Broadcom's VMware Acquisition: A 1050% Price Hike For AT&T

Table of Contents

Understanding the VMware Acquisition and its Market Impact

Broadcom's acquisition of VMware represents a strategic move to significantly expand its presence in the enterprise software market. VMware, a leading provider of virtualization and cloud computing solutions, holds a dominant position in the industry. Its vSphere platform is integral to many businesses' IT infrastructure, making this acquisition a lucrative opportunity for Broadcom. The deal allows Broadcom to:

- Increase market dominance in the enterprise software sector: By combining its existing semiconductor and infrastructure software portfolio with VMware's virtualization expertise, Broadcom gains a commanding market share.

- Synergies between Broadcom's existing portfolio and VMware's technology: This integration promises significant cost savings and efficiencies, allowing for optimized product offerings.

- Potential for cross-selling and upselling opportunities: Broadcom can leverage VMware's existing customer base to expand its product reach and drive revenue growth.

The Detrimental Impact on AT&T's Costs: A 1050% Price Increase

The acquisition's most immediate and dramatic impact is evident in the dramatic increase in licensing fees for existing VMware clients like AT&T. The 1050% price hike represents a monumental cost burden for the telecom giant. This drastic increase stems directly from:

- Changes to existing contracts and agreements: The acquisition triggered renegotiations of contracts, leaving many long-term clients with significantly higher renewal costs.

- Significant impact on AT&T's operating costs and profitability: The unexpected increase forces AT&T to re-evaluate its IT budget and potentially impact its overall profitability.

This 1050% increase translates into millions, if not billions, of dollars in additional expenditure for AT&T. This substantial increase will inevitably force a reassessment of AT&T’s IT infrastructure budget, potentially affecting investment in other crucial areas. It might also lead to changes in service offerings and pricing strategies for AT&T's customers.

Broadcom's Pricing Strategy and its Ethical Implications

Broadcom's post-acquisition pricing strategy has raised concerns about potential monopolistic practices. The sharp increase in VMware licensing costs for many customers, including AT&T, raises questions about the fairness and ethical implications of this strategy.

- Potential for monopolistic practices and reduced competition: The combined market power of Broadcom and VMware raises concerns about reduced competition and limited choices for businesses relying on virtualization technology.

- Analysis of consumer impact due to increased prices for IT services: The increased costs are likely to trickle down, affecting consumers who may experience higher prices for various IT-dependent services.

- Discussion of potential legal challenges and regulatory responses: The significant price increases are likely to attract regulatory scrutiny and potential antitrust investigations.

Future Outlook: Navigating the Post-Acquisition Landscape

The long-term effects of Broadcom's VMware acquisition remain uncertain, but the impact on the tech industry is undeniable. Companies like AT&T are now forced to navigate a new landscape. Mitigating the increased costs will require:

- Exploration of alternative virtualization solutions and open-source technologies: Businesses may explore alternatives to reduce reliance on VMware's products.

- Strategies for negotiating better licensing agreements with Broadcom: Companies need to develop robust strategies for negotiating more favorable terms with the now dominant player.

- Long-term implications for the pricing of virtualization and cloud computing services: The acquisition sets a precedent for future mergers and acquisitions in the tech sector, with potential implications for pricing and competition.

Conclusion: The Long Shadow of Broadcom's VMware Acquisition

The acquisition of VMware by Broadcom has cast a long shadow over the tech industry, with AT&T's 1050% price hike serving as a stark illustration of its immediate impact. The potential for monopolistic practices, reduced competition, and increased costs for consumers cannot be ignored. The ramifications of this deal are far-reaching, and it is crucial for businesses of all sizes to carefully consider the implications of Broadcom's VMware acquisition for their own operations. Further research into the impact of Broadcom's VMware deal, and the potential for VMware price increases after the Broadcom acquisition, is essential for anyone involved in the enterprise software market. Understanding the complexities of this merger is critical to navigating the evolving landscape of virtualization and cloud computing.

