Cenovus Prioritizes Internal Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Internal Growth Strategy: A Focus on Organic Expansion

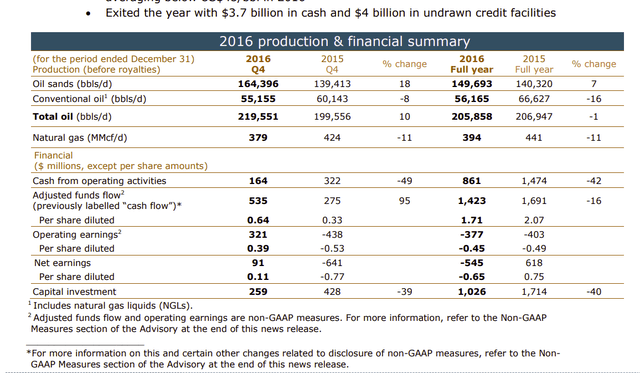

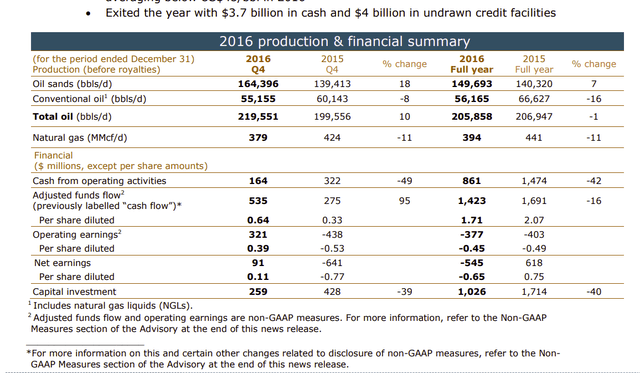

Cenovus's new strategy centers on organic expansion, aiming to boost shareholder value through efficient operations and strategic investments within its existing assets. This approach prioritizes several key areas:

Enhanced Oil Production and Reserves

Cenovus plans to significantly increase oil production from its current reserves. This involves several key initiatives:

- Expanding existing oil sands operations: Investments are focused on optimizing extraction techniques and expanding capacity at existing facilities, leveraging existing infrastructure for maximum efficiency.

- Implementing enhanced oil recovery (EOR) techniques: Cenovus is actively investing in and deploying advanced EOR technologies to extract more oil from mature fields, extending the lifespan of these assets and boosting overall reserves growth.

- Exploration and appraisal of existing licenses: Further exploration within already-held licenses is being undertaken to identify and develop new reserves, adding to the company’s long-term production potential.

These projects are projected to increase oil production by [insert projected percentage or volume] over the next [insert timeframe], significantly impacting revenue and reinforcing Cenovus's position in the upstream operations sector. This organic growth strategy, focused on oil production and reserves growth, provides a stable and predictable path to increased profitability.

Operational Efficiency and Cost Reduction

Alongside production increases, Cenovus is aggressively pursuing operational efficiency and cost reduction measures. These include:

- Streamlining operations: Process optimization and technological upgrades are reducing operational costs across the board.

- Supply chain optimization: Negotiating better deals with suppliers and improving logistical efficiency is lowering procurement costs.

- Automation and digitalization: Investing in automation and digital tools is enhancing efficiency and reducing labor costs.

These cost optimization strategies directly contribute to improved profitability and enhanced shareholder value. By focusing on operational efficiency, Cenovus aims to maximize returns from existing assets and increase its overall margin.

Technological Innovation and Sustainability

Cenovus is committed to technological innovation and aligning its operations with ESG (environmental, social, and governance) factors. This commitment manifests in:

- Investing in renewable energy projects: The company is exploring opportunities in renewable energy sources to diversify its energy portfolio and reduce its carbon footprint.

- Implementing carbon capture, utilization, and storage (CCUS) technologies: Cenovus is actively researching and deploying CCUS technology to minimize greenhouse gas emissions.

