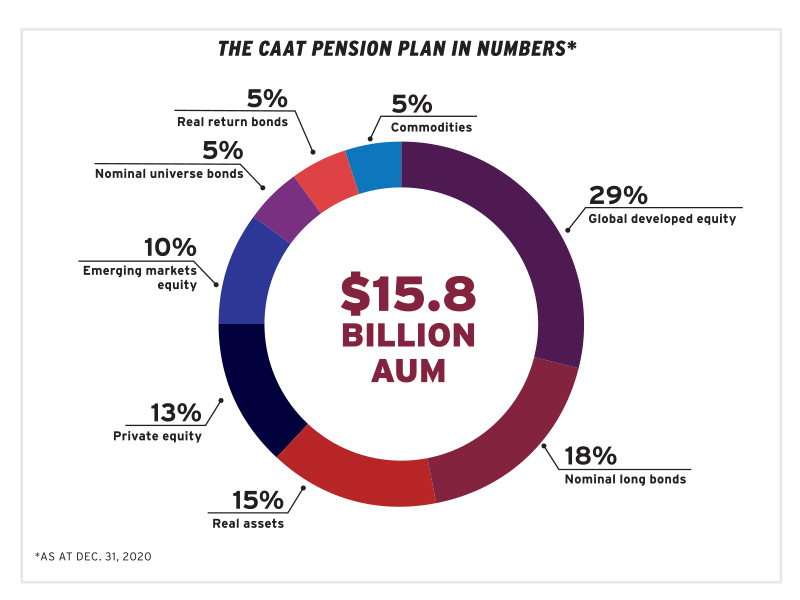

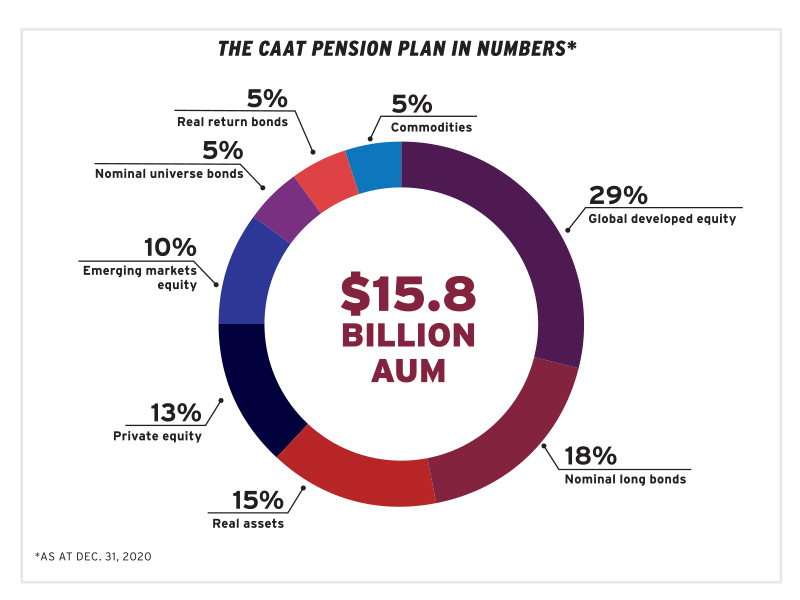

CAAT Pension Plan Targets Growth Through Canadian Private Investments

Table of Contents

Why Canadian Private Investments?

CAAT's decision to increase its allocation to Canadian private investments is driven by several key factors:

Diversification and Risk Mitigation

Investing in private companies offers a powerful tool for diversification and risk reduction. Unlike publicly traded stocks and bonds, private investments often demonstrate less correlation with traditional asset classes. This means that even when public markets experience downturns, private investments may perform differently, potentially cushioning the overall portfolio from significant losses.

- Reduced reliance on public markets: Decreases vulnerability to market volatility.

- Less correlation with traditional assets: Creates a more resilient and stable portfolio.

- Exposure to a wider range of asset classes: Provides access to investment opportunities not available in public markets.

This diversification strategy significantly enhances the resilience of the CAAT Pension Plan's portfolio, protecting members' retirement savings from the risks inherent in a solely publicly traded investment strategy.

Potential for Higher Returns

Private companies frequently exhibit higher growth trajectories than their publicly traded counterparts. This presents the potential for significant capital appreciation and long-term value creation. CAAT's active investment strategy, detailed below, further amplifies this potential.

- Access to illiquid assets with higher growth potential: Unlocks opportunities for superior long-term returns.

- Potential for significant capital appreciation: Offers the chance for substantial growth in investment value.

- Long-term value creation through active management: Allows for direct influence on portfolio companies’ growth.

By actively engaging with portfolio companies, CAAT aims to drive growth and maximize returns, exceeding the potential of passive investment strategies in traditional public markets.

Supporting Canadian Businesses

CAAT's investment in Canadian private companies isn't solely focused on financial returns. It's also a strategic investment in the Canadian economy. This approach fosters economic growth, job creation, and innovation within the country.

