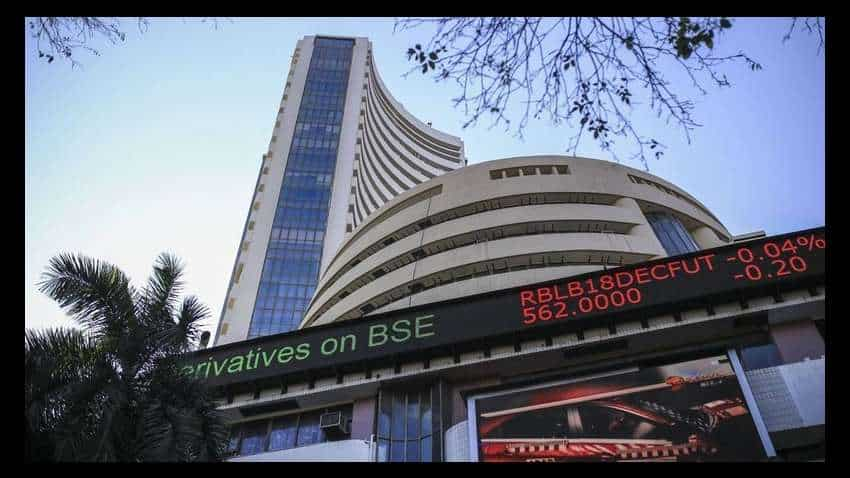

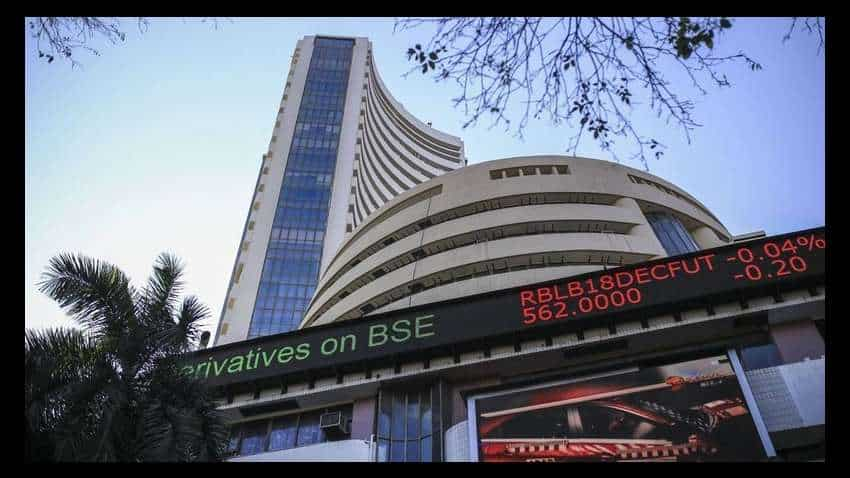

BSE Market Surge: Stocks Up Over 10% - Sensex Rally

Table of Contents

Key Drivers Behind the BSE Market Surge

Several crucial elements contributed to the impressive 10%+ surge in the BSE market and the accompanying Sensex rally. Let's examine the most significant factors:

Positive Global Economic Indicators

Positive news from the global economy played a pivotal role. Improved economic data from major economies like the US and Europe boosted investor confidence.

- Lower Inflation: A decline in inflation rates in several key economies eased concerns about aggressive interest rate hikes, fostering a more positive outlook for global growth.

- Increased Consumer Confidence: Rising consumer spending and improved consumer confidence indicators signaled a strengthening global economy, further fueling investor optimism.

- Stable Geopolitical Landscape: A relatively stable geopolitical environment, compared to recent years, reduced uncertainty and encouraged investment.

These positive global economic indicators, coupled with the strengthening US dollar, had a ripple effect, positively impacting the Indian stock market and contributing significantly to the BSE market surge and Sensex rally. Increased foreign investment flowed into emerging markets, including India, further boosting stock prices.

Strong Corporate Earnings

Robust corporate earnings reports from leading Indian companies across various sectors added fuel to the market's upward trajectory. Strong profit and revenue growth demonstrated the resilience and strength of the Indian economy.

- IT Sector Boom: The IT sector showed particularly strong performance, with several companies exceeding earnings expectations.

- Pharmaceutical Sector Growth: The pharmaceutical sector also contributed significantly, driven by increased demand both domestically and internationally.

