Canada's Economic Outlook: The Importance Of Fiscal Responsibility

Table of Contents

Current State of the Canadian Economy

Canada's economy has shown resilience in recent years, but faces significant headwinds. Understanding the current state is crucial for assessing the need for fiscal responsibility.

-

Recent GDP growth percentage and its trajectory: While Canada experienced robust GDP growth in the years leading up to the pandemic, recent growth has moderated due to global economic slowdowns and high inflation. The trajectory of future GDP growth remains uncertain, depending on factors such as global demand, commodity prices, and interest rates.

-

Current inflation rate and its impact on consumer spending: Inflation in Canada has been significantly higher than the Bank of Canada's target, impacting consumer spending and purchasing power. This necessitates careful management of government finances to avoid exacerbating inflationary pressures.

-

Unemployment rate and its implications for the labor market: While the unemployment rate has generally remained relatively low, certain sectors experience higher unemployment than others. Fiscal policies can play a role in supporting job creation and addressing labor market imbalances.

-

Key economic sectors and their performance: Key sectors like energy, manufacturing, and technology are vital to Canada's economic health. Their performance significantly impacts overall GDP growth and revenue generation, influencing the government’s fiscal capacity.

The Role of Fiscal Policy in Economic Stability

Fiscal policy, encompassing government spending and taxation, significantly influences economic stability. Responsible fiscal policy acts as a crucial tool for navigating economic cycles.

-

Impact of government spending on infrastructure development and job creation: Government investments in infrastructure—roads, bridges, public transit—stimulate economic activity, creating jobs and boosting private sector investment.

-

Effects of taxation policies on consumer spending and business investment: Tax policies impact disposable income, influencing consumer spending, and business investment decisions. Well-designed tax policies can encourage investment and economic growth.

-

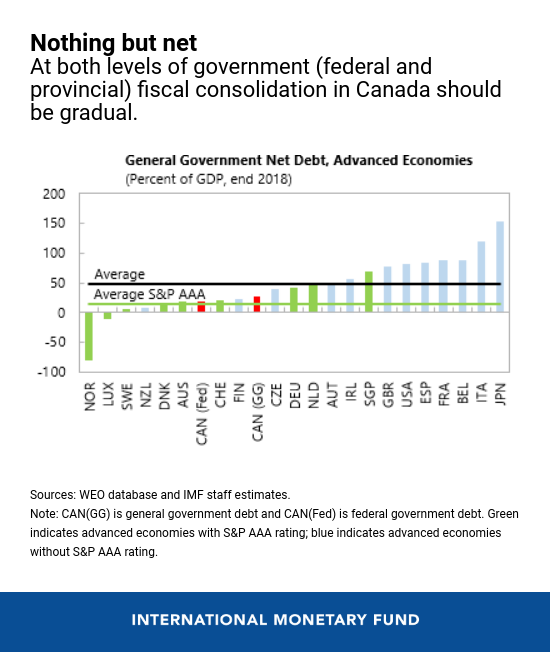

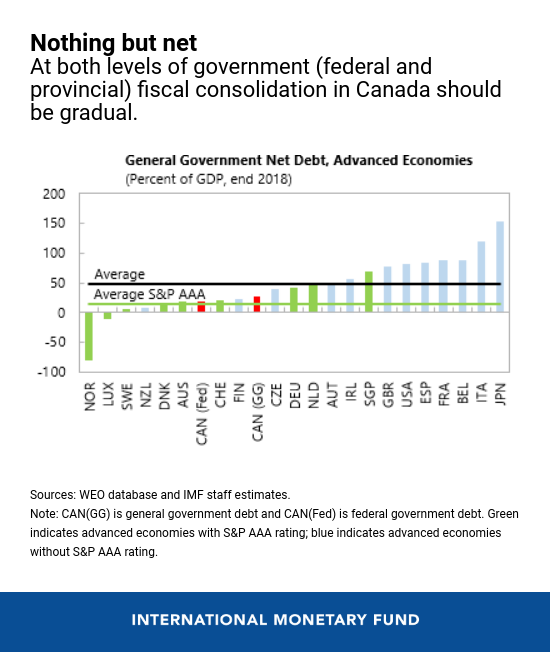

The importance of balancing the budget or maintaining a manageable deficit: While temporary deficits can be justifiable during economic downturns, long-term sustainable fiscal management requires efforts to balance the budget or maintain a manageable deficit. Excessive debt burdens can constrain future economic growth.

