BTC Price Increase: Analyzing The Impact Of Trump And The Federal Reserve

Table of Contents

Bitcoin (BTC), the pioneering cryptocurrency, is known for its dramatic price swings. Its decentralized nature and limited supply make it a unique asset, largely independent of traditional financial markets, yet still susceptible to broader economic and political trends. This analysis will explore the potential connections between significant political and economic events and the observed BTC price increase.

Donald Trump's Influence on BTC Price Increase

Donald Trump's presidency was marked by unconventional economic policies and a highly active social media presence. Both these aspects could have indirectly influenced Bitcoin's price.

Trump's Economic Policies and their Ripple Effect on Crypto

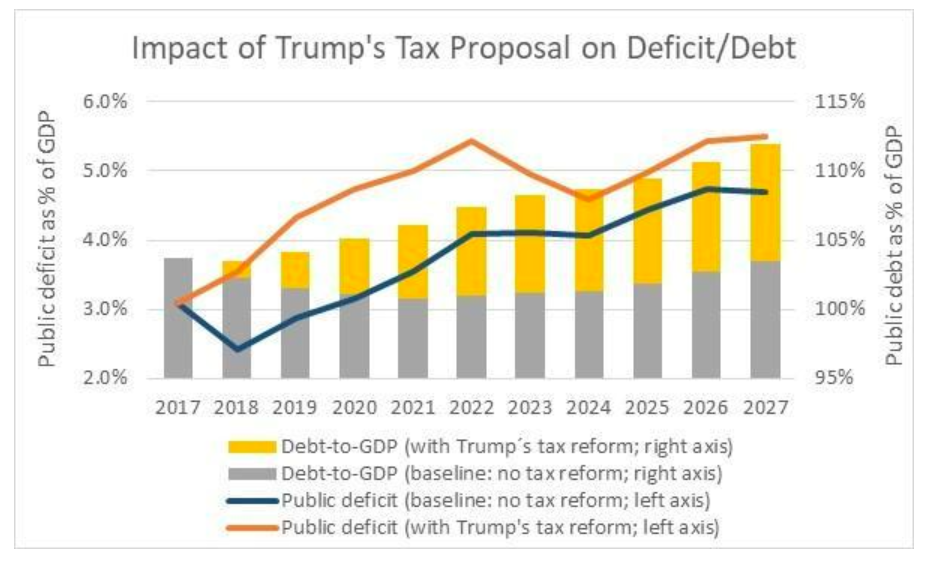

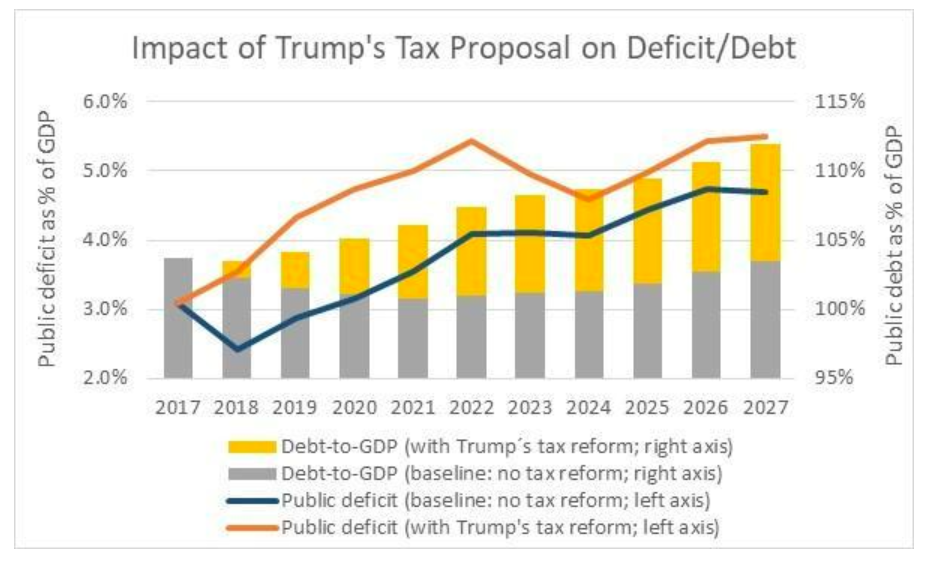

Trump's fiscal policies, characterized by significant tax cuts and deregulation, had a profound impact on the US economy. These policies, while stimulating short-term growth for some, also led to increased national debt and fueled concerns about inflation. This economic uncertainty could have driven investors towards alternative assets, including Bitcoin, as a potential hedge.

- Increased national debt: The soaring national debt under Trump's administration might have pushed some investors to seek assets perceived as less susceptible to devaluation, such as Bitcoin.

