BP CEO Pay Cut: A 31% Decrease In Executive Compensation

Table of Contents

The Details of the BP CEO Pay Cut

The Magnitude of the Reduction

The 31% decrease in Bernard Looney's compensation represents a significant reduction in executive pay. While the exact figures fluctuate depending on performance-based bonuses and stock options, the cut is substantial. For instance, let's assume Looney's total compensation in the previous year was $10 million (this is a hypothetical figure for illustrative purposes). A 31% reduction would bring his current year's compensation down to approximately $6.9 million. This hypothetical example highlights the magnitude of the pay cut and its considerable impact on his overall earnings.

- Previous Year's Compensation (Hypothetical): $10 million (including salary, bonuses, and stock options)

- Current Year's Compensation (Hypothetical): $6.9 million (following the 31% reduction)

- Salary: (Specific figures would be added here, referencing official BP reports)

- Bonuses: (Specific figures would be added here, referencing official BP reports)

- Stock Options: (Specific figures would be added here, referencing official BP reports)

- Comparison to Other Oil Company CEOs: (Data comparing Looney’s compensation to other CEOs in similar roles would be included here. Sources should be cited.)

Reasons Behind the BP CEO Pay Cut

Pressure from Shareholders

Growing concerns about executive pay, particularly within the oil and gas sector, have led to increased shareholder activism. Shareholders are increasingly demanding greater transparency and accountability regarding executive compensation, arguing that it should be more closely aligned with company performance and broader societal interests.

- Shareholder Groups Involved: (Specific names of shareholder advocacy groups and their involvement should be detailed here with cited sources.)

- Resolutions/Votes: (Details on any specific shareholder resolutions or votes related to executive pay at BP should be included, along with citations.)

- Impact of Negative Public Opinion: Negative press surrounding high executive pay in the face of climate change concerns and fluctuating energy prices can significantly impact shareholder value.

Impact of the Energy Transition

BP's ambitious strategic shift toward renewable energy sources and its commitment to reducing its carbon footprint have significantly influenced the company's financial performance and, consequently, executive compensation decisions. The transition to a lower-carbon future requires significant investments and can impact short-term profitability.

- BP's Investments in Renewables: (Specific examples of BP's renewable energy projects and investments should be included.)

- Financial Performance: (An analysis of BP's financial performance in relation to the energy transition should be given. This may show a correlation between reduced profitability and the CEO pay cut.)

- Link Between Performance and Pay: The decision to reduce the CEO’s pay may reflect a move to align executive compensation more closely with the current financial realities of the energy transition.

Implications of the BP CEO Pay Cut

Setting a Precedent

The 31% BP CEO pay cut could potentially set a precedent for other oil and gas companies and even corporations in other sectors. This action might encourage increased shareholder activism and a renewed focus on corporate governance.

- Reactions from Other Companies: (Reactions from other oil and gas company CEOs and boards should be documented here, citing relevant sources.)

- Increased Shareholder Activism: This could lead to more pressure on boards to reconsider executive compensation packages.

- Future Executive Compensation Trends: The move could influence future trends in executive pay, potentially leading to more moderate increases or even reductions in compensation.

Impact on Employee Morale and Public Perception

The impact of this decision extends beyond the CEO. It could affect employee morale, potentially boosting it if seen as fair and responsible, or negatively if perceived as unfair or signaling financial instability. Public perception is also crucial.

- Potential Impacts on Employee Morale: (A discussion of the potential positive and negative effects on employee morale is needed.)

- Improvements in Public Image: This act of corporate responsibility could enhance BP's image and improve its brand reputation.

- Attracting and Retaining Talent: A perceived commitment to fairness and responsibility may positively influence the company's ability to attract and retain top talent.

Conclusion

The 31% BP CEO pay cut is a significant development, reflecting the increasing pressure on energy companies to address concerns about executive compensation and demonstrate corporate responsibility in a changing energy landscape. The decision is driven by a confluence of factors, including shareholder activism, the challenging energy transition, and the need to enhance public perception. Its implications could be far-reaching, potentially influencing future executive compensation practices across various industries.