Featured Posts

-

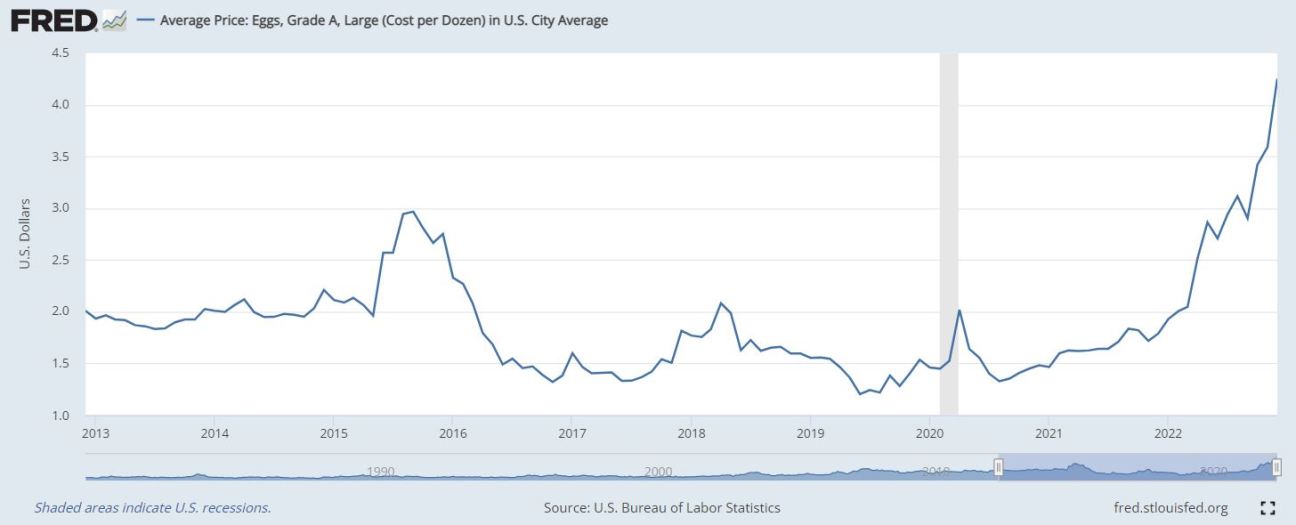

Relief For Shoppers Egg Prices Drop To 5 A Dozen

May 15, 2025

Relief For Shoppers Egg Prices Drop To 5 A Dozen

May 15, 2025 -

Paddy Pimbletts Post Ufc 314 Callouts Topuria And More

May 15, 2025

Paddy Pimbletts Post Ufc 314 Callouts Topuria And More

May 15, 2025 -

Paddy Pimbletts Impressive Win Adesanyas High Praise And Chandler Fight

May 15, 2025

Paddy Pimbletts Impressive Win Adesanyas High Praise And Chandler Fight

May 15, 2025 -

Three Hits One Sweep Chandler Simpson Fuels Rays Victory Over Padres

May 15, 2025

Three Hits One Sweep Chandler Simpson Fuels Rays Victory Over Padres

May 15, 2025 -

Examining The Validity Of Trumps Statements On Egg Prices

May 15, 2025

Examining The Validity Of Trumps Statements On Egg Prices

May 15, 2025

Latest Posts

-

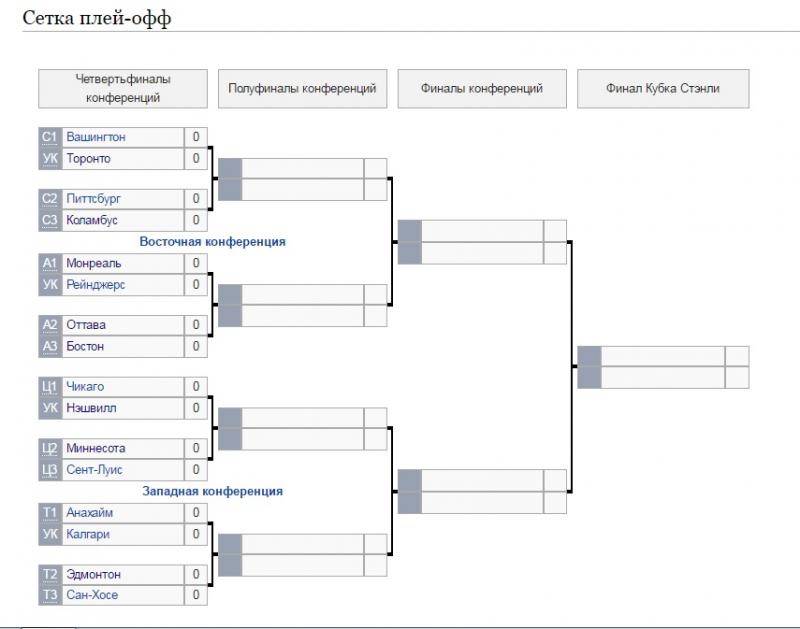

Karolina Vashington Itogi Matcha Pley Off N Kh L I Analiz Igry

May 15, 2025

Karolina Vashington Itogi Matcha Pley Off N Kh L I Analiz Igry

May 15, 2025 -

Ovechkin Podnimaetsya V Reytinge Luchshikh Snayperov Pley Off N Kh L

May 15, 2025

Ovechkin Podnimaetsya V Reytinge Luchshikh Snayperov Pley Off N Kh L

May 15, 2025 -

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025 -

Ovechkin 12 E Mesto V Istorii N Kh L Po Golam V Pley Off

May 15, 2025

Ovechkin 12 E Mesto V Istorii N Kh L Po Golam V Pley Off

May 15, 2025 -

Pley Off N Kh L Karolina Oderzhivaet Razgromnuyu Pobedu Nad Vashingtonom

May 15, 2025

Pley Off N Kh L Karolina Oderzhivaet Razgromnuyu Pobedu Nad Vashingtonom

May 15, 2025