- FMCG Sector Resilience: The fast-moving consumer goods (FMCG) sector demonstrated resilience, indicating strong consumer demand despite inflationary pressures.

This surge in corporate profits solidified investor confidence and fueled further buying, pushing the BSE market and Sensex to record highs.

Increased Foreign Institutional Investor (FII) Inflows

A significant influx of funds from Foreign Institutional Investors (FIIs) played a crucial role in the BSE market surge. Increased FII investment signifies a positive outlook on the Indian economy and its growth potential.

- Positive Outlook on Indian Economy: FIIs are increasingly viewing India as an attractive investment destination, driven by factors such as strong economic fundamentals, a young and growing population, and government initiatives promoting economic growth.

- Attractive Valuation: The relatively attractive valuation of Indian stocks compared to global markets also drew significant FII interest.

- Portfolio Diversification: FIIs are also diversifying their portfolios by increasing their exposure to emerging markets like India.

The substantial inflow of FII investment directly contributed to the increased demand for Indian stocks, leading to the significant rise in the BSE market and the Sensex rally.

Impact on Key Sectors and Individual Stocks

The BSE market surge impacted various sectors and individual stocks differently.

Winning Sectors

Several sectors experienced exceptional growth during this period:

- Information Technology: The IT sector was among the top performers, with many stocks recording double-digit gains. Specific examples include [mention specific high-performing stocks and their percentage gains].

- Pharmaceuticals: The pharmaceutical sector also saw significant gains, boosted by strong export demand and robust domestic sales. [mention specific high-performing stocks and their percentage gains].

- Financials: The financial sector, including banking and insurance, also experienced positive growth, driven by improved economic conditions. [mention specific high-performing stocks and their percentage gains].

The strong performance of these sectors significantly contributed to the overall BSE market surge and Sensex rally.

Investor Sentiment and Volatility

The market surge was accompanied by a significant increase in investor optimism and enthusiasm. However, the level of market volatility was relatively high, reflecting the rapid price movements. The surge wasn't a gradual increase but rather a more dramatic and swift upward movement. This volatility highlights the importance of careful risk assessment and a well-defined investment strategy.

Analyzing the Sustainability of the BSE Market Surge

The sustainability of the recent BSE market surge is a key question for investors.

Short-term vs. Long-term Outlook

The short-term outlook remains positive, with many analysts predicting continued growth, albeit potentially at a slower pace. However, the long-term outlook hinges on several factors, including global economic conditions, geopolitical stability, and the performance of Indian companies. Potential risks include global recessionary fears, inflation resurgence, and geopolitical uncertainties.

Expert Opinions and Market Forecasts

Market analysts offer diverse opinions on the future trajectory of the BSE. Some predict sustained growth, highlighting the strong fundamentals of the Indian economy. Others express caution, warning about potential corrections due to global economic headwinds. [Include quotes or summaries from financial experts and analysts, citing sources].

Conclusion: Navigating the BSE Market Surge and Future Opportunities

The significant BSE market surge and Sensex rally of October 26th, 2023, were driven by a combination of positive global economic indicators, strong corporate earnings, and increased FII investment. Key sectors like IT, Pharmaceuticals, and Financials experienced exceptional growth. While the short-term outlook is positive, investors should approach the market with caution, considering both the opportunities and potential risks. To navigate this dynamic environment, stay informed about BSE market and Sensex movements. Conduct thorough research and consider consulting with a financial advisor to make informed investment decisions during this period of significant BSE market surge and Sensex rally. Learn more about effective stock market investment strategies to capitalize on potential opportunities while mitigating risks.

Featured Posts

-

Kuzey Kibris In Lezzetleri Berlin I Fethediyor Itb 2024

May 15, 2025

Kuzey Kibris In Lezzetleri Berlin I Fethediyor Itb 2024

May 15, 2025 -

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025 -

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025 -

Discussie Leeflang Noodzaak Voor Gesprek Tussen Bruins En Npo Toezichthouder

May 15, 2025

Discussie Leeflang Noodzaak Voor Gesprek Tussen Bruins En Npo Toezichthouder

May 15, 2025 -

Impact Of Positive Monsoon Predictions On Indias Agricultural Growth And Consumption

May 15, 2025

Impact Of Positive Monsoon Predictions On Indias Agricultural Growth And Consumption

May 15, 2025

Latest Posts

-

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025 -

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025 -

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025