- Contribution to economic growth: Injection of capital into Canadian businesses stimulates economic activity.

- Job creation: Investments in growing companies translate into new employment opportunities.

- Investment in innovative sectors: Supports the development of cutting-edge technologies and industries.

This socially responsible investment strategy aligns CAAT’s financial objectives with the broader goal of contributing to a thriving Canadian economy.

CAAT's Investment Strategy in Canadian Private Equity

CAAT's approach to investing in Canadian private equity is characterized by a rigorous and transparent process:

Due Diligence and Selection Process

CAAT employs a rigorous screening process to identify promising investment opportunities. This involves a thorough assessment of management teams, business models, and alignment with Environmental, Social, and Governance (ESG) principles.

- Rigorous screening process: Ensures only high-potential investments are selected.

- Focus on strong management teams: Prioritizes companies with experienced and capable leadership.

- Alignment with ESG principles: Integrates environmental, social, and governance factors into investment decisions.

This meticulous approach minimizes risk and maximizes the likelihood of successful investments, ensuring responsible stewardship of members’ retirement funds.

Investment Sectors and Target Companies

CAAT focuses its private equity investments across various sectors with high growth potential. This includes, but is not limited to, technology, renewable energy, and infrastructure. The specific companies targeted vary in size and maturity, depending on the investment strategy and risk tolerance.

- Technology: Investing in cutting-edge technologies and innovative companies.

- Renewable Energy: Supporting the transition to a sustainable energy future.

- Infrastructure: Contributing to the development of essential infrastructure projects.

This diversified approach across multiple sectors mitigates risk and provides exposure to a range of growth opportunities within the Canadian economy.

Active Portfolio Management

CAAT's involvement extends beyond simply providing capital. They actively engage with portfolio companies, providing guidance, support, and implementing value-add strategies to maximize returns.

- Engagement with portfolio companies: Providing strategic advice and operational support.

- Value-add strategies: Implementing initiatives to improve efficiency and profitability.

- Exit strategies: Developing clear plans for realizing investment returns.

This hands-on approach significantly contributes to the success of portfolio companies and ultimately, the overall return on investment for CAAT Pension Plan members.

The Long-Term Impact on CAAT Pension Plan Members

CAAT's strategic shift towards Canadian private investments is expected to yield significant long-term benefits for its members:

Enhanced Retirement Security

The successful implementation of this strategy is projected to improve the long-term financial performance of the pension plan, leading to increased fund stability and potentially higher benefit payouts for members.

- Improved long-term financial performance: Driving growth and enhancing the overall fund value.

- Increased fund stability: Reducing volatility and ensuring a more secure retirement income.

- Higher potential for benefit payouts: Providing members with potentially larger retirement benefits.

This proactive approach to investment management directly translates into a more secure and comfortable retirement for CAAT Pension Plan members.

Transparency and Reporting

CAAT is committed to transparency, providing regular updates to its members on investment performance and strategy.

- Regular updates to members on investment performance: Keeping members informed about the progress of their retirement savings.

- Clear communication of investment strategy: Ensuring members understand the rationale behind investment decisions.

Open and honest communication fosters trust and confidence in the management of members’ retirement funds.

Conclusion

The CAAT Pension Plan's strategic focus on Canadian private investments represents a forward-thinking approach to securing the financial future of its members. By diversifying its portfolio, targeting higher returns, and contributing to the Canadian economy, CAAT is setting a benchmark for responsible and innovative pension fund management. This commitment to long-term planning and strategic investment underscores the importance of proactive strategies in ensuring the continued success and viability of the CAAT Pension Plan and the retirement security of its beneficiaries. Learn more about the CAAT Pension Plan and its innovative investment strategies to gain a deeper understanding of how your retirement savings are being managed.

Featured Posts

-

Ser Aldhhb Alywm Fy Swq Alsaght Sbykt 10 Jramat 17 Fbrayr 2025

Apr 23, 2025

Ser Aldhhb Alywm Fy Swq Alsaght Sbykt 10 Jramat 17 Fbrayr 2025

Apr 23, 2025 -

Rethinking Middle Management Their Impact On Organizational Performance

Apr 23, 2025

Rethinking Middle Management Their Impact On Organizational Performance

Apr 23, 2025 -

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 23, 2025

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 23, 2025 -

Mlb Discipline Three Game Ban For Nationals Jorge Lopez After Hitting Mc Cutchen

Apr 23, 2025

Mlb Discipline Three Game Ban For Nationals Jorge Lopez After Hitting Mc Cutchen

Apr 23, 2025 -

Rezultati Matchu Upl Dinamo Kiyiv Obolon 18 Kvitnya

Apr 23, 2025

Rezultati Matchu Upl Dinamo Kiyiv Obolon 18 Kvitnya

Apr 23, 2025