Buy-and-Hold: Facing The Reality Of Long-Term Investing

Table of Contents

The Allure of Buy-and-Hold: Understanding the Benefits

Buy-and-hold, a popular passive investing strategy, offers several compelling advantages for long-term investors. Understanding these benefits is crucial before deciding if it’s the right approach for your portfolio management.

Minimizing Transaction Costs

Frequent trading can significantly erode your investment returns. Buy-and-hold dramatically reduces these costs:

- Lower brokerage fees: Less frequent trades mean lower commissions paid to your brokerage. This seemingly small saving adds up over time, particularly with larger investment portfolios.

- Reduced capital gains taxes: Capital gains taxes are only incurred when you sell assets. A buy-and-hold strategy minimizes the frequency of taxable events, allowing more of your investment returns to compound.

- Simplified portfolio management: Instead of constantly monitoring market fluctuations and making frequent trades, you can dedicate more time to other aspects of your financial life. This simplifies your investment process and reduces stress.

Harnessing the Power of Compounding

Buy-and-hold allows your investments to benefit from the magic of compounding – earning returns on your initial investment and on the accumulated returns.

- Reinvested dividends: Many stocks pay dividends, and with a buy-and-hold approach, these dividends are typically automatically reinvested, purchasing more shares and accelerating growth. This is crucial for long-term growth potential.

- Long-term growth potential: Buy-and-hold allows you to ride out short-term market downturns, benefiting from the eventual upturns that historically characterize the stock market. This patience is key to long-term success in the stock market.

- Exponential returns: The longer you hold your investments, the more pronounced the compounding effect becomes, leading to exponentially greater returns over time. This exponential growth is a significant benefit of this long-term investment strategy.

Emotional Discipline and Avoiding Market Timing

Trying to time the market – buying low and selling high – is notoriously difficult, even for experienced investors. Buy-and-hold helps you avoid this emotional rollercoaster:

- Reduced emotional stress: Instead of constantly worrying about short-term market fluctuations, you can focus on your long-term financial goals.

- Avoiding impulsive decisions: Buy-and-hold minimizes the risk of making impulsive trades based on fear or greed, which often lead to poor investment decisions. This long-term perspective helps investors weather market volatility.

- Long-term perspective: Buy-and-hold fosters a long-term perspective, focusing on overall portfolio growth rather than daily market movements. This disciplined approach helps investors to succeed.

The Realities of Buy-and-Hold: Addressing the Challenges

While buy-and-hold offers many advantages, it's not without its challenges. Understanding these realities is essential for successful long-term investing.

Market Volatility and Drawdowns

Even with a long-term horizon, significant market corrections can cause substantial temporary losses.

- Risk tolerance assessment: Before employing a buy-and-hold strategy, honestly assess your risk tolerance. Can you withstand potentially significant short-term losses without panic selling?

- Diversification strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk and reduce the impact of market downturns.

- Emotional preparedness: Develop a plan for how you will handle potential losses. Having a pre-defined strategy can prevent impulsive decisions during market volatility.

Opportunity Cost and Missed Gains

While buy-and-hold minimizes losses from frequent trading, it may also mean missing out on potential gains from active trading or strategic adjustments.

- Rebalancing your portfolio: Regularly review and rebalance your portfolio to maintain your desired asset allocation. This helps to capitalize on market shifts and maintain a balanced approach to your long-term investing.

- Tax-loss harvesting (if applicable): In some cases, strategically selling losing assets can help offset capital gains taxes, improving your overall returns. Consult with a financial advisor to understand if this is applicable to your situation.

- Monitoring economic shifts: Stay informed about major economic shifts and their potential impact on your portfolio. This allows for more informed long-term investment decisions.

The Importance of Diversification and Proper Asset Allocation

Buy-and-hold isn't a "set it and forget it" strategy. Proper asset allocation and diversification are crucial for mitigating risk and maximizing long-term growth.

- Asset class diversification: Don't put all your eggs in one basket. Diversify across stocks, bonds, real estate, and other asset classes to reduce overall portfolio risk.

- Geographic diversification: Consider investing in different countries and markets to reduce exposure to specific regional economic downturns.

- Sector diversification: Spread your investments across various industries to mitigate the risk associated with specific sectors performing poorly.

Conclusion

Buy-and-hold investing offers a compelling path to long-term wealth building, minimizing trading costs and harnessing the power of compounding. However, it's crucial to understand and address the challenges posed by market volatility and the potential for missed gains. By carefully considering your risk tolerance, diversifying your portfolio, and regularly reviewing your strategy, you can effectively utilize buy-and-hold investing as part of a robust long-term investment plan. Ready to explore the realities of buy-and-hold and develop a sound long-term investment strategy? Contact us today to learn more about how buy-and-hold and other long-term investment strategies can help you achieve your financial goals.

