Canada's Housing Market: The Impact Of 3% Mortgage Rates

Table of Contents

Affordability Challenges in a 3% Mortgage Rate Landscape

The increase to 3% mortgage rates Canada has undeniably created affordability challenges for many. The impact is felt across various segments of the population, with significant regional variations.

Impact on First-Time Homebuyers:

First-time homebuyers are facing a steeper climb than ever before. The higher rates significantly impact their ability to enter the market.

- Increased difficulty in saving for a down payment: Higher interest rates mean less disposable income, making saving for a substantial down payment even more challenging.

- Higher monthly payments stretching budgets: Even with a down payment secured, the monthly mortgage payments at 3% are significantly higher than those at lower rates, potentially exceeding comfortable budget limits.

- Reduced purchasing power: With higher mortgage payments, first-time buyers may need to reconsider their desired location or the size and type of property they can afford.

Government programs like the First-Time Home Buyers' Incentive can provide some assistance, but they don't fully offset the impact of increased mortgage rates Canada.

Effect on Existing Homeowners:

Existing homeowners are also feeling the pressure of 3% mortgage rates. Those with variable-rate mortgages are directly impacted by the increase, and even those with fixed rates may face challenges.

- Potential for refinancing challenges: Securing a new mortgage at favourable rates can be challenging, especially for those with less-than-perfect credit scores.

- Increased stress on household budgets: Higher monthly payments can strain household budgets, leaving less room for other expenses.

- Impact on housing equity: While home prices may still be appreciating in certain areas, the increased cost of borrowing can slow down equity growth for existing homeowners.

Regional Variations in Affordability:

The impact of 3% mortgage rates varies across Canada. Major cities like Toronto and Vancouver, already characterized by high housing costs, are experiencing intensified affordability challenges. Meanwhile, other cities like Calgary or Montreal might see a milder impact, though it's still notable.

- Toronto: The already competitive market in Toronto faces further pressure, potentially leading to decreased sales volume.

- Vancouver: Similar to Toronto, Vancouver's high housing prices are further exacerbated by higher mortgage rates.

- Montreal: Montreal's market, typically more affordable, will still feel the impact, though possibly less drastically.

- Calgary: Calgary's market might see a more moderate effect, depending on local economic factors.

Market Trends and Predictions with 3% Mortgage Rates

The rise in mortgage rates Canada is expected to trigger notable shifts in market trends. Understanding these potential changes is vital for both buyers and sellers.

Impact on Housing Prices:

The effect on housing prices is a complex interplay of supply and demand. While a price correction is possible, the degree and duration remain uncertain.

- Potential for price deceleration or correction: Reduced buyer demand due to higher mortgage rates could lead to a slowing down of price growth or even a price correction in certain areas.

- Influence of buyer demand: The level of buyer demand will be crucial in determining the overall impact on housing prices.

- Impact on investor activity: Investors, often sensitive to interest rate changes, may reduce their activity, influencing market dynamics.

Changes in Sales Volume:

A decline in sales volume is a likely consequence of the higher mortgage rates.

- Projected decrease in sales activity: Fewer buyers can afford to purchase homes, leading to a reduction in transactions.

- Impact on market inventory levels: A decrease in sales could potentially lead to an increase in inventory levels in some areas.

- Effects on different property types: The impact might differ across property types, with condos potentially more affected than single-family homes.

Predictions for the Future:

Predicting the future of Canada's housing market is challenging, but several factors point to a period of adjustment.

- Short-term forecast: Expect a slowdown in sales and price growth in the short term, with the degree of impact varying regionally.

- Long-term forecast: The long-term outlook will depend on several factors, including economic growth, inflation, and future interest rate adjustments.

- Potential for rate adjustments: Future adjustments to the Bank of Canada's policy interest rate will significantly impact mortgage rates and market trends.

Strategies for Navigating the 3% Mortgage Rate Environment

Despite the challenges, there are strategies for buyers and sellers to navigate the current environment. Careful planning and sound financial advice are paramount.

Tips for Buyers:

Prospective homebuyers need to be strategic and well-prepared.

- Strategies for saving for a down payment: Prioritize saving, explore high-yield savings accounts, and cut unnecessary expenses.

- Securing pre-approval: Getting pre-approved for a mortgage will give buyers a clearer picture of their budget and strengthen their position when making offers.

- Negotiating offers: In a potentially slowing market, buyers may have more leverage to negotiate prices.

- Exploring alternative financing options: Consider options like shared-equity mortgages or assistance programs offered by the government.

Tips for Sellers:

Sellers need to adapt their strategies to the changing market.

- Pricing strategies in a changing market: Price your property competitively to attract buyers. Consider seeking a professional appraisal.

- Preparing properties for sale: Ensure your property is in top condition to maximize appeal and potentially command a better price.

- Attracting potential buyers: Highlight the property's features and benefits, and use high-quality photos and virtual tours.

The Role of Financial Planning:

Effective financial planning is crucial in this environment.

