Canada's Fiscal Future: A Vision For Responsible Spending

Table of Contents

Managing the National Debt and Deficit

Understanding the Current Fiscal Landscape

Canada's current fiscal situation presents both challenges and opportunities. Understanding the landscape is the first step towards responsible fiscal management.

- Current debt-to-GDP ratio: While fluctuating, Canada's debt-to-GDP ratio remains a significant concern, requiring careful management. [Insert current data from a reputable source, e.g., Statistics Canada].

- Projected deficit figures: The government's projected deficits for the coming years need to be analyzed in the context of economic forecasts and potential risks. [Insert projected deficit figures from a reputable source].

- Impact of recent economic events: The COVID-19 pandemic and subsequent inflation significantly impacted Canada's fiscal position, increasing both debt and deficit. These events underscore the need for robust fiscal planning to withstand future economic shocks.

- Comparison to other OECD countries: Comparing Canada's fiscal indicators to other developed nations provides context and benchmarks for improvement. [Insert comparative data from a reputable source, e.g., OECD data].

The current state of Canada's finances necessitates a proactive approach to fiscal sustainability. Addressing the national debt and deficit requires a multifaceted strategy incorporating several key measures.

Strategies for Debt Reduction

Reducing Canada's national debt and deficit requires a concerted effort encompassing several key strategies:

- Fiscal consolidation measures: Implementing targeted cuts in government spending while prioritizing essential services is crucial. This necessitates a rigorous review of existing programs and identification of areas for efficiency gains.

- Revenue enhancement strategies: Exploring options for tax reform, such as closing tax loopholes or adjusting tax brackets, can increase government revenue without unduly burdening taxpayers. Careful consideration of the impact on different income groups is necessary.

- Spending review and prioritization: Conducting thorough reviews of government spending to identify areas of duplication or inefficiency can free up resources for higher-priority initiatives. This requires a data-driven approach to ensure effective resource allocation.

- Potential for increased efficiency in government operations: Implementing modern technologies and streamlining bureaucratic processes can significantly improve government efficiency and reduce operational costs.

By adopting a combination of these strategies, Canada can move towards fiscal responsibility and long-term budgetary control.

Prioritizing Public Spending

Investing in Key Sectors

Strategic investments in key sectors are essential for driving economic growth and improving the quality of life for Canadians. Prioritization is key to ensuring responsible spending.

- Infrastructure spending: Investing in modern transportation networks, sustainable energy infrastructure, and high-speed broadband access is crucial for boosting productivity and competitiveness.

- Education and skills development: Investing in education and training programs equips the workforce with the skills needed for a competitive economy, fostering long-term economic growth.

- Healthcare improvements: Ensuring access to high-quality healthcare is paramount, requiring investments in infrastructure, personnel, and innovative technologies.

- Social programs: Providing support for affordable housing, childcare, and other essential social programs strengthens the social safety net and reduces inequality.

The trade-offs between these crucial areas require careful consideration and prioritization based on both economic impact and social need.

Ensuring Accountability and Transparency

Public trust in government spending is paramount. Transparency and accountability are crucial for responsible fiscal management.

- Open budget data: Making budget information readily available to the public promotes transparency and allows citizens to hold their government accountable.

- Independent audits: Regular independent audits of government spending ensure accuracy and identify potential areas for improvement.

- Performance-based budgeting: Linking budget allocations to measurable outcomes enhances accountability and ensures that funds are used effectively.

- Robust oversight mechanisms: Strengthening parliamentary oversight and establishing independent bodies to monitor government spending helps maintain fiscal responsibility.

These measures are vital for fostering public trust and ensuring that government resources are used efficiently and effectively.

Adapting to Economic Uncertainty

Navigating Global Economic Challenges

Canada's fiscal future must account for the uncertainties of the global economy.

- Impact of global inflation: Managing inflationary pressures requires proactive monetary and fiscal policies to mitigate their impact on the economy.

- Supply chain disruptions: Developing strategies to mitigate the risks of supply chain disruptions, ensuring the resilience of Canada's economy.

- Potential economic slowdowns: Preparing for potential economic slowdowns through contingency planning and fiscal buffers is crucial.

- Diversification of the economy: Reducing reliance on specific sectors and fostering diversification promotes economic resilience.

Proactive adaptation is essential for navigating global economic headwinds.

Promoting Long-Term Economic Growth

Sustainable economic growth is essential for responsible fiscal management.

- Investing in innovation and technology: Supporting research and development, fostering innovation, and adopting new technologies enhance productivity and competitiveness.

- Supporting small and medium-sized businesses: These businesses are the backbone of the Canadian economy and require support to thrive.

- Attracting foreign investment: Creating an attractive investment climate encourages foreign investment, fostering economic growth.

- Fostering a skilled workforce: Investing in education and training programs ensures Canada has a skilled workforce to meet the demands of a changing economy.

These strategies are crucial for achieving sustainable long-term economic growth, creating a strong foundation for Canada's fiscal future.