Call to Action: Stay informed about the ongoing developments in BP CEO pay and the wider conversation regarding executive compensation in the energy sector. Follow us for further updates on BP executive compensation, corporate responsibility initiatives, and other related news.

Featured Posts

-

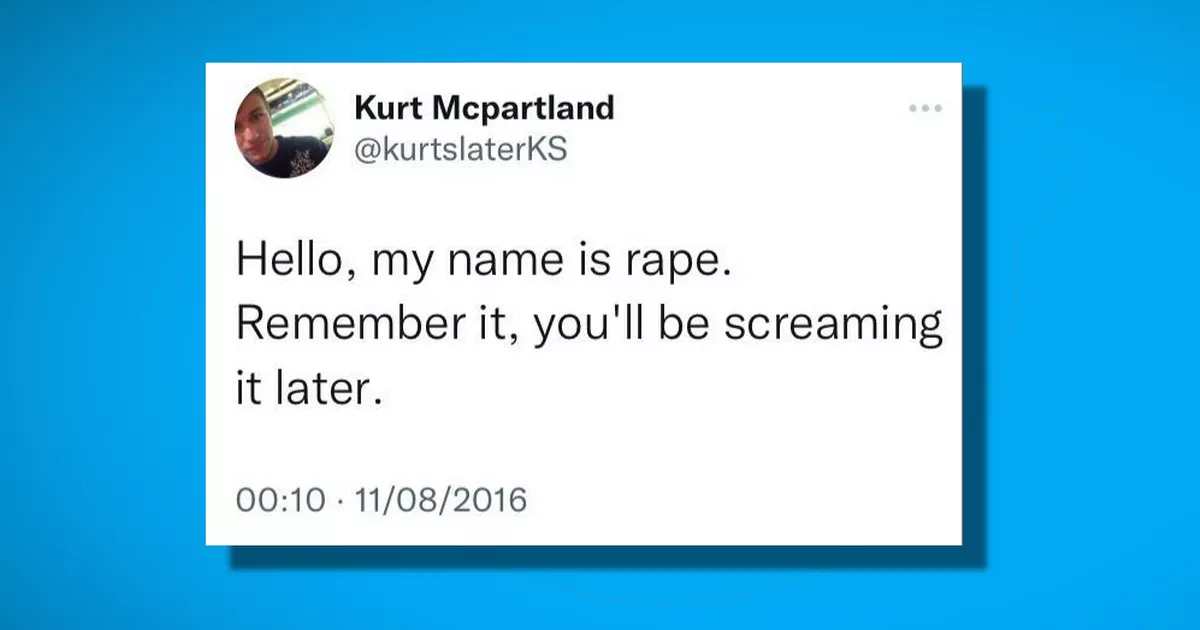

Sentence Appeal Following Racial Hatred Tweet By Ex Tory Councillors Wife

May 22, 2025

Sentence Appeal Following Racial Hatred Tweet By Ex Tory Councillors Wife

May 22, 2025 -

The Goldbergs Complete Guide To Characters Episodes And More

May 22, 2025

The Goldbergs Complete Guide To Characters Episodes And More

May 22, 2025 -

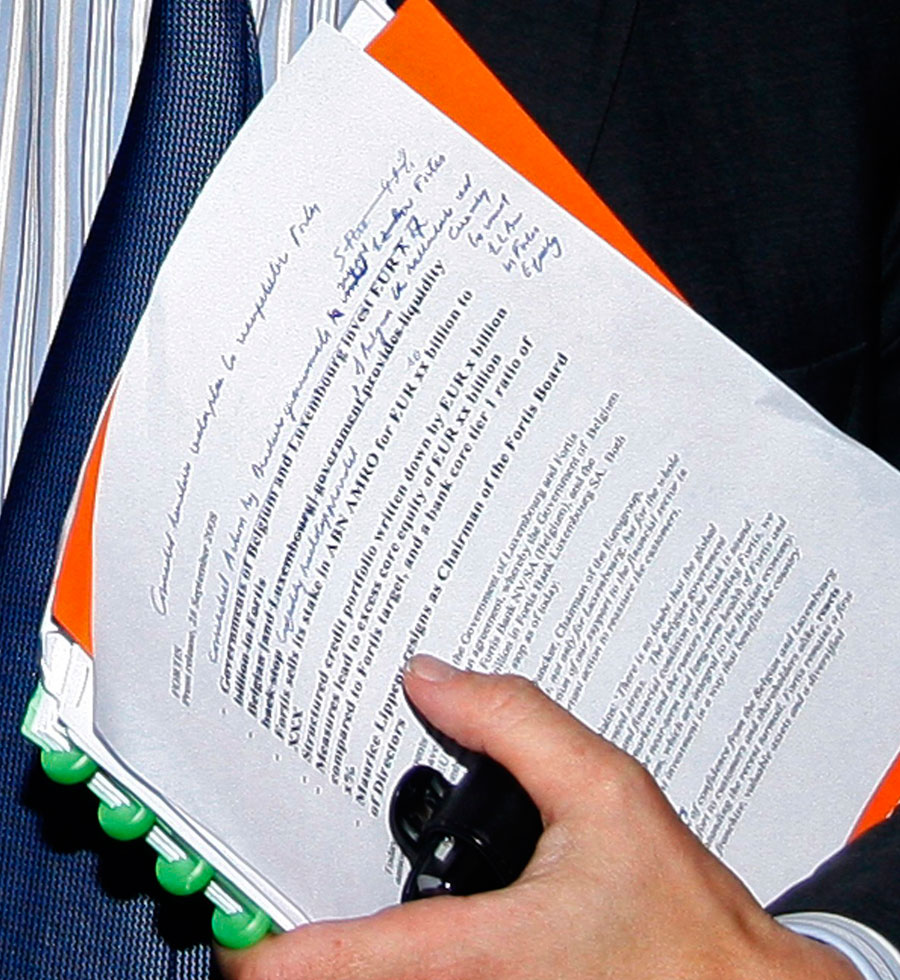

Pivdenniy Mist Aktualna Informatsiya Pro Remont Ta Zalucheni Koshti

May 22, 2025

Pivdenniy Mist Aktualna Informatsiya Pro Remont Ta Zalucheni Koshti

May 22, 2025 -

Foul Mouthed Rant Pub Landladys Response To Employees Notice

May 22, 2025

Foul Mouthed Rant Pub Landladys Response To Employees Notice

May 22, 2025 -

Nederlandse Huizenmarkt Is De Kritiek Van Geen Stijl Op Abn Amro Terecht

May 22, 2025

Nederlandse Huizenmarkt Is De Kritiek Van Geen Stijl Op Abn Amro Terecht

May 22, 2025

Latest Posts

-

Analyse Abn Amro Heffingen Treffen Voedselexport Naar Verenigde Staten

May 22, 2025

Analyse Abn Amro Heffingen Treffen Voedselexport Naar Verenigde Staten

May 22, 2025 -

Stijgende Occasionverkoop Bij Abn Amro Analyse Van De Groei

May 22, 2025

Stijgende Occasionverkoop Bij Abn Amro Analyse Van De Groei

May 22, 2025 -

Groeiende Autobezit Drijft Occasionverkoop Abn Amro Omhoog

May 22, 2025

Groeiende Autobezit Drijft Occasionverkoop Abn Amro Omhoog

May 22, 2025 -

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 22, 2025

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 22, 2025 -

Abn Amro Ziet Occasionverkoop Explosief Stijgen Analyse Van De Groeiende Automarkt

May 22, 2025

Abn Amro Ziet Occasionverkoop Explosief Stijgen Analyse Van De Groeiende Automarkt

May 22, 2025