Canada's Resource Sector Seeks Salvation: A Bulldog Banker's Approach

Table of Contents

Challenges Facing Canada's Resource Sector

The Canadian resource sector faces a confluence of challenges threatening its continued success. Addressing these head-on is crucial for the sector's survival and future competitiveness.

Volatility in Commodity Prices

Global commodity markets are notoriously volatile, significantly impacting Canadian resource companies. Fluctuations in the prices of oil, natural gas, lumber, potash, and various minerals directly affect profitability and investor confidence. This volatility creates significant financial risk, impacting everything from exploration and extraction to processing and export.

- Example 1: The sharp decline in oil prices in 2014-2016 forced numerous Canadian oil and gas companies into bankruptcy or restructuring.

- Example 2: Recent lumber price swings have drastically affected Canadian forestry companies' bottom lines, impacting jobs and investment.

- Example 3: Fluctuations in metal prices impact mining companies' investment decisions and operational plans.

This price instability necessitates robust risk management strategies to ensure the long-term viability of Canadian resource companies.

Environmental Regulations and Sustainability

Increasingly stringent environmental regulations at both federal and provincial levels are significantly impacting Canadian resource operations. Companies face substantial costs associated with environmental compliance, including emissions reduction, waste management, and habitat protection. Failure to meet these regulations can result in hefty fines, operational shutdowns, and reputational damage.

- Example 1: The federal government's carbon pricing mechanism adds significant costs for high-emitting resource companies.

- Example 2: Provincial regulations related to water usage and waste disposal significantly impact mining operations.

- Example 3: Growing concerns about biodiversity loss are driving stricter regulations surrounding forestry and mining activities.

However, this also presents an opportunity. Investment in green technologies and sustainable practices can reduce environmental impact, improve efficiency, and enhance a company’s reputation.

Global Competition and Market Access

Canada faces stiff competition from other resource-rich nations, including Australia, Brazil, and several countries in Africa. These nations often offer lower production costs, less stringent environmental regulations, or more favorable access to key markets. Navigating international trade agreements and overcoming geopolitical barriers further complicates the situation.

- Key Competitors: Australia in mining, Russia in natural gas, and the US in oil and lumber present significant challenges.

- Trade Barriers: Tariffs, trade disputes, and complex regulatory frameworks can limit market access for Canadian resource products.

- Geopolitical Factors: Global events and political instability can dramatically disrupt supply chains and impact demand.

To compete effectively, Canadian resource companies need to focus on differentiation, value-added processing, and strategic partnerships to secure access to lucrative global markets.

The "Bulldog Banker's" Approach: A Strategic Solution

To achieve salvation and sustainable growth, Canada's resource sector needs to adopt a "bulldog banker's" approach – a tenacious, results-oriented strategy that prioritizes financial prudence, technological innovation, and strategic collaboration.

Financial Prudence and Risk Management

Conservative financial strategies are paramount. This includes diversifying investments, employing hedging strategies to mitigate commodity price volatility, and maintaining strong liquidity positions. Robust corporate governance and transparency are essential for attracting investment and building trust with stakeholders.

- Financial Strategies: Diversification into different commodities, hedging contracts, and strategic reserves.

- Risk Mitigation: Stress testing financial models, robust contingency planning, and insurance strategies.

- Corporate Governance: Independent boards, transparent reporting, and ethical business practices.

Technological Innovation and Efficiency

Investment in research and development (R&D) is vital for improving efficiency, reducing environmental impact, and enhancing competitiveness. Adopting new technologies, such as automation, artificial intelligence (AI), and advanced analytics, can optimize resource extraction, processing, and transportation.

- Innovative Technologies: Automation in mining, AI-powered predictive maintenance, and precision forestry techniques.

- Potential Benefits: Reduced operational costs, increased productivity, minimized environmental footprint, and improved safety.

- Challenges in Implementation: High initial investment costs, skill gaps in the workforce, and the need for supportive policy frameworks.

Strategic Partnerships and Collaboration

Collaboration between government, industry, and Indigenous communities is crucial. Strategic partnerships can facilitate access to capital, technology, and markets, while fostering a more inclusive and sustainable approach to resource development. A unified strategy is essential to address the challenges facing the sector.

- Successful Collaborations: Joint ventures between mining companies and Indigenous communities, government-industry partnerships to support innovation, and international collaborations for market access.

- Potential Areas for Partnership: Shared infrastructure development, technology transfer, and collaborative research on sustainable resource management.

- Benefits of Collaboration: Access to capital, shared expertise, reduced risk, and enhanced social license to operate.

