BSE Stock Rally: Positive Earnings Impact Indian Bourse

Table of Contents

Strong Corporate Earnings Drive BSE Rally

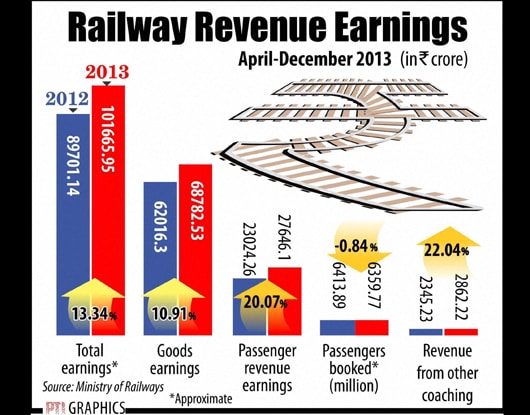

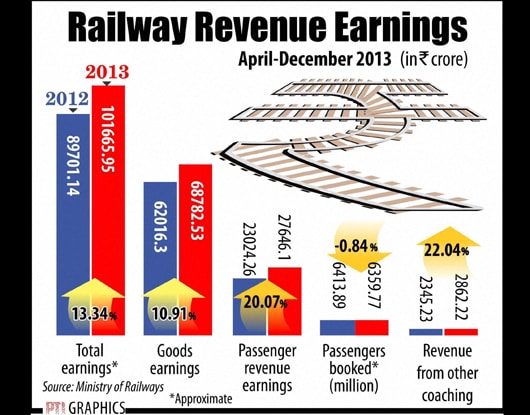

A primary driver of the recent BSE stock rally is the strong performance reported by numerous major Indian companies in Q[Insert Relevant Quarter, e.g., Q2 2024]. Positive earnings reports have boosted investor confidence and fueled a surge in stock prices across various sectors. This correlation between robust corporate performance and the rise in the BSE index is undeniable.

-

Specific Sectors Showing Strong Performance: The IT, Pharma, and Banking sectors have been particularly prominent, showcasing impressive revenue growth and healthy profit margins. Companies within these sectors have released earnings reports exceeding expectations, leading to significant stock price increases.

-

Data Points: The BSE index has seen a [Insert Percentage]% increase in recent weeks, exceeding expectations. For example, Company X, a leading player in the IT sector, reported a [Insert Percentage]% increase in revenue and a [Insert Percentage]% jump in profits, resulting in a [Insert Percentage]% surge in its stock price. Similarly, Company Y in the Pharma sector saw [Insert relevant data].

-

Impact on Investor Sentiment: Robust profit margins and impressive revenue growth have significantly bolstered investor sentiment. This positive outlook has encouraged further investment, creating a positive feedback loop that continues to drive the BSE stock rally. The market is reacting favorably to demonstrable financial health.

Increased Foreign Institutional Investor (FII) Investment

The influx of Foreign Institutional Investor (FII) investment has played a crucial role in the recent BSE rally. Significant capital inflows demonstrate a growing international confidence in the Indian economy and its potential for future growth.

-

Inflow Figures: In recent weeks/months, FII investment in the Indian market has totalled [Insert Figure – e.g., billions of dollars], marking a substantial increase compared to previous periods.

-

Factors Attracting FII Investment: Several factors are attracting FII investment, including positive economic growth projections for India, supportive government policies aimed at boosting foreign investment, and the country's large and growing consumer market. India's relative stability compared to some other global markets is also a significant draw.

-

Impact of Global Economic Conditions: While global economic uncertainty remains a factor, the Indian market's resilience and strong fundamentals have attracted investors seeking stable and high-growth opportunities. This suggests a degree of decoupling from broader global economic trends.

Government Policies and Regulatory Reforms

Supportive government initiatives and regulatory reforms have contributed significantly to the positive market sentiment and the subsequent BSE rally. These measures have instilled confidence among both domestic and foreign investors.

-

Specific Policies and Reforms: Recent tax reforms, aimed at simplifying the tax structure and improving ease of doing business, have been well-received. Furthermore, investments in infrastructure development, such as improved transportation networks and digital infrastructure, have created a more favorable investment climate.

-

Impact on Market Sentiment: These policies have significantly improved investor confidence, signaling a commitment to economic growth and stability. This positive outlook is translating into increased investment and fueling the BSE stock rally.

-

Potential Future Policy Changes: Further policy reforms focused on deregulation and ease of doing business could further strengthen the Indian market and sustain the positive momentum in the BSE.

Long-Term Outlook for the Indian Bourse

While the current BSE stock rally is impressive, it’s crucial to maintain a balanced perspective on its sustainability. Several factors could influence future market trends.

-

Potential Risks and Challenges: Global economic uncertainty, inflationary pressures, and geopolitical risks pose potential challenges. These factors could impact investor sentiment and potentially lead to market corrections.

-

Future Market Trends: Based on current economic indicators, the long-term outlook for the Indian bourse remains cautiously optimistic. Continued strong corporate earnings, sustained FII investment, and further government support could drive further growth.

-

Cautious but Optimistic Outlook: While potential risks exist, the fundamental strength of the Indian economy and the positive momentum in the BSE suggest a bright outlook for long-term investors.

Conclusion

The recent BSE stock rally is a result of a confluence of positive factors: strong corporate earnings, increased FII investment, and supportive government policies. These elements have created a favorable environment for investment and fueled significant growth in the Indian bourse. The BSE stock rally presents exciting opportunities, but careful analysis and understanding of market dynamics are crucial. Stay updated on the latest BSE news and insights to make informed investment decisions in the Indian Bourse, and capitalize on the opportunities presented by this positive trend.

Featured Posts

-

How To Watch Mariners Vs Reds Live Stream Mlb And Tv Channel Guide

May 07, 2025

How To Watch Mariners Vs Reds Live Stream Mlb And Tv Channel Guide

May 07, 2025 -

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025 -

Xrp Investment Analysis Considering The Recent 400 Jump

May 07, 2025

Xrp Investment Analysis Considering The Recent 400 Jump

May 07, 2025 -

Adames Walk Off Hit Seals Giants Home Opener Win

May 07, 2025

Adames Walk Off Hit Seals Giants Home Opener Win

May 07, 2025 -

The Karate Kid A Legacy Of Martial Arts And Life Lessons

May 07, 2025

The Karate Kid A Legacy Of Martial Arts And Life Lessons

May 07, 2025

Latest Posts

-

7 Surprisingly Good Movies On Paramount

May 08, 2025

7 Surprisingly Good Movies On Paramount

May 08, 2025 -

160 Year Old Pierce County House To Become Park

May 08, 2025

160 Year Old Pierce County House To Become Park

May 08, 2025 -

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025 -

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025 -

Ranking Steven Spielbergs War Films 7 Must See Movies Saving Private Ryan Omitted

May 08, 2025

Ranking Steven Spielbergs War Films 7 Must See Movies Saving Private Ryan Omitted

May 08, 2025