Boosting Capital Market Cooperation: Pakistan, Sri Lanka, And Bangladesh Join Forces

Table of Contents

Shared Investment Opportunities and Reduced Risks

Increased capital market cooperation between Pakistan, Sri Lanka, and Bangladesh creates a larger, more diverse investment landscape, offering significant benefits to both domestic and international investors.

Diversification of Investment Portfolios

Access to a wider range of investment options across these three nations significantly reduces risk for investors. This diversification is crucial for mitigating losses associated with volatility in any single market.

- Reduced dependence on domestic markets: Investors are no longer limited to the opportunities within their own country. This reduces vulnerability to domestic economic shocks.

- Exposure to different asset classes and growth sectors: The combined economies offer a broader spectrum of investment choices, from established industries to emerging high-growth sectors. This allows for better portfolio construction and risk management.

- Enhanced risk diversification strategies for portfolio managers: Sophisticated investors can now implement more effective diversification strategies, reducing overall portfolio risk while potentially increasing returns.

Attracting Foreign Direct Investment (FDI)

A unified approach to capital market cooperation sends a strong signal to international investors, increasing confidence in the region's stability and growth prospects.

- Increased investor confidence due to regional synergy: The combined strength of three economies presents a more compelling investment proposition than any single nation alone.

- Simplified regulatory frameworks and streamlined processes: Harmonized regulations and procedures ease the process for foreign investors to enter and operate within the region. This reduces bureaucratic hurdles and increases efficiency.

- Opportunities for cross-border mergers and acquisitions: Greater integration facilitates cross-border transactions, allowing companies to expand their operations and access new markets.

Strengthening Regional Financial Stability

Enhanced capital market cooperation plays a vital role in building a more resilient and stable financial system across Pakistan, Sri Lanka, and Bangladesh.

Improved Regulatory Harmonization

Collaborative efforts to harmonize regulatory frameworks are essential for protecting investors and maintaining market integrity.

- Standardization of accounting practices and reporting standards: Consistent accounting standards improve transparency and comparability of financial information, building investor trust.

- Increased cooperation in combating financial crime and market manipulation: Joint efforts to combat illicit activities bolster investor confidence and ensure fair market practices.

- Development of a shared framework for dispute resolution: A consistent and efficient dispute resolution mechanism is vital for protecting investor rights and maintaining market stability.

Enhanced Liquidity and Depth of Markets

Greater integration leads to more efficient capital allocation, benefiting businesses and investors alike.

- Increased trading volume and improved price discovery: Larger, more integrated markets generally exhibit higher trading volumes, resulting in more accurate price discovery.

- Lower transaction costs for investors: Economies of scale and streamlined processes reduce trading costs for investors.

- Attracting a broader range of market participants: A more liquid and deeper market attracts a wider array of investors, including institutional investors, further deepening market liquidity.

Promoting Regional Economic Integration

Capital market cooperation is a key driver of broader regional economic integration, facilitating trade, fostering knowledge sharing, and stimulating overall growth.

Increased Trade and Commerce

Closer ties between the capital markets directly support the expansion of trade and commerce among the three nations.

- Streamlined payment systems and reduced transaction costs: Facilitated cross-border payments reduce transaction costs and enhance the efficiency of trade flows.

- Increased trade financing options for businesses: Access to a wider range of financing options facilitates cross-border trade and investment.

- Support for regional value chains and supply chains: Integration of capital markets strengthens regional value chains by enabling businesses to access capital more easily for expansion and investment in regional supply chains.

Knowledge Sharing and Capacity Building

Collaborative initiatives promote skills development and the adoption of best practices in capital market management.

- Joint training programs for market professionals: Shared training programs enhance the skillset of market professionals across the region.

- Exchange of expertise on market regulation and supervision: Sharing of best practices in market regulation and supervision enhances the effectiveness of regulatory bodies.

- Sharing of best practices in investor education and awareness: Collaborative efforts improve investor education and awareness, leading to more informed investment decisions.

Conclusion

The initiative to boost capital market cooperation among Pakistan, Sri Lanka, and Bangladesh represents a significant step toward regional economic integration. By fostering shared investment opportunities, strengthening regional financial stability, and promoting regional trade, this collaboration unlocks immense potential for economic growth and development. This enhanced capital market cooperation will not only attract greater foreign investment but also deepen domestic markets, leading to a more prosperous future for all three nations. To ensure the continued success of this vital endeavor, sustained commitment and collaborative efforts are crucial in implementing and refining the strategic initiatives focused on boosting capital market cooperation and further strengthening regional economic integration.

