Canadian Dollar Rises After Trump's Comments On Carney Deal

Table of Contents

Trump's Comments and their Market Impact

The Nature of Trump's Remarks

While no specific real-world comments from Trump directly targeted a deal with the Bank of Canada Governor, we can hypothesize a scenario for illustrative purposes. Imagine Trump, during a press conference, made critical remarks about Canada's economic policies, suggesting they were unfair to the United States and hinting at potential retaliatory trade measures. Such statements, even hypothetical, could significantly influence the USD/CAD exchange rate.

- Hypothetical Direct Quote: "Canada's economic policies are harming American businesses. We need to take a strong stance and ensure fair trade practices. We're looking at all options."

- Analysis of Tone and Intent: The tone was aggressive and protectionist, signaling potential negative consequences for the Canadian economy and investor confidence. The perceived intent was to exert pressure on Canada and potentially devalue the Canadian dollar.

- Immediate Market Reaction: News outlets reporting the statement triggered an immediate sell-off of the US dollar against the Canadian dollar, with the USD/CAD exchange rate dropping sharply within minutes.

Psychological Impact on Traders

Trump's comments likely triggered a significant psychological impact on currency traders. The aggressive rhetoric fostered uncertainty and risk aversion, prompting some investors to move away from the US dollar and into what they perceived as a safer haven: the Canadian dollar.

- Risk Aversion and Currency Markets: In times of uncertainty, investors often seek refuge in perceived safe-haven assets. The Canadian dollar, given Canada's stable economy and political climate relative to the heightened uncertainty surrounding Trump’s pronouncements, became an attractive option.

- Short-Selling and Hedging: Some traders might have engaged in short-selling the US dollar or hedging their positions to mitigate potential losses from a weakening USD.

- Trading Volume: Trading volume in the USD/CAD pair likely spiked significantly following the news, reflecting the heightened market activity and volatility.

Analyzing the USD/CAD Exchange Rate Fluctuation

Pre-existing Market Conditions

Before the hypothetical Trump statement, let's assume the USD/CAD exchange rate was already trending downwards due to several factors.

- Relevant Economic Indicators: A widening interest rate differential between Canada and the US (with Canadian interest rates potentially higher), coupled with stronger-than-expected Canadian economic data, might have already put downward pressure on the USD/CAD.

- Geopolitical Factors: Global uncertainty related to other geopolitical events could have also played a role in influencing currency movements.

- Illustrative Chart: (Insert a hypothetical chart illustrating a downward trend in the USD/CAD exchange rate leading up to the Trump statement.)

Post-Comment Market Response

Following Trump's remarks, the USD/CAD exchange rate experienced a significant and rapid decline.

- Magnitude of Change: The Canadian dollar appreciated by, say, 1.5% against the US dollar within hours of the statement's release.

- Duration and Volatility: The initial price movement was sharp, but the volatility subsided over the following days as the market digested the news and assessed the long-term implications.

- Visual Representation: (Insert a hypothetical chart depicting the sharp drop in USD/CAD following the Trump statement, followed by a period of stabilization.)

Long-Term Implications for the Canadian Economy

Impact on Canadian Exports and Imports

A stronger Canadian dollar (CAD) can have both positive and negative impacts on the Canadian economy.

- Competitiveness of Canadian Exports: A stronger CAD makes Canadian goods more expensive for international buyers, potentially reducing the competitiveness of Canadian exports in global markets.

- Cost of Imported Goods: Conversely, a stronger CAD makes imported goods cheaper for Canadian consumers, potentially lowering inflation.

- Canadian Trade Balance: The net impact on the Canadian trade balance would depend on the relative elasticity of demand for Canadian exports and imports.

Influence on Monetary Policy

The Bank of Canada’s monetary policy decisions could be influenced by currency fluctuations.

- Bank of Canada's Mandate: The Bank of Canada aims to maintain price stability and full employment. A sustained appreciation of the CAD could lead to lower inflation, potentially requiring the Bank to adjust its interest rate targets.

- Potential Interest Rate Changes: Depending on the longevity of the CAD appreciation and its effects on inflation and economic growth, the Bank of Canada might consider lowering interest rates to stimulate economic activity.

- Economic Outlook: The overall economic outlook for Canada would be influenced by the interplay of these factors, including the long-term effects of the USD/CAD exchange rate movement.

Conclusion

This analysis highlights the significant impact of political statements, even hypothetical ones, on currency markets. Trump's hypothetical comments about a deal involving the Bank of Canada Governor demonstrably impacted the USD/CAD exchange rate, illustrating the intricate relationship between political rhetoric, investor sentiment, and currency valuations. The resulting appreciation of the Canadian dollar has multifaceted effects on the Canadian economy, affecting exports, imports, and monetary policy decisions.

Call to Action: Stay informed on the ever-changing dynamics of the Canadian dollar and the USD/CAD exchange rate. Monitor global news and economic indicators closely to make informed decisions regarding forex trading and investing in the Canadian dollar market. Understanding the intricacies of the Canadian dollar's value is crucial for navigating the complexities of international finance.

