Canadian Dollar Forecast: Minority Government's Impact

Table of Contents

Economic Policy Impacts on the CAD

A minority government's inherent instability can significantly influence Canada's economic policies, directly impacting the Canadian dollar (CAD) and its exchange rate. Understanding these potential impacts is crucial for forming a sound Canadian dollar forecast.

Fiscal Policy Uncertainty

A minority government may lead to less predictable fiscal spending and budgeting compared to a majority government. This uncertainty stems from:

- Increased likelihood of budget negotiations and compromises: Reaching consensus across multiple parties can lead to delayed budget approvals and compromises on spending priorities.

- Potential for delays in infrastructure projects and economic stimulus initiatives: Political gridlock can stall crucial infrastructure projects and economic stimulus programs, impacting economic growth and, subsequently, the CAD.

- Impact on government debt and the overall fiscal outlook: Negotiations and compromises may affect the government's ability to manage debt effectively, impacting investor confidence in the long term.

- Effect on investor confidence and foreign investment in Canada: Uncertainty regarding fiscal policy can deter foreign investors, reducing capital inflows and weakening the CAD.

Monetary Policy Considerations

While the Bank of Canada's monetary policy operates independently, it interacts with the government's fiscal policy. Therefore, a minority government can indirectly influence the CAD through:

- Interest rate decisions and their influence on the CAD: The Bank of Canada's interest rate decisions are a key determinant of the CAD's value. These decisions are influenced by the overall economic climate, including the government's fiscal policy.

- Inflation control measures and their impact on the currency's value: The Bank of Canada aims to control inflation. Fiscal policy choices can either support or hinder these efforts, affecting the CAD's value accordingly.

- Potential for divergence between government fiscal policy and monetary policy goals: Conflicts between fiscal and monetary policies can create uncertainty and volatility in the currency markets.

- The Bank of Canada's communication strategy and its effect on market expectations: Clear and consistent communication from the Bank of Canada can help mitigate some of the uncertainty caused by a minority government.

Political Instability and Investor Sentiment

Minority governments are often associated with political instability, which significantly impacts investor sentiment and, consequently, the Canadian dollar forecast.

Impact of Political Gridlock

Frequent elections or potential government collapses create considerable uncertainty:

- Reduced foreign direct investment (FDI) flows: Political instability discourages long-term foreign investment, reducing capital inflows and potentially weakening the CAD.

- Increased risk premiums for Canadian assets: Investors demand higher returns for taking on increased political risk, impacting the attractiveness of Canadian investments.

- Short-term capital flight and currency fluctuations: Uncertainty can lead to short-term capital flight, causing increased volatility in the CAD exchange rate.

- Uncertainty in implementing long-term economic strategies: The lack of a stable government can hinder the implementation of consistent long-term economic strategies, creating further uncertainty.

Influence on Commodity Prices

Canada's economy is heavily reliant on commodity exports. Political uncertainty can significantly impact commodity prices and, in turn, the CAD:

- Impact of political uncertainty on commodity prices (oil, lumber, etc.): Uncertainty can lead to price fluctuations in key Canadian commodities, affecting export revenues and the CAD.

- The relationship between commodity prices and the Canadian dollar: Generally, higher commodity prices tend to strengthen the CAD, while lower prices weaken it.

- Potential for volatility in commodity markets due to policy changes: Policy changes related to resource extraction or environmental regulations can significantly impact commodity prices and the CAD.

- The role of global commodity demand in shaping the CAD forecast: Global demand for Canadian commodities plays a major role in determining the CAD's strength.

Global Economic Factors and their Interaction

The Canadian dollar is not solely determined by domestic factors; global economic conditions also play a crucial role.