-

The role of the Bank of Canada and its monetary policies in relation to fiscal policy: The Bank of Canada's monetary policy, primarily focused on interest rate adjustments, interacts with fiscal policy. Coordination between monetary and fiscal policy is crucial for achieving macroeconomic stability.

Risks Associated with Irresponsible Fiscal Management

Excessive government debt and persistent deficits pose significant risks to Canada's long-term economic prosperity.

-

Increased interest payments crowding out other essential government spending: High levels of debt lead to increased interest payments, diverting resources from essential services like healthcare and education.

-

Higher taxes to repay debt impacting economic growth: To repay debt, governments might resort to higher taxes, potentially hindering economic growth by reducing consumer spending and business investment.

-

Reduced investor confidence and negative impact on credit ratings: High debt levels can erode investor confidence, leading to higher borrowing costs and potentially downgrades in credit ratings, increasing the cost of borrowing for both the government and the private sector.

-

Potential for economic instability and sovereign debt crises: In extreme cases, irresponsible fiscal management can trigger economic instability and even sovereign debt crises, threatening the overall stability of the Canadian economy.

Strategies for Promoting Fiscal Responsibility in Canada

Promoting fiscal responsibility requires a multi-faceted approach focused on both revenue generation and expenditure management.

-

Implementing efficient tax collection systems: Improving tax collection efficiency reduces tax evasion and increases government revenue, contributing to fiscal health.

-

Prioritizing government spending on high-impact programs: Careful evaluation and prioritization of government programs ensure that public funds are used efficiently and effectively to maximize their impact on economic and social outcomes.

-

Enhancing transparency and accountability in government finance: Transparent and accountable government finance builds public trust and encourages responsible fiscal management.

-

Promoting sustainable economic growth through innovation and investment: Investing in innovation and productivity-enhancing measures fosters long-term economic growth, increasing government revenue and reducing the need for drastic fiscal adjustments.

-

Long-term strategic planning for fiscal management: Developing and adhering to long-term fiscal plans helps ensure sustainable fiscal management and reduces the risk of short-sighted decisions.

Conclusion

Maintaining fiscal responsibility is not merely a policy choice, but a necessity for Canada’s continued economic prosperity. This article highlighted the current economic situation, the powerful role of fiscal policy, the dangers of irresponsible fiscal management, and strategies for improvement. Understanding the intricacies of Canada's fiscal health is crucial for citizens, businesses, and policymakers alike. Let's actively engage in promoting informed discussions and advocating for responsible fiscal policies to secure a bright economic future for Canada. The path to a strong Canadian economy is paved with fiscal responsibility.

Featured Posts

-

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025 -

Investing In Middle Management A Key Strategy For Enhanced Productivity And Employee Retention

Apr 24, 2025

Investing In Middle Management A Key Strategy For Enhanced Productivity And Employee Retention

Apr 24, 2025 -

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 24, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 24, 2025 -

B And B Recap April 3 Liams Collapse Bills Departure And Hopes New Living Arrangement

Apr 24, 2025

B And B Recap April 3 Liams Collapse Bills Departure And Hopes New Living Arrangement

Apr 24, 2025

Latest Posts

-

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere

May 12, 2025

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere

May 12, 2025 -

The Next Papal Election Key Cardinals To Watch

May 12, 2025

The Next Papal Election Key Cardinals To Watch

May 12, 2025 -

Next Pope Analyzing The Leading Cardinals In The Conclave

May 12, 2025

Next Pope Analyzing The Leading Cardinals In The Conclave

May 12, 2025 -

Nine Candidates For The Papacy A Look At Potential Successors To Pope Francis

May 12, 2025

Nine Candidates For The Papacy A Look At Potential Successors To Pope Francis

May 12, 2025 -

Possible Papal Successor Examining Leading Cardinal Candidates

May 12, 2025

Possible Papal Successor Examining Leading Cardinal Candidates

May 12, 2025