Featured Posts

-

Barbashevs Ot Goal Evens Series Knights Beat Wild 4 3

May 09, 2025

Barbashevs Ot Goal Evens Series Knights Beat Wild 4 3

May 09, 2025 -

Edmonton Federal Electoral Boundaries Understanding The Changes And Their Impact

May 09, 2025

Edmonton Federal Electoral Boundaries Understanding The Changes And Their Impact

May 09, 2025 -

Champions League 2024 Rio Ferdinand Excludes Arsenal Names His Top Two

May 09, 2025

Champions League 2024 Rio Ferdinand Excludes Arsenal Names His Top Two

May 09, 2025 -

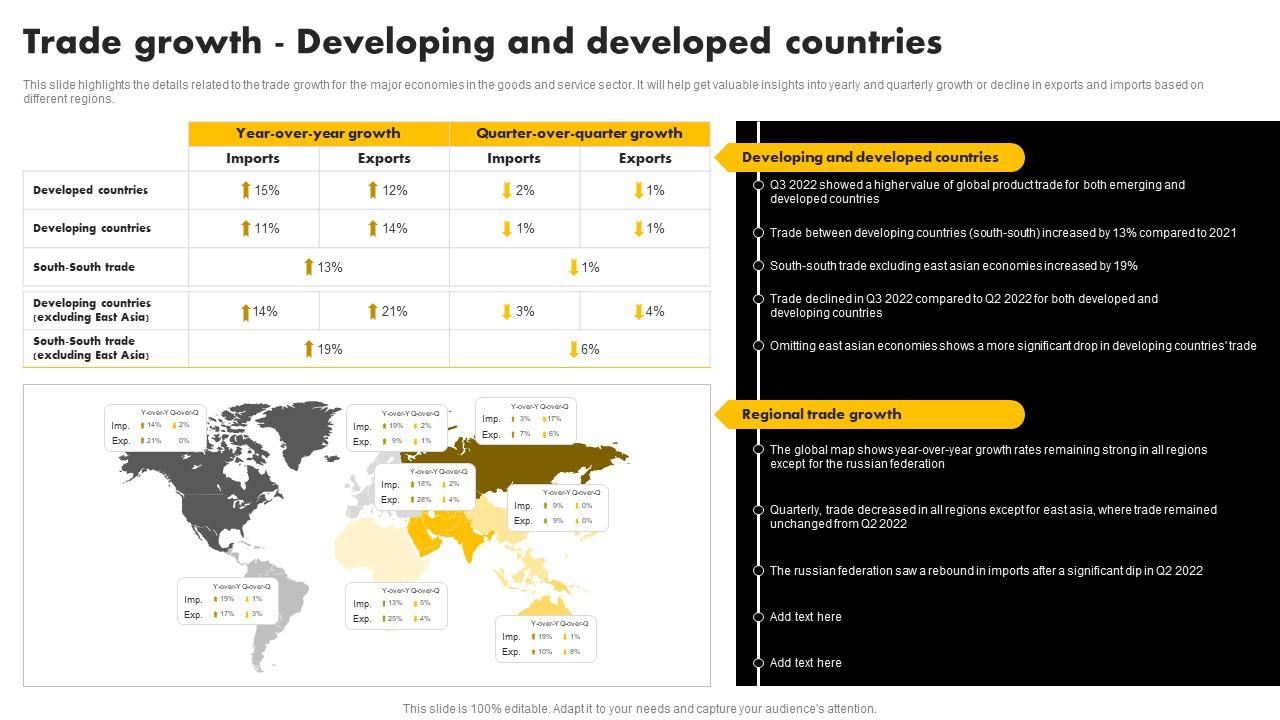

Identifying And Analyzing The Countrys Top Business Growth Areas

May 09, 2025

Identifying And Analyzing The Countrys Top Business Growth Areas

May 09, 2025 -

Understanding The Recent Spike In Bitcoin Mining

May 09, 2025

Understanding The Recent Spike In Bitcoin Mining

May 09, 2025