Brookfield's US Manufacturing Investment: A Tariffs Conundrum

Table of Contents

The Allure of US Manufacturing for Brookfield

Brookfield's interest in US manufacturing is driven by several key factors. The company recognizes the significant potential for growth and profitability within this sector, despite the challenges posed by tariffs.

Domestic Market Access & Reduced Supply Chain Risks

Investing in US manufacturing offers several compelling advantages. By establishing production facilities within the US, Brookfield can reduce its reliance on global supply chains, mitigating risks associated with geopolitical instability and disruptions. This approach also provides direct access to the massive US consumer market, reducing transportation costs and lead times.

- Lower transportation costs: Reduced shipping expenses contribute to improved profitability.

- Faster delivery times: Quicker delivery to customers enhances responsiveness and competitiveness.

- Closer proximity to customers: Improved customer relationships and faster response to market demands.

- Potential for government incentives: Access to federal, state, and local incentives can further reduce investment costs.

Strategic Acquisitions and Greenfield Investments

Brookfield employs a dual strategy of acquisitions and greenfield investments to expand its presence in US manufacturing. Acquisitions allow for immediate entry into established markets, while greenfield investments offer the opportunity to build facilities tailored to specific needs and future growth.

- Automotive: Investments in auto parts manufacturing and electric vehicle component production.

- Technology: Acquisitions of companies specializing in semiconductor manufacturing or advanced materials.

- Food processing: Investments in facilities focused on sustainable and efficient food production.

- Renewable Energy Manufacturing: Investments in solar panel and wind turbine component manufacturing, aligning with broader ESG goals.

The Tariffs Tightrope: Navigating the Trade War Fallout

The imposition of tariffs on imported goods presents a considerable challenge to Brookfield's US manufacturing investment strategy. This impacts both input costs and pricing strategies, creating a complex environment for long-term planning.

Impact of Tariffs on Input Costs & Pricing Strategies

Tariffs on imported raw materials and components directly increase the cost of production. This necessitates adjustments to pricing strategies, potentially affecting competitiveness and profitability.

- Increased costs of imported goods: Higher input costs reduce profit margins.

- Need for price adjustments: Passing increased costs onto consumers could impact market share.

- Potential impact on competitiveness: Higher prices may make US-manufactured goods less competitive against imports from countries with lower tariff rates.

Trade Policy Uncertainty and Investment Decisions

The fluctuating nature of US trade policy creates considerable uncertainty for long-term investment planning. Predicting future tariff rates and trade agreements is difficult, making accurate risk assessment critical.

- Risk assessment: Thorough analysis of potential tariff impacts is crucial for investment decisions.

- Potential for policy changes: Sudden shifts in trade policy can significantly impact investment returns.

- Impact on return on investment: Uncertainty can influence the overall attractiveness of US manufacturing investments.

Reshoring and the Shift in Global Manufacturing

Tariffs are accelerating the trend of reshoring, prompting companies to move manufacturing back to the US. Brookfield is well-positioned to capitalize on this trend by providing capital for reshoring initiatives.

- Advantages of reshoring: Reduced reliance on global supply chains, increased domestic job creation, and improved control over production.

- Opportunities for growth: Strong demand for domestically produced goods creates significant growth opportunities.

- Challenges in implementing reshoring strategies: High initial investment costs and potential workforce challenges require careful planning.

Mitigation Strategies Employed by Brookfield

Brookfield is proactively implementing several strategies to mitigate the risks associated with tariffs and maximize the returns on its US manufacturing investments.

Supply Chain Diversification

Brookfield is diversifying its supply chains by sourcing raw materials and components from multiple countries and suppliers. This reduces reliance on any single source and mitigates the impact of potential disruptions.

- Sourcing raw materials from multiple suppliers: Reduces vulnerability to supply chain disruptions.

- Exploring alternative sourcing locations: Identifying alternative suppliers in countries with favorable trade relationships.

Negotiation and Lobbying Efforts

Brookfield likely engages in active dialogue with policymakers and participates in lobbying efforts to advocate for trade policies that support its investments in US manufacturing.

- Engagement with policymakers: Direct communication with government officials to influence trade policy.

- Advocating for favorable trade policies: Supporting policies that reduce barriers to trade and promote fair competition.

Technological Advancements and Automation

Brookfield is likely investing in technological advancements and automation to improve efficiency, reduce labor costs, and enhance competitiveness.

- Investing in automation: Implementing robotics and other automation technologies to reduce reliance on manual labor.

- Implementing lean manufacturing principles: Optimizing production processes to minimize waste and maximize efficiency.

Conclusion

Brookfield's significant investments in US manufacturing present both substantial opportunities and considerable challenges. The impact of tariffs is a central factor influencing investment decisions and profitability. By employing strategies like supply chain diversification, engaging in policy discussions, and leveraging technological advancements, Brookfield seeks to navigate the complexities of the current trade landscape. Understanding Brookfield's strategy is crucial for comprehending the future of US manufacturing investment. Further research into Brookfield's specific approaches to navigating these tariffs is encouraged to gain a clearer picture of the challenges and opportunities surrounding US manufacturing investments.