- Importance of budgeting: Create a detailed budget to assess your affordability and manage your finances effectively.

- Debt management: Reduce high-interest debt before taking on a mortgage to improve your financial standing.

- Seeking financial advice: Consult a financial advisor to gain personalized guidance and tailor strategies to your unique circumstances.

Conclusion: Understanding the Impact of 3% Mortgage Rates on Canada's Housing Market

3% mortgage rates in Canada have undeniably shifted the housing market landscape. Affordability challenges are increasing, leading to potential price adjustments and reduced sales activity. However, with careful planning and adaptation, both buyers and sellers can navigate this new environment. Understanding regional variations and exploring alternative strategies are key to success in this evolving market.

Stay informed about the evolving dynamics of Canada’s housing market and 3% mortgage rates by regularly checking reputable financial news sources and consulting with a financial advisor. Don't let the changes in mortgage rates Canada deter you from your homeownership dreams; with careful planning and the right information, you can still achieve your goals.

Featured Posts

-

The Impact Of Michael Kays Remarks On Juan Sotos Bat

May 12, 2025

The Impact Of Michael Kays Remarks On Juan Sotos Bat

May 12, 2025 -

Melodi Grand Prix 2025 Danmark Vaelger Sin Repraesentant

May 12, 2025

Melodi Grand Prix 2025 Danmark Vaelger Sin Repraesentant

May 12, 2025 -

Ufc 315 Fight Card Preview Key Fights And Potential Outcomes

May 12, 2025

Ufc 315 Fight Card Preview Key Fights And Potential Outcomes

May 12, 2025 -

Ines Reg Et Chantal Ladesou Tensions Dans Mask Singer

May 12, 2025

Ines Reg Et Chantal Ladesou Tensions Dans Mask Singer

May 12, 2025 -

Boston Celtics Playoff Opener How Payton Pritchard Stepped Up

May 12, 2025

Boston Celtics Playoff Opener How Payton Pritchard Stepped Up

May 12, 2025

Latest Posts

-

Sabalenkas Dominant Victory Claims Madrid Open Title

May 13, 2025

Sabalenkas Dominant Victory Claims Madrid Open Title

May 13, 2025 -

Aryna Sabalenkas Miami Open Championship 19th Tour Title

May 13, 2025

Aryna Sabalenkas Miami Open Championship 19th Tour Title

May 13, 2025 -

Sabalenka Claims Miami Open Victory Securing 19th Wta Title

May 13, 2025

Sabalenka Claims Miami Open Victory Securing 19th Wta Title

May 13, 2025 -

Sabalenka Falls To Ostapenko In Stuttgart

May 13, 2025

Sabalenka Falls To Ostapenko In Stuttgart

May 13, 2025 -

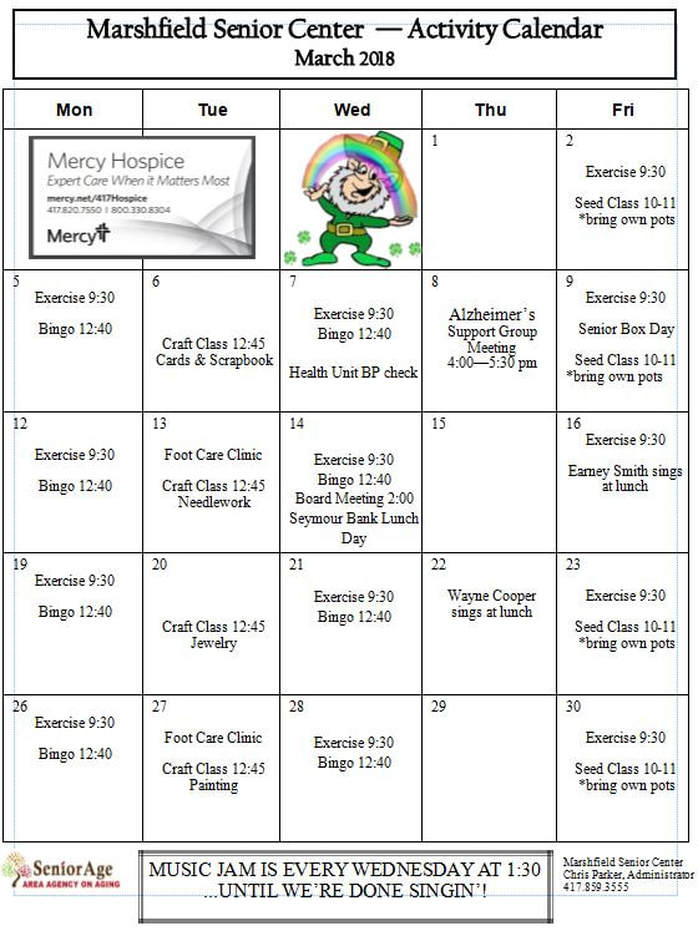

Comprehensive Senior Activities Calendar Trips And Events

May 13, 2025

Comprehensive Senior Activities Calendar Trips And Events

May 13, 2025