Buy-and-Hold Investing: A Long-Term Perspective On Market Volatility

Table of Contents

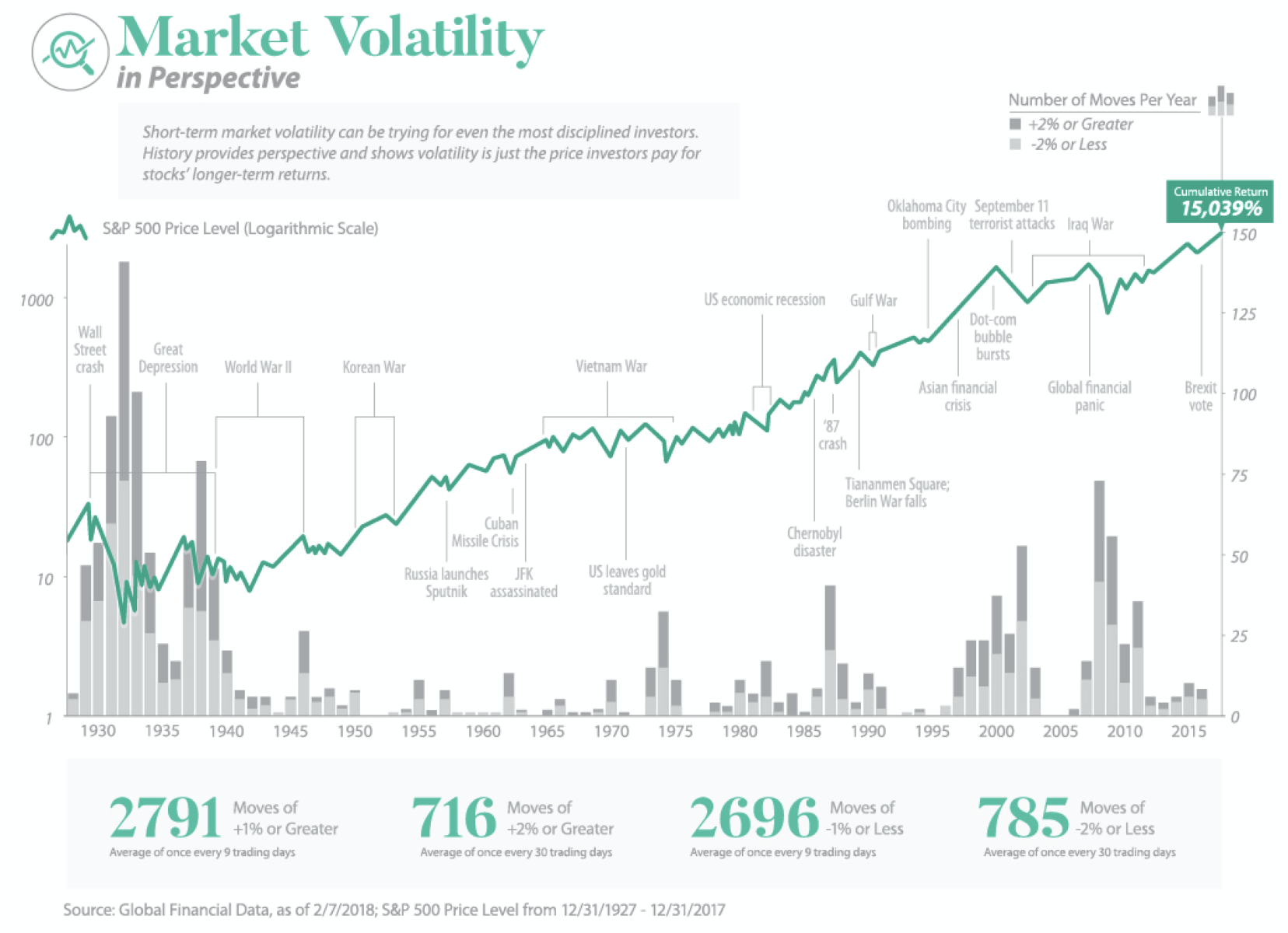

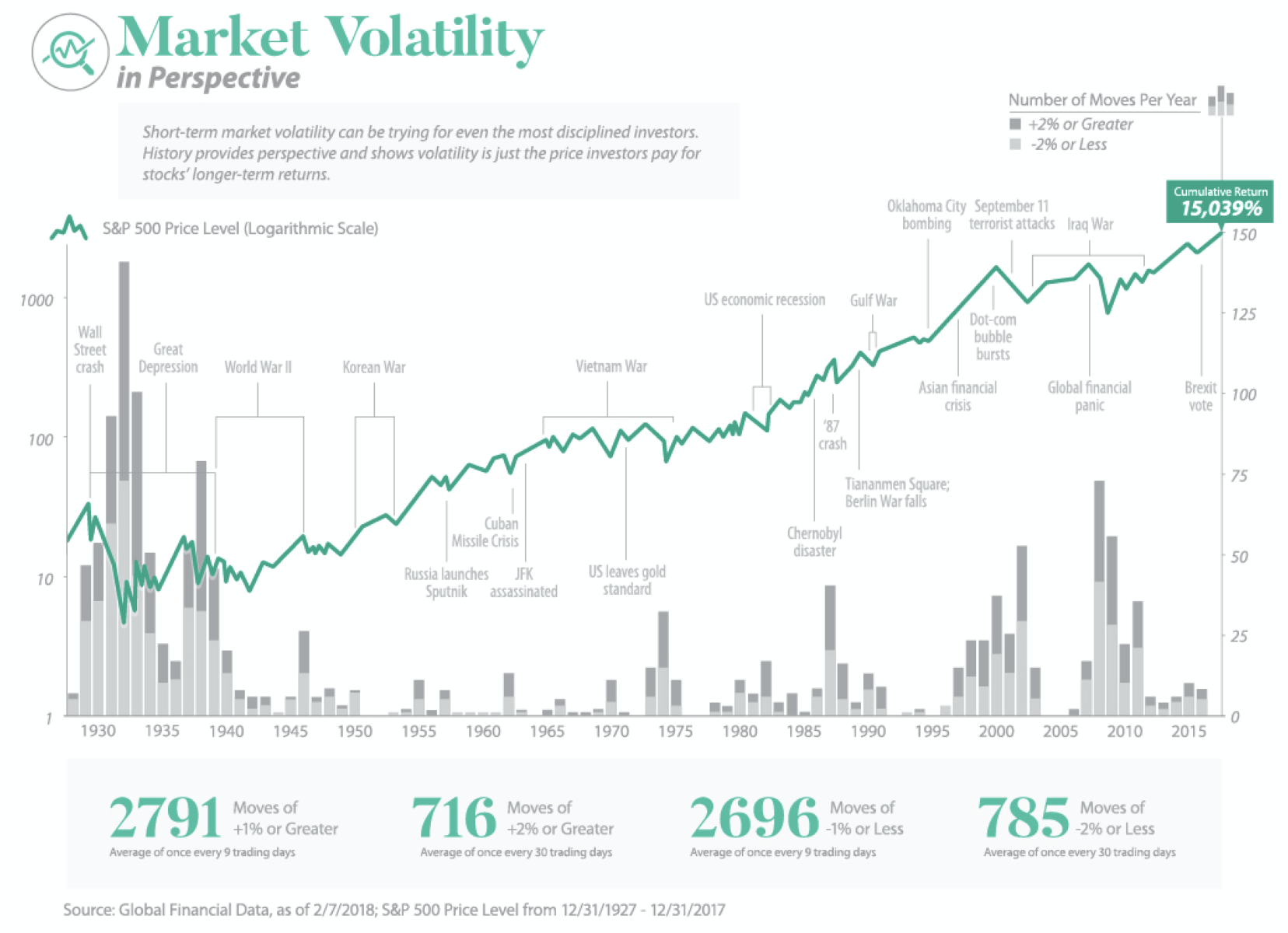

Understanding Market Volatility and its Impact

Market volatility refers to the rapid and unpredictable swings in asset prices, like stocks and bonds. These fluctuations are driven by a variety of factors, including:

- Economic News: Reports on inflation, unemployment, and economic growth significantly impact investor sentiment and market prices. A surprise increase in inflation, for example, can trigger a market sell-off.

