Businessman's Bold Move On Dragon Den: Rejecting Favourable Deals

Table of Contents

The Psychology Behind Rejecting a Deal

The decision to reject a seemingly favorable deal on Dragon's Den is often driven by complex psychological factors. It's not simply about the money; it's about the long-term vision and the entrepreneur's deep understanding of their own business.

Maintaining Control and Vision

Entrepreneurs pour their heart and soul into their businesses. Giving up control can feel like relinquishing a part of themselves. Rejecting a deal often stems from a desire to maintain ownership and the creative direction of their company.

- Loss of creative direction: Investors may have different visions for the company, potentially clashing with the founder's original plans.

- Dilution of equity beyond comfort levels: Accepting significant investment often means surrendering a large percentage of ownership, which some entrepreneurs aren't willing to do.

- Clash of business philosophies: Differences in business values and strategies can lead to conflicts and hinder future growth.

For example, consider the story of [insert example of a successful entrepreneur who prioritized long-term vision over short-term gains]. Their unwavering commitment to their original vision, even in the face of a tempting offer, ultimately led to greater success.

Valuation and Future Potential

Sometimes, the Dragons' offer simply undervalues the company's true potential. Entrepreneurs with a strong belief in their business may see the offer as a short-sighted assessment that fails to account for future growth.

- Projected growth: Entrepreneurs may have ambitious growth projections that far exceed the valuation offered on the show.

- Future market opportunities: They might anticipate tapping into new markets or technological advancements that would significantly increase the company's value in the future.

- Intellectual property value: The offer might not adequately reflect the value of patents, trademarks, or other intellectual property.

Imagine a startup with disruptive technology. A Dragon's Den offer might look attractive in the short term, but rejecting it allows them to pursue further development and secure a much higher valuation down the line. This illustrates how rejecting a seemingly favorable deal on Dragon's Den can lead to exponential growth.

Seeking Strategic Partnerships over Financial Investments

The allure of Dragon's Den isn't solely financial; it's also about gaining access to invaluable expertise and networks. Some entrepreneurs might reject purely financial offers in favor of securing strategic partners who can offer more than just capital.

- Industry expertise: A strategic partner can bring decades of experience and invaluable industry insights.

- Market access: Partnerships can unlock access to new markets and distribution channels.

- Mentorship opportunities: Mentorship from experienced investors can provide priceless guidance and support.

A businessman might reject a hefty offer to gain access to a major distribution network instead. This strategic decision often proves far more valuable in the long run than a one-time injection of capital.

Analyzing the Risks and Rewards

Rejecting a Dragon's Den offer isn't a decision to be taken lightly. It involves carefully weighing the potential downsides against the long-term vision.

The Potential Downside of Accepting a Deal

Accepting an offer, while seemingly advantageous, can lead to unforeseen consequences.

- Loss of equity: Surrendering a significant stake in the company can limit future control and earning potential.

- Relinquishing control: Investors often demand a say in company decisions, potentially hindering the founder's creative vision.

- Potential conflicts with investors: Differences in business philosophies can lead to friction and disagreements.

For example, numerous companies have seen their growth stifled by investor interference or disagreements, showcasing the potential pitfalls of accepting a deal without careful consideration.

Long-Term Vision vs. Immediate Gratification

The core of the decision often lies in the balance between immediate financial gain and long-term vision.

- Building a sustainable business: Entrepreneurs might prioritize building a robust, self-sufficient business over quick profits.

- Achieving long-term goals: Short-term gains might be sacrificed to achieve larger, more ambitious objectives.

- Brand integrity: Accepting certain offers might compromise the brand's values or long-term goals.

Entrepreneurs often choose the harder, longer road because it ultimately leads to more sustainable and lasting success.

Lessons from Successful Rejections on Dragon's Den

The entrepreneurs who successfully navigate the rejection of Dragon's Den offers often possess key skills and attributes.

Negotiating Skills and Confidence

Confidence and strong negotiation skills are crucial for securing better terms in the future.

- Knowing your worth: Understanding the true value of the business is paramount in negotiating favourable deals.

- Understanding market value: Having a solid grasp of market trends and competitor analysis allows for realistic valuation.

- Preparation for future fundraising rounds: Rejecting an offer allows for more refined planning for future funding.

By leveraging their experience, these entrepreneurs often secure even better terms in subsequent funding rounds.

The Importance of a Strong Business Plan

A well-defined business plan is crucial in justifying the rejection of an offer.

- Clear financial projections: Demonstrates a clear understanding of the company's financial position and future potential.

- Strong market analysis: Provides evidence of market demand and competitive advantage.

- A well-defined exit strategy: Shows investors a clear path towards a successful exit, enhancing the company’s appeal.

A meticulously crafted business plan provides the confidence to walk away from unfavorable terms and attract better investors later.

Conclusion

Rejecting favorable deals on Dragon's Den isn't about recklessness; it's about strategic decision-making. Entrepreneurs often prioritize maintaining control, securing a fair valuation, and building strategic partnerships over immediate financial gains. By carefully weighing the risks and rewards, understanding the psychology involved, and having a robust business plan, they position themselves for long-term success. Learn from these bold moves and make informed decisions for your business. Don't be afraid to reject unfavourable deals—build your own success story!

Featured Posts

-

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025 -

Adonis Smith Trial Friend Of Murder Victim Gives Testimony

Apr 30, 2025

Adonis Smith Trial Friend Of Murder Victim Gives Testimony

Apr 30, 2025 -

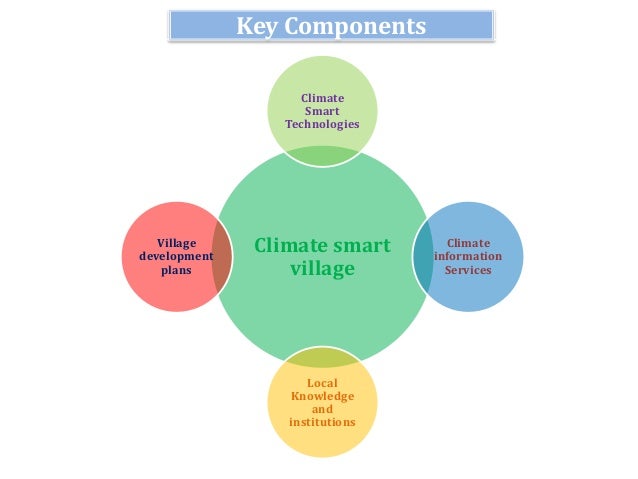

Schneider Electrics Climate Smart Village A Sustainable Future For Africa

Apr 30, 2025

Schneider Electrics Climate Smart Village A Sustainable Future For Africa

Apr 30, 2025 -

Analysis Trumps Decision To Remove Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Analysis Trumps Decision To Remove Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

United Kingdoms Eurovision 2025 Act Meet Remember Monday

Apr 30, 2025

United Kingdoms Eurovision 2025 Act Meet Remember Monday

Apr 30, 2025