- Uncertainty and Bitcoin's perceived stability: The unpredictable nature of Trump's policies and pronouncements created an environment of uncertainty, potentially increasing the demand for Bitcoin, seen by some as a more stable store of value compared to traditional markets.

- Examples: While directly linking specific policy changes to immediate BTC price movements is complex, periods of heightened economic uncertainty during the Trump era often coincided with periods of increased Bitcoin adoption and price appreciation. Further research is needed to definitively establish causal relationships.

Trump's Social Media Presence and its Impact on Crypto Markets

Trump's frequent and often controversial use of social media significantly influenced market sentiment across various sectors. His statements, whether directly about Bitcoin or related to broader economic issues, could have had a ripple effect on cryptocurrency markets.

- Tweets and statements: While Trump rarely directly mentioned Bitcoin, his comments on economic policy, regulation, or even unrelated topics, could trigger market reactions. Analyzing the correlation between specific tweets and subsequent price movements requires careful consideration of other market factors.

- Market Manipulation and Prominent Figures: The influence of prominent figures like Trump on investor psychology cannot be ignored. His pronouncements, regardless of their direct relevance to Bitcoin, could sway investor confidence and trigger buying or selling pressure.

The Federal Reserve's Role in BTC Price Increase

The Federal Reserve's monetary policies play a crucial role in shaping the overall economic landscape and, consequently, the price of Bitcoin.

Monetary Policy and Bitcoin's Safe-Haven Status

The Federal Reserve's actions, such as interest rate hikes and quantitative easing (QE), directly impact the value of the US dollar and, indirectly, the price of Bitcoin. Bitcoin is often viewed as a hedge against inflation or economic uncertainty stemming from Federal Reserve policies.

- Quantitative Easing (QE) and Inflation: QE, a monetary policy tool involving the creation of new money, can lead to increased inflation if not managed carefully. This inflation can drive investors towards Bitcoin as a store of value.

- Interest Rate Changes: Changes in interest rates affect the attractiveness of traditional investments. Low interest rates can make Bitcoin a more appealing option, while high rates can potentially draw investors back to traditional assets.

- Data and Charts: Analyzing historical data showing correlations between Fed actions (interest rate changes, QE announcements) and subsequent BTC price fluctuations can reveal potential relationships. However, it's crucial to consider other factors influencing the market.

Impact of Inflation on Bitcoin Investment

High inflation erodes the purchasing power of fiat currencies, making investors seek alternative stores of value. Bitcoin, with its limited supply of 21 million coins, has gained traction as a potential hedge against inflation.

- Historical Examples: Periods of high inflation in various countries have often seen increased adoption of Bitcoin as people seek to preserve their wealth.

- Bitcoin as "Digital Gold": Bitcoin's limited supply and decentralized nature have led to comparisons with gold, a traditional safe haven asset. This perception contributes to its appeal during inflationary periods.

Conclusion: Understanding the Factors Behind BTC Price Increase

This analysis explored the potential influence of both Donald Trump's policies and the Federal Reserve's actions on recent BTC price increases. While it's difficult to definitively attribute specific price movements solely to these factors, the interplay of economic uncertainty, inflation concerns, and the impact of influential figures like Trump on market sentiment likely played a role. Other market factors, technological advancements, and regulatory developments also significantly impact Bitcoin's price.

It's crucial to remember that the cryptocurrency market is highly volatile and unpredictable. Attributing price changes to single causes is an oversimplification. However, understanding the potential connections between macroeconomic factors, political events, and Bitcoin's price is vital for making informed investment decisions. We encourage further research into BTC price prediction tools and analysis to navigate the complex world of cryptocurrency investing. Stay informed about the interplay between global economics and the BTC price increase to make smarter investment choices in this exciting, yet volatile, market.

Featured Posts

-

Hornets Fall To Warriors Marking Seventh Straight Defeat

Apr 24, 2025

Hornets Fall To Warriors Marking Seventh Straight Defeat

Apr 24, 2025 -

Is Instagrams New Video Editor A Game Changer

Apr 24, 2025

Is Instagrams New Video Editor A Game Changer

Apr 24, 2025 -

No Plans To Fire Powell Trump On Federal Reserve Leadership

Apr 24, 2025

No Plans To Fire Powell Trump On Federal Reserve Leadership

Apr 24, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025 -

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025

Latest Posts

-

Loanees Bid For Celtic Success

May 12, 2025

Loanees Bid For Celtic Success

May 12, 2025 -

Celtic Loanees Push For League Victory

May 12, 2025

Celtic Loanees Push For League Victory

May 12, 2025 -

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025 -

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025 -

Sheehans Reaction Ipswich Town Face Challenges Head On

May 12, 2025

Sheehans Reaction Ipswich Town Face Challenges Head On

May 12, 2025