Canadian Tire Acquisition Of Hudson's Bay: Potential Benefits And Risks

Table of Contents

Potential Benefits of the Canadian Tire Acquisition of Hudson's Bay

The potential acquisition of Hudson's Bay by Canadian Tire offers several compelling benefits, potentially transforming both companies and the Canadian retail market.

Expanded Retail Footprint and Market Share

A successful Canadian Tire Acquisition of Hudson's Bay would significantly expand Canadian Tire's physical retail footprint across Canada. This broadened presence would allow them to reach new customer demographics and solidify their position as a retail giant.

- Increased physical store presence: Access to Hudson's Bay's prime real estate locations across the country would provide Canadian Tire with immediate access to new markets and a larger customer base.

- Enhanced brand recognition and market dominance: The combined entity would enjoy enhanced brand recognition and a more dominant market share in various retail sectors.

- Synergies leading to economies of scale: Combining operations allows for cost savings through shared resources, logistics, and supply chain optimization.

- Improved efficiency: The merger could lead to improved supply chain efficiency, reduced operational costs, and increased profitability.

- Cross-selling opportunities: Canadian Tire could cross-sell its products within Hudson's Bay locations and vice-versa, creating new revenue streams.

- Expansion into new geographic markets: This acquisition could open doors to previously untapped geographical markets for both brands.

Diversification of Product Offerings

Currently, Canadian Tire focuses on hardware, automotive, and sporting goods. The Canadian Tire Acquisition of Hudson's Bay would diversify its product offerings significantly.

- Access to higher-end merchandise: Hudson's Bay offers higher-end apparel and home goods, broadening Canadian Tire's appeal to a more affluent customer segment.

- Reduced reliance on core product lines: This diversification mitigates the risk associated with market fluctuations affecting any single product category.

- A more comprehensive shopping experience: The combined company could create a more holistic and comprehensive shopping experience, attracting customers seeking diverse product offerings under one roof.

- Expansion into fashion and home goods: Canadian Tire gains immediate entry into lucrative fashion and home goods markets, leveraging Hudson's Bay's established presence.

- Access to luxury brands: The acquisition could provide access to established luxury brands, enhancing the overall brand portfolio.

- One-stop shop creation: The ultimate goal is the creation of a "one-stop shop" catering to a much wider range of consumer needs.

Enhanced E-commerce Capabilities

Hudson's Bay has a more developed e-commerce platform than Canadian Tire. The Canadian Tire Acquisition of Hudson's Bay would allow Canadian Tire to leverage this expertise.

- Improved online infrastructure: Canadian Tire could benefit from Hudson's Bay's established online infrastructure and digital expertise.

- Wider online reach: The combined online presence would reach a larger audience and enhance brand visibility.

- Improved customer experience: This would lead to a superior online shopping experience, increasing customer satisfaction and loyalty.

- Integrated online and offline channels: The merger allows for seamless integration of online and offline shopping experiences.

- Improved website functionality: This includes enhanced website design, improved navigation, and streamlined checkout processes.

- Enhanced delivery options: Expanding delivery options and improving delivery times will also attract more online customers.

- Better customer service: Improved digital customer service channels would enhance customer engagement and loyalty.

Potential Risks of the Canadian Tire Acquisition of Hudson's Bay

Despite the potential benefits, the Canadian Tire Acquisition of Hudson's Bay also presents significant challenges and risks.

Integration Challenges and Costs

Merging two large retail companies is complex and costly. The Canadian Tire Acquisition of Hudson's Bay is no exception.

- Operational integration challenges: Combining different IT systems, supply chains, and employee management systems will be a huge undertaking.

- Supply chain disruptions: Integration could cause temporary disruptions in supply chains and negatively impact customer service.

- High upfront costs: Mergers and acquisitions come with substantial upfront costs associated with due diligence, legal fees, and integration expenses.

- IT system integration: Harmonizing disparate IT systems is a complex and potentially costly process.