Conclusion

Canada's resource sector faces significant challenges, including commodity price volatility, environmental regulations, and global competition. However, by adopting a "bulldog banker's" approach – characterized by financial prudence, technological innovation, and strategic collaboration – the sector can achieve salvation and ensure sustainable growth. This requires a commitment to responsible resource management, investment in innovation, and a collaborative approach that engages all stakeholders. Learn more about saving Canada's resource sector and support policies that promote sustainable growth and the adoption of this crucial strategy for the future of Canada's resource industry. [Link to relevant resource website]

Featured Posts

-

Mlb All Star On Torpedo Bats Why He Hated Using Them

May 16, 2025

Mlb All Star On Torpedo Bats Why He Hated Using Them

May 16, 2025 -

Vont Weekend Photos April 4th 6th 2025 96 1 Kissfm

May 16, 2025

Vont Weekend Photos April 4th 6th 2025 96 1 Kissfm

May 16, 2025 -

Rezultat Matcha Pley Off N Kh L Ovechkin Zabil No Vashington Poterpel Porazhenie

May 16, 2025

Rezultat Matcha Pley Off N Kh L Ovechkin Zabil No Vashington Poterpel Porazhenie

May 16, 2025 -

Co Parenting Challenges And Successes Ayesha Howard And Anthony Edwards Story

May 16, 2025

Co Parenting Challenges And Successes Ayesha Howard And Anthony Edwards Story

May 16, 2025 -

Hyeseong Kims Homer And Two Steals Lead Okc Dodgers To Doubleheader Victory

May 16, 2025

Hyeseong Kims Homer And Two Steals Lead Okc Dodgers To Doubleheader Victory

May 16, 2025

Latest Posts

-

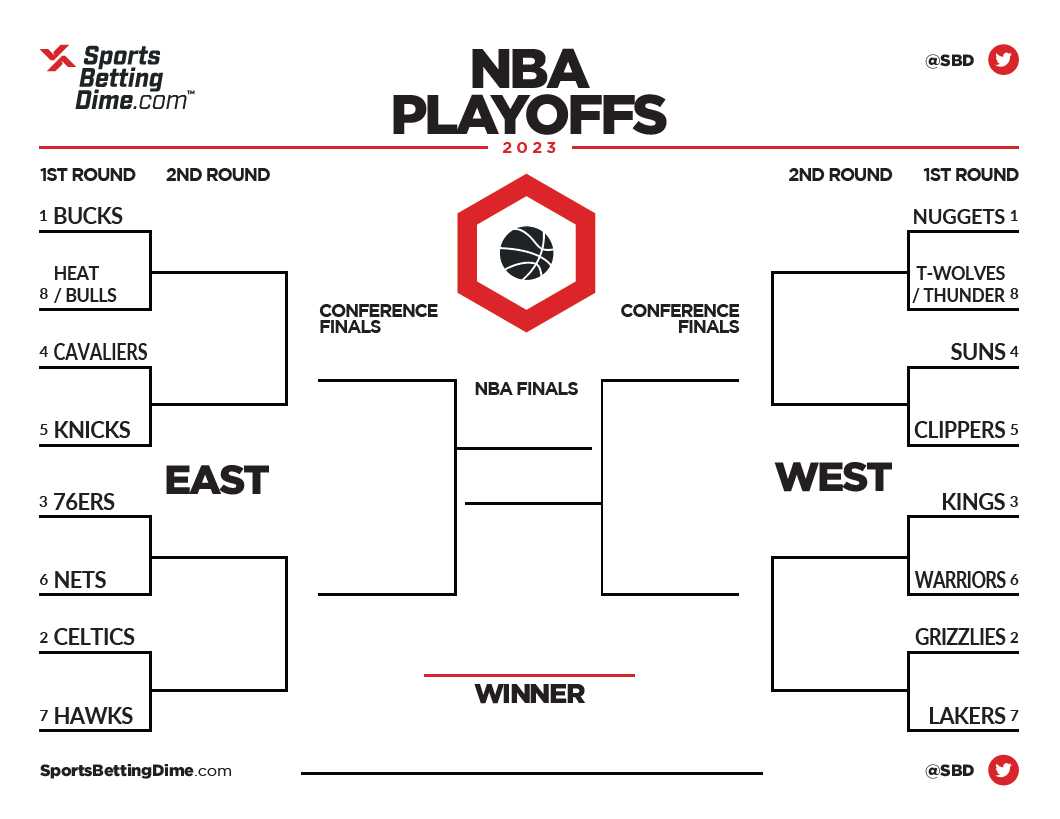

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025 -

Playoff Betting Expert Picks For Nba And Nhl Round 2

May 16, 2025

Playoff Betting Expert Picks For Nba And Nhl Round 2

May 16, 2025 -

Rekord Leme Po Golam V Pley Off N Kh L Pobit Ovechkinym

May 16, 2025

Rekord Leme Po Golam V Pley Off N Kh L Pobit Ovechkinym

May 16, 2025 -

Smart Money Nba And Nhl Round 2 Playoff Predictions

May 16, 2025

Smart Money Nba And Nhl Round 2 Playoff Predictions

May 16, 2025 -

N Kh L Pley Off Vashington I Monreal Gotovyatsya K Bitve Ovechkina I Demidova

May 16, 2025

N Kh L Pley Off Vashington I Monreal Gotovyatsya K Bitve Ovechkina I Demidova

May 16, 2025