Featured Posts

-

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 26, 2025

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 26, 2025 -

Auction Michael Schumachers Detailed Benetton F1 Show Car

May 26, 2025

Auction Michael Schumachers Detailed Benetton F1 Show Car

May 26, 2025 -

Review Of The Best Nike Running Shoes For 2025

May 26, 2025

Review Of The Best Nike Running Shoes For 2025

May 26, 2025 -

I Naomi Kampel Sta 54 Apolamvanei Eksotikes Diakopes Stis Maldives Me Ta Paidia Tis

May 26, 2025

I Naomi Kampel Sta 54 Apolamvanei Eksotikes Diakopes Stis Maldives Me Ta Paidia Tis

May 26, 2025 -

The F1 Drivers Press Conference Key Moments And Highlights

May 26, 2025

The F1 Drivers Press Conference Key Moments And Highlights

May 26, 2025

Latest Posts

-

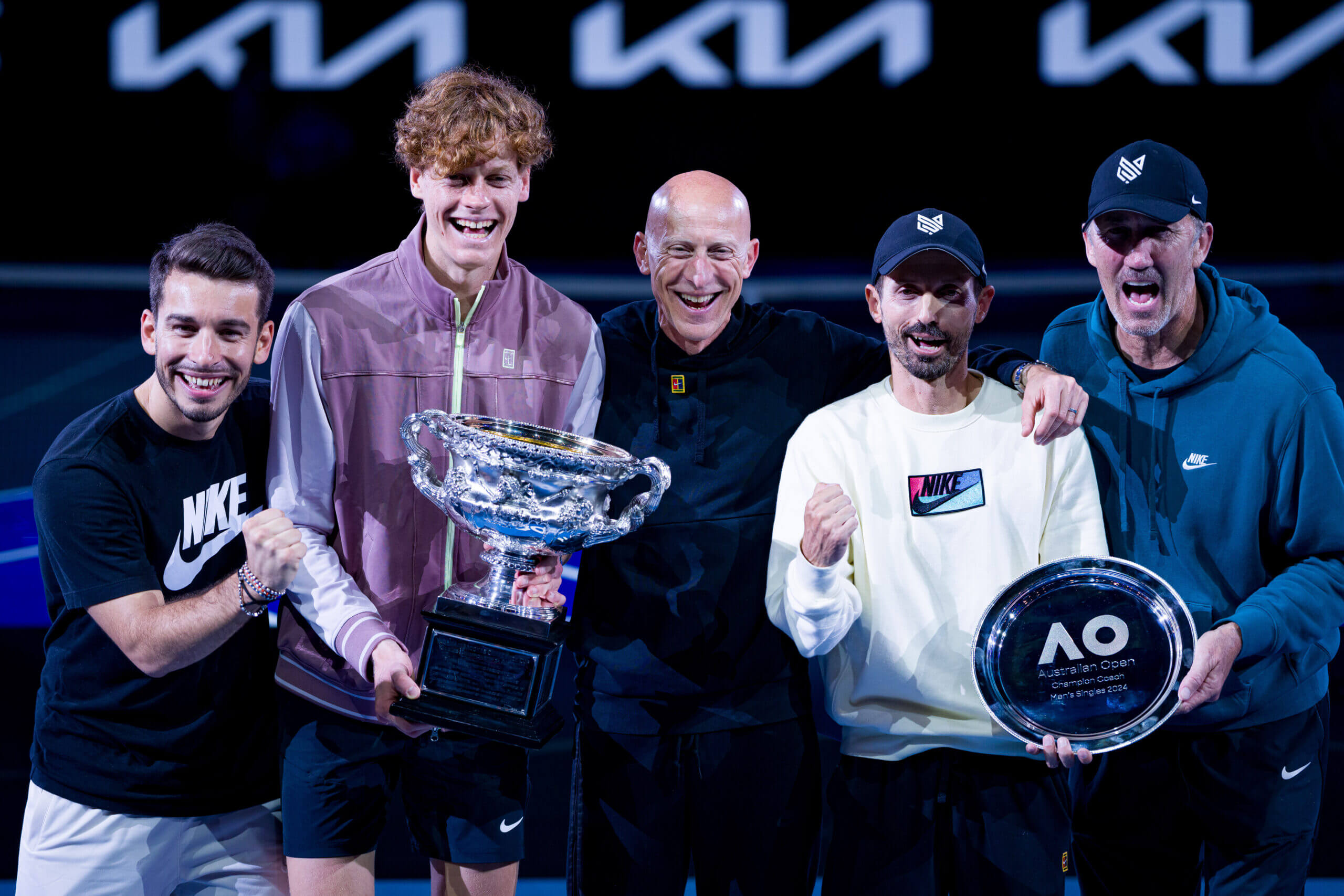

Post Ban Comeback Sinner To Play In Hamburg

May 28, 2025

Post Ban Comeback Sinner To Play In Hamburg

May 28, 2025 -

Jannik Sinners Comeback Hamburg Stop Confirmed

May 28, 2025

Jannik Sinners Comeback Hamburg Stop Confirmed

May 28, 2025 -

Sinner Returns To Tennis Hamburg Tournament On The Calendar

May 28, 2025

Sinner Returns To Tennis Hamburg Tournament On The Calendar

May 28, 2025 -

Hamburg Tournament Added To Sinners Return Schedule After Doping Ban

May 28, 2025

Hamburg Tournament Added To Sinners Return Schedule After Doping Ban

May 28, 2025 -

Three Month Ban Jannik Sinners Grand Slam Outlook

May 28, 2025

Three Month Ban Jannik Sinners Grand Slam Outlook

May 28, 2025