Buffett's Apple Holdings: A Post-Trump Tariff Analysis

Table of Contents

Trump's Tariffs and their Impact on Apple's Supply Chain

The Trump administration imposed various tariffs on goods imported from China, significantly impacting numerous industries, including technology. These tariffs, implemented in phases starting in 2018, targeted a wide range of products, aiming to protect American businesses and create a more balanced trade relationship.

-

Products Affected: The tariffs directly impacted key Apple products manufactured largely in China, including:

- iPhones

- iPads

- MacBooks

- Apple Watches

- AirPods

-

Increased Production Costs: The tariffs led to a substantial increase in Apple's production costs. The added tariffs on imported components directly translated to higher manufacturing expenses for Apple, potentially squeezing profit margins.

-

Mitigation Strategies: To mitigate these increased costs, Apple employed several strategies:

- Shifting Production: Apple began exploring and implementing plans to diversify its manufacturing base, moving some production out of China to countries like Vietnam and India.

- Price Adjustments: While not immediately drastic, Apple subtly adjusted its pricing strategy in some markets to account for the increased costs, though they aimed to minimize the impact on consumers.

-

Impact on Profits: While precise figures quantifying the direct impact of tariffs on Apple's profits during that period are difficult to isolate, analysts observed a slight dampening effect on profit growth, though it wasn't catastrophic thanks to Apple's robust brand loyalty and global demand.

Berkshire Hathaway's Response to Tariff-Related Risks

Berkshire Hathaway's response to the tariff-related risks impacting Apple was relatively passive, reflecting Buffett's long-term investment philosophy.

-

Investment Strategy: Berkshire Hathaway largely maintained its significant Apple holdings throughout the tariff period. This suggests confidence in Apple's long-term prospects and ability to navigate these challenges.

-

Diversification: While not a direct reaction to the Apple-specific tariffs, Berkshire Hathaway’s already extensive and diversified portfolio served as a buffer against the potential negative impact of tariffs on Apple's performance.

-

Public Statements: Warren Buffett didn't publicly express significant concern about the tariffs’ impact on Apple. This reflects his characteristic long-term perspective and faith in the company's management.

-

Influence on Overall Portfolio: The tariff risks related to Apple were likely a minor factor within Berkshire Hathaway’s highly diversified portfolio. The overall impact on Berkshire’s performance was minimal compared to other factors influencing the market.

The Long-Term Effects on Buffett's Apple Holdings

The long-term effects of the tariffs on Buffett’s Apple holdings were ultimately less significant than initially feared.

-

Impact on Apple: While the tariffs temporarily increased production costs, Apple successfully adapted, largely mitigating the long-term damage. Its brand strength and market position proved resilient.

-

Implications for Berkshire Hathaway: The tariffs did not significantly alter Berkshire Hathaway's investment strategy regarding Apple. The long-term value proposition of Apple remained compelling.

-

Global Supply Chain Changes: The tariff disputes accelerated a pre-existing trend towards supply chain diversification for many companies, including Apple. This shift, while prompted by tariffs, likely offers long-term benefits in terms of resilience and geopolitical stability.

-

Post-Tariff Market Adjustments: Post-tariff, Apple's stock continued its upward trajectory, demonstrating a resilience to these external pressures. Buffett’s continued investment reflects this sustained confidence.

-

Future Implications: The experience highlights the importance of considering geopolitical risks when making investment decisions. Diversification and a long-term perspective become even more crucial in the face of global trade uncertainties.

Comparing Apple's Performance with and without Tariffs (Comparative Analysis)

Analyzing Apple's performance before, during, and after the tariff period reveals the relative impact. While precise isolation of tariff impact is difficult, a comparative analysis shows:

-

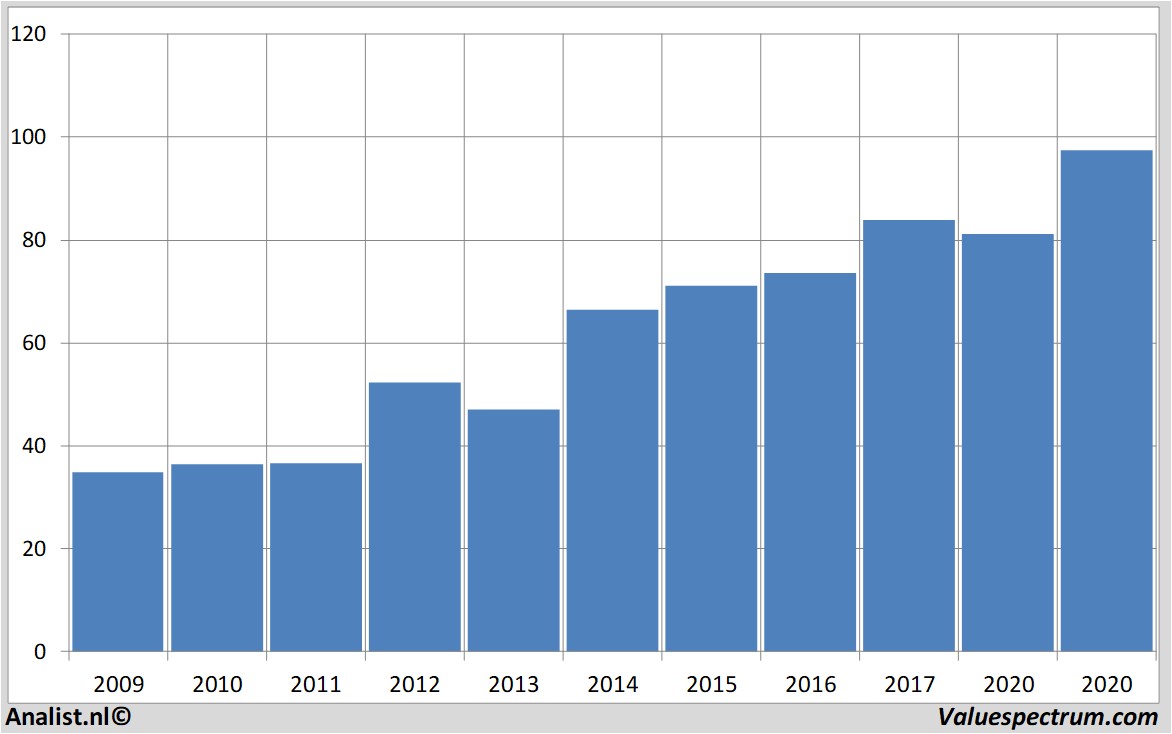

Stock Prices: Apple's stock price experienced volatility during the tariff period, but ultimately continued its overall upward trend. (Insert chart showing stock price performance).

-

Revenue Streams: While revenue growth might have been slightly slower during the tariff period, it remained robust. (Insert graph illustrating revenue comparison).

-

Market Capitalization: Apple’s market capitalization continued to increase despite the tariffs, highlighting the overall strength of the company. (Insert data illustrating market cap comparison).

-

Volatility: Periods of heightened tariff uncertainty did correlate with increased volatility in Apple’s stock price, reflecting investor sentiment.

Conclusion:

Trump's tariffs presented a significant challenge to Apple's supply chain and potentially impacted Buffett's Apple holdings. However, Apple's strategic responses, including production diversification and price adjustments, mitigated much of the negative impact. Berkshire Hathaway’s continued investment showcases confidence in Apple's long-term potential. While the tariffs caused temporary volatility, the long-term effects on both companies appear relatively minor. Understanding the influence of geopolitical events like tariffs on major investments like Buffett's Apple holdings is crucial for informed investment decisions. Continue researching the dynamics of Buffett's Apple holdings and other significant investments to make better-informed choices.

Featured Posts

-

2002 Submarine Bribery Case Malaysian Ex Pm Najib Faces New Accusations

May 24, 2025

2002 Submarine Bribery Case Malaysian Ex Pm Najib Faces New Accusations

May 24, 2025 -

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025 -

Positief Beurzenklimaat Na Trump Uitstel Aex Analyse

May 24, 2025

Positief Beurzenklimaat Na Trump Uitstel Aex Analyse

May 24, 2025 -

Prezzi Moda Usa Analisi Dell Impatto Dei Dazi Sulle Importazioni

May 24, 2025

Prezzi Moda Usa Analisi Dell Impatto Dei Dazi Sulle Importazioni

May 24, 2025 -

Daxs Upward Trend Will Wall Streets Recovery Change The Game

May 24, 2025

Daxs Upward Trend Will Wall Streets Recovery Change The Game

May 24, 2025

Latest Posts

-

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025