Canadian Dollar Strengthens Following Trump-Carney Deal Hints

Table of Contents

The Trump-Carney (Macklem) Deal Hints and their Market Impact

While not explicitly a "deal," recent statements and actions from both President Trump and Governor Macklem have created a more positive atmosphere surrounding US-Canada trade relations. This shift in tone, after periods of trade tension, significantly impacts the perception of risk associated with investing in the Canadian dollar.

-

Specific quotes or actions: Although no formal agreement has been announced, positive statements regarding the effectiveness of the USMCA from both sides have calmed previous anxieties. President Trump has, on occasion, publicly praised aspects of the agreement, while Governor Macklem has highlighted the importance of stable trade relationships for Canada's economic health. These positive signals, however subtle, were enough to alter market sentiment.

-

Mention of potential breakthroughs: While not a dramatic breakthrough, the lack of overt negative rhetoric from either side regarding the USMCA is a considerable improvement and contributes to a sense of improved trade relations. This subtle shift has helped to ease concerns about potential future trade disruptions.

-

Analysis of market reactions: The immediate reaction to this perceived improvement in US-Canada trade relations was a noticeable jump in the value of the Canadian dollar against the US dollar (USD/CAD exchange rate). This indicates a renewed confidence among investors in the Canadian economy's stability. The positive economic sentiment was clearly reflected in the forex market.

The Role of the USMCA in Canadian Dollar Strength

The USMCA (United States-Mexico-Canada Agreement) is paramount to the Canadian economy. Canada's close economic ties with the United States make the agreement's success crucial for Canadian economic stability and the performance of the Loonie.

-

Statistics on Canadian exports: A significant percentage of Canadian exports are destined for the US market. Disruptions to this vital trade flow directly impact the Canadian economy and its currency.

-

Impact of trade uncertainty: Past periods of US-Canada trade uncertainty have historically weakened the Canadian dollar. The threat of tariffs or trade restrictions has created volatility in the currency markets, making investors hesitant.

-

Positive resolution's effect on investor confidence: A positive resolution, or even the perception of one, regarding USMCA negotiations significantly boosts investor confidence. This confidence translates directly into increased demand for the Canadian dollar, leading to appreciation. The removal of trade uncertainty fosters economic stability and strengthens the Loonie.

Other Factors Contributing to Canadian Dollar Appreciation

While the improved US-Canada trade outlook played a significant role, other factors contributed to the Canadian dollar's recent appreciation.

-

Oil prices: Crude oil is a major Canadian export. Higher oil prices increase the demand for the Canadian dollar, bolstering its value in the forex market.

-

Interest rate differentials: Interest rate differences between Canada and the US also influence the USD/CAD exchange rate. Higher interest rates in Canada can attract foreign investment, increasing demand for the Canadian dollar.

-

Global economic sentiment: Overall global economic conditions significantly impact currency values. Positive global sentiment often leads to increased demand for higher-yielding currencies, which can include the Canadian dollar.

-

Canadian stock market performance: A strong Canadian stock market generally indicates a healthy economy, boosting investor confidence and thereby the value of the Loonie.

Potential Implications for Investors and Businesses

The strengthening Canadian dollar has significant implications for businesses and investors on both sides of the border.

-

Impact on export competitiveness: A stronger Loonie makes Canadian exports more expensive for US buyers, potentially impacting export competitiveness.

-

Impact on import costs: Conversely, it makes imports from the US cheaper for Canadians.

-

Opportunities and challenges for Canadian businesses: Canadian businesses need to adjust their strategies to navigate these currency fluctuations. Hedging strategies might be employed to mitigate the risks associated with currency volatility.

-

Currency risk management: Businesses involved in international trade must actively manage currency risk. This may involve utilizing financial instruments such as forward contracts or options to lock in exchange rates and protect profits. Professional financial advice is crucial in navigating these complexities.

Conclusion

The recent strengthening of the Canadian dollar is a complex issue with multiple contributing factors. The perceived improvement in US-Canada trade relations, driven by positive signals from President Trump and Governor Macklem regarding the USMCA, played a key role. However, other factors, including oil prices, interest rate differentials, and broader global economic sentiment, also contributed to the Loonie's appreciation. Understanding these interconnected elements is critical for businesses and investors operating in the Canadian and US markets.

Call to Action: Stay informed about the latest developments impacting the Canadian dollar and US-Canada trade relationships. Monitor the USD/CAD exchange rate closely. For significant financial decisions involving the Canadian dollar or forex trading, consider seeking professional financial advice. Understanding the intricacies of what influences the Canadian dollar's strength is paramount to effectively navigating the forex market and managing currency risk.