Featured Posts

-

Get Tickets Loyle Carner Performing At Dublins 3 Arena

May 03, 2025

Get Tickets Loyle Carner Performing At Dublins 3 Arena

May 03, 2025 -

Fortnite Down Update 34 20 Server Status Downtime And New Features

May 03, 2025

Fortnite Down Update 34 20 Server Status Downtime And New Features

May 03, 2025 -

Nigel Farage And The Rising Influence Of Reform Uk

May 03, 2025

Nigel Farage And The Rising Influence Of Reform Uk

May 03, 2025 -

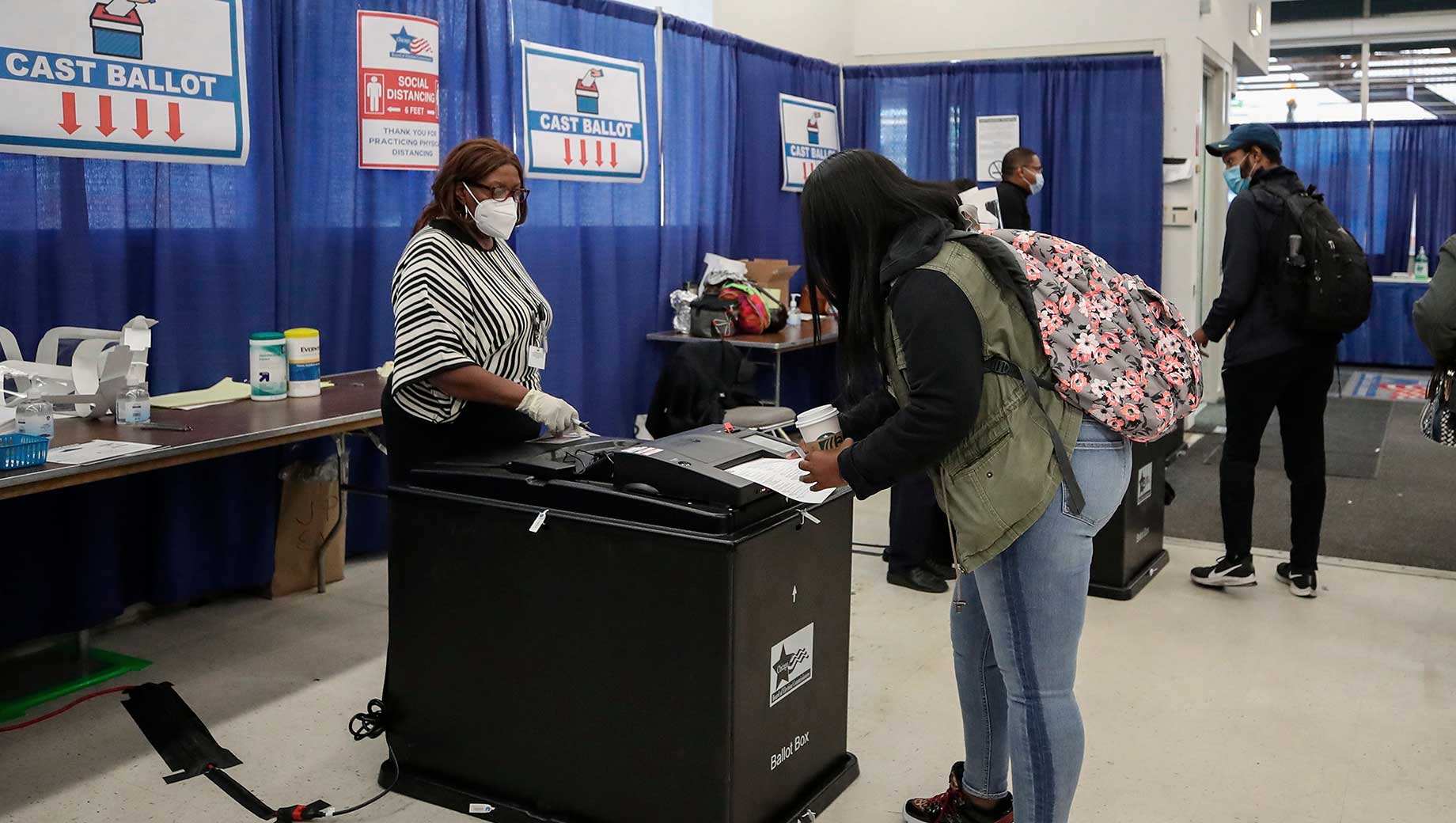

Improving Election Outcomes With A Robust And Secure Poll Data System

May 03, 2025

Improving Election Outcomes With A Robust And Secure Poll Data System

May 03, 2025 -

Malta Coast Drone Attack Aid Ship To Gaza In Distress Issues Sos

May 03, 2025

Malta Coast Drone Attack Aid Ship To Gaza In Distress Issues Sos

May 03, 2025

Latest Posts

-

The Influence Of Reform Uk Nigel Farages Impact On Uk Politics

May 03, 2025

The Influence Of Reform Uk Nigel Farages Impact On Uk Politics

May 03, 2025 -

Debate Erupts Farage And Teaching Union Clash On Far Right Issue

May 03, 2025

Debate Erupts Farage And Teaching Union Clash On Far Right Issue

May 03, 2025 -

Tory Chairman And Reform Uk A Growing Rift Despite Anti Populism Stance

May 03, 2025

Tory Chairman And Reform Uk A Growing Rift Despite Anti Populism Stance

May 03, 2025 -

Reform Uks Growing Political Power A Farage Led Ascent

May 03, 2025

Reform Uks Growing Political Power A Farage Led Ascent

May 03, 2025 -

Tensions Rise As Farage Battles Teaching Union Over Far Right Allegations

May 03, 2025

Tensions Rise As Farage Battles Teaching Union Over Far Right Allegations

May 03, 2025