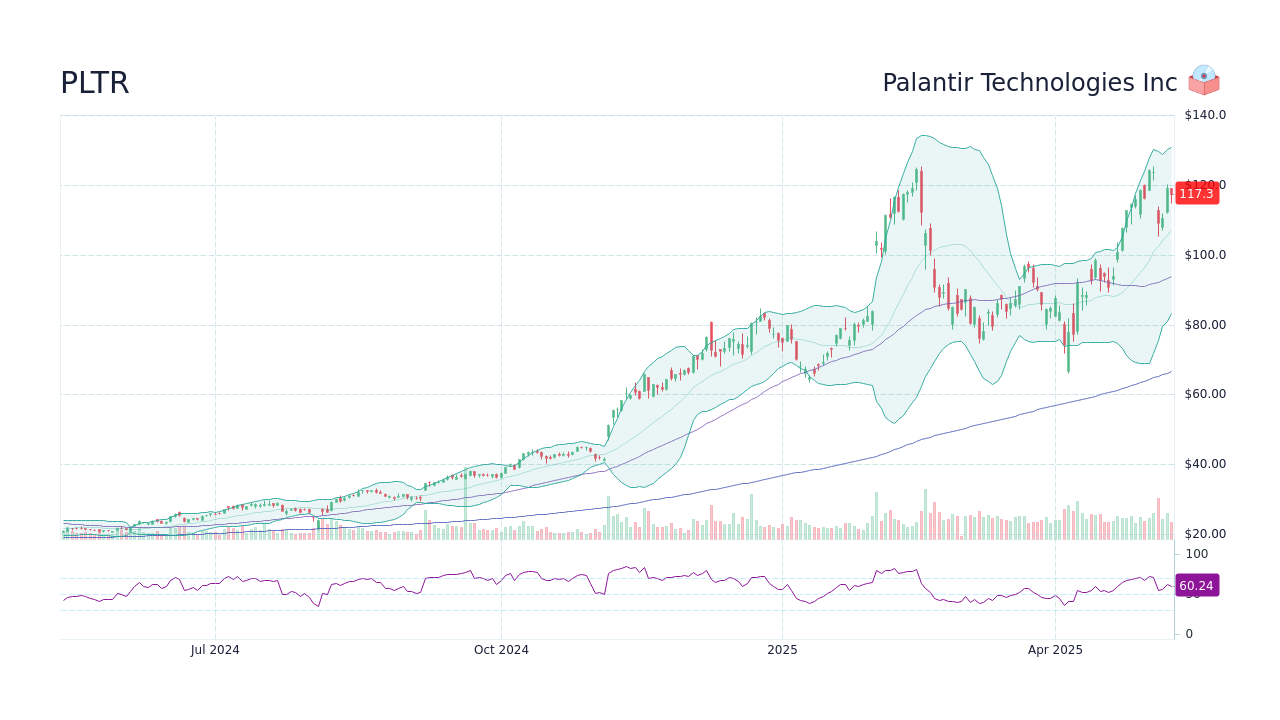

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Opinions

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Opinions

May 10, 2025 -

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Made

May 10, 2025

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Made

May 10, 2025