Canadian Dollar Vulnerable: Strategist Warns Of Minority Government Risk

Table of Contents

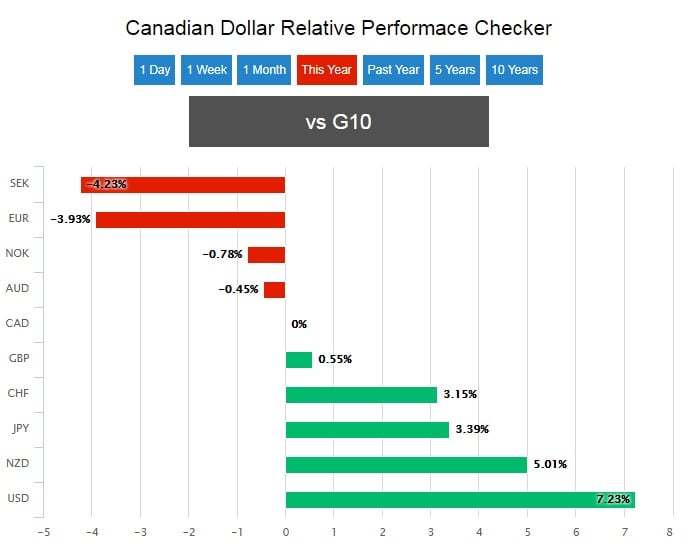

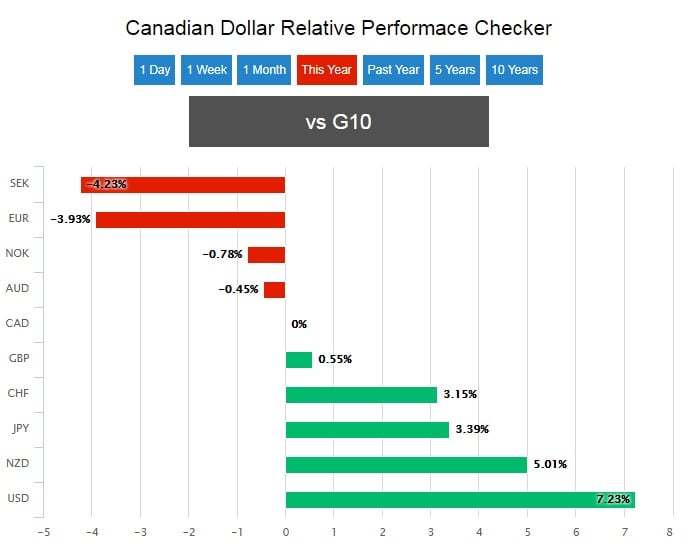

Political Instability and its Impact on the CAD

A minority government inherently introduces significant uncertainty into the Canadian economic landscape, directly impacting the Canadian dollar. This translates to increased volatility in the forex market and makes the CAD more susceptible to rapid fluctuations.

Increased Uncertainty and Volatility

The slower decision-making processes and increased potential for political gridlock characteristic of a minority government create a climate of uncertainty that unnerves investors. This uncertainty is a key driver of volatility in the forex market.

- Increased likelihood of snap elections: The ever-present threat of an unexpected election creates further instability and discourages long-term investment.

- Difficulty passing key economic legislation: Essential legislation, including budget bills and economic reforms, can face significant delays or even fail to pass altogether, hindering economic growth and investor confidence.

- Potential for conflicting policy priorities: Compromises required to maintain a minority government coalition can lead to conflicting policy priorities, further eroding investor confidence in the stability and direction of the Canadian economy.

Impact on Investor Confidence

The unpredictable nature of a minority government significantly reduces investor confidence, both domestically and internationally. Investors seek stability and predictability; a minority government offers neither. This directly affects demand for the CAD.

- Reduced foreign direct investment (FDI): Uncertainty deters foreign companies from investing in Canada, limiting economic growth and weakening the CAD.

- Lower portfolio investment flows: International investors are less likely to allocate capital to Canada given the increased risk profile associated with a minority government.

- Negative impact on business confidence: Domestic businesses may postpone expansion plans or investment decisions due to the uncertain political climate, impacting overall economic activity.

