Canadians And 10-Year Mortgages: A Look At The Low Uptake

Table of Contents

Financial Uncertainty and the Canadian Housing Market

The Canadian housing market, known for its volatility, significantly impacts mortgage decisions. Choosing a 10-year mortgage in Canada requires a high degree of confidence in long-term financial stability, a factor many Canadians currently lack.

Interest Rate Volatility and its Impact on Long-Term Commitments

Fluctuating interest rates present a considerable risk for those committed to long-term mortgages. The possibility of higher rates later in the 10-year term can be daunting.

- Risk of higher rates later in the term: Locking into a rate for a decade means potential exposure to rising interest rates, increasing monthly payments and potentially impacting long-term financial planning.

- Potential for refinancing costs: Refinancing a 10-year mortgage before the term ends can incur significant fees and penalties, making it a less attractive option compared to shorter-term alternatives.

- Difficulty predicting long-term financial stability: Unforeseen job losses, economic downturns, or unexpected life events can severely impact the ability to maintain mortgage payments over such an extended period.

Canada has experienced significant interest rate fluctuations in recent years, adding to the uncertainty surrounding long-term financial commitments. The Bank of Canada's adjustments to its benchmark interest rate directly affect mortgage rates, making long-term predictions challenging.

The Canadian Homeowner's Preference for Flexibility

Many Canadians prioritize flexibility in their financial planning, preferring shorter-term mortgages that allow for adjustments based on changing circumstances. This preference reflects a cultural attitude toward adaptable financial strategies.

- Job security concerns: The increasingly fluid nature of the Canadian job market makes long-term financial commitments less appealing for many homeowners.

- Potential for relocation: Canadians are relatively mobile, and the need to relocate for work or other reasons makes a shorter-term mortgage a more practical choice.

- Unpredictable life events: Unexpected life changes such as marriage, childbirth, or illness can drastically alter financial priorities, making flexibility a vital element in mortgage planning.

Surveys consistently show that a significant portion of Canadian homeowners favor shorter-term mortgages due to their inherent flexibility, further highlighting the reasons behind the low uptake of long-term mortgages Canada.

The Role of Mortgage Brokers and Lender Practices in Canada

The accessibility and associated costs of 10-year mortgages also play a role in their low adoption rate.

Limited Availability and Higher Fees for 10-Year Mortgages

While 5-year mortgages are widely available, 10-year mortgages may be less readily accessible or come with higher fees.

- Comparison of fees and rates across different mortgage terms: A detailed comparison often reveals higher interest rates and potentially increased administrative fees associated with longer-term mortgages.

- Availability across various lenders: Not all lenders offer 10-year mortgages, limiting consumer choices and potentially reducing competition, which could affect rates.

- Potential barriers to access: Stricter lending criteria for longer-term mortgages could also act as a barrier, making it harder for some borrowers to qualify.

Mortgage brokers confirm that the perceived complexity and less common nature of 10-year mortgages contribute to their limited uptake.

Lack of Consumer Awareness and Education Regarding 10-Year Mortgages

Many Canadians lack a comprehensive understanding of the benefits and drawbacks of 10-year mortgages.

- The need for better consumer education: Increased public awareness campaigns focusing on the advantages of long-term mortgages could influence consumer choices.

- The role of financial literacy programs: Incorporating information about various mortgage options into financial literacy programs could improve public understanding.

- The benefits of comparing different mortgage terms: Emphasizing the importance of comparing various mortgage options and calculating their long-term costs can empower consumers to make informed decisions.

Government initiatives or educational resources focusing on mortgages and financial planning could potentially bridge the information gap and increase the uptake of 10-year mortgages Canada.

Alternative Long-Term Financial Strategies for Canadian Homeowners

The popularity of shorter-term mortgages and refinancing, combined with other investment strategies, also contributes to the preference for shorter-term commitments.

The Popularity of Shorter-Term Mortgages and Refinancing

The flexibility offered by shorter-term mortgages and the option to refinance make them an attractive alternative to 10-year commitments.

- Advantages of refinancing – lower interest rates, access to funds, better terms: Refinancing allows homeowners to take advantage of lower interest rates or access equity for other investments.

- Benefits of shorter mortgage terms – flexibility and adaptability: The ability to adapt to changing circumstances makes shorter-term mortgages a preferred choice for many.

Refinancing provides a strategic approach for managing mortgage costs and adapting to evolving financial situations, making it a more attractive alternative to a 10-year commitment for some.

Other Investment Strategies and Their Impact on Mortgage Choices

Other investment choices and financial planning significantly influence mortgage decisions.