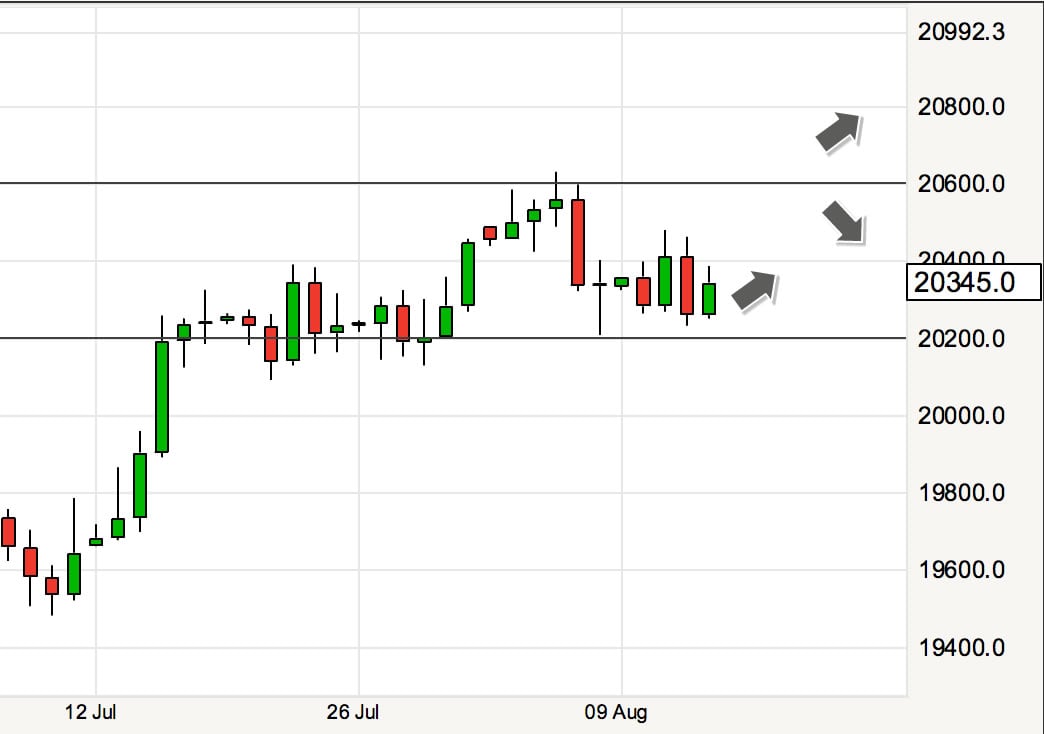

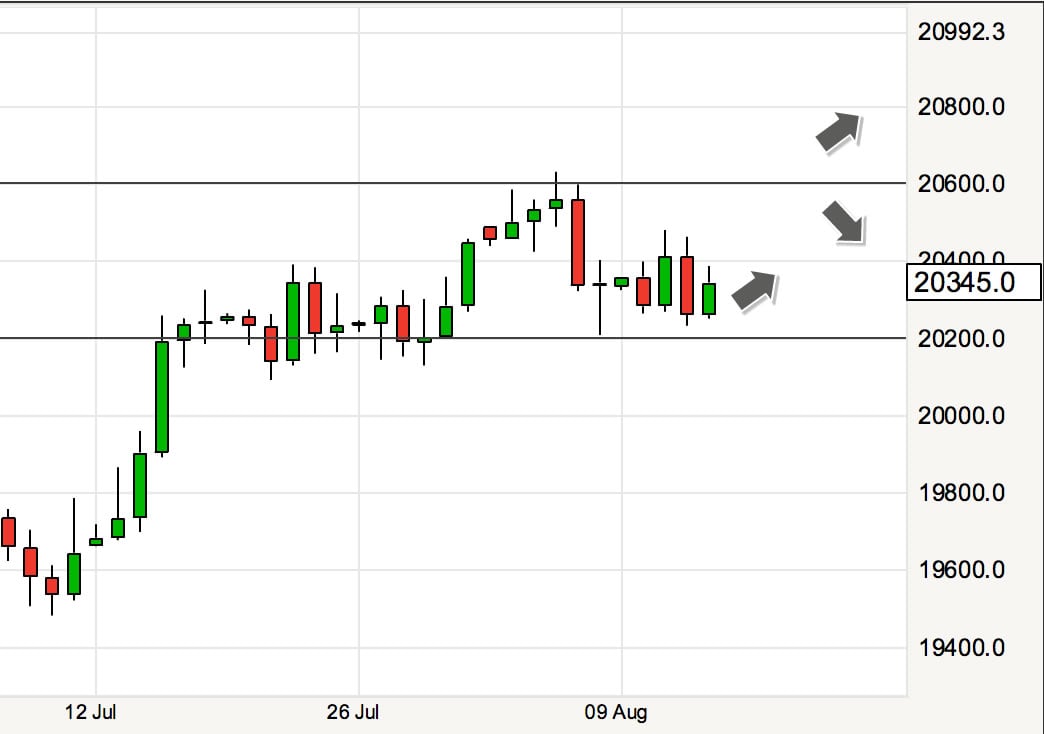

US Dollar Movement

The US dollar (USD) is a major influencing factor on the CAD:

- Correlation between the CAD and USD exchange rates: The CAD and USD are highly correlated; a stronger USD typically leads to a weaker CAD.

- Impact of US economic policy on both currencies: US economic policy decisions significantly impact both the USD and CAD exchange rates.

- Influence of trade relations between Canada and the US: The trade relationship between Canada and the US is critical and directly affects both currencies.

Global Economic Growth

Global economic health significantly influences the demand for Canadian exports:

- The effect of global recessions or expansions on the CAD: Global economic downturns usually weaken the CAD, while expansions tend to strengthen it.

- Impact of trade wars and international tensions: Global trade wars and geopolitical tensions can negatively impact the CAD.

- Influence of emerging markets on the Canadian dollar: The growth and stability of emerging markets can influence demand for Canadian exports and affect the CAD.

Conclusion

The Canadian dollar forecast under a minority government is inherently complex and depends on numerous interacting factors, both domestic and global. Fiscal and monetary policy decisions, political stability, commodity prices, and global economic conditions all play crucial roles in shaping the CAD's trajectory. While short-term volatility is likely, prudent investors and traders should closely monitor these factors and adapt their strategies accordingly. Understanding the intricate interplay of these elements is crucial for accurate Canadian dollar forecast analysis. For the latest updates and in-depth analysis on the Canadian dollar's future, continue to follow our regular reports on currency exchange rates and economic policy. Stay informed about the Canadian dollar forecast to make well-informed investment decisions.

Featured Posts

-

Michael Sheen Channel 4 In Copyright Dispute Over Debt Documentary

May 01, 2025

Michael Sheen Channel 4 In Copyright Dispute Over Debt Documentary

May 01, 2025 -

Nothings Phone 2 A Modular Phone Revolution

May 01, 2025

Nothings Phone 2 A Modular Phone Revolution

May 01, 2025 -

Inside Michael Sheens Life From Famous Relationships To Hollywoods Backstage

May 01, 2025

Inside Michael Sheens Life From Famous Relationships To Hollywoods Backstage

May 01, 2025 -

How To Prepare For A Dragons Den Pitch

May 01, 2025

How To Prepare For A Dragons Den Pitch

May 01, 2025 -

Germanys Potential New Finance Minister Lars Klingbeil

May 01, 2025

Germanys Potential New Finance Minister Lars Klingbeil

May 01, 2025