Canadian Dollar's Unexpected Dip: Strong Against USD, Weak Against Others

Table of Contents

The Canadian dollar (CAD) has presented a perplexing scenario recently: a surprising strength against the US dollar (USD), yet concurrent weakness against other major global currencies. This unexpected dip in the CAD's value relative to the Euro (EUR), British Pound (GBP), Japanese Yen (JPY), and others, has sparked considerable debate amongst economists and financial analysts. This unusual market behavior raises important questions about the underlying health of the Canadian economy and its future prospects. This article will delve into the multifaceted factors driving this unpredictable trend, exploring the complexities of CAD exchange rates and their implications for businesses and investors navigating the current global financial climate. We will examine the interplay between various economic indicators, geopolitical events, and monetary policy decisions that are shaping the Canadian dollar's performance.

<h2>The CAD's Strength Against the USD</h2>

The Canadian dollar's relative strength against the US dollar is a seemingly paradoxical element of its recent performance. Several key factors contribute to this phenomenon:

<h3>Oil Prices and Energy Exports</h3>

Canada's economy is significantly tied to its energy sector, making oil prices a crucial determinant of the CAD's value.

- Higher oil prices generally boost the CAD: Increased demand for Canadian energy resources translates directly into higher export revenues, strengthening the Canadian dollar.

- Recent oil price trends show a positive correlation with CAD/USD exchange rates: While volatility remains, periods of higher oil prices have generally coincided with periods of CAD strengthening against the USD. Analyzing this correlation using historical data provides valuable insights.

- Future oil price scenarios are crucial for predicting CAD movement: Forecasting future oil prices, considering factors like global demand, OPEC+ decisions, and geopolitical events, is key to understanding future CAD/USD trends. A sustained rise in oil prices could further strengthen the CAD against the USD.

<h3>US Economic Weakness</h3>

The relative strength of the Canadian economy compared to the weakening US economy also plays a role in the CAD's performance against the USD.

- Recent US economic data, including inflation and interest rate decisions, indicate potential vulnerability: High inflation and aggressive interest rate hikes by the Federal Reserve are impacting the US dollar's strength.

- A weaker USD naturally makes the CAD appear stronger by comparison: The relative weakness of the USD creates a contrasting effect, highlighting the relative stability (or at least lesser instability) of the Canadian economy.

- Robust US-Canada trade relations generally support a stable exchange rate: However, any significant disruptions in trade could impact the CAD's performance against the USD.

<h2>The CAD's Weakness Against Other Currencies</h2>

Despite its strength against the USD, the CAD has shown weakness against other major currencies. This disparity highlights the influence of broader global economic factors.

<h3>Global Economic Uncertainty</h3>

Global economic uncertainty plays a significant role in the CAD's performance against currencies like the EUR, GBP, and JPY.

- Rising interest rates globally impact the attractiveness of the CAD: While the Bank of Canada adjusts its monetary policy, global interest rate hikes can influence investors’ decisions regarding asset allocation, potentially reducing demand for the CAD.

- Risk aversion in investor behavior significantly impacts currency markets: During periods of global uncertainty, investors often flock to "safe haven" currencies like the USD or JPY, decreasing demand for the CAD.

- Geopolitical events, such as the ongoing conflict in Ukraine, create volatility and uncertainty: These events can trigger significant shifts in currency exchange rates as investors reassess global risk profiles.

<h3>Bank of Canada Monetary Policy</h3>

The Bank of Canada's monetary policy decisions significantly influence the CAD's value.

- The Bank of Canada's recent statements on inflation and interest rates shape market expectations: The central bank's communication regarding its monetary policy strategy directly influences investor sentiment and CAD valuation.

- Comparison of the Bank of Canada's monetary policy with other central banks provides valuable context: Analyzing how the Bank of Canada's actions differ from those of other central banks (e.g., the European Central Bank or the Bank of England) helps explain CAD fluctuations relative to other currencies.

- Potential future monetary policy changes will likely impact the CAD's future performance: Market participants closely watch for any indications of changes in the Bank of Canada's monetary policy stance, anticipating how these changes might affect the CAD's value.

