Broadcom's VMware Acquisition: AT&T Reports Extreme Price Surge

Table of Contents

AT&T's Price Increase: Unpacking the Details

AT&T's experience serves as a stark illustration of the potential fallout from the Broadcom-VMware merger. The price surge isn't simply a matter of market fluctuations; it's a direct consequence of the acquisition's impact on contractual agreements and market dynamics.

Direct Contractual Impacts:

-

Renegotiated Contracts: Existing contracts between AT&T and VMware are undergoing renegotiation, with Broadcom leveraging its newly acquired market power to demand higher prices. The terms of these agreements, previously negotiated with VMware, are being rewritten, often resulting in significant increases.

-

Favorable Clauses: Some contracts may contain clauses that permit price adjustments based on market conditions or changes in ownership. Broadcom is likely utilizing these clauses to justify the price increases, capitalizing on the absence of competitive pressure.

-

Specific Product Price Hikes: AT&T's reliance on key VMware products like vSphere (for server virtualization) and NSX (for network virtualization) has made them particularly vulnerable to these price increases. These are core components of AT&T's network infrastructure, making price hikes particularly impactful.

Market Power and Monopoly Concerns:

-

Monopolistic Market Position: Broadcom's acquisition of VMware significantly increases its market share in critical areas of enterprise software, raising concerns about monopolistic practices and reduced competition. This concentrated power allows them to exert greater control over pricing.

-

Impact on Large Clients: AT&T, as a major client, is feeling the brunt of this reduced competition. With fewer alternatives, AT&T has limited negotiating power, making them more susceptible to price increases imposed by Broadcom.

-

Regulatory Scrutiny: The acquisition has already attracted regulatory scrutiny, with investigations underway in various jurisdictions to assess the potential anti-competitive implications of the merger and its impact on pricing across the industry.

Broadcom's Strategy and the Rationale Behind Price Increases

Broadcom's actions aren't entirely without justification, at least from their perspective. Their post-acquisition strategy involves integrating VMware's technologies with their existing portfolio, which involves significant costs.

Synergies and Cost-Cutting Measures:

-

Integration Costs: Broadcom may argue that the price increases are necessary to recoup the substantial costs associated with integrating VMware's operations and technologies into their own.

-

Cost-Cutting Impact on Pricing: While aiming for synergies, Broadcom might also implement cost-cutting measures within VMware's operations. This could indirectly lead to increased prices for clients as services are streamlined or reduced.

-

Post-Acquisition Strategy: Broadcom's overall strategy involves maximizing profitability from its expanded portfolio, and price increases are a direct reflection of this strategy. This is likely to affect other clients similarly in the future.

Shifting Market Dynamics and Increased Demand:

-

Increased Demand: Ironically, the acquisition itself might increase demand for VMware products due to Broadcom's market position and integration efforts. This increased demand could contribute to price increases, even without explicit price hikes.

-

Market Competition Changes: The acquisition has undeniably altered the competitive landscape, reducing the number of significant players in certain market segments. This diminished competition allows Broadcom to dictate pricing to a larger extent.

-

Enterprise Software Market Conditions: The current state of the enterprise software market, characterized by consolidation and high demand for specific technologies, is a contributing factor to Broadcom’s ability to implement price increases.

The Wider Impact on the Telecom Industry and Beyond

The ramifications of the Broadcom-VMware acquisition extend far beyond AT&T and the immediate impact on their network costs.

Implications for Other Telecom Providers:

-

Industry-Wide Price Increases: Other telecom providers that rely on VMware solutions should expect similar price increases, creating a ripple effect throughout the industry.

-

Consolidated Market: The acquisition contributes to a more consolidated market, reducing competition and creating a landscape where price negotiation is significantly more challenging.

-

Reduced Choice: Telecom companies will face fewer choices in vendors and will be pushed to accept higher prices due to lack of viable alternatives.

Long-Term Effects on Cloud Computing and Infrastructure:

-

Cloud Computing Impact: The acquisition has significant implications for the cloud computing industry, potentially affecting pricing models and the availability of competitive solutions.

-

Infrastructure Choices: Businesses might reconsider their infrastructure choices in response to the increased costs of VMware products, potentially leading to a shift towards alternative technologies and vendors.

-

Alternative Solutions: Enterprises are now actively seeking and evaluating alternative virtualization and network solutions to mitigate the impact of Broadcom’s price increases.

Conclusion

The Broadcom-VMware acquisition and the subsequent price surge reported by AT&T highlight significant changes in the enterprise software and telecom landscape. The potential for increased market consolidation and reduced competition warrants close monitoring. Businesses reliant on VMware solutions must carefully consider the implications of these price increases and explore alternative strategies to manage their IT infrastructure costs effectively. Understanding the ramifications of the Broadcom VMware acquisition is crucial for planning future IT budgets and navigating the evolving landscape of enterprise software and cloud computing. Stay informed about the ongoing developments concerning the Broadcom VMware acquisition and its impact on your business.