- Geopolitical Events: International conflicts, political instability, and unexpected global events can create uncertainty and lead to market volatility. The Russian invasion of Ukraine in 2022 is a prime example of a geopolitical event causing significant market disruption.

- Interest Rate Changes: Decisions made by central banks regarding interest rates profoundly affect borrowing costs and investment returns. Interest rate hikes often lead to decreased market valuations in the short term.

History is replete with examples of market downturns. The dot-com bubble burst of 2000, the 2008 financial crisis, and the COVID-19 market crash of 2020 are stark reminders of market volatility's potential impact. However, each of these periods was eventually followed by a recovery, demonstrating the resilience of the market over the long term.

Investing during volatile periods can be emotionally challenging. Fear of further losses can lead to panic selling, while greed can tempt investors into risky, ill-timed trades.

The Emotional Rollercoaster of Short-Term Trading

Trying to time the market—buying low and selling high—is notoriously difficult and often counterproductive. Emotional decision-making frequently leads to poor investment outcomes. Short-term trading strategies often result in:

- Increased transaction costs: Frequent buying and selling increase brokerage fees and other transaction expenses, eating into potential profits.

- Missed opportunities: Attempts to perfectly time the market frequently result in missing out on substantial gains during periods of market growth.

- Higher tax implications: More frequent trading generally leads to higher capital gains taxes, further reducing net returns.

The Power of Buy-and-Hold: A Long-Term Strategy

Buy-and-hold investing is a long-term strategy that minimizes the impact of short-term market fluctuations. Instead of constantly reacting to daily price changes, investors employing this strategy buy assets and hold them for an extended period, typically several years or even decades. This approach allows investors to ride out market downturns and benefit from the eventual recovery.

Dollar-cost averaging (DCA) is a valuable tool within a buy-and-hold strategy. DCA involves investing a fixed amount of money at regular intervals, regardless of market prices. This method reduces the risk of investing a lump sum at a market peak.

Diversification is crucial for any successful buy-and-hold portfolio. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors minimizes risk and improves the chances of long-term growth.

Compounding and Long-Term Growth

The magic of buy-and-hold lies in the power of compounding. Compounding is the process where investment returns generate further returns, creating a snowball effect. Over time, this effect significantly increases the overall value of your investments.

- 10-year example: A $10,000 investment earning an average annual return of 7% would grow to approximately $19,671.

- 20-year example: The same investment would grow to approximately $38,696.

- 30-year example: It would grow to an impressive approximately $76,122. These figures illustrate the transformative power of long-term investing.

Selecting the Right Assets for Buy-and-Hold Investing

Choosing the right assets for your buy-and-hold portfolio is crucial. Several asset classes are suitable, each with its own risk and return profile:

- Stocks: Offer the potential for higher returns but carry higher risk.

- Bonds: Generally less risky than stocks, offering a steady income stream.

- Real Estate: Can provide diversification and potential for long-term appreciation.

Your risk tolerance and investment goals should guide your asset allocation. A younger investor with a longer time horizon might tolerate a higher proportion of stocks, while an older investor closer to retirement might prefer a more conservative allocation with a greater emphasis on bonds.

Seeking professional advice from a qualified financial advisor or conducting thorough research using reputable investment websites is highly recommended.

Diversification and Risk Management

Diversification is essential for mitigating risk within a buy-and-hold strategy. Spreading your investments across various sectors and asset classes helps to reduce the impact of any single investment performing poorly.

