Boston Celtics Ownership Change: Analyzing The $6.1 Billion Private Equity Acquisition

Table of Contents

The Private Equity Firm and its Acquisition Strategy

The $6.1 billion acquisition of the Boston Celtics was orchestrated by [Insert Name of Private Equity Firm Here], a prominent player in the private equity world. While specific details of their investment strategy regarding the Celtics remain undisclosed, their existing portfolio and past acquisitions offer valuable insights. [Insert Name of Private Equity Firm Here] is known for [brief description of their investment strategy and portfolio, highlighting any previous experience with sports franchises or similar high-value acquisitions]. Their motive behind this substantial investment likely involves a combination of factors:

-

Long-term Investment: The Celtics represent a stable, high-value asset with substantial potential for future growth. Private equity firms often seek long-term appreciation, benefiting from increased franchise value over time.

-

Brand Building: The Celtics are a globally recognized brand with a loyal fanbase. This acquisition provides [Insert Name of Private Equity Firm Here] with an opportunity to leverage this strong brand recognition for broader business purposes.

-

Potential for Growth: The firm may see untapped potential within the franchise, aiming to capitalize on opportunities in areas such as marketing, merchandising, and stadium revenue generation.

-

Details on the firm's history and expertise: [Expand on their history, areas of expertise and successful investments.]

-

Specific examples of similar acquisitions: [Provide details and outcome of similar acquisitions.]

-

Financial analysis: [Discuss leveraged buyout strategies employed, projected debt levels, and anticipated return on investment. Include any publicly available information regarding financing methods.]

Impact on the Boston Celtics Franchise

The change in Boston Celtics ownership inevitably brings about potential alterations to various aspects of the franchise. The new owners' influence could extend to:

-

Team Management and Player Acquisitions: While the current management team may remain in place initially, the new owners might eventually exert influence over personnel decisions, impacting player recruitment, coaching strategies, and overall team direction. This could lead to more aggressive pursuit of top-tier talent or a shift in the team’s overall playing style.

-

Ticket Prices, Fan Experience, and Marketing: The $6.1 billion acquisition could lead to changes in ticket pricing, aiming to maximize revenue. However, the new owners' approach to fan engagement and overall game-day experience remains to be seen. Marketing strategies might undergo a significant overhaul, potentially focusing on broader global reach or embracing new digital platforms.

-

Community Involvement and Charitable Initiatives: The new owners' commitment to the Boston community and existing charitable endeavors will be crucial. Maintaining a strong community presence is vital to the long-term success and positive perception of the franchise.

-

Potential changes in team branding and marketing: [Discuss potential rebranding strategies or expansion into new markets.]

-

Expected impact on ticket sales and revenue streams: [Analyze potential price increases and their effect on attendance and overall revenue.]

-

Analysis of the new ownership's commitment to the community: [Discuss their history of community involvement and expectations for their actions in Boston.]

Financial Implications and Market Analysis of the Acquisition

The $6.1 billion price tag for the Boston Celtics is unprecedented in NBA history. This valuation reflects the franchise's robust brand value, consistent profitability, and loyal fanbase. A detailed comparison to other high-profile NBA team sales highlights its significance:

- Comparison to other high-value sports team acquisitions: [Provide comparative data on recent sales of other major sports teams, highlighting what makes the Celtics’ sale unique.]

- Discussion of the Celtics' brand value and profitability: [Analyze the factors contributing to the Celtics’ high valuation, such as revenue streams, brand recognition, and market share.]

- Market trends in sports franchise valuations: [Discuss the overall trend in sports team valuations and how the Celtics' sale fits within that broader context.]

Analyzing the valuation requires considering factors beyond just revenue; the Celtics’ strong brand reputation, consistent playoff appearances, and dedicated fanbase all contributed significantly to the final price. This sale sets a new benchmark for NBA team valuations and may influence future transactions within the league.

