Canada Significantly Reduces Tariffs On US Imports: A Detailed Analysis Of Exemptions

Table of Contents

Which US Imports are Affected by the Tariff Reduction?

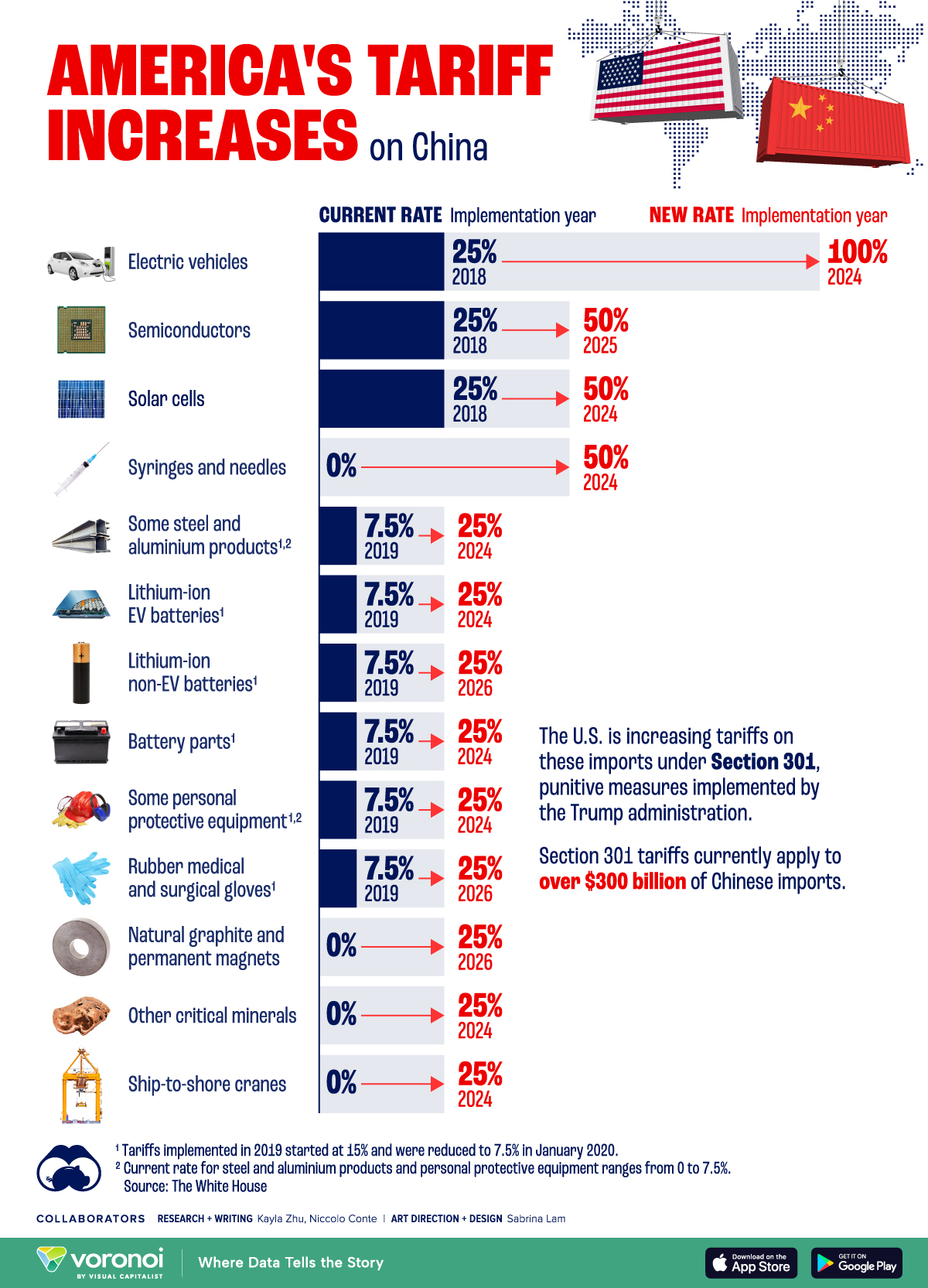

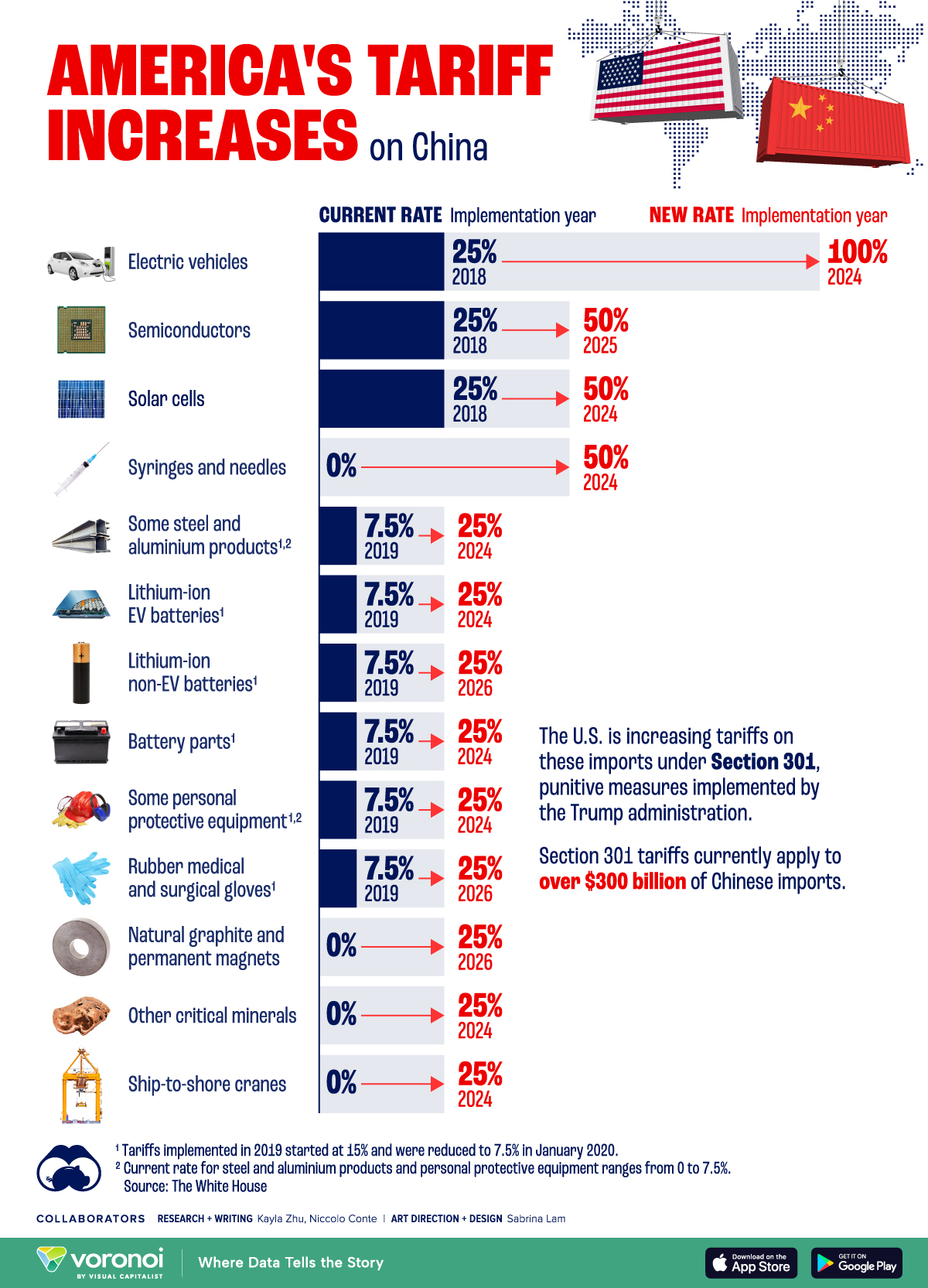

The Canadian government's initiative to lower import tariffs has impacted a range of US products. This "import tariff reduction" strategy aims to stimulate economic growth and strengthen trade relationships. The changes are not uniform across the board; significant variations exist depending on the product category. Let's examine the specifics:

- Dairy Products: The reduction in tariffs on certain dairy products has been a particularly noteworthy aspect of this initiative. While some dairy imports see complete "tariff elimination," others benefit from significant reductions in import duties.