Conclusion

Securing Canada's fiscal future requires a commitment to responsible spending, strategic investments, and transparent governance. By implementing the strategies outlined above – including managing the national debt, prioritizing public spending, and adapting to economic uncertainty – Canada can navigate economic challenges, build a more resilient economy, and ensure a strong social safety net for future generations. A vision for responsible spending translates to a stronger, more prosperous Canada. Let's work together to secure a positive Canada's Fiscal Future.

Featured Posts

-

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025 -

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025 -

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

Gambling On Calamity The Los Angeles Wildfires And The Trend Of Disaster Betting

Apr 24, 2025

Gambling On Calamity The Los Angeles Wildfires And The Trend Of Disaster Betting

Apr 24, 2025

Latest Posts

-

Understanding Debbie Elliotts Contributions

May 12, 2025

Understanding Debbie Elliotts Contributions

May 12, 2025 -

Learn About Debbie Elliott Life Work And Impact

May 12, 2025

Learn About Debbie Elliott Life Work And Impact

May 12, 2025 -

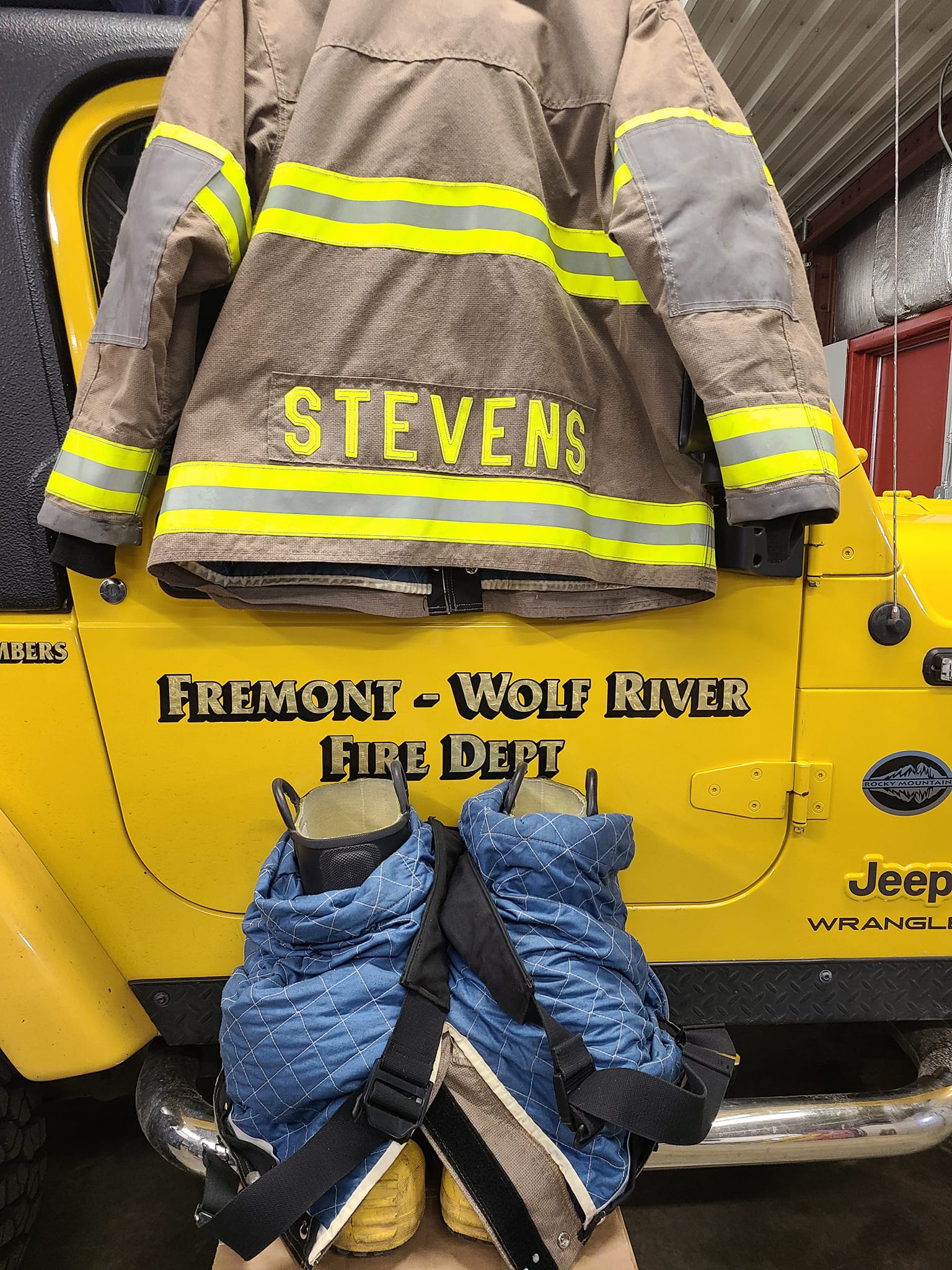

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025 -

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025 -

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025