BP Chief Executive's Pay Drops By 31 Percent

Table of Contents

The Extent of the Pay Cut and its Financial Details

Bernard Looney's Previous Compensation

Before the reduction, Bernard Looney's total compensation package was substantial. In [Insert Year], his total compensation reportedly reached [Insert precise figure], including a base salary of [Insert precise figure], significant bonuses totaling [Insert precise figure], and substantial long-term incentive payments primarily through stock options valued at [Insert precise figure]. This placed him amongst the highest-paid CEOs in the energy sector.

The New Compensation Package

The revised compensation package for 2023 shows a considerable reduction. Looney's new total compensation is reported to be around [Insert precise figure], a 31% decrease from the previous year. This reduction impacts all components of his pay. His base salary is now [Insert precise figure], bonuses are reduced to [Insert precise figure], and the value of long-term incentives has been significantly lowered.

- Specific figures for previous and current total compensation: [Insert precise figures for both years, clearly stating the difference]

- Breakdown of salary, bonus, and long-term incentives: [Provide a detailed breakdown for both years, highlighting percentage changes where possible]

- Comparison with CEO pay at other major oil and gas companies (e.g., Shell, ExxonMobil): [Insert comparative data; mention if Looney's pay is still above or below average compared to competitors. Cite sources.]

- Mention any changes to pension or other benefits: [Specify any alterations to pension contributions or other benefits included in the compensation package]

Reasons Behind the Significant Reduction in BP CEO Pay

Company Performance and Profitability

BP's recent financial performance played a crucial role in the decision to reduce Looney's compensation. While the company reported [Insert relevant financial data, e.g., profits, revenue, stock performance] in [Insert Year], these figures fell short of expectations in comparison to previous years. The lower-than-anticipated performance directly influenced the board's decision regarding executive bonuses and long-term incentives.

Shareholder Activism and Pressure

Shareholder activism significantly contributed to the pressure on BP to reduce executive compensation. [Mention specific examples of shareholder resolutions or campaigns related to executive pay. Cite sources where possible]. Growing concerns about CEO-to-worker pay ratios and the overall fairness of executive compensation within the energy industry likely fueled this activism.

Industry Trends and Comparisons

BP's move to significantly reduce its CEO's pay aligns with a broader trend in the energy sector. Several other major oil and gas companies, facing similar pressures related to profitability and shareholder concerns, have also implemented adjustments to their executive compensation packages. [Insert examples and data from other companies, such as Shell and ExxonMobil. Cite sources.] This indicates a shift towards greater accountability and a more cautious approach to executive pay in the industry.

- Specific financial data illustrating BP's performance (e.g., net income, revenue, stock price): [Insert precise figures and cite the source]

- Examples of shareholder activism influencing executive pay: [Provide specific examples and cite sources]

- Comparison data on CEO pay at competing energy firms: [Include data comparisons with competitors like Shell and ExxonMobil. Cite sources.]

- Analysis of the broader trend of CEO pay adjustments in the energy sector: [Discuss the wider industry trend and the factors driving it]

Implications of the Pay Cut on BP and the Energy Industry

Impact on Employee Morale and Motivation

The significant pay cut for the BP CEO could potentially impact employee morale and perceptions of fairness within the company. While some employees might see it as a positive sign of shared sacrifice during challenging times, others may feel demotivated if they perceive a disparity between executive pay reductions and their own compensation.

Signaling to Investors and Stakeholders

The reduction in BP CEO pay sends a strong message to investors and stakeholders about corporate governance and social responsibility. It signifies a commitment to aligning executive compensation with company performance and addressing concerns about excessive executive pay. This can potentially enhance investor confidence and improve the company's reputation.

Future Trends in Executive Compensation

This pay cut could be a significant precedent for future CEO compensation at BP and potentially influence other energy companies. It suggests a shift towards a more performance-based and socially conscious approach to executive pay, moving away from excessively high compensation packages irrespective of company performance.

- Potential impact on employee retention and recruitment: [Discuss the potential positive and negative impacts on employee morale and retention]

- Analysis of investor and stakeholder reactions: [Discuss how investors and other stakeholders have responded to the pay cut]

- Predictions about future CEO pay structures within BP and the energy sector: [Offer informed speculation about the future of CEO pay in the energy sector]

Conclusion

The 31% reduction in BP Chief Executive Bernard Looney's pay is a noteworthy event, driven by a combination of factors including disappointing financial performance, increased shareholder activism, and emerging industry trends. This significant decrease carries implications for employee morale, investor perception, and future executive compensation practices within BP and the wider energy sector. The move underscores a growing demand for greater accountability and a more balanced approach to executive remuneration.

What are your thoughts on this significant reduction in BP CEO pay? Share your opinions in the comments below! Stay tuned for further updates on BP executive compensation and industry trends.

Featured Posts

-

Betaalbare Huizen In Nederland Een Analyse Van Abn Amro En De Reactie Van Geen Stijl

May 22, 2025

Betaalbare Huizen In Nederland Een Analyse Van Abn Amro En De Reactie Van Geen Stijl

May 22, 2025 -

No Es El Arandano Descubre El Superalimento Para La Salud Y El Envejecimiento

May 22, 2025

No Es El Arandano Descubre El Superalimento Para La Salud Y El Envejecimiento

May 22, 2025 -

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025 -

Understanding Cassis Blackcurrant From Vine To Glass

May 22, 2025

Understanding Cassis Blackcurrant From Vine To Glass

May 22, 2025 -

10 Episodes Of Peppa Pig And Baby In Cinemas This May

May 22, 2025

10 Episodes Of Peppa Pig And Baby In Cinemas This May

May 22, 2025

Latest Posts

-

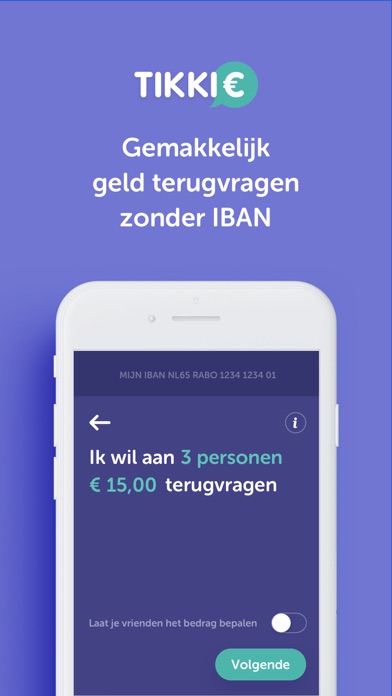

Betalingen Doen Met Tikkie De Ultieme Gids Voor Nederland

May 22, 2025

Betalingen Doen Met Tikkie De Ultieme Gids Voor Nederland

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025 -

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025 -

Abn Amro Analyse Van De Sterke Groei In De Occasionmarkt

May 22, 2025

Abn Amro Analyse Van De Sterke Groei In De Occasionmarkt

May 22, 2025 -

Occasionverkoop Abn Amro Flinke Toename Door Stijgend Autobezit

May 22, 2025

Occasionverkoop Abn Amro Flinke Toename Door Stijgend Autobezit

May 22, 2025