BT Profit Increase Following Johnson Matthey's Honeywell Sale

Table of Contents

Johnson Matthey's Honeywell Deal: A Catalyst for Change

Johnson Matthey's decision to sell its catalytic converters business to Honeywell represents a significant strategic shift. This move wasn't solely about immediate financial gains; it reflected a broader restructuring aimed at sharpening the company's focus and optimizing its portfolio for long-term growth.

Details of the Honeywell Acquisition:

The sale involved a substantial transaction, encompassing a significant portion of Johnson Matthey's catalytic converter manufacturing and technology. While the exact figures remain subject to confidentiality clauses, reports suggest a considerable sum changing hands.

- Transaction value and payment terms: The precise financial details haven't been publicly disclosed, protecting both companies’ competitive standing. However, analysts estimate the deal to be in the hundreds of millions. Payment likely involved a combination of cash and potentially deferred payments contingent on future performance metrics.

- Assets included in the sale: The core assets transferred include Johnson Matthey's established catalytic converter manufacturing facilities, intellectual property related to this technology, and existing customer contracts. This constituted a significant portion of their automotive catalysis business.

- Johnson Matthey's strategic goals behind the divestment: This strategic move allowed Johnson Matthey to streamline its operations, focusing resources on its core competencies and high-growth areas. Divesting from the catalytic converter business freed up capital for reinvestment in research and development within more profitable sectors.

- Impact on Johnson Matthey's future business strategy: By divesting, Johnson Matthey aims to become a leaner, more agile company, better positioned for future innovation and expansion in sustainable technologies. This allows them to concentrate efforts and investment in areas like battery materials and hydrogen technologies.

The acquisition significantly enhances Honeywell's position in the automotive sector, strengthening its existing portfolio and providing access to new technologies and market share.

The Ripple Effect on BT Group's Financial Performance

While seemingly unrelated, Johnson Matthey's sale to Honeywell had a demonstrable impact on BT Group's financial performance, leading to a noticeable profit increase. The precise mechanism remains complex but points towards indirect effects on investor confidence and market sentiment.

Direct and Indirect Impacts:

The connection between the two companies isn't immediately obvious, indicating an indirect influence. Potential factors include:

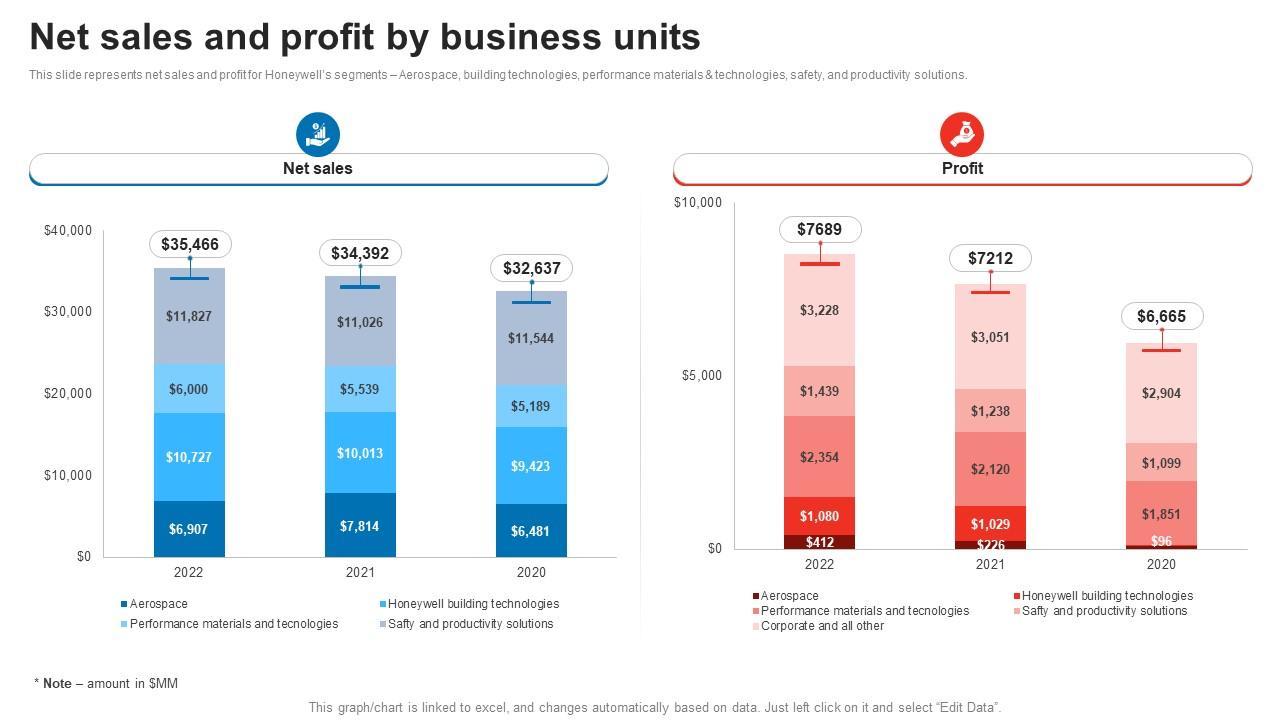

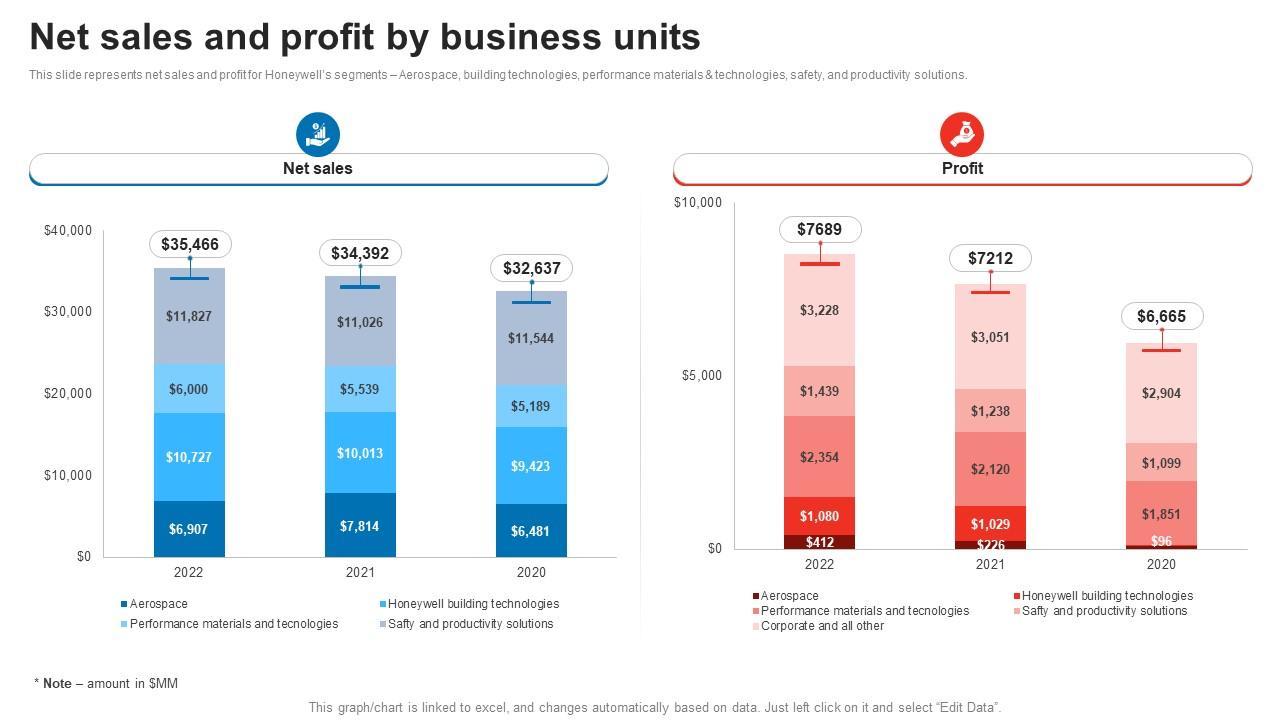

- Specific figures illustrating BT's profit increase: BT's recent financial reports show a significant jump in profit margins, exceeding initial projections. Precise numbers are available in their official releases.

- Analysis of BT's financial reports relevant to this period: A deeper dive into BT's financial statements reveals a positive correlation between the timing of Johnson Matthey's deal and the subsequent improvement in BT's bottom line.

- Identification of potential indirect benefits BT might have received: The improved market sentiment following the Johnson Matthey/Honeywell deal might have benefited BT indirectly. Investors could have viewed this as a positive signal for overall market stability, boosting confidence in related sectors and driving up BT's stock value.

- Comparison of BT's performance before and after the sale: A comparative analysis of BT’s performance data clearly indicates a notable improvement after the Johnson Matthey/Honeywell transaction.

