Canadian Aluminum Trader Files For Bankruptcy, Citing Trade War

Table of Contents

The Impact of the Trade War on the Canadian Aluminum Industry

The trade war has significantly impacted the Canadian aluminum industry, creating a perfect storm that contributed directly to [Company Name]'s downfall.

Increased Tariffs and Import Restrictions

The imposition of tariffs and import restrictions on aluminum products has severely hampered the profitability of aluminum trading in Canada.

- Specific Tariffs: The US imposed a 10% tariff on Canadian aluminum in [Year], followed by [mention other relevant tariffs and their percentages]. These tariffs significantly increased the cost of imported aluminum, making Canadian products less competitive in global markets.

- Supply Chain Disruptions: These restrictions severely disrupted [Company Name]'s supply chain, limiting access to key materials and hindering their ability to fulfill contracts. The increased lead times and higher costs ate into profit margins.

- Market Instability: The overall effect was a ripple effect across the Canadian aluminum industry, impacting competitors and creating significant market instability. Many smaller players were forced to reduce operations or shutter entirely.

Decreased Demand and Price Volatility

The trade war also led to a decrease in overall demand for aluminum and exacerbated price volatility, creating an incredibly challenging environment for aluminum traders.

- Price Fluctuations: Aluminum prices experienced significant fluctuations during [period], with prices swinging wildly between [price range]. These volatile swings made it nearly impossible to accurately forecast profits.

- Trading Margin Compression: The price volatility significantly compressed trading margins, leaving little room for error and making the business extremely risky. [Company Name] struggled to maintain profitability in this unpredictable environment.

- Contractual Difficulties: Many long-term contracts became unprofitable due to unexpected price shifts, leading to financial losses for the company.

Financial Difficulties and the Bankruptcy Filing

The combination of trade war impacts and existing financial pressures ultimately led to [Company Name]'s bankruptcy filing.

Mounting Debts and Liquidity Issues

The company faced a cascade of financial difficulties, culminating in its inability to meet its financial obligations.

- Key Financial Indicators: [Company Name]'s debt-to-equity ratio increased dramatically from [percentage] to [percentage] during [timeframe], reflecting a deteriorating financial position. Revenue declined by [percentage] year-over-year.

- Failed Restructuring Attempts: The company attempted to restructure its debt and secure additional financing but these efforts ultimately proved unsuccessful.

- Bankruptcy Timeline: The bankruptcy filing followed a series of missed payments and a period of intense negotiations with creditors, ultimately concluding on [date].

Creditor Impacts and Potential Legal Ramifications

The bankruptcy has significant implications for creditors and may lead to legal disputes.

- Creditor Types: The company's creditors include banks, suppliers, and potentially other businesses involved in its trading activities.

- Legal Challenges: There's a potential for legal challenges and investigations regarding the company's financial dealings leading up to the bankruptcy.

- Job Losses: The bankruptcy has resulted in significant job losses for employees of [Company Name], further compounding the economic impact.

Future Outlook for the Canadian Aluminum Industry

The bankruptcy of [Company Name] raises serious questions about the future of the Canadian aluminum industry.

Market Consolidation and Uncertainty

The exit of a major player like [Company Name] is likely to lead to further market consolidation.

- Increased Market Share: Competitors are poised to acquire market share, potentially leading to a more concentrated industry.

- Trade Relations Uncertainty: The ongoing uncertainty surrounding future trade relations creates a challenging environment for all businesses operating in the Canadian aluminum sector.

- Government Intervention: The Canadian government might consider intervening to support the industry through subsidies or other forms of assistance.

Opportunities for Other Players

Despite the challenges, the bankruptcy also creates opportunities for other players in the market.

- Market Share Gains: Competitors are positioned to absorb the market share vacated by [Company Name].

- Investment Opportunities: The situation might present investment opportunities for companies looking to expand their presence in the Canadian aluminum market.

- Market Restructuring: The bankruptcy could trigger a necessary restructuring of the Canadian aluminum market, leading to a more efficient and resilient sector in the long term.

Conclusion

The bankruptcy of [Company Name] serves as a stark reminder of the significant impact of the trade war on Canadian businesses. The Canadian Aluminum Trader Bankruptcy highlights the vulnerabilities within the Canadian aluminum market and the broader challenges faced by businesses navigating international trade disputes. This event underscores the need for proactive strategies to mitigate risks and build resilience within the Canadian aluminum industry. The consequences of this bankruptcy will undoubtedly reshape the Canadian aluminum market, triggering market consolidation and creating both challenges and opportunities for remaining players. Stay informed about the evolving situation in the Canadian aluminum industry and the ongoing impact of trade wars on Canadian businesses. Follow [your publication name/website] for continued updates on the Canadian aluminum trader bankruptcy and its ripple effects.

