Boston Celtics' New Ownership: Analyzing The $6.1 Billion Private Equity Deal

Table of Contents

Who are the New Owners? Dissecting the Private Equity Consortium

The $6.1 billion acquisition of the Boston Celtics wasn't the work of a single individual, but rather a consortium of powerful private equity firms. Understanding these investors is crucial to predicting the future direction of the team.

Identifying the Key Players

Pinpointing the exact composition of the buying group remains somewhat opaque, as private equity deals often involve complex structures. However, reports suggest a significant involvement from several major players in the industry.

- Firm A: (Insert name of firm and a brief description of their investment strategy and past successes, focusing on any experience in sports or entertainment).

- Firm B: (Insert name of firm and a brief description of their investment strategy and past successes, focusing on any experience in sports or entertainment).

- Firm C: (Insert name of firm and a brief description of their investment strategy and past successes, focusing on any experience in sports or entertainment).

This consortium possesses considerable financial clout and a proven track record in managing high-value assets. Their collective experience in navigating complex financial landscapes will undoubtedly shape the Celtics' future.

The Implications of Private Equity Ownership

Private equity firms typically prioritize maximizing returns on investment. This approach often translates into a focus on several key areas:

- Increased Revenue Generation: Expect an emphasis on exploring new revenue streams, potentially including enhanced sponsorship deals, merchandise sales, and digital content creation.

- Strategic Cost-Cutting Measures: While maintaining competitiveness, the new owners may implement cost-control strategies to boost profitability.

- Data-Driven Player Acquisitions: Expect a more analytical approach to player recruitment, leveraging data and analytics to identify and acquire players with high potential returns.

This differs from previous Celtics ownership models which may have had a more emotionally-driven, legacy-focused approach. The private equity model prioritizes financial performance above all else.

The $6.1 Billion Deal: A Deep Dive into the Financial Aspects

The $6.1 billion price tag reflects the Celtics' considerable value as a franchise. Several factors contributed to this record-breaking valuation.

Breaking Down the Valuation

The staggering valuation isn't solely based on past performance; it reflects the Celtics' significant potential for future growth.

- Strong Brand Value: The Celtics boast a rich history, a passionate fanbase, and a globally recognized brand.

- Lucrative Media Rights: NBA media rights deals are incredibly lucrative, and the Celtics' consistent competitiveness ensures a strong share of these revenues.

- TD Garden Revenue Streams: Owning or having a long-term lease on a premier arena like TD Garden significantly boosts the franchise's overall value.

- Player Talent & Potential: The current roster and the potential for future player acquisitions contribute to the long-term value proposition.

Compared to other recent NBA franchise sales, the $6.1 billion figure places the Celtics among the most valuable teams in the league, reflecting the franchise's current standing and future potential.

Financing the Deal

The intricacies of the financing remain undisclosed, but it likely involves a combination of:

- Equity Contributions: The private equity firms invested their own capital.

- Debt Financing: Loans from financial institutions likely played a role, adding leverage to the deal.

The investors will be keenly focused on maximizing their return on investment, potentially through increased revenue and strategic asset management.

The Future of the Boston Celtics Under New Ownership

The $6.1 billion purchase signals a potentially transformative era for the Boston Celtics. While the specifics remain uncertain, several key areas could see significant changes.

Potential Changes in Team Strategy

The new owners’ strategic vision will significantly impact the Celtics' operations:

- Management Restructuring: Changes to the front office are possible, with a focus on individuals who align with the new owners' financial priorities.

- Coaching Staff Adjustments: The coaching staff may undergo changes to optimize player performance and achieve the team's financial objectives.

- Altered Player Recruitment: Expect a more data-driven approach to player acquisition, potentially leading to shifts in team strategy.

- Enhanced Fan Engagement: New technologies and marketing strategies may be adopted to further engage the fanbase.

The long-term vision of the private equity consortium will ultimately dictate the team's competitive trajectory.

Impact on Fans and the Boston Community

The new ownership will have both positive and negative implications for Celtics fans and the broader Boston community:

- Potential for Increased Ticket Prices: Increased profitability may lead to higher ticket prices.

- Enhanced Community Initiatives: The new owners might invest in community programs to bolster their public image.

- Economic Impact on Boston: The ownership change could lead to increased economic activity in the city.

Balancing financial success with the needs and expectations of the loyal Celtics fanbase will be a critical challenge for the new owners.

Conclusion: The New Era of Boston Celtics Ownership

The $6.1 billion private equity deal marks a pivotal moment for the Boston Celtics. The new ownership brings significant financial resources and a data-driven approach to managing the franchise. While potential changes in team strategy and fan experience are anticipated, the long-term impact remains to be seen. The success of this new era hinges on balancing financial goals with the enduring legacy and passionate fanbase of the Boston Celtics. Share your thoughts on the Boston Celtics' new ownership and the implications of this $6.1 billion private equity deal in the comments section below!