<h2>Implications for Investors and Businesses</h2>

The fluctuating CAD presents significant implications for both investors and businesses.

<h3>Currency Risk Management</h3>

Effective currency risk management is crucial for mitigating potential losses.

- Hedging strategies, such as forward contracts or options, can help reduce exposure to currency fluctuations: Businesses involved in international trade can utilize these tools to lock in exchange rates and protect their profits.

- Accurate forecasting of exchange rates is crucial for decision-making: Utilizing economic models and market analysis can help businesses and investors make informed predictions about future exchange rate movements.

- Diversifying investments across different currencies can help reduce overall currency risk: A well-diversified portfolio minimizes exposure to significant losses from fluctuations in any single currency.

<h2>Conclusion</h2>

The Canadian dollar's recent performance highlights the complex interplay of domestic and global economic forces. While exhibiting strength against the US dollar, its relative weakness against other major currencies reflects broader global economic uncertainties and the Bank of Canada's monetary policy responses. Understanding these interconnected factors is critical for investors and businesses seeking to navigate the complexities of the global currency markets and effectively manage currency risk. Stay informed on the latest developments impacting the Canadian dollar's value. Regularly monitor key economic indicators and geopolitical events to make sound decisions regarding your investments and international transactions. Mastering the intricacies of the Canadian dollar's performance is key to successfully navigating the global financial landscape. Keep up-to-date on Canadian dollar exchange rate fluctuations and trends.

Featured Posts

-

Transforming Repetitive Scatological Data An Ai Powered Podcast Solution

Apr 24, 2025

Transforming Repetitive Scatological Data An Ai Powered Podcast Solution

Apr 24, 2025 -

Hegseths Role Delivering Trumps Message Despite Signal App Criticism

Apr 24, 2025

Hegseths Role Delivering Trumps Message Despite Signal App Criticism

Apr 24, 2025 -

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025 -

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025 -

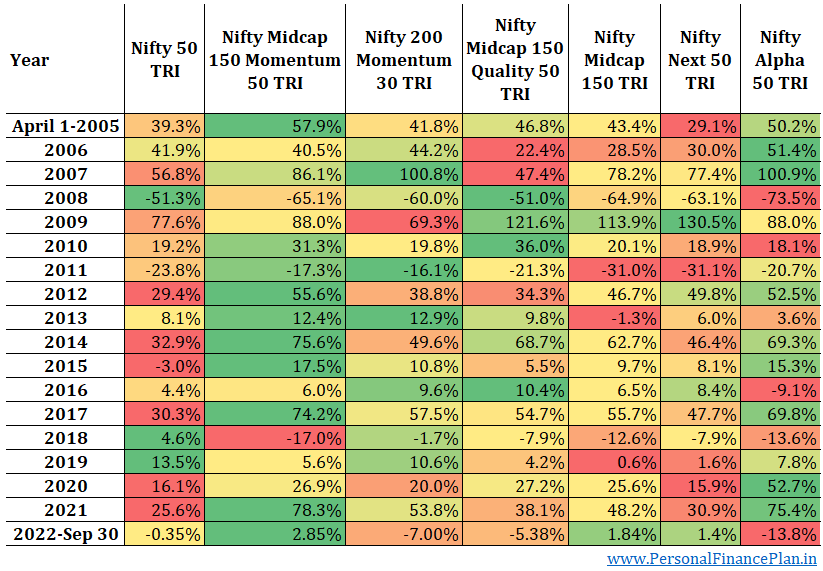

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025

Latest Posts

-

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025 -

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025 -

Sheehans Reaction Ipswich Town Face Challenges Head On

May 12, 2025

Sheehans Reaction Ipswich Town Face Challenges Head On

May 12, 2025 -

Ipswich Town Women Target Victory Against Gwalia To Secure Top Spot

May 12, 2025

Ipswich Town Women Target Victory Against Gwalia To Secure Top Spot

May 12, 2025 -

Ipswich Town News Sheehan Addresses Teams Disappointment

May 12, 2025

Ipswich Town News Sheehan Addresses Teams Disappointment

May 12, 2025