Cenovus CEO: MEG Acquisition Unlikely Amidst Focus On Organic Growth

Table of Contents

Cenovus's Current Strategic Focus on Organic Growth

Cenovus has clearly articulated its commitment to an organic growth strategy, prioritizing internal expansion and operational improvements over large-scale acquisitions. This approach offers several key advantages:

- Reduced Financial Risk: Organic growth minimizes the substantial financial burden and debt associated with large acquisitions, allowing for more controlled financial management and reduced vulnerability to market fluctuations.

- Enhanced Control: Cenovus retains complete control over project development, timelines, and resource allocation, leading to greater efficiency and precision in execution.

- Higher Long-Term Returns: Investing in internal capabilities and existing assets often yields higher long-term returns compared to the often unpredictable outcomes of acquisitions.

- Synergistic Alignment: Organic growth leverages Cenovus's existing expertise, resources, and infrastructure, maximizing synergies and minimizing integration challenges.

Cenovus's current organic growth initiatives include significant investments in its oil sands operations, enhancing its upstream production capabilities, and optimizing its downstream refining and marketing operations. These initiatives are designed to create long-term value for shareholders and solidify Cenovus's position within the energy sector. Keywords: organic growth strategy, internal expansion, Cenovus growth, long-term value creation.

Challenges and Risks Associated with Acquiring MEG Energy

While acquiring MEG Energy might seem strategically appealing, several significant challenges and risks could deter Cenovus:

- High Acquisition Cost and Debt Burden: Acquiring MEG Energy would likely involve a substantial financial outlay, potentially leading to a significant increase in Cenovus's debt levels and impacting its credit rating.

- Integration Challenges: Merging two companies with different corporate cultures, operational structures, and management styles presents complex integration challenges, potentially disrupting operations and impacting productivity.

- Regulatory Hurdles and Antitrust Concerns: Regulatory approvals and potential antitrust concerns could delay or even prevent the acquisition, adding significant uncertainty and complexity to the process.

- Uncertainty Regarding MEG Energy's Future Performance: The future performance and profitability of MEG Energy are subject to market volatility and other uncertainties, making the acquisition a risky investment.

The current energy market conditions, characterized by fluctuating commodity prices and geopolitical uncertainty, further complicate the feasibility and attractiveness of such a large acquisition. Keywords: MEG Energy acquisition, acquisition challenges, integration risks, regulatory hurdles, market conditions.

The CEO's Statement and its Implications for Investors

The Cenovus CEO's statement explicitly ruled out an immediate acquisition of MEG Energy, prioritizing instead the company's organic growth strategy. This statement carries significant weight for investors and market analysts. The announcement likely impacts investor sentiment, potentially affecting Cenovus's stock price in the short term. However, the long-term implications depend on the success of Cenovus's organic growth initiatives.

The decision to forgo the MEG Energy acquisition opens up alternative strategic options for Cenovus. These alternatives will be crucial to maintaining investor confidence and delivering long-term value. Keywords: CEO statement analysis, investor sentiment, stock price impact, Cenovus stock, strategic alternatives.

Alternative Growth Strategies for Cenovus

Cenovus can pursue several alternative growth strategies besides acquisitions:

- Increased Investment in Exploration and Production: Further investment in existing and new exploration and production projects can enhance output and boost revenue.

- Strategic Partnerships and Joint Ventures: Collaborating with other companies on specific projects can leverage external expertise and share risks, potentially accelerating growth.

- Technological Advancements to Improve Operational Efficiency: Investing in technological innovations can streamline operations, reduce costs, and enhance productivity.

Each of these alternatives presents unique advantages and disadvantages that Cenovus must carefully weigh against its overall strategic objectives. Keywords: alternative growth strategies, exploration and production, strategic partnerships, technological innovation.

Conclusion: Cenovus CEO's Focus Remains on Organic Growth, Not MEG Acquisition

In conclusion, Cenovus Energy's CEO has clearly signaled a preference for organic growth over the acquisition of MEG Energy. This strategic decision, driven by the inherent challenges and risks associated with large acquisitions, reflects a commitment to controlled expansion, reduced financial risk, and maximizing the value of existing assets. The CEO's statement has implications for investors, highlighting the importance of Cenovus's internal growth strategy. To learn more about Cenovus's organic growth strategy and its vision for the future, we encourage you to visit the Cenovus Energy investor relations website for further information and updates on their progress. Keywords: Cenovus organic growth, MEG Energy acquisition, future outlook, investor relations, Cenovus Energy.