- Lumber: The lumber industry has also experienced substantial tariff reductions, leading to increased competitiveness in the Canadian market for US lumber producers.

- Auto Parts: Reductions on auto parts are expected to enhance the efficiency of automotive manufacturing supply chains between the two countries.

Here's a table comparing pre- and post-reduction tariff rates for key items:

| Product Category | Pre-Reduction Tariff Rate | Post-Reduction Tariff Rate |

|---|---|---|

| Dairy Products (Specific Sub-category A) | 25% | 10% |

| Dairy Products (Specific Sub-category B) | 15% | 0% |

| Lumber (Softwood) | 10% | 5% |

| Auto Parts (Specific Component X) | 8% | 3% |

It's important to note that not all US imports have benefited equally. Several product categories remain subject to existing tariff rates, representing exclusions to the broader tariff reduction program. These exclusions often stem from ongoing domestic policy considerations or the need to protect specific Canadian industries.

Understanding the Exemptions and Their Implications

The exemptions within the "Canada Significantly Reduces Tariffs on US Imports" initiative are far from arbitrary. Several factors drive these decisions, including:

- Protecting Domestic Industries: Some exemptions exist to safeguard sensitive sectors within the Canadian economy. This involves balancing the benefits of increased trade with the need to protect domestic jobs and producers.

- International Trade Agreements: Existing trade agreements with other countries may constrain the extent of tariff reductions on certain products.

- Political Considerations: Political factors and bilateral negotiations undoubtedly play a role in deciding which exemptions are granted and which are not.

The impact of these exemptions varies significantly across US industries. Certain sectors will see minimal change, while others may experience a significant boost or hindrance. Exemption categories include:

- Specific agricultural products: These often face higher barriers due to domestic production and food security concerns.

- Certain manufactured goods: These exclusions may target strategic industries or those perceived as vital for national security or technological advancement.

Potential unintended consequences of these exemptions might include:

- Increased market distortions.

- Negative impacts on Canadian producers of exempted goods.

- Potential trade disputes if the exemptions are deemed unfair by affected parties.

Economic Impacts of the Tariff Reduction and Exemptions

The economic impact of "Canada Significantly Reduces Tariffs on US Imports" is expected to be multifaceted. Predictive models suggest:

- Increased Bilateral Trade: Lower tariffs are predicted to stimulate a significant increase in trade volumes between Canada and the US.

- Job Creation: The removal of trade barriers is expected to lead to job creation in both countries, particularly in sectors directly affected by tariff reductions. However, the distribution of these jobs remains uncertain.

- Consumer Price Impact: Consumers in both countries could benefit from lower prices on certain goods due to reduced import costs.

While positive economic impacts are anticipated, there are potential challenges:

- Adjustments in Domestic Industries: Some Canadian industries might require adjustments to adapt to increased competition from cheaper US imports. Government support programs may be needed to ensure a smooth transition.

- Supply Chain Disruptions: Initial disruptions to supply chains are possible during the implementation phase.

Studies published by the Canadian and US governments are analyzing the economic effects in detail. These should provide a deeper understanding of the long-term impacts over time.

Future Outlook and Potential Changes to the Tariff Structure

The tariff reduction is not a static policy. Future adjustments and expansions are highly likely, based on:

- Ongoing Negotiations: Canada and the US continue to engage in trade discussions that might influence tariff structures.

- Economic Conditions: Changes in the global and domestic economies may necessitate adjustments to the tariff policy.

Long-term implications depend on the political climate and economic performance of both countries. These changes will undoubtedly affect "Canada-US trade agreement" interpretations and future negotiations. The ongoing dialogue between both governments will be critical in shaping the long-term future of bilateral trade and tariff policies.