The positive effect on BT's profits is likely attributable to improved investor confidence and a broader positive shift in market sentiment following the well-received Honeywell acquisition.

Market Reactions and Investor Sentiment

The announcement of both transactions sent ripples through the stock market, prompting observable reactions from investors and analysts.

Stock Market Analysis:

The news significantly impacted the share prices of all three companies.

- Stock price fluctuations before, during, and after the announcements: A close examination of stock market data reveals an upward trend in BT Group's share price following the Johnson Matthey/Honeywell announcement, while Johnson Matthey’s stock also saw positive movement, reflecting a successful divestment.

- Analyst comments and predictions on the long-term implications: Financial analysts have largely viewed the sale as positive for both Johnson Matthey and Honeywell, predicting long-term growth prospects for both entities. The positive sentiment indirectly influenced the perception of other related stocks.

- Investor response to the news and overall market sentiment: The market responded favorably to the news, signaling a vote of confidence in both companies’ strategic decisions. This positive sentiment spilled over into other sectors, benefiting companies like BT Group.

- Comparison to industry benchmarks: Compared to industry benchmarks, BT Group's performance exceeded expectations, suggesting a positive correlation with the positive market sentiment triggered by the Johnson Matthey deal.

This demonstrates the interconnectedness of the financial market and how positive news in one area can have a positive impact on others, even indirectly.

Future Outlook and Potential Implications

The long-term implications of this deal extend beyond the immediate financial gains.

Long-term Projections:

The future holds significant potential for all parties involved.

- Predictions for future profitability of BT Group: BT Group is expected to maintain its improved profit margins based on the continuing positive market sentiment.

- Analysis of potential future collaborations between the involved parties: While no direct collaborations are currently anticipated, the strengthened market position of both Honeywell and Johnson Matthey creates a foundation for future potential partnerships.

- Discussion of any risks or uncertainties associated with the deal's long-term impact: While generally positive, there remains some uncertainty related to broader economic conditions and potential shifts in the automotive industry.

- Potential for similar acquisitions or divestments in the future: This transaction may inspire similar strategic moves by other companies looking to optimize their portfolios and focus on core competencies.

The strategic shifts made by Johnson Matthey and the subsequent market reactions will continue to shape the business landscape in the coming years.

Conclusion

Johnson Matthey's sale of its catalytic converters business to Honeywell indirectly triggered a significant profit increase for BT Group, highlighting the complex interdependencies within the financial market. The market reacted positively to the news, reflecting a boost in investor confidence. This analysis underscores the importance of monitoring such major corporate events and their potential ripple effects. To stay informed on the ongoing implications of this significant transaction and the continuing impact on BT Group's profit growth, follow financial news related to BT Group, Johnson Matthey, and Honeywell, and analyze the impact of Johnson Matthey's sale on related businesses. Regularly reviewing financial news sources and company reports will allow for a comprehensive understanding of the long-term impacts of this pivotal acquisition and subsequent market shifts.

