Can XRP Make You Rich? Analyzing Ripple's 15,000% Rise And Future

Table of Contents

H2: XRP's Meteoric Rise: A Look Back at the 15,000% Surge

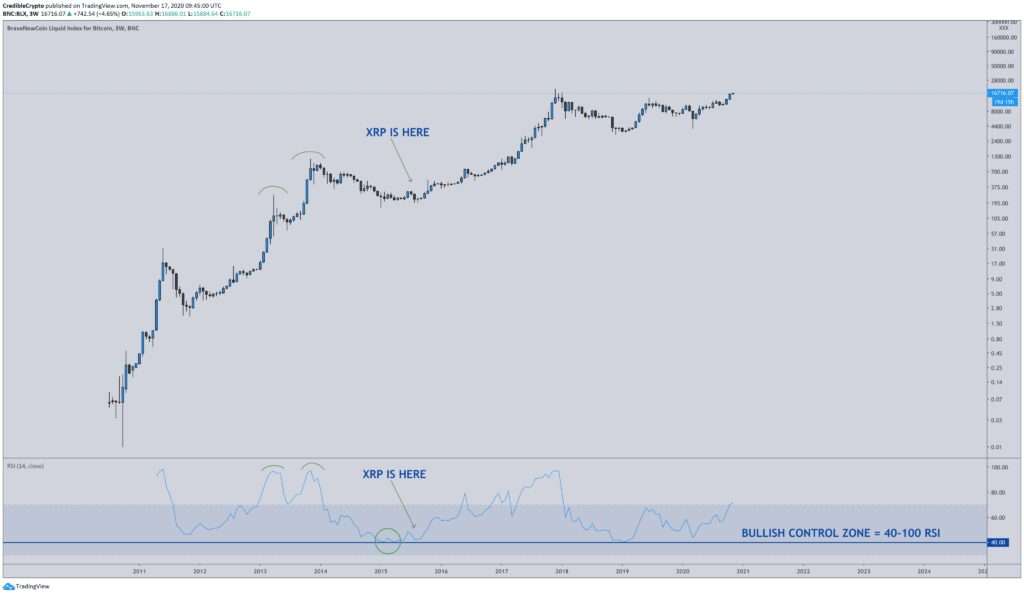

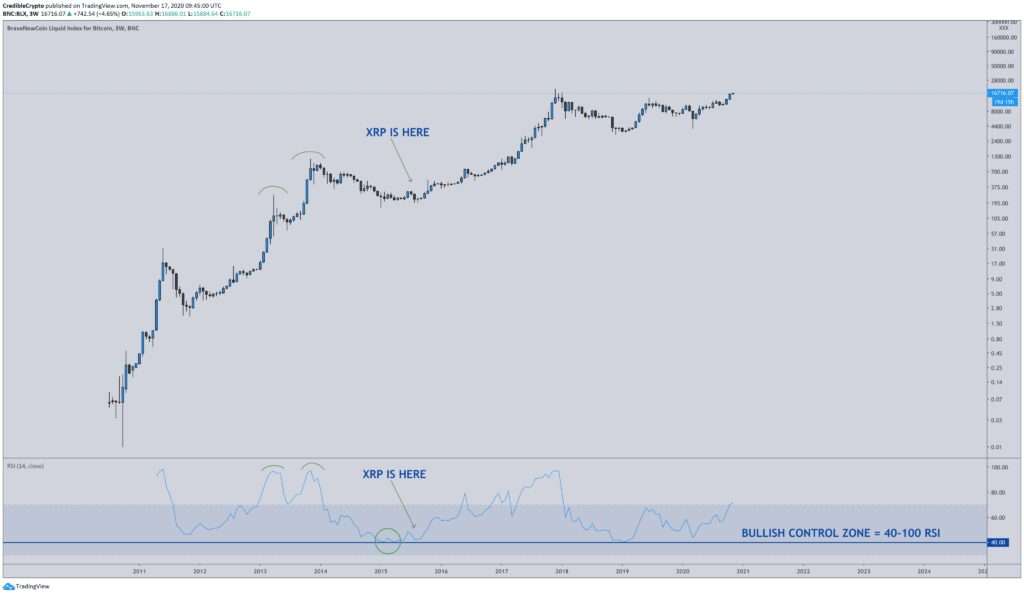

XRP, the native cryptocurrency of Ripple Labs, experienced a phenomenal rise, increasing in value by a staggering 15,000% at its peak. Understanding this dramatic growth requires examining several key factors.