Featured Posts

-

Analyzing Michael Strahans Interview Acquisition A Ratings War Perspective

May 20, 2025

Analyzing Michael Strahans Interview Acquisition A Ratings War Perspective

May 20, 2025 -

Report Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025

Report Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025 -

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025 -

Endless Night Agatha Christie Novel To Become Bbc Tv Series

May 20, 2025

Endless Night Agatha Christie Novel To Become Bbc Tv Series

May 20, 2025 -

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Latest Posts

-

Mainz Extends Top Four Claim Following Victory Over Gladbach

May 20, 2025

Mainz Extends Top Four Claim Following Victory Over Gladbach

May 20, 2025 -

Mainzs Impressive Win At Gladbach Solidifies Top Four Position

May 20, 2025

Mainzs Impressive Win At Gladbach Solidifies Top Four Position

May 20, 2025 -

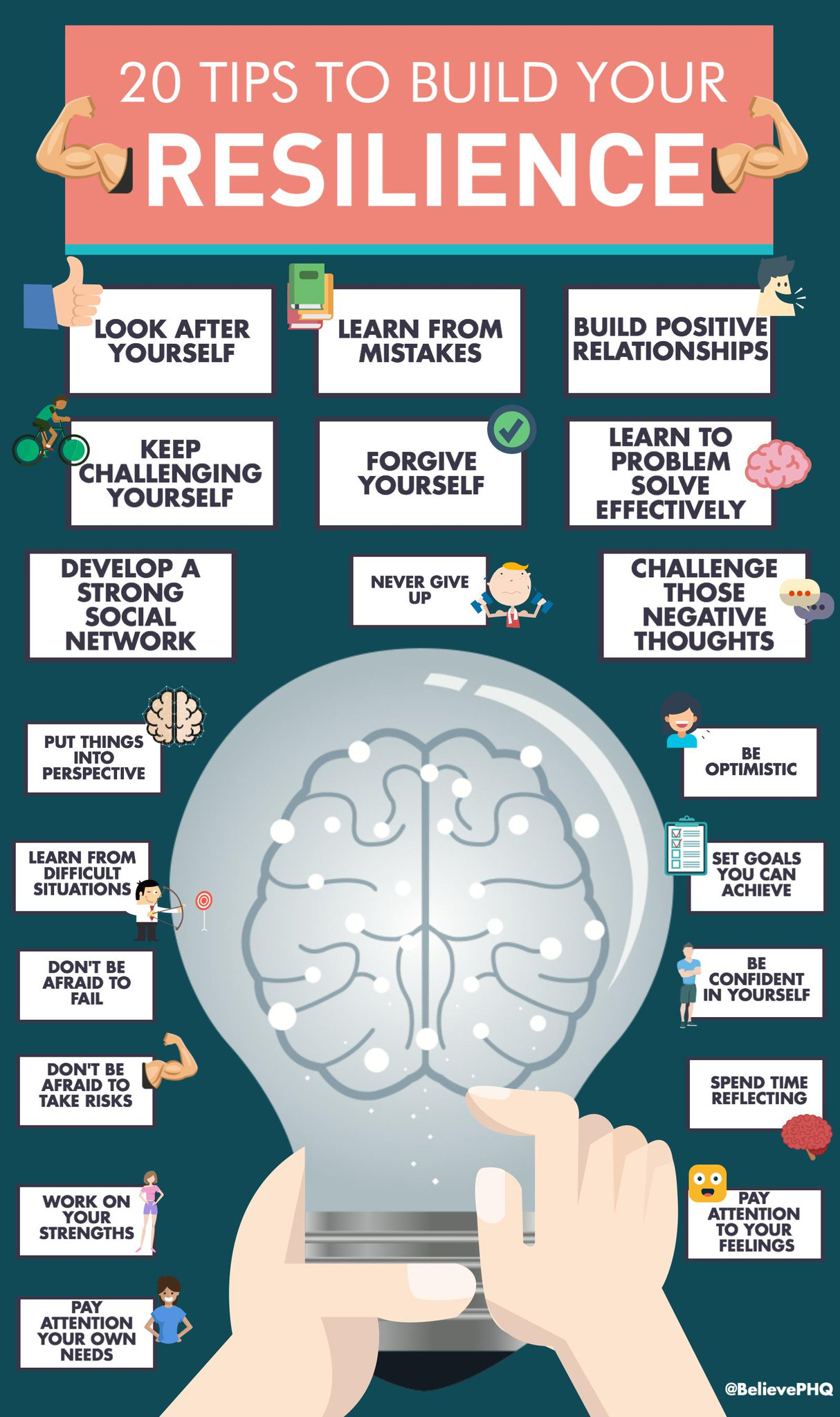

Resilience And Mental Health Turning Setbacks Into Success

May 20, 2025

Resilience And Mental Health Turning Setbacks Into Success

May 20, 2025 -

The Power Of Resilience Protecting Your Mental Health

May 20, 2025

The Power Of Resilience Protecting Your Mental Health

May 20, 2025 -

Developing Mental Resilience A Practical Approach

May 20, 2025

Developing Mental Resilience A Practical Approach

May 20, 2025