Brexit Slows UK Luxury Exports To The EU

Table of Contents

Increased Bureaucracy and Customs Delays

Brexit introduced a complex web of new customs procedures, paperwork, and checks, creating significant delays and increased costs for exporting luxury goods to the EU. This has had a profound effect on the efficiency and profitability of UK luxury brands.

Navigating New Trade Barriers

The increased administrative burden on exporters is substantial. Companies now face:

- Increased administrative burden for exporters: Preparing the necessary documentation, including customs declarations and certificates of origin, is significantly more time-consuming and complex.

- Longer shipping times due to customs inspections: Delays at border crossings due to increased scrutiny of goods lead to longer lead times and potential stock shortages.

- Higher compliance costs associated with new regulations: Hiring specialized customs brokers and investing in new compliance software adds to the overall cost of exporting.

Impact on Just-in-Time Delivery Models

The delays inherent in the new customs processes severely disrupt established just-in-time (JIT) delivery models, crucial for the luxury goods sector. This leads to:

- Disruption to supply chains: Unpredictable delays make it difficult to plan and manage supply chains effectively.

- Increased inventory holding costs: Businesses must hold larger inventories to mitigate the risk of stockouts, leading to increased storage and insurance costs.

- Potential loss of sales due to delayed deliveries: Missed deadlines and late deliveries can damage customer relationships and lead to lost sales, particularly in the time-sensitive luxury market.

Tariff and Non-Tariff Barriers

While the UK and EU have a Trade and Cooperation Agreement, certain tariffs and significant non-tariff barriers remain, impacting the competitiveness of UK luxury exports.

New Tariffs on Luxury Goods

Specific luxury goods are subject to tariffs, increasing their price and reducing their competitiveness in the EU market. This includes:

- Specific examples of goods affected by tariffs: Certain types of high-end clothing, leather goods, and perfumes may be subject to tariffs.

- Analysis of the impact of tariffs on consumer demand: Increased prices due to tariffs can reduce consumer demand and market share for UK luxury brands.

- Comparison of pre- and post-Brexit tariff rates: Analyzing the difference reveals the financial impact on individual businesses.

Non-Tariff Barriers (NTBs)

Beyond tariffs, non-tariff barriers (NTBs) pose significant obstacles. These include:

- Examples of NTBs impacting luxury goods exports: Sanitary and phytosanitary (SPS) measures for food and beverage products, and complex rules of origin verification, creating delays and costs.

- Explanation of the complexities of complying with NTBs: Navigating these regulations requires specialized knowledge and resources, adding to the costs for exporters.

- Case studies highlighting the challenges faced by exporters due to NTBs: Real-world examples illustrate the practical difficulties faced by luxury brands trying to comply with these regulations.

Reduced Market Access and Consumer Confidence

Brexit has eliminated the frictionless trade previously enjoyed with the EU, impacting UK luxury goods exports.

Loss of Frictionless Trade

The shift to a more complex trading relationship has resulted in:

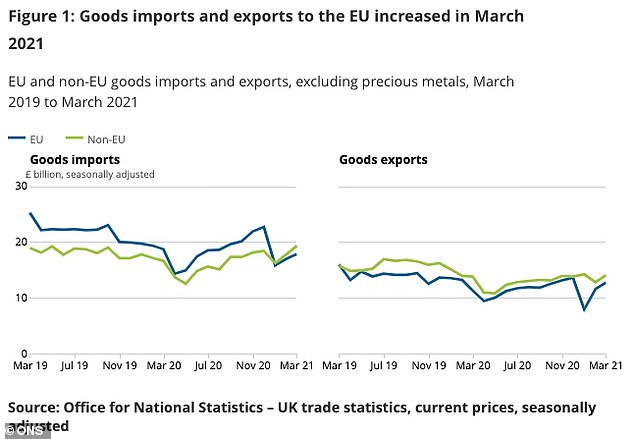

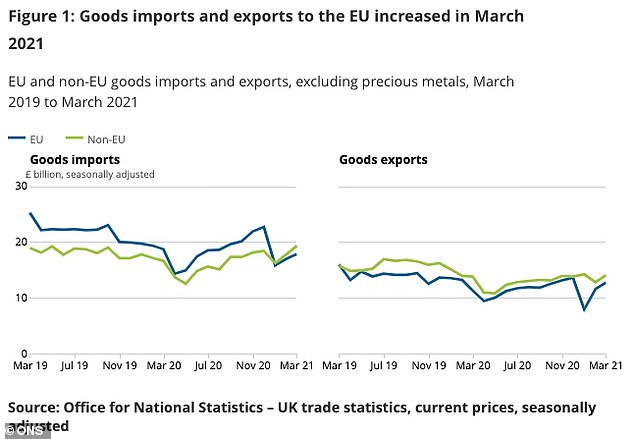

- Statistical data illustrating the decline in exports: Concrete numbers demonstrate the drop in exports since Brexit.

- Analysis of market share changes: Examining the loss of market share to competitor nations highlights the severity of the impact.

- Comparison with other exporting countries: Benchmarking against countries with easier access to the EU market provides a comparative analysis.

Impact on Brand Reputation and Consumer Perception

The added complexities and delays associated with exporting post-Brexit can negatively impact brand reputation and consumer perception:

- Potential damage to brand image: Delayed deliveries and increased prices can damage the image of UK luxury brands.

