Broadcom's VMware Acquisition: AT&T Details Extreme 1,050% Cost Increase

Table of Contents

The Impact of Broadcom's VMware Acquisition on AT&T's Costs

Unpacking the 1050% Increase: A Detailed Breakdown

AT&T's 1,050% cost increase highlights the significant challenges faced by businesses relying on VMware products after Broadcom's takeover. The exact reasons behind this drastic surge remain partly unclear, but several factors likely contributed:

-

Specific VMware Products Affected: While AT&T hasn't publicly specified the precise VMware products causing this increase, the scale suggests it involves a significant portion of their VMware infrastructure, potentially encompassing vSphere, vSAN, NSX, and other key components of their virtualization and cloud strategy.

-

Pricing Model Shifts: Before the acquisition, AT&T likely benefited from various pricing models, including volume discounts, bundled offerings, and potentially long-term contracts with favorable rates. Broadcom's acquisition may have resulted in the consolidation of these models, leading to higher per-unit costs.

-

Contributing Factors to the Price Surge:

- Consolidation of VMware's product lines: Broadcom might be streamlining VMware's offerings, leading to the elimination of some previously available discounts or bundled packages.

- Removal of discounts or special offers: Pre-acquisition deals and promotions may have expired without comparable replacements.

- Changes in licensing agreements: New licensing terms and conditions could impose significantly higher costs.

- Increased demand following the acquisition: Increased demand for VMware products after the acquisition could contribute to price increases.

AT&T's Response and Potential Legal Ramifications

AT&T's response to this unexpected cost explosion remains to be seen publicly, but the scale of the increase suggests they are likely exploring all available options. Potential legal avenues could include:

-

Public Statements and Actions: Expect a detailed analysis of Broadcom's actions to be undertaken. While AT&T may not have made public statements regarding a legal challenge, their internal analysis will be carefully studying the changes in pricing.

-

Potential Legal Challenges: AT&T might pursue legal action based on several arguments:

- Anti-competitive practices: If Broadcom's actions are deemed to stifle competition, AT&T could argue anti-competitive practices.

- Breach of contract: Existing contracts with VMware prior to the acquisition might contain clauses that could be violated by Broadcom.

- Unfair pricing: AT&T could argue that the new pricing is unreasonable and lacks justification.

-

Regulatory Scrutiny: Regulatory bodies might investigate Broadcom's pricing practices following the acquisition, particularly if similar complaints arise from other VMware customers.

Broadcom's Perspective and Justification

Broadcom has yet to fully articulate its justification for such a significant price increase to the public. However, several potential arguments might be used:

-

Official Statements: Broadcom’s official communication will likely center around a justification that emphasizes the increased value of VMware's products and services.

-

Business Strategy: Broadcom's strategy likely aims to maximize profitability from its substantial investment. This approach potentially prioritizes extracting value from existing customers.

-

Broadcom's Arguments:

- Integration costs: The integration of VMware into Broadcom's operations is a costly undertaking, and these costs might be passed on to customers.

- Investment in R&D: Increased investment in research and development could be used as justification for higher prices.

- Market positioning: Broadcom might be repositioning VMware's products within the market to support premium pricing.

The Broader Implications of the VMware Acquisition

Ripple Effects Across the IT Industry

AT&T's experience is likely not an isolated incident. The impact of Broadcom's VMware acquisition extends far beyond a single company:

-

Impact on other VMware customers: Many businesses could face similar price hikes, leading to increased IT spending and budget constraints.

-

Implications for competition: Broadcom's control of VMware could reduce competition in the virtualization market, potentially leading to less innovation and higher prices across the board.

-

Long-term effects on enterprise IT spending: The increase in VMware costs could force businesses to re-evaluate their IT budgets and potentially seek alternative solutions.

-

Industry-wide consequences:

- Increased licensing costs: Businesses across various sectors may experience significant cost increases for their VMware licenses.

- Shift in market share: Competitors might gain market share as businesses seek alternatives to VMware.

- Increased scrutiny of large tech acquisitions: The AT&T case may prompt increased regulatory scrutiny of large mergers and acquisitions in the tech industry.

Regulatory Concerns and Future Acquisitions

The AT&T case raises significant regulatory concerns and could influence future acquisitions in the tech industry.

