Broadcom's VMware Bid Faces Backlash: AT&T Reports Extreme Cost Increase

Table of Contents

AT&T's Cost Concerns Highlight Potential Antitrust Issues

AT&T's vocal opposition to the Broadcom-VMware merger highlights significant concerns about potential antitrust issues. The telecommunications giant has publicly expressed alarm over substantial price increases following Broadcom's previous acquisitions of other networking companies. This pattern raises serious red flags for antitrust regulators examining the VMware deal.

- Significant Price Hikes: AT&T's statements suggest a clear trend of inflated pricing post-acquisition by Broadcom, impacting their operational budget significantly. This isn't just about a single product increase; it speaks to a broader strategy that could harm competition.

- Leveraging Market Power: The concern isn't simply about higher prices; it's about the potential for Broadcom to leverage its combined market power after acquiring VMware to further increase prices and stifle innovation. This is a key concern for antitrust regulators worldwide.

- Impact on Operational Efficiency and Consumer Services: The increased costs directly affect AT&T's operational efficiency and profitability. These increased expenses could ultimately translate into higher prices for consumers or reduced service quality. This is a critical factor in the antitrust review.

- A Precedent for Regulatory Scrutiny: AT&T's experience serves as a powerful case study illustrating the potential negative consequences of the Broadcom-VMware merger for major players in the telecommunications and broader technology sectors. Other companies may be hesitant to voice their concerns publicly but share similar anxieties.

Regulatory Scrutiny Intensifies Amidst Growing Opposition

The growing opposition to the Broadcom VMware acquisition isn't just coming from AT&T; it's fueling increased regulatory scrutiny. Antitrust regulators in both the US (Federal Trade Commission or FTC) and the European Union (EU Commission) are intensely examining the proposed merger, focusing on the potential for monopolistic practices and reduced competition.

- FTC and EU Commission Investigation: Both the FTC and the EU Commission are undertaking thorough investigations into the potential anti-competitive effects of the merger, including market dominance and potential abuse of power.

- Concerns about Reduced Competition: Regulators are particularly concerned about the potential impact on competition in key markets, such as networking equipment, virtualization software, and data center solutions. The combined market share of Broadcom and VMware is substantial.

- Strengthened Case for Blocking the Merger: The public statements from companies like AT&T, coupled with detailed economic analyses by regulatory bodies, strengthen the argument for either blocking the acquisition or imposing significant conditions on its approval.

- Lengthy and Rigorous Review Process: The regulatory review process is expected to be lengthy and rigorous, involving extensive data collection, market analysis, and potentially public hearings. This could significantly delay or even prevent the deal's closure.

Impact on the Networking and Software Market

The Broadcom-VMware acquisition has the potential to significantly reshape the networking and software landscape. The merger could lead to considerable market consolidation, potentially stifling innovation and harming competition.

- Market Consolidation and Reduced Competition: The combined entity would control a substantial portion of the market for networking equipment, virtualization software, and other critical technologies. This consolidation could lead to reduced choices for businesses.

- Increased Prices for VMware Products: Businesses of all sizes that rely on VMware's virtualization technologies could face significantly increased prices following the acquisition, impacting their operational costs.

- Concerns about VMware's Future Direction: The potential loss of VMware's independence raises concerns about its future product development and its responsiveness to customer needs. Will innovation be prioritized under Broadcom's ownership?

- Ripple Effect Across the Industry: Other competitors are closely watching this situation. The outcome will significantly influence the strategic decisions and future investments of companies in the networking and software industries.

Conclusion: The Future of the Broadcom VMware Acquisition Remains Uncertain

Broadcom's pursuit of VMware faces mounting opposition, driven largely by concerns about increased costs and potential antitrust violations. AT&T's public statements exemplify these concerns. Regulatory scrutiny is intensifying, and the outcome of this review process will have a profound impact on the competitive landscape of the networking and software industries. The potential for reduced competition, increased prices, and stifled innovation raises serious questions about the long-term consequences of this merger.

Call to Action: Stay informed about the unfolding Broadcom-VMware acquisition saga. The ongoing debate surrounding this merger highlights the critical importance of monitoring antitrust enforcement and its impact on market competition and consumer prices. Follow further developments on the Broadcom VMware acquisition to understand how this significant deal will shape the future of the technology industry.

Featured Posts

-

Voenno Politicheskoe Sotrudnichestvo Frantsii I Polshi Posledstviya Dlya Rossii I S Sh A

May 09, 2025

Voenno Politicheskoe Sotrudnichestvo Frantsii I Polshi Posledstviya Dlya Rossii I S Sh A

May 09, 2025 -

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025 -

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 09, 2025

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 09, 2025 -

Formula Racing Colapinto A Potential Threat To Lawsons Red Bull Position

May 09, 2025

Formula Racing Colapinto A Potential Threat To Lawsons Red Bull Position

May 09, 2025 -

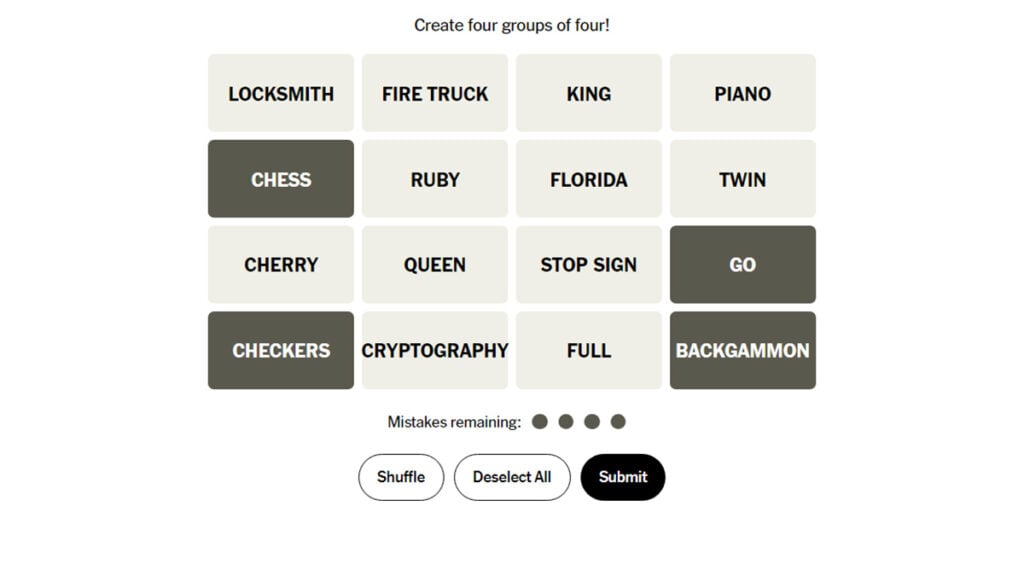

Nyt Strands Thursday April 10th Game 403 Help And Answers

May 09, 2025

Nyt Strands Thursday April 10th Game 403 Help And Answers

May 09, 2025