Canadian Mortgage Preferences: The Case Against 10-Year Terms

Table of Contents

The Risk of Higher Interest Rates Over the Long Term

Predicting future Canadian mortgage rates with certainty is impossible. The Canadian mortgage market is incredibly dynamic, with interest rates fluctuating based on complex economic conditions. Locking into a 10-year term means accepting today's rate, which might be significantly higher than rates available in the future.

-

Consider the possibility of lower rates after your initial 5-year term. Many 10-year mortgages allow for a break after 5 years, but this often comes with penalties. If rates drop significantly, you're stuck with a higher rate for the remaining 5 years.

-

Illustrative Example: Imagine you lock into a 10-year mortgage at 5%. Five years later, rates fall to 3%. You’re paying 2% more than necessary for the remaining five years, resulting in a substantial overpayment.

-

Psychological Impact: Being locked into a high rate for a prolonged period can cause significant financial stress and negatively impact your overall financial well-being.

The Penalty for Breaking a 10-Year Mortgage: Prepaying or breaking a 10-year mortgage before its maturity often incurs substantial penalties. This cost can significantly outweigh the benefits of a seemingly low initial rate.

-

Penalty Calculation: Penalties are typically calculated based on the difference between your current mortgage rate and the prevailing rate for a new mortgage with similar terms. This can be a significant amount.

-

Example Penalties: A penalty could easily amount to thousands of dollars, depending on the outstanding mortgage balance and the interest rate differential.

-

Mitigating Penalty Risk: Choosing a shorter-term mortgage, like a 5-year term, significantly reduces the risk and the potential amount of any penalties. You'll have more frequent opportunities to renegotiate your rate.

The Opportunity Cost of Tied-Up Funds

A 10-year mortgage ties up a large portion of your finances for an extended period, limiting your financial flexibility. This can hinder your ability to invest, save for retirement, or address unexpected expenses.

-

Financial Flexibility: Unexpected events, such as job loss or home repairs, can be financially crippling if a large portion of your assets are locked into a long-term mortgage.

-

Alternative Investments: If you opted for a shorter-term mortgage, the funds saved could be invested in higher-yielding options, potentially generating greater returns over the long term.

-

Changing Circumstances: Life is unpredictable. A 10-year mortgage commitment might not align with future changes, including job relocation, family growth, or unexpected financial hardships.

-

Adaptability of Shorter Terms: Shorter-term mortgages offer greater adaptability. If your circumstances change, you can easily adjust your mortgage strategy when the term expires.

-

Emotional and Practical Effects: Being locked into a long-term commitment during uncertain times can create undue stress and limit your ability to respond effectively to changing circumstances.

Exploring Better Alternatives for Canadian Homeowners

Shorter-Term Mortgages: 5-year or even 1-year terms provide greater flexibility and the chance to re-negotiate your rate when it expires. This allows you to take advantage of potential rate drops in the Canadian mortgage market.

-

Rate Comparison: While the initial interest rate might be slightly higher, the potential savings from renegotiating after a shorter term can offset this.

-

Refinancing Benefits: Refinancing after a shorter term allows you to explore better rates and potentially lower your monthly payments.

-

Mortgage Broker Consultation: A mortgage broker can help you compare rates from different lenders to find the best deal for your specific needs.

Variable-Rate Mortgages (with caution): Variable-rate mortgages offer the potential for lower rates than fixed-rate mortgages, but they also carry the risk of rate increases. This option requires a higher tolerance for risk and a careful assessment of your financial situation.

Conclusion

While a 10-year fixed-rate mortgage in Canada might initially seem appealing, the potential risks of higher long-term interest rates, limited financial flexibility, and unforeseen life changes need careful consideration. For many Canadian homeowners, shorter-term mortgages offer a greater degree of control and adaptability. Before committing to a 10-year term, carefully weigh the pros and cons, considering your individual financial situation and risk tolerance. Consult with a qualified financial advisor or mortgage broker to explore the best mortgage options tailored to your specific needs and preferences. Make an informed decision about your Canadian mortgage – it could save you considerable time and money in the long run. Remember to research thoroughly and compare different Canadian mortgage options before making a commitment.

Featured Posts

-

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025 -

Blake Lively And Anna Kendricks Relationship A Timeline Of Events

May 04, 2025

Blake Lively And Anna Kendricks Relationship A Timeline Of Events

May 04, 2025 -

Australia Election Anti Trump Sentiment Takes Center Stage

May 04, 2025

Australia Election Anti Trump Sentiment Takes Center Stage

May 04, 2025 -

Understanding Googles Search Ai Training Practices The Opt Out Factor

May 04, 2025

Understanding Googles Search Ai Training Practices The Opt Out Factor

May 04, 2025 -

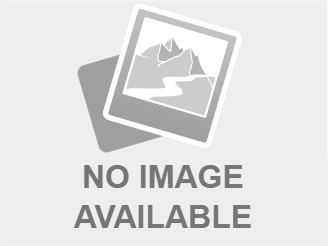

The Future Of Electric Vehicles A Us China Showdown

May 04, 2025

The Future Of Electric Vehicles A Us China Showdown

May 04, 2025

Latest Posts

-

New Cruella Trailer Emma Stone Vs Emma Thompsons Baroness Von Hellman

May 04, 2025

New Cruella Trailer Emma Stone Vs Emma Thompsons Baroness Von Hellman

May 04, 2025 -

Oskar 2024 I Tasi Tis Emma Stooyn Kai Tis Margkaret Koyalei

May 04, 2025

Oskar 2024 I Tasi Tis Emma Stooyn Kai Tis Margkaret Koyalei

May 04, 2025 -

Disneys Cruella New Trailer Shows Emma Stones Growing Rivalry With Emma Thompson

May 04, 2025

Disneys Cruella New Trailer Shows Emma Stones Growing Rivalry With Emma Thompson

May 04, 2025 -

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Binteo

May 04, 2025

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Binteo

May 04, 2025 -

I Anatropi Tis Emma Stooyn Ti Ekane Me To Forema Tis

May 04, 2025

I Anatropi Tis Emma Stooyn Ti Ekane Me To Forema Tis

May 04, 2025