Canadian Tire And Hudson's Bay: A Strategic Fit?

Table of Contents

Overlapping Customer Base and Market Reach

Shared Demographics

Both Canadian Tire and Hudson's Bay target a largely overlapping demographic: middle-to-upper-middle-class families and homeowners. This shared customer base presents significant opportunities for synergy.

- Shared Demographics: Both retailers attract customers with families, homeowners seeking home improvement products, and individuals interested in recreational activities (e.g., camping gear from Canadian Tire, sporting goods from both). This shared demographic represents a substantial pool of potential customers for a combined entity.

- Geographic Reach: Canadian Tire boasts a wide network of stores across Canada, with a strong presence in smaller towns and suburban areas. HBC's department stores, while fewer in number, are predominantly located in major urban centres. A combined entity could leverage the strengths of both networks for increased market penetration and reach a broader customer base.

Synergistic Marketing Opportunities

A merger could unlock significant synergistic marketing opportunities. Imagine the possibilities of a combined loyalty program, offering rewards across both retailers' product lines!

- Combined Loyalty Programs: Integrating the respective loyalty programs would create a more comprehensive and rewarding experience for customers, driving increased spending and brand loyalty. This also allows for better data collection and targeted marketing.

- Cross-Promotional Campaigns: Joint marketing campaigns could effectively reach a wider audience. For example, promotions featuring Canadian Tire's automotive products alongside HBC's home décor items could tap into complementary customer needs.

- Cost Savings: Consolidated marketing efforts would lead to significant cost savings through economies of scale, reduced advertising expenditures, and streamlined marketing operations.

Complementary Product Offerings and Diversification

Expanding Product Portfolio

Canadian Tire's focus on automotive parts, hardware, sporting goods, and home improvement products complements HBC's offerings in apparel, home furnishings, and luxury brands. This creates a significantly broader product portfolio.

- Complementary Product Categories: Think of the synergy between Canadian Tire's tools and HBC's home improvement selection, or Canadian Tire's sporting goods and HBC's apparel lines for outdoor activities.

- Reduced Risk through Diversification: A combined entity would benefit from reduced reliance on any single product sector, mitigating risks associated with fluctuations in specific market segments.

Enhanced Customer Experience

For customers, a combined entity promises enhanced convenience and an improved shopping experience.

- One-Stop Shopping: Customers could potentially find a wider range of products and services under one roof, simplifying their shopping journeys and saving time.

- Bundled Services: The potential for offering bundled services, such as home renovations combining products from both retailers, presents an attractive proposition for consumers.

Cost Savings and Operational Efficiencies

Supply Chain Synergies

Significant cost savings can be achieved through streamlined supply chains and increased purchasing power.

- Shared Logistics and Distribution: Consolidating logistics and distribution networks would reduce transportation costs, warehouse space, and handling expenses.

- Bulk Purchasing Power: The combined entity would have greater bargaining power with suppliers, leading to lower prices for raw materials and finished goods.

Consolidation of Store Operations

Closing redundant stores and consolidating back-office functions offer opportunities for substantial cost reductions.

- Store Closures: This is a sensitive area with potential impacts on employees. However, it offers the possibility of optimizing store locations and reducing overhead. A well-managed approach is crucial.

- Shared Administrative and Operational Functions: Consolidating back-office functions like accounting, human resources, and IT would create economies of scale and reduce administrative overhead.

Competitive Landscape and Challenges

Increased Competition

A combined Canadian Tire and HBC entity would create a retail behemoth, significantly impacting the Canadian competitive landscape.

- Antitrust Concerns: Such a merger would likely face regulatory scrutiny, with potential concerns about monopolistic practices.

- Competitive Advantages and Disadvantages: While the combined entity would gain significant scale and market power, it could also face increased competition from other large retailers.

Integration Challenges

Merging two companies of this size presents significant integration challenges.

- Cultural Differences: Integrating two distinct corporate cultures, management styles, and employee expectations could be complex and time-consuming.

- IT Systems and Operations: Consolidating different IT systems and operational procedures requires careful planning and execution to avoid disruptions and ensure seamless functionality.

Conclusion: Is a Canadian Tire and Hudson's Bay Partnership a Winning Strategy?