H3: Understanding the Factors Behind XRP's Growth

Several factors contributed to XRP's impressive growth:

- Early adoption and technological advancements: RippleNet, Ripple's payment solution, gained early traction, showcasing the potential of blockchain technology for faster and cheaper cross-border transactions. This early adoption fueled interest and price appreciation.

- Strategic partnerships with financial institutions: Ripple strategically partnered with major banks and financial institutions globally, integrating XRP into their payment systems. This institutional adoption significantly boosted credibility and demand.

- Increased institutional interest and trading volume: As more institutional investors entered the cryptocurrency market, XRP's trading volume increased, further driving up its price.

- Market speculation and FOMO (fear of missing out): The rapid price increases fueled speculation, with many investors fearing they would miss out on potential profits, creating a self-reinforcing cycle of price appreciation.

Key Price Milestones:

- 2013: XRP's initial launch and early trading.

- 2017: The cryptocurrency bull market propelled XRP to its all-time high.

- 2020-2021: Periods of significant volatility, reflecting the broader crypto market trends.

H3: Analyzing the Volatility of XRP

While XRP's past performance is impressive, it's crucial to acknowledge the inherent volatility of cryptocurrencies. XRP's price has fluctuated wildly throughout its history, demonstrating both massive gains and significant losses. Investors must be prepared for these price swings and understand the associated risks. For example, the period following the SEC lawsuit saw considerable price volatility.

H2: Ripple's Current Market Position and Partnerships

Understanding Ripple's current position requires analyzing its technology, partnerships, and the regulatory landscape.

H3: Ripple's Technology and Use Cases

RippleNet, Ripple's payment network, uses XRP to facilitate faster and more cost-effective cross-border payments. Its potential to disrupt traditional banking systems is a key driver of its value proposition.

- Key Partnerships: Ripple has partnered with numerous financial institutions, including Santander, American Express, and MoneyGram.

- Other Applications: XRP's technology is also being explored for other applications, such as supply chain management and micropayments.

H3: Regulatory Landscape and Legal Challenges

The ongoing SEC lawsuit against Ripple significantly impacts XRP's price and future. The outcome of this case could determine XRP's legal status in the United States and potentially influence its global adoption. Understanding the evolving regulatory landscape for cryptocurrencies is crucial for any investor.

H2: Future Predictions and Potential for XRP Growth

Predicting the future price of any cryptocurrency is inherently speculative, but several factors could influence XRP's growth trajectory.

H3: Factors That Could Contribute to Future Growth

- Wider adoption of RippleNet by financial institutions.

- A favorable resolution of the SEC lawsuit.

- Expansion into new markets and use cases for XRP.

- Increased demand for efficient cross-border payment solutions.

Potential Price Targets: While impossible to predict with certainty, various analysts offer differing price projections based on varying market conditions and adoption rates.

H3: Risks and Challenges That Could Hinder Growth

- Continued regulatory uncertainty and potential further legal action.

- Competition from other cryptocurrencies and payment solutions like Stellar Lumens (XLM).

- Technological limitations or vulnerabilities in the RippleNet system.

- Market volatility and macroeconomic factors.

H2: Investing in XRP: Strategies and Considerations

Investing in XRP, like any cryptocurrency, involves significant risk. A well-informed approach is essential.

H3: Risk Assessment and Diversification

Never invest more than you can afford to lose. Diversification across different asset classes, including traditional investments, is vital to mitigating risk.

H3: Due Diligence and Research

Thorough research is paramount before investing in XRP. Stay informed about Ripple's developments, the regulatory landscape, and market trends through reputable news sources and analytical platforms.

3. Conclusion:

XRP's past performance, while impressive, doesn't guarantee future success. Its potential for growth is linked to factors such as the resolution of the SEC lawsuit, wider adoption of RippleNet, and the overall cryptocurrency market sentiment. However, the inherent volatility and regulatory uncertainty highlight the significant risks involved. Could XRP be a part of your investment strategy? Learn more and make informed decisions. [Link to relevant resources/further reading].

Featured Posts

-

Tulsa Road Crews Working Ahead Of Tonights Winter Storm

May 02, 2025

Tulsa Road Crews Working Ahead Of Tonights Winter Storm

May 02, 2025 -

Should You Invest In Riot Platforms Stock Now Assessing The Risks And Rewards

May 02, 2025

Should You Invest In Riot Platforms Stock Now Assessing The Risks And Rewards

May 02, 2025 -

Tulsas Winter Key Weather Statistics And Analysis

May 02, 2025

Tulsas Winter Key Weather Statistics And Analysis

May 02, 2025 -

Justice Department Ends School Desegregation Order Whats Next

May 02, 2025

Justice Department Ends School Desegregation Order Whats Next

May 02, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 02, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 02, 2025