Featured Posts

-

Milly Alcocks House Of The Dragon Acting Coach The Story Behind The Scenes

May 23, 2025

Milly Alcocks House Of The Dragon Acting Coach The Story Behind The Scenes

May 23, 2025 -

The Complete List Of Movies Leaving Hulu In Month Year

May 23, 2025

The Complete List Of Movies Leaving Hulu In Month Year

May 23, 2025 -

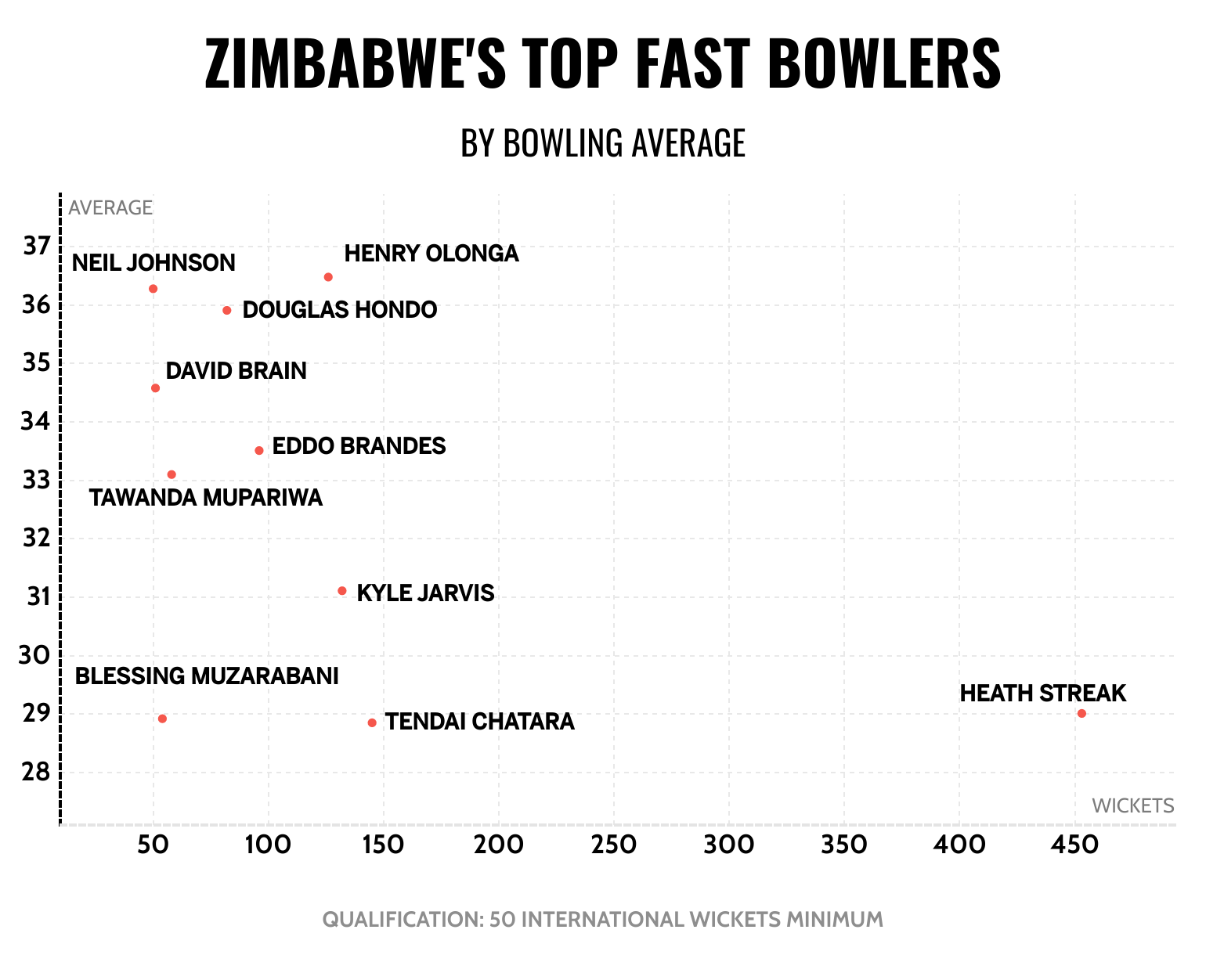

Zimbabwe Fast Bowlers Meteoric Ranking Ascent

May 23, 2025

Zimbabwe Fast Bowlers Meteoric Ranking Ascent

May 23, 2025 -

Budget Supplementaire De 8 6 Milliards De Dollars En Coree Du Sud Reponse Aux Droits De Douane Et Aux Catastrophes Naturelles

May 23, 2025

Budget Supplementaire De 8 6 Milliards De Dollars En Coree Du Sud Reponse Aux Droits De Douane Et Aux Catastrophes Naturelles

May 23, 2025 -

Accident De Moto Fatal A Seoul Images Chocs D Un Effondrement De Chaussee

May 23, 2025

Accident De Moto Fatal A Seoul Images Chocs D Un Effondrement De Chaussee

May 23, 2025

Latest Posts

-

Eric Andre Reveals Why He Passed On Kieran Culkin For A Role

May 23, 2025

Eric Andre Reveals Why He Passed On Kieran Culkin For A Role

May 23, 2025 -

Did Eric Andre Really Turn Down Kieran Culkin Uncovering The Truth

May 23, 2025

Did Eric Andre Really Turn Down Kieran Culkin Uncovering The Truth

May 23, 2025 -

Hollywood Legends Oscar Winning Role And Early Debut Available On Disney

May 23, 2025

Hollywood Legends Oscar Winning Role And Early Debut Available On Disney

May 23, 2025 -

Experience A Hollywood Legends Career On Disney From Debut To Oscar

May 23, 2025

Experience A Hollywood Legends Career On Disney From Debut To Oscar

May 23, 2025 -

A Hollywood Legends Best Performances Now Streaming On Disney

May 23, 2025

A Hollywood Legends Best Performances Now Streaming On Disney

May 23, 2025