- Employee restructuring: Potential redundancies and restructuring may lead to employee morale issues and legal challenges.

- Potential brand dilution: Integrating two distinct brands requires careful management to avoid diluting the value of either brand.

Financial Risk and Debt

The acquisition will likely increase Canadian Tire's debt load. This carries inherent financial risks.

- Increased financial burden: Assuming Hudson's Bay's debt could significantly increase Canadian Tire's overall financial burden.

- Reduced profitability: Unsuccessful integration could negatively impact profitability and shareholder value.

- Negative impact on credit rating: Increased debt levels could negatively affect Canadian Tire's credit rating.

- Increased leverage: Higher debt levels increase the company's financial risk and vulnerability to economic downturns.

- Shareholder dissatisfaction: Poor financial performance could lead to shareholder dissatisfaction and potential legal action.

- Impact on dividend payments: Increased debt servicing costs may reduce the company's ability to pay dividends.

Regulatory Hurdles and Antitrust Concerns

The Canadian Tire Acquisition of Hudson's Bay will likely face regulatory scrutiny and potential antitrust concerns.

- Regulatory review and approvals: The merger will require approvals from relevant competition authorities, which may involve lengthy delays.

- Antitrust concerns: Competition regulators might raise concerns about reduced competition in the Canadian retail market.

- Conditions imposed on acquisition: Regulatory approvals may be conditional upon the divestiture of certain assets or business units.

- Merger review process: The lengthy and complex merger review process may result in unforeseen delays and challenges.

- Potential for divestitures: Regulators may require Canadian Tire to divest certain overlapping businesses to address antitrust concerns.

- Impact on competition: The acquisition could potentially reduce competition within specific retail sectors, impacting consumer choice and prices.

Conclusion

The potential Canadian Tire acquisition of Hudson's Bay presents a multifaceted scenario. While the expansion of market share, product diversification, and enhanced e-commerce capabilities offer significant advantages, integrating two large retail organizations presents considerable financial and operational risks. The success of this venture hinges upon meticulous integration planning, proactive management of regulatory hurdles, and prudent financial management. Thorough consideration of these benefits and risks is essential for understanding the long-term ramifications of this potential merger on the Canadian retail landscape. Continued analysis and monitoring of this situation are crucial for a comprehensive understanding of the implications of the Canadian Tire acquisition of Hudson's Bay. Stay informed about further developments in this significant retail merger.