Featured Posts

-

Warri Itakpe Railway Operations Temporarily Suspended Engine Problems Cited By Nrc

May 02, 2025

Warri Itakpe Railway Operations Temporarily Suspended Engine Problems Cited By Nrc

May 02, 2025 -

New Loyle Carner Album Details Revealed

May 02, 2025

New Loyle Carner Album Details Revealed

May 02, 2025 -

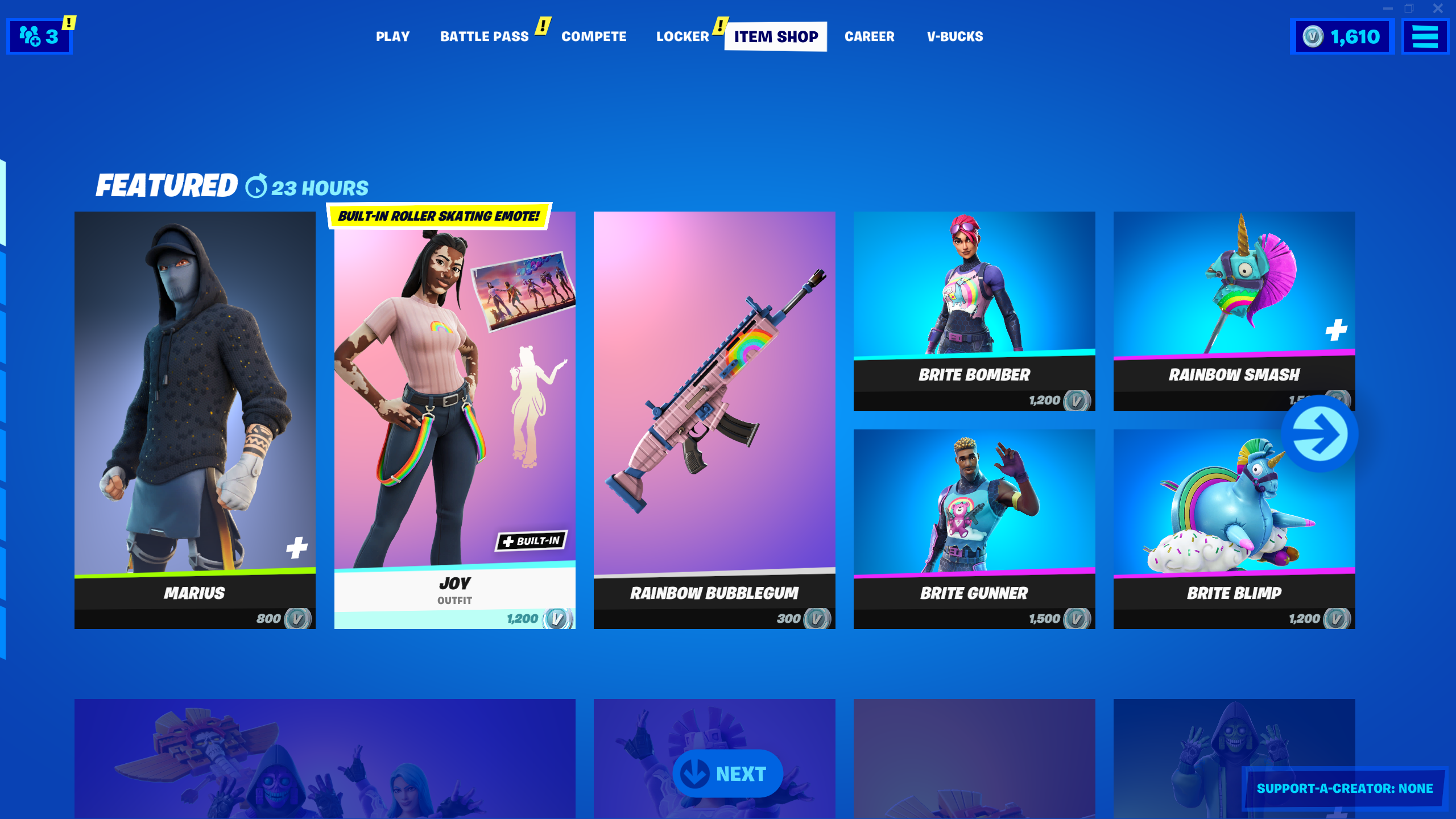

Fortnites Item Shop Update A Disappointment For Many Players

May 02, 2025

Fortnites Item Shop Update A Disappointment For Many Players

May 02, 2025 -

Loyle Carner Announces New Album Release Date Tracklist And More

May 02, 2025

Loyle Carner Announces New Album Release Date Tracklist And More

May 02, 2025 -

Clayton Kellers 500 Point Milestone A Missouri Hockey First

May 02, 2025

Clayton Kellers 500 Point Milestone A Missouri Hockey First

May 02, 2025