Fan Reaction and Future Outlook for the Boston Celtics

The reaction from the Boston Celtics fanbase to the ownership change has been mixed. While some fans express concern about potential changes in team culture or a focus on maximizing profits over on-field success, others view the acquisition as a positive sign, anticipating increased investment in player talent and infrastructure.

- Social media sentiment analysis: [Summarize the prevailing sentiment expressed on social media platforms like Twitter and Facebook regarding the ownership change.]

- Fan forum discussions and opinions: [Provide insights gathered from discussions in online fan forums and communities.]

- Expert predictions on the franchise's future performance: [Share perspectives from sports analysts and experts on the potential impact of the ownership change on the team’s on-field performance.]

Analyzing the fan reaction provides crucial insights into the wider community’s perception of the acquisition. While some apprehension is natural, a proactive communication strategy from the new owners could help alleviate concerns and foster a positive relationship with the dedicated Boston Celtics fanbase.

Conclusion: The Future of the Boston Celtics Under New Ownership

The $6.1 billion private equity acquisition of the Boston Celtics marks a pivotal moment in the franchise’s history. This unprecedented transaction signifies the enormous value of successful NBA franchises and highlights the growing role of private equity in professional sports. While the short-term impact remains to be seen, the long-term implications for the team’s on-field success and overall business operations will heavily depend on the new owner’s approach to management, player acquisition, fan engagement, and community involvement. The future trajectory of the Boston Celtics will be shaped by the decisions made under this new ownership regime. The success or failure of this private equity acquisition will be closely watched by the NBA and the wider sports business world.

We encourage you to share your thoughts and predictions on the Boston Celtics ownership change and the impact of this significant private equity acquisition. What are your expectations for the team's future? Leave your comments below! [Link to relevant articles and resources on the Boston Celtics and private equity acquisitions].