Conclusion: Canada Significantly Reduces Tariffs on US Imports: Key Takeaways and Next Steps

This analysis demonstrates the significance of "Canada Significantly Reduces Tariffs on US Imports" and highlights the complexity of its implementation. The reduction in tariffs, alongside the nuances of the exemption process, will have a profound and lasting impact on the Canadian and US economies. Understanding the specific exemptions and their implications for different industries is critical to anticipating the long-term economic repercussions.

For a more detailed understanding, we encourage readers to consult official government websites such as the Canadian government's website on international trade and the US Trade Representative's office for comprehensive data on tariff rates and ongoing trade negotiations related to "Canada significantly reduces tariffs on US imports." This detailed information will be essential to fully assess the broad economic significance of this major trade policy shift.

Featured Posts

-

Gold Xauusd Gains Momentum Rate Cut Speculation Boosts Prices

May 17, 2025

Gold Xauusd Gains Momentum Rate Cut Speculation Boosts Prices

May 17, 2025 -

Todays Mlb Game Mariners Vs Tigers Predictions Odds And Best Bets

May 17, 2025

Todays Mlb Game Mariners Vs Tigers Predictions Odds And Best Bets

May 17, 2025 -

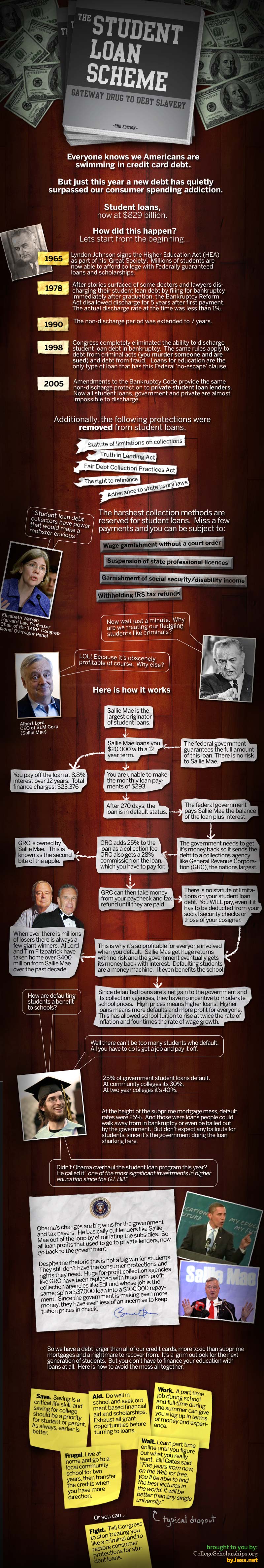

Impacto De La Nueva Politica Del Departamento De Educacion Sobre Prestamos Estudiantiles

May 17, 2025

Impacto De La Nueva Politica Del Departamento De Educacion Sobre Prestamos Estudiantiles

May 17, 2025 -

Police Activity In Austintown And Boardman Your Local News Source

May 17, 2025

Police Activity In Austintown And Boardman Your Local News Source

May 17, 2025 -

Supporting Her Family Angel Reeses Message To Her Mom After Brothers Ncaa Victory

May 17, 2025

Supporting Her Family Angel Reeses Message To Her Mom After Brothers Ncaa Victory

May 17, 2025

Latest Posts

-

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025 -

Analyzing The Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Analyzing The Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025 -

Analyzing School Lockdown Effectiveness In Florida Post Shooter Response And Future Strategies

May 17, 2025

Analyzing School Lockdown Effectiveness In Florida Post Shooter Response And Future Strategies

May 17, 2025 -

2025 Cinema Con What Warner Bros Pictures Revealed

May 17, 2025

2025 Cinema Con What Warner Bros Pictures Revealed

May 17, 2025 -

The Evolution Of Florida School Lockdown Procedures A Generational Perspective

May 17, 2025

The Evolution Of Florida School Lockdown Procedures A Generational Perspective

May 17, 2025