- Strategies to maintain brand reputation despite Brexit challenges: Companies need to be proactive in communicating with customers and finding ways to maintain service levels.

- Qualitative data on consumer perception of UK luxury goods: Consumer surveys and feedback reveal the change in perception towards UK luxury goods.

Conclusion

The Brexit impact on UK luxury exports is undeniable. Increased bureaucracy, new tariffs, and non-tariff barriers have created significant challenges for the industry, slowing export growth and increasing costs. To thrive in the post-Brexit landscape, UK luxury brands must proactively adapt. This includes investing in compliance measures, exploring new strategies to maintain market access, and actively managing their brand reputation. Ignoring the impact of Brexit on UK luxury exports would be detrimental. Proactive planning and adaptation are crucial for the long-term success and sustainability of the UK luxury sector. Understanding and addressing the ongoing Brexit impact on UK luxury exports is paramount for future growth and survival.

Featured Posts

-

Funkos Dexter Pops First Ever Release Details

May 21, 2025

Funkos Dexter Pops First Ever Release Details

May 21, 2025 -

Ancelottis Future At Real Madrid Uncertain Amidst Klopp Speculation

May 21, 2025

Ancelottis Future At Real Madrid Uncertain Amidst Klopp Speculation

May 21, 2025 -

Hilarious Wh Moments Trump Irish Pm Jd Vance And Those Socks

May 21, 2025

Hilarious Wh Moments Trump Irish Pm Jd Vance And Those Socks

May 21, 2025 -

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 21, 2025

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 21, 2025 -

Robin Roberts Shares Joyful Family News On Good Morning America

May 21, 2025

Robin Roberts Shares Joyful Family News On Good Morning America

May 21, 2025

Latest Posts

-

Mainz Defeat Leipzig Key Roles Of Burkardt And Amiri In The Comeback

May 21, 2025

Mainz Defeat Leipzig Key Roles Of Burkardt And Amiri In The Comeback

May 21, 2025 -

Burkardt And Amiri Power Mainz To Victory Over Rb Leipzig

May 21, 2025

Burkardt And Amiri Power Mainz To Victory Over Rb Leipzig

May 21, 2025 -

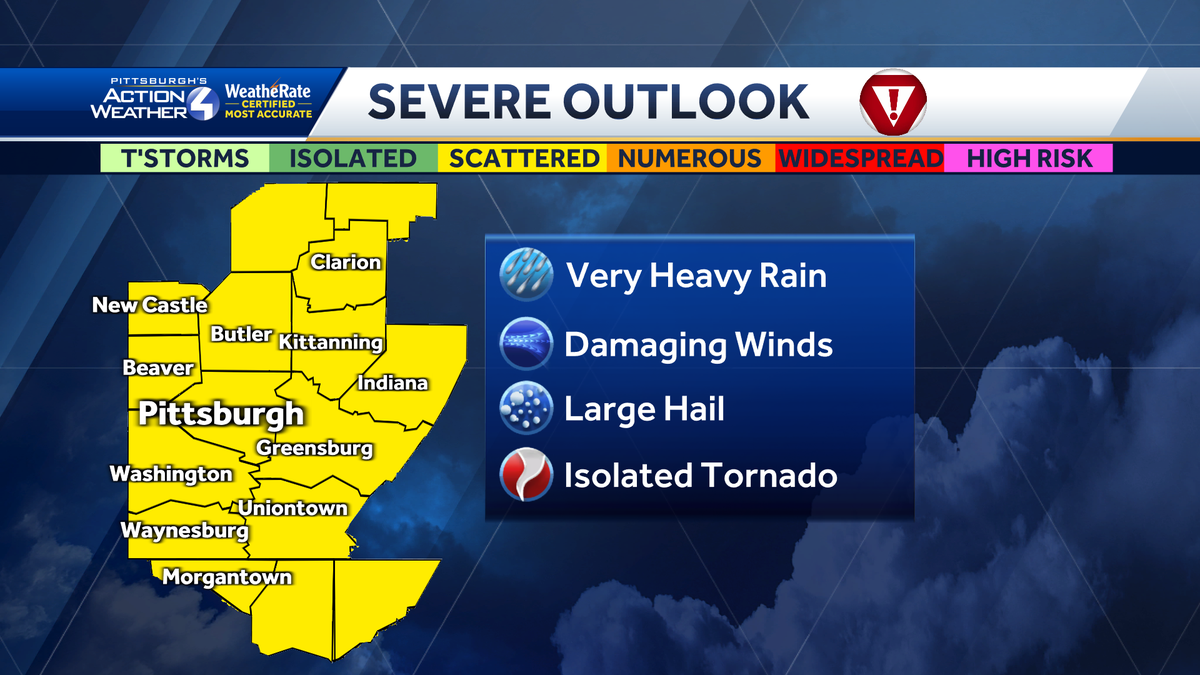

When To Watch For Damaging Winds From Fast Storms

May 21, 2025

When To Watch For Damaging Winds From Fast Storms

May 21, 2025 -

High Winds And Fast Moving Storms A Weather Safety Guide

May 21, 2025

High Winds And Fast Moving Storms A Weather Safety Guide

May 21, 2025 -

Severe Weather Alert High Winds With Fast Moving Storms

May 21, 2025

Severe Weather Alert High Winds With Fast Moving Storms

May 21, 2025