Featured Posts

-

Michael Schumacher Are O Nepoata Gina Maria A Nascut

May 20, 2025

Michael Schumacher Are O Nepoata Gina Maria A Nascut

May 20, 2025 -

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025 -

Ferrari And Leclerc Imola Gp Statement Explained

May 20, 2025

Ferrari And Leclerc Imola Gp Statement Explained

May 20, 2025 -

Ignoring This Hmrc Child Benefit Message Could Cost You

May 20, 2025

Ignoring This Hmrc Child Benefit Message Could Cost You

May 20, 2025 -

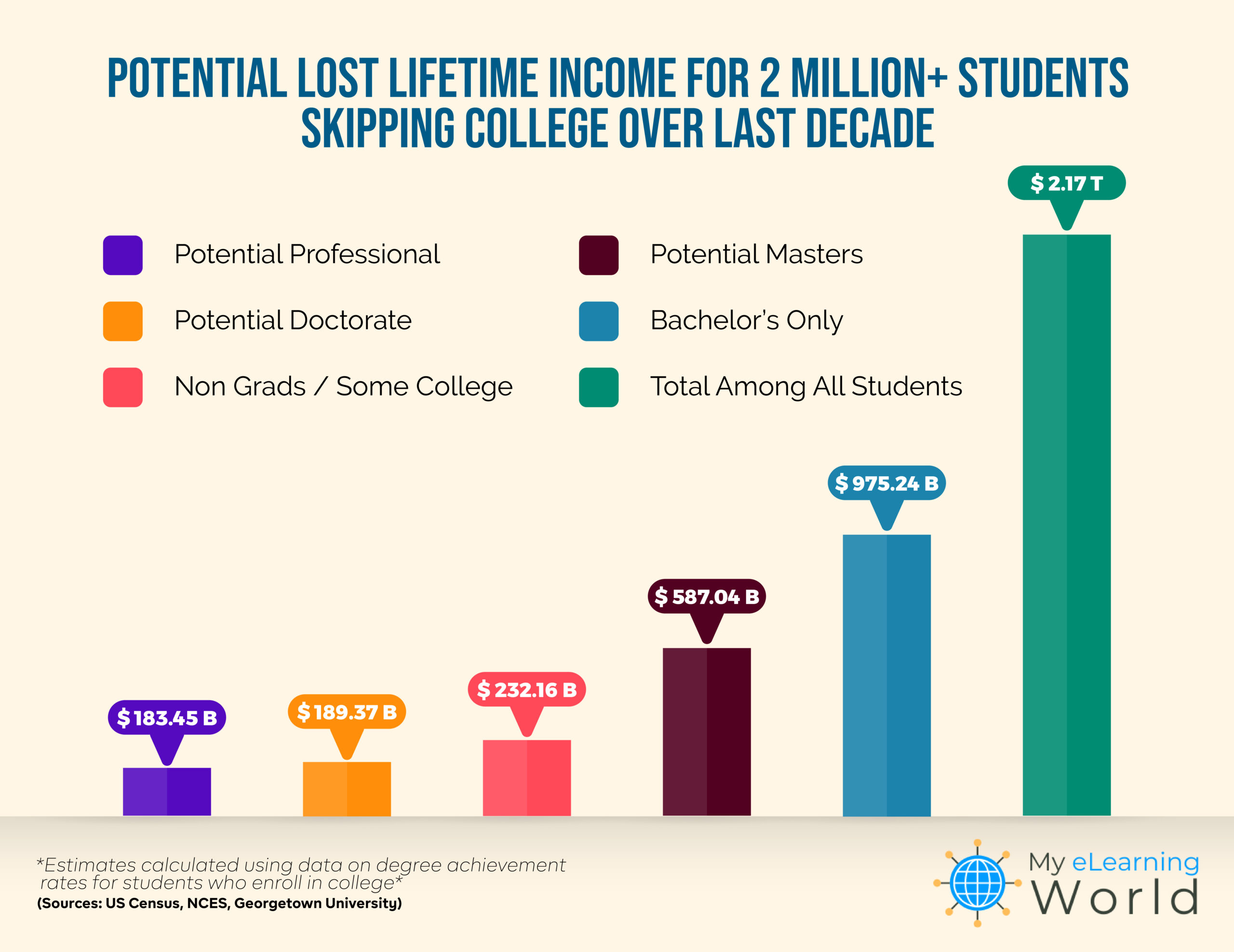

College Enrollment Decline A Case Study Of Battered Local Economies

May 20, 2025

College Enrollment Decline A Case Study Of Battered Local Economies

May 20, 2025

Latest Posts

-

Hinchcliffes Wwe Report Segment A Disappointment For Fans And Talents

May 20, 2025

Hinchcliffes Wwe Report Segment A Disappointment For Fans And Talents

May 20, 2025 -

Seger I Malta En Tuff Start Foer Jacob Friis

May 20, 2025

Seger I Malta En Tuff Start Foer Jacob Friis

May 20, 2025 -

Analyzing Tyler Bates Surprise Return To Wwe Raw

May 20, 2025

Analyzing Tyler Bates Surprise Return To Wwe Raw

May 20, 2025 -

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025 -

Wwes Hinchcliffe Segment A Critical Evaluation Of A Backstage Failure

May 20, 2025

Wwes Hinchcliffe Segment A Critical Evaluation Of A Backstage Failure

May 20, 2025