Boston Celtics Sold For $6.1B: Fans React To Private Equity Ownership

Table of Contents

The $6.1 Billion Sale: A Record-Breaking Deal in the NBA

The $6.1 billion price tag attached to the Boston Celtics sale shatters previous NBA team valuation records, highlighting the immense financial power and potential of the franchise. This surpasses previous sales, solidifying the Celtics' position as one of the most valuable sports teams globally. The previous owners, [insert previous owner names and relevant tenure details], oversaw a period of [mention key achievements during their ownership]. The entrance of private equity into sports ownership is becoming increasingly common, driven by the lucrative nature of professional sports and the potential for significant returns on investment.

- Comparison to other recent NBA team sales: A detailed comparison with recent sales of other NBA teams (e.g., Phoenix Suns, Brooklyn Nets) can illustrate the exceptional nature of this transaction.

- Analysis of the valuation: The high valuation reflects several factors: the Celtics' rich history and consistent success, their passionate and loyal fanbase, their location in a major media market like Boston, and their strong brand recognition. Potential future revenue streams from merchandise, sponsorships, and media rights also play a vital role.

- Future financial implications: The influx of capital from private equity could lead to increased investments in infrastructure improvements, enhanced scouting and player development programs, and a more aggressive approach to free agency.

Private Equity Ownership: What it Means for the Boston Celtics

Private equity firms typically aim for maximizing returns on investment within a specific timeframe. This approach, while potentially beneficial in terms of capital injection, can also raise concerns. The strategies employed often involve cost-cutting measures, increased debt, and a sharper focus on short-term gains, potentially at the expense of long-term team building. How this translates to the Celtics remains to be seen.

- Potential changes in team management: The new owners might bring in new management, potentially leading to changes in team strategy and player acquisitions.

- Impact on ticket prices and fan accessibility: A key concern for fans is the potential increase in ticket prices to improve profitability. This might affect accessibility for many loyal supporters.

- Comparison to other teams under private equity ownership: Examining how other NBA teams under private equity ownership have fared provides valuable context. Analyzing successes and failures can offer insights into potential future scenarios for the Celtics.

Fan Reactions: A Mixed Bag of Emotions

The news of the Boston Celtics sold for $6.1B has generated a wide spectrum of reactions from the passionate fanbase. Social media platforms are awash with opinions, ranging from optimistic anticipation to apprehensive skepticism.

- Positive reactions: Many fans express hope for increased investment in the team, leading to improved player recruitment and a stronger chance of winning championships. The potential for infrastructure upgrades at TD Garden is also a point of optimism.

- Negative reactions: Concerns abound regarding potential ticket price hikes, a shift away from the team's traditional culture, and the prioritization of profit over long-term team building.

- Neutral reactions: A significant portion of the fanbase is adopting a wait-and-see approach, reserving judgment until the new owners' strategies and actions become clearer. Many are keen to observe the new leadership and their approach.

The Future of the Boston Celtics Under New Ownership

The future trajectory of the Boston Celtics under private equity ownership is uncertain but holds both opportunities and challenges. The new owners will need to balance the demands of maximizing profits with the need to maintain the team's competitive edge and cultivate fan loyalty.

- Potential changes in coaching staff or player recruitment: Significant changes in coaching staff or player personnel are possible, depending on the new ownership's vision.

- Focus on short-term versus long-term goals: The emphasis on short-term profitability could potentially lead to a more transactional approach to player acquisitions, potentially neglecting long-term development.

- Opportunities for growth and expansion: The substantial investment could unlock opportunities for the franchise's growth, such as expanding its global brand reach or investing in community initiatives.

The $6.1 Billion Question – What's Next for the Boston Celtics?

The sale of the Boston Celtics for $6.1 billion marks a pivotal moment in the franchise's history. The transition to private equity ownership carries both significant potential and considerable uncertainty. Fan reactions are diverse, reflecting the complex emotions surrounding such a monumental change. The key question remains: will this deal ultimately benefit the team, its players, and its loyal fanbase, or will it prioritize short-term profits over long-term success? Share your thoughts and predictions on the future of the Boston Celtics under new ownership! What are your expectations regarding the "Boston Celtics sale," the impact of "Celtics private equity," and the overall "future of the Boston Celtics"? Let the discussion begin in the comments below!

Featured Posts

-

Student Loan Debt Understanding The Governments Intensified Collection Efforts

May 17, 2025

Student Loan Debt Understanding The Governments Intensified Collection Efforts

May 17, 2025 -

Isabt Stylr Thdyth Wtathyrha Ela Shtwtjart Qbl Alnhayy

May 17, 2025

Isabt Stylr Thdyth Wtathyrha Ela Shtwtjart Qbl Alnhayy

May 17, 2025 -

Everton Vina Coquimbo Unido Reporte Del Encuentro 0 0

May 17, 2025

Everton Vina Coquimbo Unido Reporte Del Encuentro 0 0

May 17, 2025 -

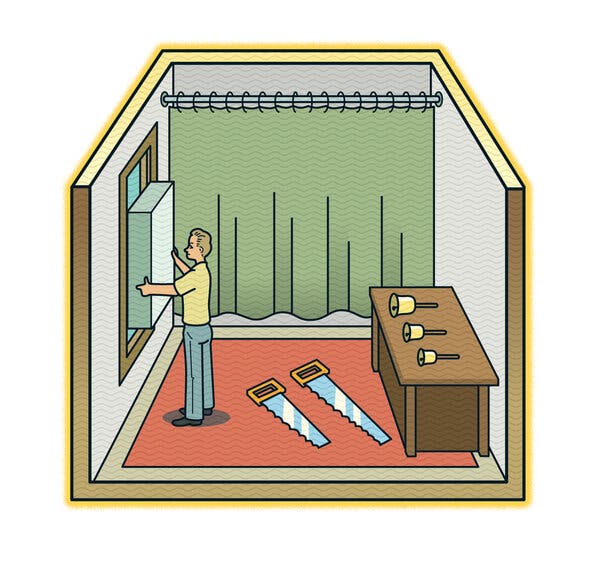

Securing Silence Tokyo Real Estates Focus On Soundproofing And Tranquility

May 17, 2025

Securing Silence Tokyo Real Estates Focus On Soundproofing And Tranquility

May 17, 2025 -

Tvs Jupiter Cng R1 Km

May 17, 2025

Tvs Jupiter Cng R1 Km

May 17, 2025

Mob Land Premiere Photos Of Pregnant Cassie Ventura And Alex Fine

Mob Land Premiere Photos Of Pregnant Cassie Ventura And Alex Fine

Cassie And Alex Fines Red Carpet Appearance Photos From The Mob Land Premiere

Cassie And Alex Fines Red Carpet Appearance Photos From The Mob Land Premiere

Pregnant Cassie Ventura And Alex Fines Red Carpet Debut At Mob Land Premiere

Pregnant Cassie Ventura And Alex Fines Red Carpet Debut At Mob Land Premiere