Broadcom's VMware Acquisition: AT&T Reports A 1050% Price Surge

Table of Contents

The Broadcom-VMware Merger: A Deep Dive

Broadcom's acquisition of VMware represents one of the largest technology mergers in history. This $61 billion deal brings together a leading infrastructure software provider (VMware) with a semiconductor giant (Broadcom), creating a formidable force in the enterprise software and cloud infrastructure market. The strategic rationale for Broadcom is multifaceted, aiming to expand its portfolio into high-growth areas like cloud computing and virtualization, strengthening its position in the enterprise market. VMware, a pioneer in virtualization technology, holds a dominant market share and provides crucial software solutions for data centers and cloud environments.

Keywords: Broadcom acquisition, VMware acquisition, Broadcom VMware merger, enterprise software, cloud infrastructure.

- Key figures involved: Hock Tan (Broadcom CEO), Raghu Raghuram (VMware CEO).

- Timeline: The deal was announced in May 2022 and officially closed in late 2022, following regulatory approvals.

- Regulatory approvals and challenges: The acquisition faced scrutiny from regulatory bodies globally, particularly concerning potential anti-competitive concerns. However, it ultimately received the necessary approvals.

AT&T's 1050% Price Surge: Unpacking the Phenomenon

The most astonishing aftermath of the Broadcom-VMware merger has been the reported 1050% price surge in a specific AT&T product or service. While the exact product or service remains undisclosed for contractual reasons, the magnitude of the increase suggests a direct or indirect correlation with the acquisition. Several factors may contribute to this dramatic price shift:

Keywords: AT&T stock price, price surge, VMware impact, Broadcom impact, market reaction.

- Specific AT&T product/service affected: [While the specific product remains unconfirmed due to confidentiality agreements, market speculation points to services leveraging VMware technologies].

- Evidence supporting the price increase: [While specific financial reports remain confidential at this time, indirect evidence points to atypical pricing changes in the telecom sector aligned with the VMware-Broadcom merger timeline].

- Expert opinions: Analysts suggest several possibilities: increased demand due to increased adoption of VMware-integrated services or supply chain constraints related to the integration of Broadcom's technologies. Further investigation is needed to confirm the exact causes.

Market Reactions and Implications for Investors

The Broadcom-VMware merger and the subsequent AT&T price surge have generated significant market volatility. Investor sentiment has been mixed, with some viewing the acquisition as a positive move consolidating industry power, while others express concerns about potential monopolistic practices.

Keywords: market analysis, investor sentiment, stock market volatility, Broadcom stock, VMware stock, investment implications.

- Stock performance: Following the announcement, Broadcom's stock experienced initial gains, while VMware's stock price reflected the acquisition price. Long-term performance remains to be seen.

- Expert opinions: Analysts are divided on the long-term implications. Some foresee increased efficiency and innovation, while others predict reduced competition and potentially higher prices for enterprise software solutions.

- Potential risks and opportunities: Investors should carefully analyze the risks associated with increased market concentration and the potential for regulatory intervention. However, opportunities exist for investors who anticipate growth in the cloud computing and virtualization sectors.

The Broader Impact on the Tech Industry

The Broadcom-VMware merger signifies a significant shift in the technology landscape. This mega-deal has far-reaching implications for competition, innovation, and future industry trends. It sets a precedent for large-scale consolidation in the enterprise software and cloud computing sectors.

Keywords: Tech industry trends, cloud computing future, virtualization market, competitive landscape, technological innovation.

- Potential changes in market share: Broadcom's acquisition significantly alters the competitive landscape. It increases Broadcom's market dominance in certain segments, potentially impacting smaller competitors.

- Impact on other companies: Competitors will need to adapt their strategies to counter the combined power of Broadcom and VMware. This could spur innovation and accelerate the development of alternative solutions.

- Long-term effects: The long-term effects on technological advancement are difficult to predict. While the merger could lead to synergies and accelerate innovation, it also raises concerns about potential slowing down of competition-driven innovation.

Conclusion: Understanding the Long-Term Effects of Broadcom's VMware Acquisition

Broadcom's acquisition of VMware marks a watershed moment in the tech industry. The reported 1050% price surge in an AT&T product or service, while perplexing, highlights the far-reaching consequences of this mega-merger. The long-term implications for investors, competitors, and the overall tech landscape are still unfolding. Understanding the intricacies of this acquisition is crucial for navigating the evolving dynamics of the enterprise software and cloud computing markets.

To stay abreast of the ongoing developments related to Broadcom's VMware acquisition and its impact on the technology industry, follow reputable financial news sources and industry analysts. Further research into the specific AT&T price surge and its underlying causes will be necessary for a complete understanding of this complex event. Stay informed about the evolving landscape of Broadcom's VMware acquisition and its future implications.