A potential partnership between Canadian Tire and Hudson's Bay presents both significant opportunities and substantial challenges. The potential synergies, including expanded market reach, complementary product offerings, and substantial cost savings, are compelling. However, the complexities of integration, potential antitrust concerns, and the competitive landscape require careful consideration. Ultimately, the success of such a venture would depend on meticulous planning, effective execution, and a clear strategy for navigating the integration process.

What are your thoughts on a potential Canadian Tire and Hudson's Bay merger? Share your insights in the comments below! Let's discuss the strategic implications of a Canadian Tire and Hudson's Bay collaboration – comment below with your analysis!

Featured Posts

-

Bin Laden Hunt A Critical Look At Netflixs American Manhunt Documentary

May 18, 2025

Bin Laden Hunt A Critical Look At Netflixs American Manhunt Documentary

May 18, 2025 -

Meta Faces Ftc Defense In Antitrust Case

May 18, 2025

Meta Faces Ftc Defense In Antitrust Case

May 18, 2025 -

Jenna Bush Hager Fans Call For Permanent Today Show Change

May 18, 2025

Jenna Bush Hager Fans Call For Permanent Today Show Change

May 18, 2025 -

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Phla Nam

May 18, 2025

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Phla Nam

May 18, 2025 -

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025

Latest Posts

-

6000 2025

May 18, 2025

6000 2025

May 18, 2025 -

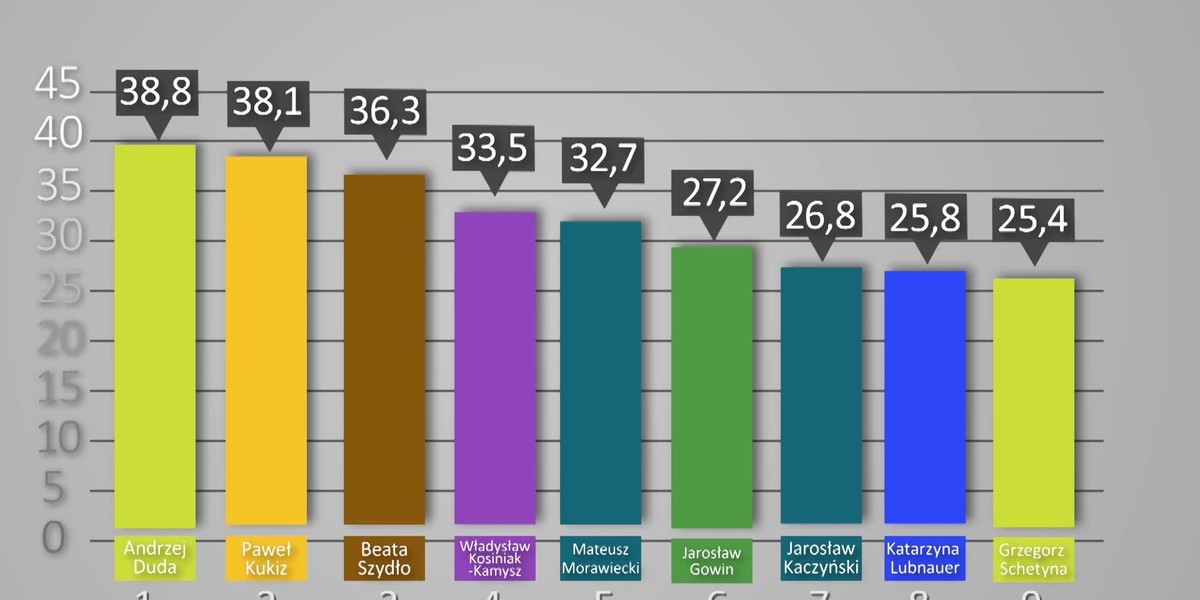

Ib Ri S Dla Onetu Liderem Zaufania Rafal Trzaskowski

May 18, 2025

Ib Ri S Dla Onetu Liderem Zaufania Rafal Trzaskowski

May 18, 2025 -

Ranking Zaufania Ib Ri S Dla Onetu Trzaskowski Przed Morawieckim I Duda

May 18, 2025

Ranking Zaufania Ib Ri S Dla Onetu Trzaskowski Przed Morawieckim I Duda

May 18, 2025 -

Spectacle De Christophe Mali A Onet Le Chateau

May 18, 2025

Spectacle De Christophe Mali A Onet Le Chateau

May 18, 2025 -

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 18, 2025

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 18, 2025