Featured Posts

-

Tulsa Storm Damage Reporting Crucial For Nws Tracking Of Saturdays Weather

May 03, 2025

Tulsa Storm Damage Reporting Crucial For Nws Tracking Of Saturdays Weather

May 03, 2025 -

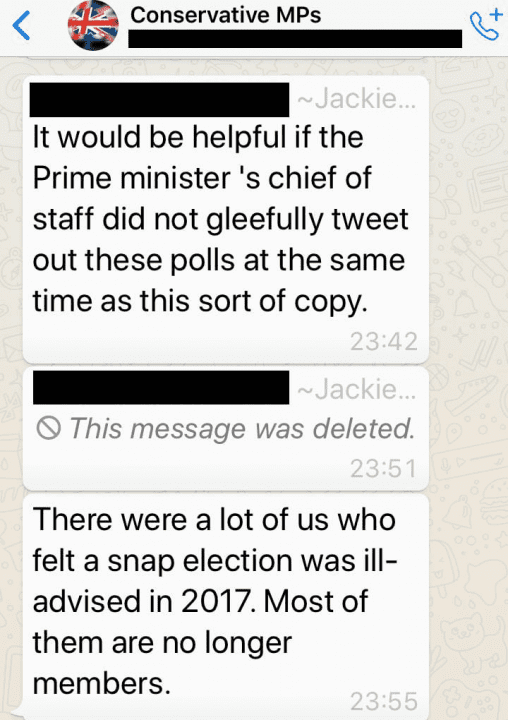

Leaked Whats App Messages Expose Rift In Reform Party

May 03, 2025

Leaked Whats App Messages Expose Rift In Reform Party

May 03, 2025 -

Ndcs Techiman South Parliamentary Election Petition Fails In High Court

May 03, 2025

Ndcs Techiman South Parliamentary Election Petition Fails In High Court

May 03, 2025 -

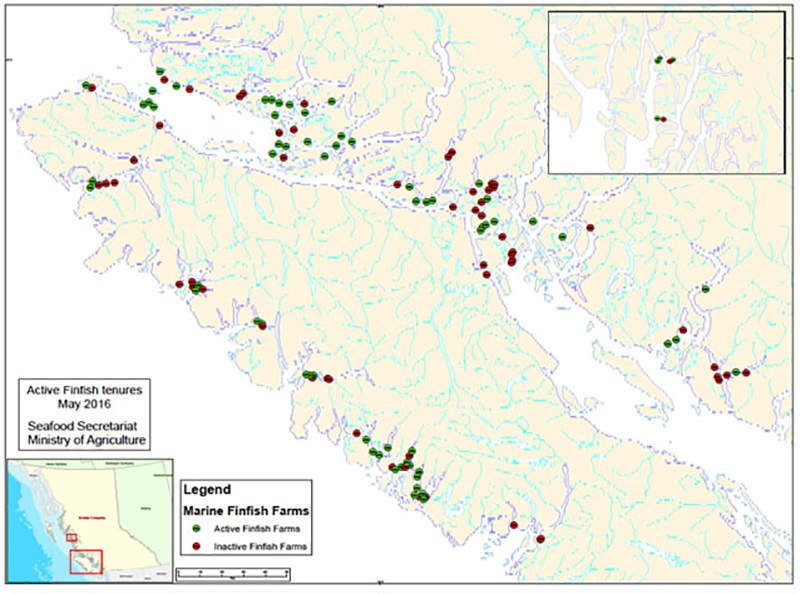

Farmings Future Under Reform Uk Trust And Transparency

May 03, 2025

Farmings Future Under Reform Uk Trust And Transparency

May 03, 2025 -

Reform Uk Figure Rupert Lowe Faces Bullying Allegations Police Involved

May 03, 2025

Reform Uk Figure Rupert Lowe Faces Bullying Allegations Police Involved

May 03, 2025

Latest Posts

-

Reform Uk Facing Collapse Five Critical Issues

May 03, 2025

Reform Uk Facing Collapse Five Critical Issues

May 03, 2025 -

Nigel Farage And The Growing Power Of Reform Uk In British Politics

May 03, 2025

Nigel Farage And The Growing Power Of Reform Uk In British Politics

May 03, 2025 -

Reform Uks Challenges Five Threats To Its Success

May 03, 2025

Reform Uks Challenges Five Threats To Its Success

May 03, 2025 -

The Future Of Reform Uk Five Potential Pitfalls For Nigel Farage

May 03, 2025

The Future Of Reform Uk Five Potential Pitfalls For Nigel Farage

May 03, 2025 -

Understanding Reform Uks Rise Nigel Farages Leadership And Strategy

May 03, 2025

Understanding Reform Uks Rise Nigel Farages Leadership And Strategy

May 03, 2025