- Example of a well-diversified portfolio: A mix of large-cap and small-cap stocks, bonds from different countries, and potentially real estate investment trusts (REITs).

- Index funds and ETFs: These offer diversified exposure to a broad range of assets at a relatively low cost, making them ideal for buy-and-hold strategies.

Overcoming Obstacles and Maintaining Discipline in Buy-and-Hold

Even the most well-planned buy-and-hold strategy will encounter challenges: market corrections, economic downturns, and emotional pressures. Staying disciplined during these periods is crucial.

Regularly reviewing and rebalancing your portfolio is vital. Rebalancing involves adjusting your asset allocation to maintain your desired risk level. For example, if stocks have outperformed bonds, you might sell some stocks and buy more bonds to bring your portfolio back to its target allocation.

The Importance of a Long-Term Investment Plan

A clear, well-defined financial plan is essential for successful buy-and-hold investing. This plan should include:

- Realistic goals: Clearly defining your financial objectives (retirement, education, etc.) helps you stay focused on the long-term.

- Robust investment strategy: A well-diversified portfolio aligned with your risk tolerance and time horizon.

- Professional guidance (when needed): Seeking advice from a financial advisor can provide valuable support and guidance.

Conclusion: Embrace Buy-and-Hold Investing for Your Future

Buy-and-hold investing offers significant advantages, including the mitigation of market volatility, long-term growth through compounding, and the benefits of discipline and diversification. By aligning your investment strategy with your long-term financial goals and remaining disciplined, you can significantly increase your chances of achieving lasting financial success.

Start your journey towards long-term financial success by learning more about buy-and-hold investing today. Discover how a disciplined buy-and-hold approach can help you navigate market uncertainty and achieve your financial aspirations.

Featured Posts

-

Gauff Holds Nerve Reaches Italian Open Third Round

May 25, 2025

Gauff Holds Nerve Reaches Italian Open Third Round

May 25, 2025 -

L Impatto Dei Dazi Di Trump 20 Sull Industria Della Moda Europea

May 25, 2025

L Impatto Dei Dazi Di Trump 20 Sull Industria Della Moda Europea

May 25, 2025 -

Naomi Kempbell 55 Rokiv Naykraschi Obrazi Ta Foto Z Podiumiv

May 25, 2025

Naomi Kempbell 55 Rokiv Naykraschi Obrazi Ta Foto Z Podiumiv

May 25, 2025 -

Southern Tourist Destination Addresses Safety Concerns Post Shooting Incident

May 25, 2025

Southern Tourist Destination Addresses Safety Concerns Post Shooting Incident

May 25, 2025 -

Artfae Mwshr Daks Alalmany Tathyr Atfaq Altjart Byn Alwlayat Almthdt Walsyn

May 25, 2025

Artfae Mwshr Daks Alalmany Tathyr Atfaq Altjart Byn Alwlayat Almthdt Walsyn

May 25, 2025

Latest Posts

-

Strong Starts For Alcaraz And Sabalenka In Rome

May 25, 2025

Strong Starts For Alcaraz And Sabalenka In Rome

May 25, 2025 -

Swiatek Fights Back To Defeat Keys Sets Up Gauff Semifinal Clash In Madrid

May 25, 2025

Swiatek Fights Back To Defeat Keys Sets Up Gauff Semifinal Clash In Madrid

May 25, 2025 -

Gauff Holds Nerve Reaches Italian Open Third Round

May 25, 2025

Gauff Holds Nerve Reaches Italian Open Third Round

May 25, 2025 -

Italian Open Alcaraz And Sabalenka Begin With Victories

May 25, 2025

Italian Open Alcaraz And Sabalenka Begin With Victories

May 25, 2025 -

Swiateks Comeback Victory From 0 6 To Madrid Semifinal Against Gauff

May 25, 2025

Swiateks Comeback Victory From 0 6 To Madrid Semifinal Against Gauff

May 25, 2025