Economic Implications and Policy Uncertainty

The economic consequences of a minority government extend beyond investor sentiment, impacting fiscal policy, trade, and the overall health of the Canadian economy. This uncertainty directly affects the CAD's performance.

Budgetary Constraints and Fiscal Policy

Minority governments often face difficulties in passing their budgets, leading to potential delays or compromises on crucial economic policies. This uncertainty can negatively affect investor sentiment and, subsequently, the CAD's exchange rate.

- Potential for fiscal policy uncertainty: Uncertainties around government spending and taxation impact business planning and consumer confidence.

- Delayed or scaled-back infrastructure projects: Essential infrastructure projects, crucial for long-term economic growth, may be delayed or even cancelled due to budgetary constraints or political disagreements.

- Impact on government spending and economic growth: Delayed or reduced government spending can negatively affect economic growth and, in turn, the value of the CAD.

Trade Policy and Global Economic Factors

Canada's significant reliance on trade makes it particularly vulnerable to global economic shifts and changes in trade policies. Political instability within the country can amplify these risks.

- Negotiating trade deals with a minority government: The process of negotiating and ratifying international trade agreements can be significantly complicated and slowed down by a minority government.

- Exposure to global economic shocks: A minority government can make Canada more vulnerable to global economic shocks, as the ability to respond effectively might be hampered by political gridlock.

- Sensitivity to changes in commodity prices: Canada’s economy is heavily reliant on commodity exports. Fluctuations in commodity prices can have a magnified impact on the CAD, particularly under a politically unstable regime.

Strategies for Navigating the CAD's Vulnerability

While the current political landscape presents challenges, investors can employ several strategies to mitigate the risks associated with the CAD's vulnerability.

Diversification of Investments

Diversification is key to mitigating risk. Spreading investments across various asset classes and geographies reduces reliance on the performance of the CAD.

- Explore international investments: Diversify into assets denominated in other currencies to reduce exposure to CAD volatility.

- Consider hedging strategies: Utilize hedging techniques such as currency futures or options to protect against potential CAD depreciation.

- Diversify across different currencies: Holding assets in a basket of currencies can help mitigate risk associated with any single currency’s fluctuation.

Monitoring Economic Indicators

Closely monitoring key economic indicators provides valuable insights into potential shifts in the CAD's value.

- Follow Bank of Canada announcements: Pay close attention to interest rate decisions and statements from the Bank of Canada.

- Monitor Canadian economic data releases: Track key economic indicators like inflation, GDP growth, and employment data.

- Understand the impact of global events: Stay informed about global economic events and geopolitical developments that may affect the CAD.

Consulting Financial Advisors

Seeking advice from a qualified financial advisor is crucial for developing a tailored investment strategy that considers your risk tolerance and financial goals within the context of the current CAD volatility.

Conclusion

The current minority government in Canada presents significant risks to the Canadian dollar, creating an environment of uncertainty that impacts investor confidence and increases volatility in the CAD's exchange rate. Understanding these risks—including political gridlock, economic policy uncertainty, and global factors—is crucial for navigating the current economic climate. By diversifying investments, monitoring key economic indicators, and seeking professional financial advice, investors can better manage the potential vulnerabilities of the Canadian dollar. Don't let the uncertainty surrounding the Canadian dollar impact your financial future. Take proactive steps today to understand and mitigate the risks associated with the Canadian dollar and develop a robust investment strategy that accounts for the current political landscape.

Featured Posts

-

Hollywood Mourns Ted Kotcheff Director Of First Blood Passes Away

May 01, 2025

Hollywood Mourns Ted Kotcheff Director Of First Blood Passes Away

May 01, 2025 -

Gaslek Roden Vals Alarm

May 01, 2025

Gaslek Roden Vals Alarm

May 01, 2025 -

Duolingo To Replace Contract Workers With Ai A Deep Dive

May 01, 2025

Duolingo To Replace Contract Workers With Ai A Deep Dive

May 01, 2025 -

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 01, 2025

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 01, 2025 -

Is This Food Worse Than Smoking A Doctor Explains

May 01, 2025

Is This Food Worse Than Smoking A Doctor Explains

May 01, 2025