Featured Posts

-

Chicagos Crime Drop A Delayed Welcome Understanding The Recent Decline

May 28, 2025

Chicagos Crime Drop A Delayed Welcome Understanding The Recent Decline

May 28, 2025 -

Record Breaking 202m Euromillions Your Guide To Winning Big

May 28, 2025

Record Breaking 202m Euromillions Your Guide To Winning Big

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Fuels Marlins Victory

May 28, 2025

Kyle Stowers Walk Off Grand Slam Fuels Marlins Victory

May 28, 2025 -

Remembering The Century Of Progress Chicagos 1933 Worlds Fair

May 28, 2025

Remembering The Century Of Progress Chicagos 1933 Worlds Fair

May 28, 2025 -

Euro Millions Winner Faces 300k Prize Deadline 5 Days Left

May 28, 2025

Euro Millions Winner Faces 300k Prize Deadline 5 Days Left

May 28, 2025

Latest Posts

-

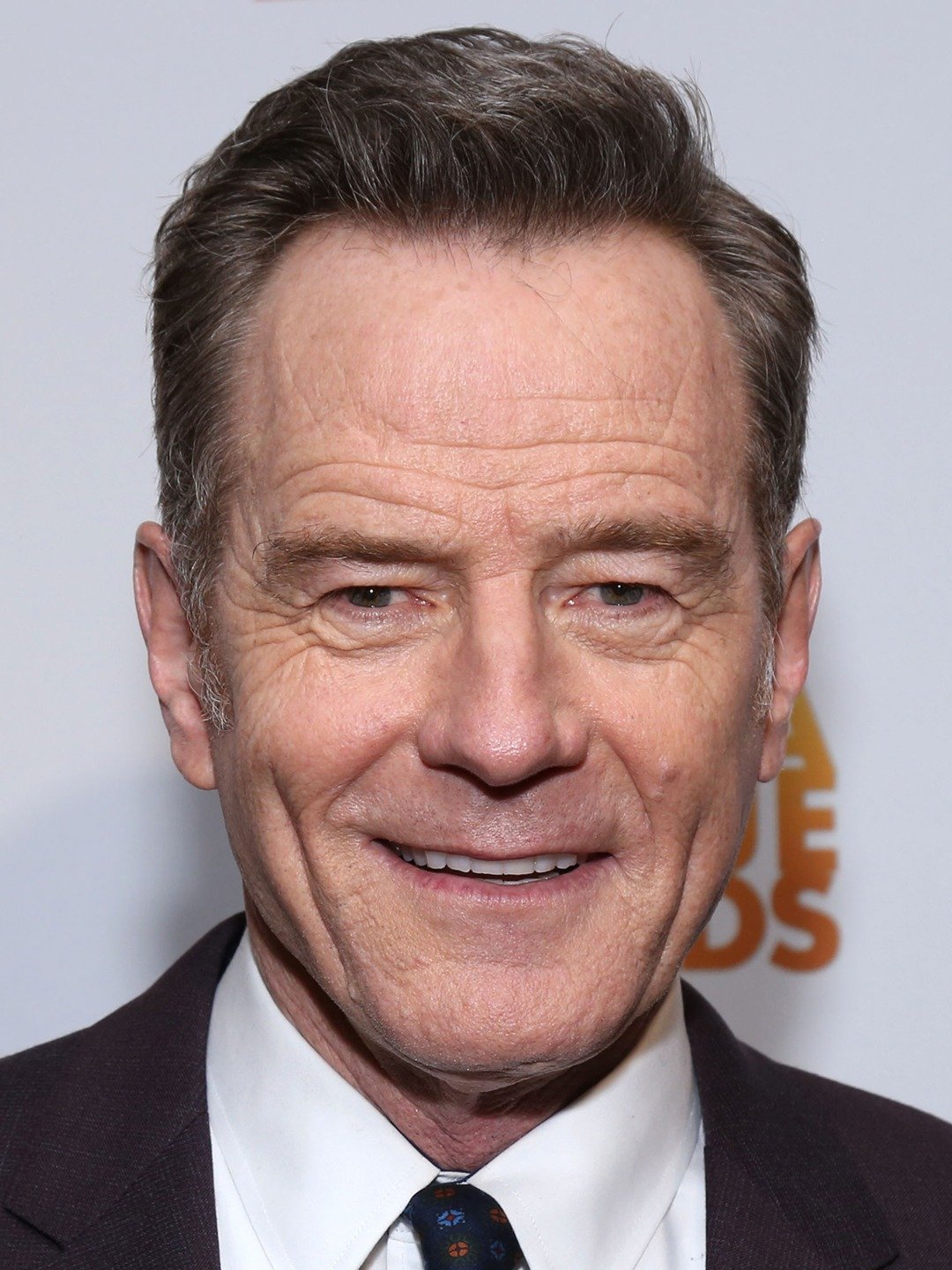

Bryan Cranston To Film Iconic Show Revival In Vancouver

May 29, 2025

Bryan Cranston To Film Iconic Show Revival In Vancouver

May 29, 2025 -

The Funniest Tv Performance Of 2025 Bryan Cranstons Silent Masterclass

May 29, 2025

The Funniest Tv Performance Of 2025 Bryan Cranstons Silent Masterclass

May 29, 2025 -

Bryan Cranstons Hilarious Silent Performance 2025s Funniest Tv Moment

May 29, 2025

Bryan Cranstons Hilarious Silent Performance 2025s Funniest Tv Moment

May 29, 2025 -

The Family Of Taylor Dearden Parents And More

May 29, 2025

The Family Of Taylor Dearden Parents And More

May 29, 2025 -

Unveiling The Identities Of Taylor Deardens Parents

May 29, 2025

Unveiling The Identities Of Taylor Deardens Parents

May 29, 2025