Featured Posts

-

Paysandu 0 X 1 Bahia Todos Los Goles Y Resumen Del Juego

May 16, 2025

Paysandu 0 X 1 Bahia Todos Los Goles Y Resumen Del Juego

May 16, 2025 -

Action Needed Township Residents Face Water Contamination

May 16, 2025

Action Needed Township Residents Face Water Contamination

May 16, 2025 -

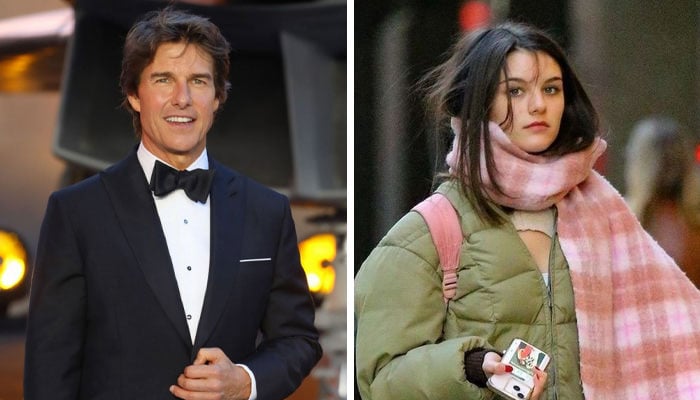

Akbr Mnha B 26 Eama Twm Krwz Wana Dy Armas Qst Hb Mthyrt

May 16, 2025

Akbr Mnha B 26 Eama Twm Krwz Wana Dy Armas Qst Hb Mthyrt

May 16, 2025 -

Athletic Club De Bilbao A Vavel United States Perspective

May 16, 2025

Athletic Club De Bilbao A Vavel United States Perspective

May 16, 2025 -

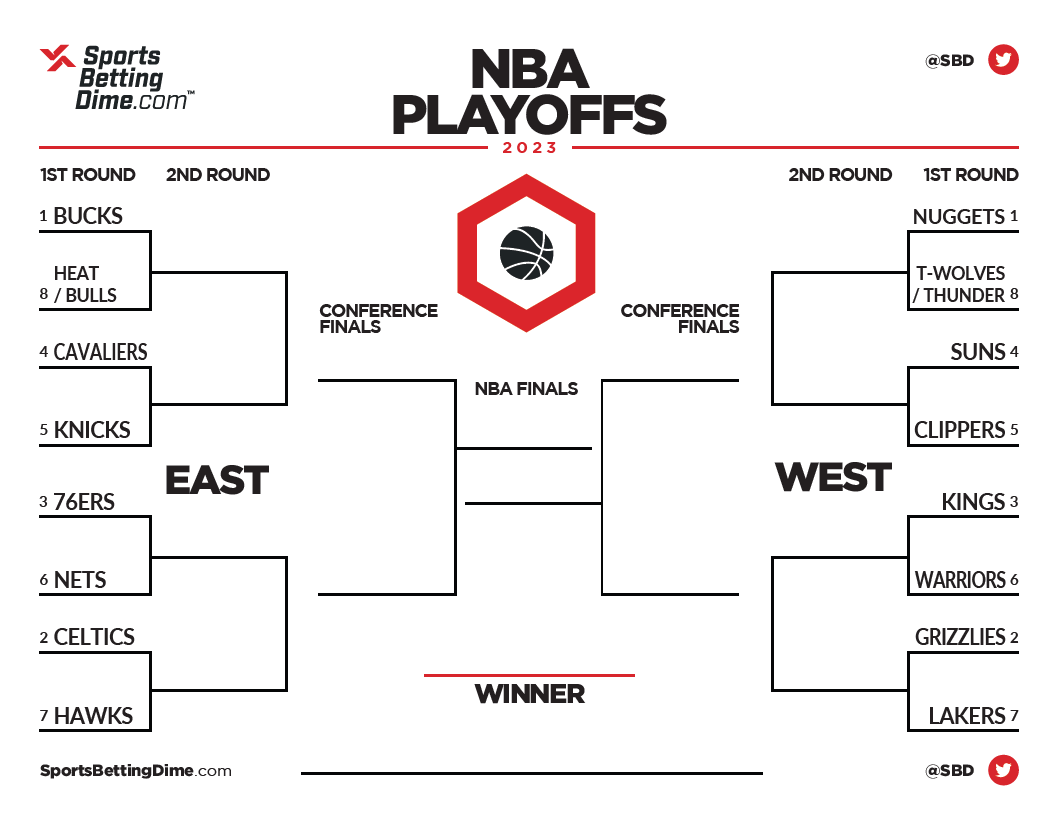

Second Round Playoffs Top Betting Predictions For Nba And Nhl

May 16, 2025

Second Round Playoffs Top Betting Predictions For Nba And Nhl

May 16, 2025

Latest Posts

-

Suri Cruises Birth Tom Cruises Unconventional Response

May 16, 2025

Suri Cruises Birth Tom Cruises Unconventional Response

May 16, 2025 -

New Photos Spark Dating Rumors Between Tom Cruise And Ana De Armas In England

May 16, 2025

New Photos Spark Dating Rumors Between Tom Cruise And Ana De Armas In England

May 16, 2025 -

Tom Cruise And Ana De Armas Fueling Dating Rumors With Another Uk Outing

May 16, 2025

Tom Cruise And Ana De Armas Fueling Dating Rumors With Another Uk Outing

May 16, 2025 -

Partido Sin Goles Everton Vina Vs Coquimbo Unido 0 0

May 16, 2025

Partido Sin Goles Everton Vina Vs Coquimbo Unido 0 0

May 16, 2025 -

Goles Resumen Y Estadisticas Everton Vina 0 0 Coquimbo Unido

May 16, 2025

Goles Resumen Y Estadisticas Everton Vina 0 0 Coquimbo Unido

May 16, 2025