Featured Posts

-

Robbie Williams Malaga Cruise Ship Christening Concert

May 29, 2025

Robbie Williams Malaga Cruise Ship Christening Concert

May 29, 2025 -

New A24 Horror Film Bring Her Back Trailer Released

May 29, 2025

New A24 Horror Film Bring Her Back Trailer Released

May 29, 2025 -

Latin Women Musicians A 2025 Forecast

May 29, 2025

Latin Women Musicians A 2025 Forecast

May 29, 2025 -

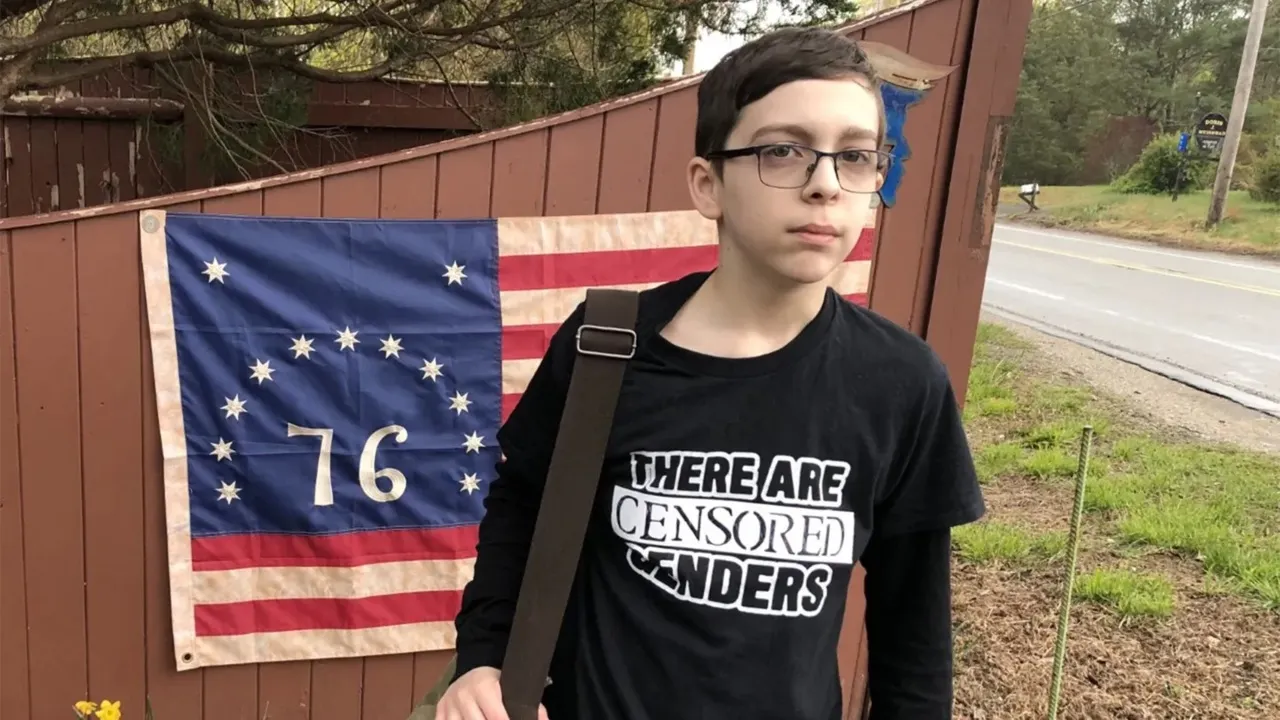

Seventh Graders Two Genders Shirt Supreme Court Denies Review

May 29, 2025

Seventh Graders Two Genders Shirt Supreme Court Denies Review

May 29, 2025 -

Apozimiosi 5 Ekat Dolarion Gia Ton Thanato Sto Kapitolio I Kyvernisi Tramp Analamvanei Tin Eythyni

May 29, 2025

Apozimiosi 5 Ekat Dolarion Gia Ton Thanato Sto Kapitolio I Kyvernisi Tramp Analamvanei Tin Eythyni

May 29, 2025

Latest Posts

-

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025 -

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025 -

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025 -

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025 -

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025