-

Regulatory Response: Expect regulatory bodies to closely monitor Broadcom's pricing practices following the acquisition. This heightened scrutiny could influence the approval process of future mergers and acquisitions.

-

Antitrust Laws: Antitrust laws are designed to prevent monopolistic practices and promote competition. This situation highlights the critical role of these laws in protecting consumers from unfair pricing.

Conclusion: Navigating the Landscape After Broadcom's VMware Acquisition

AT&T's experience demonstrates the potentially disruptive effects of Broadcom's VMware acquisition. The 1,050% cost increase is a stark warning to other businesses reliant on VMware products. The implications extend beyond individual companies, impacting competition in the virtualization market and prompting greater regulatory scrutiny of large tech mergers. It is crucial for businesses to closely monitor the ongoing developments related to Broadcom's VMware acquisition and its impact on pricing and competition. Further research into Broadcom's VMware acquisition and its effects on various sectors is strongly recommended. Stay informed about this evolving situation and plan accordingly to navigate this changing landscape.

Featured Posts

-

Last Friday Sequel Confirmed Ice Cube To Write And Star

May 27, 2025

Last Friday Sequel Confirmed Ice Cube To Write And Star

May 27, 2025 -

Guccis Bamboo Innovation Sustainability And The Future Of Fashion

May 27, 2025

Guccis Bamboo Innovation Sustainability And The Future Of Fashion

May 27, 2025 -

Air Algerie Receives Ncaa Operating Permit Inaugural Flight April 6th

May 27, 2025

Air Algerie Receives Ncaa Operating Permit Inaugural Flight April 6th

May 27, 2025 -

1910

May 27, 2025

1910

May 27, 2025 -

Kanye Wests Super Bowl Ban A Taylor Swift Connection

May 27, 2025

Kanye Wests Super Bowl Ban A Taylor Swift Connection

May 27, 2025

Latest Posts

-

Municipales Metz 2026 Laurent Jacobelli Candidat

May 30, 2025

Municipales Metz 2026 Laurent Jacobelli Candidat

May 30, 2025 -

Week End Sur Europe 1 Vos Animateurs Preferes Aurelien Veron Et Laurent Jacobelli

May 30, 2025

Week End Sur Europe 1 Vos Animateurs Preferes Aurelien Veron Et Laurent Jacobelli

May 30, 2025 -

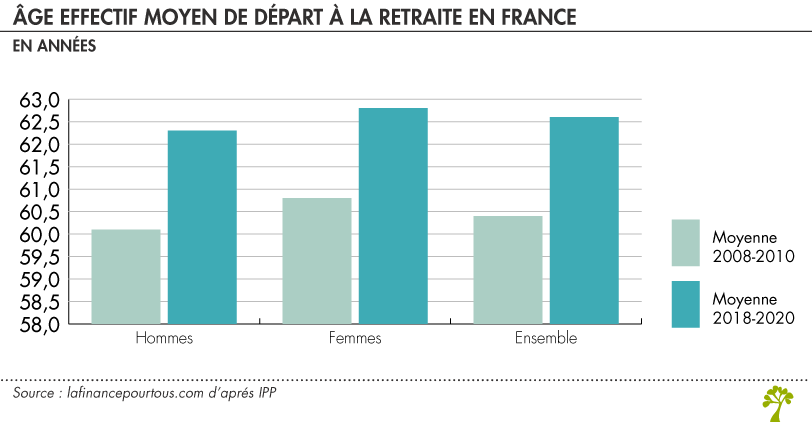

Age De Depart A La Retraite Discussions Secretes Entre Le Rn Et La Gauche

May 30, 2025

Age De Depart A La Retraite Discussions Secretes Entre Le Rn Et La Gauche

May 30, 2025 -

Europe 1 Le Week End Avec Aurelien Veron Et Laurent Jacobelli

May 30, 2025

Europe 1 Le Week End Avec Aurelien Veron Et Laurent Jacobelli

May 30, 2025 -

Alliance Improbable Le Rn Et La Gauche Unis Sur La Reforme Des Retraites

May 30, 2025

Alliance Improbable Le Rn Et La Gauche Unis Sur La Reforme Des Retraites

May 30, 2025