Featured Posts

-

Bobrovskiy Voshel V Top 20 Vratarey N Kh L Po Igram V Pley Off

May 16, 2025

Bobrovskiy Voshel V Top 20 Vratarey N Kh L Po Igram V Pley Off

May 16, 2025 -

Ovechkins 893rd Goal The Pursuit Of Gretzkys Record

May 16, 2025

Ovechkins 893rd Goal The Pursuit Of Gretzkys Record

May 16, 2025 -

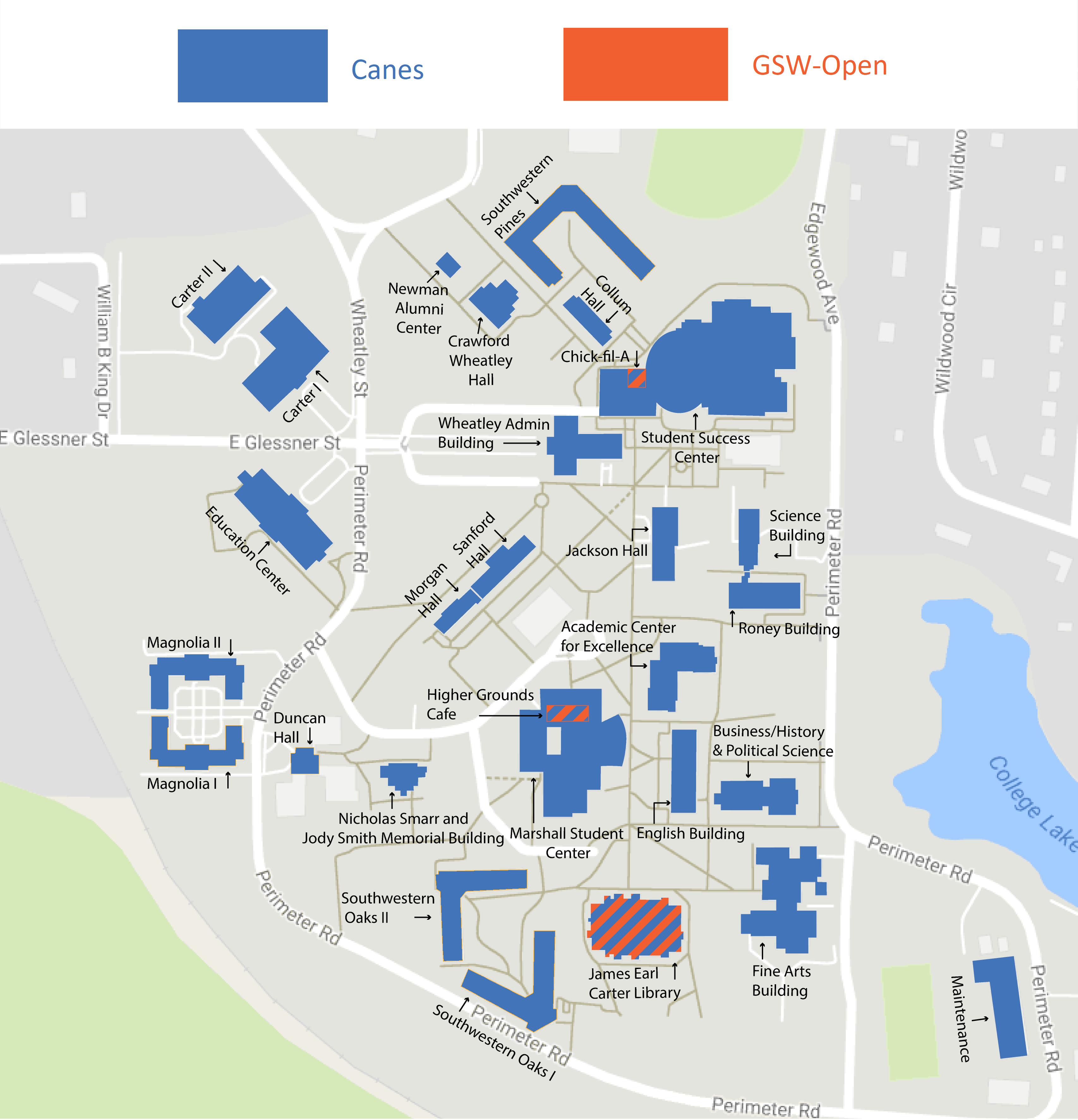

Emergency Lifted Individual In Custody At Gsw Campus

May 16, 2025

Emergency Lifted Individual In Custody At Gsw Campus

May 16, 2025 -

Jimmy Butler Injury Update Pelvic Contusion Clouds Future Games

May 16, 2025

Jimmy Butler Injury Update Pelvic Contusion Clouds Future Games

May 16, 2025 -

Panthers Vs Maple Leafs Game 5 Prediction Picks And Odds For Tonights Nhl Playoffs

May 16, 2025

Panthers Vs Maple Leafs Game 5 Prediction Picks And Odds For Tonights Nhl Playoffs

May 16, 2025

Latest Posts

-

Barcelonas Public Rebuke Of Javier Tebas And La Ligas Actions

May 16, 2025

Barcelonas Public Rebuke Of Javier Tebas And La Ligas Actions

May 16, 2025 -

Global Football And Ai La Ligas Leading Role

May 16, 2025

Global Football And Ai La Ligas Leading Role

May 16, 2025 -

La Liga Live Barcelona Vs Real Betis Where To Watch And Free Streaming Options

May 16, 2025

La Liga Live Barcelona Vs Real Betis Where To Watch And Free Streaming Options

May 16, 2025 -

Sharp Criticism From Barcelona Tebas And La Liga Accused Of Misconduct

May 16, 2025

Sharp Criticism From Barcelona Tebas And La Liga Accused Of Misconduct

May 16, 2025 -

Watch Barcelona Vs Real Betis La Liga Match Live Stream Tv Listings And Kick Off Time

May 16, 2025

Watch Barcelona Vs Real Betis La Liga Match Live Stream Tv Listings And Kick Off Time

May 16, 2025