Featured Posts

-

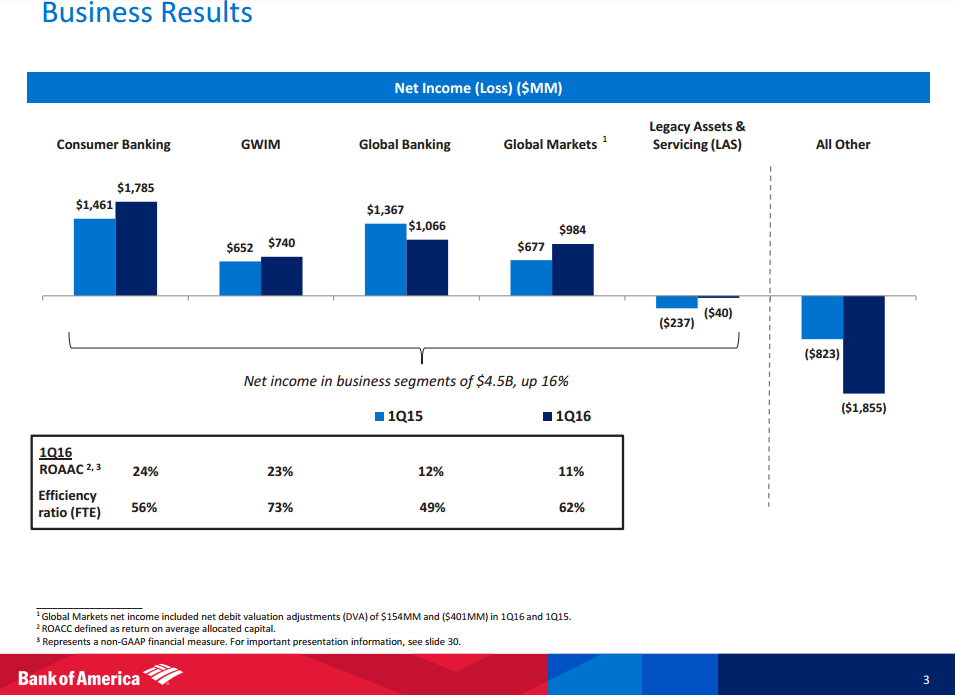

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

From Rookie To Leader How George Russell Brought Calm To Mercedes

May 25, 2025

From Rookie To Leader How George Russell Brought Calm To Mercedes

May 25, 2025 -

September Gucci Reveal Kering Reports Lower Sales Figures

May 25, 2025

September Gucci Reveal Kering Reports Lower Sales Figures

May 25, 2025 -

Princess Road Incident Pedestrian Hit By Vehicle Live Updates

May 25, 2025

Princess Road Incident Pedestrian Hit By Vehicle Live Updates

May 25, 2025 -

A Sixth Century Vessel From Sutton Hoo Exploring Its Role In Burial Ceremonies

May 25, 2025

A Sixth Century Vessel From Sutton Hoo Exploring Its Role In Burial Ceremonies

May 25, 2025

Latest Posts

-

Hells Angels Uncovering The Truth Behind The Motorcycle Club

May 25, 2025

Hells Angels Uncovering The Truth Behind The Motorcycle Club

May 25, 2025 -

Hells Angels History Structure And Activities

May 25, 2025

Hells Angels History Structure And Activities

May 25, 2025 -

Canadas Most Wanted Dave Turmel Apprehended In Italy

May 25, 2025

Canadas Most Wanted Dave Turmel Apprehended In Italy

May 25, 2025 -

The Hells Angels Myths Realities And Organization

May 25, 2025

The Hells Angels Myths Realities And Organization

May 25, 2025 -

Inside The Hells Angels A Look At Their History And Structure

May 25, 2025

Inside The Hells Angels A Look At Their History And Structure

May 25, 2025