- Alternative investment options: Canadians may prefer to diversify their investments across different assets, reducing reliance on a single, long-term mortgage commitment.

- Diversification strategies: Diversifying investments can reduce overall risk and potentially provide greater returns than focusing solely on homeownership.

- Long-term financial planning goals: Individual financial goals may not align with the long-term commitment of a 10-year mortgage.

Financial planners advise considering various investment options and aligning them with long-term financial goals, which may impact the choice of mortgage term.

Conclusion: Understanding the Canadian Landscape of 10-Year Mortgages

The low uptake of 10-year mortgages in Canada is a result of various interconnected factors. Interest rate volatility, a preference for financial flexibility, limited availability, a lack of consumer awareness, and the attractiveness of refinancing and alternative investment strategies all contribute to this trend. Choosing the right mortgage term depends on individual circumstances. It's crucial to carefully evaluate your financial situation, explore all available mortgage options – including 10-year mortgages – and understand your long-term financial goals before committing. To further your research, consider using tools like a "10-year mortgage calculator Canada," compare "mortgage rates Canada," and search for "best mortgage rates Canada" to make an informed decision.

Featured Posts

-

Bj Novak And Delaney Rowe A Normal Couple Public Perception Analyzed

May 06, 2025

Bj Novak And Delaney Rowe A Normal Couple Public Perception Analyzed

May 06, 2025 -

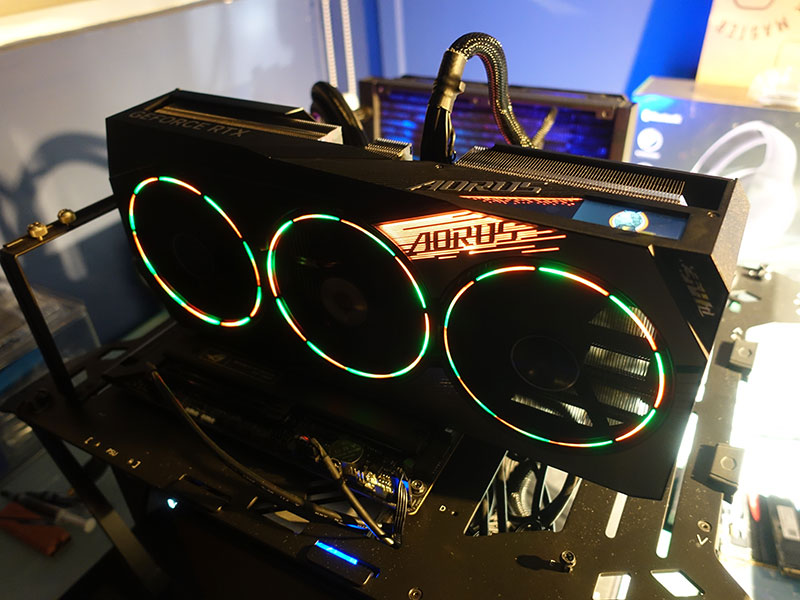

Aorus Master 16 Gigabyte Review High Performance Gaming Laptop With Fan Noise Considerations

May 06, 2025

Aorus Master 16 Gigabyte Review High Performance Gaming Laptop With Fan Noise Considerations

May 06, 2025 -

Celtics Vs 76ers Game Prediction Odds Stats And Winning Picks February 20 2025

May 06, 2025

Celtics Vs 76ers Game Prediction Odds Stats And Winning Picks February 20 2025

May 06, 2025 -

Polski Trotyl Dla Us Army Ogromny Kontrakt Nitro Chem

May 06, 2025

Polski Trotyl Dla Us Army Ogromny Kontrakt Nitro Chem

May 06, 2025 -

Third Suspect Involved In Lady Gaga Concert Bomb Plot Say Brazilian Authorities

May 06, 2025

Third Suspect Involved In Lady Gaga Concert Bomb Plot Say Brazilian Authorities

May 06, 2025

Latest Posts

-

The Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025

The Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025 -

Ddg Unleashes Take My Son Diss Track Is Halle Bailey The Target

May 06, 2025

Ddg Unleashes Take My Son Diss Track Is Halle Bailey The Target

May 06, 2025 -

The Ddg Halle Bailey Beef Continues Dont Take My Son Diss Track Released

May 06, 2025

The Ddg Halle Bailey Beef Continues Dont Take My Son Diss Track Released

May 06, 2025 -

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey Explained

May 06, 2025

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey Explained

May 06, 2025 -

New Music Ddg Releases Diss Track Targeting Halle Bailey Dont Take My Son

May 06, 2025

New Music Ddg Releases Diss Track Targeting Halle Bailey Dont Take My Son

May 06, 2025