- Improving water management practices: Sustainable water management is a priority, reducing water consumption and minimizing environmental impact.

This commitment to sustainability not only reduces Cenovus's environmental impact but also positions the company favorably in a market increasingly focused on ESG considerations. Investing in technology and sustainability is seen as a key component of their long-term organic growth.

Why Cenovus is Choosing Internal Growth Over the MEG Bid

The decision to prioritize internal growth over the proposed MEG Energy acquisition stems from several factors:

Valuation Concerns and Deal Structure

Securing a favorable valuation for MEG Energy proved challenging. Negotiations likely encountered difficulties regarding the deal structure and financing, ultimately leading Cenovus to believe that an acquisition wouldn't yield sufficient returns compared to focusing on internal growth. The complexities of mergers and acquisitions, particularly in the volatile energy market, played a significant role in this decision.

Focus on Shareholder Returns

Cenovus believes that reinvesting capital in its existing assets and focusing on organic growth offers a more predictable and sustainable path to maximizing long-term shareholder returns. This strategy minimizes risk associated with large acquisitions, allowing for controlled growth and a more stable trajectory of capital allocation.

Market Conditions and Uncertainty

The current energy market is characterized by significant volatility and uncertainty regarding global energy prices. This instability increases the risk associated with large-scale acquisitions. Cenovus's decision reflects a risk-averse approach, prioritizing a more stable path to growth in uncertain times. This calculated risk management strategy prioritizes the preservation and growth of shareholder investments.

Implications for the Energy Sector and Competitors

Cenovus's strategic shift has significant implications for the broader energy sector:

Impact on MEG Energy

The withdrawal of Cenovus's bid leaves MEG Energy seeking alternative acquisition targets or strategic partnerships to drive growth. This creates uncertainty for MEG Energy and highlights the competitive dynamics within the Canadian oil industry.

Shifting Landscape of Energy M&A

Cenovus's decision might signal a broader trend in the energy sector, with more companies prioritizing internal growth over large-scale acquisitions amidst market volatility. This shift in the approach to mergers and acquisitions in the energy sector could significantly reshape the competitive landscape.

Conclusion: Cenovus's Focus on Internal Growth: A Strategic Shift with Long-Term Implications

Cenovus Energy's decision to prioritize internal growth over the MEG Energy acquisition reflects a calculated strategic shift. By focusing on enhancing oil production, improving operational efficiency, and investing in technology and sustainability, Cenovus aims to generate long-term shareholder value in a more controlled and predictable manner. This risk-averse approach makes sense in the current volatile energy market and could influence the strategic decisions of other major energy players. To learn more about Cenovus's internal growth strategy and its impact on the Canadian energy sector and the global energy market, follow Cenovus’s official channels or consult further analyses on the topic of Cenovus's internal growth strategy, Cenovus stock performance, and other aspects of energy investment in the Canadian energy industry.

Featured Posts

-

The Woody Allen Dylan Farrow Case Sean Penns Public Statement

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Public Statement

May 25, 2025 -

Albert I Charlene De Monaco Rumors De Separacio I Una Possible Nova Relacio Per Al Princep

May 25, 2025

Albert I Charlene De Monaco Rumors De Separacio I Una Possible Nova Relacio Per Al Princep

May 25, 2025 -

Uefa Dan Arda Gueler Ve Real Madrid E Sok Karar Sorusturma Basladi

May 25, 2025

Uefa Dan Arda Gueler Ve Real Madrid E Sok Karar Sorusturma Basladi

May 25, 2025 -

Restrukturalizacia V Nemecku Prepustia Tisice Zamestnancov

May 25, 2025

Restrukturalizacia V Nemecku Prepustia Tisice Zamestnancov

May 25, 2025 -

I Mercedes Kai I Stratigiki Tis Apenanti Ston Verstappen

May 25, 2025

I Mercedes Kai I Stratigiki Tis Apenanti Ston Verstappen

May 25, 2025

Latest Posts

-

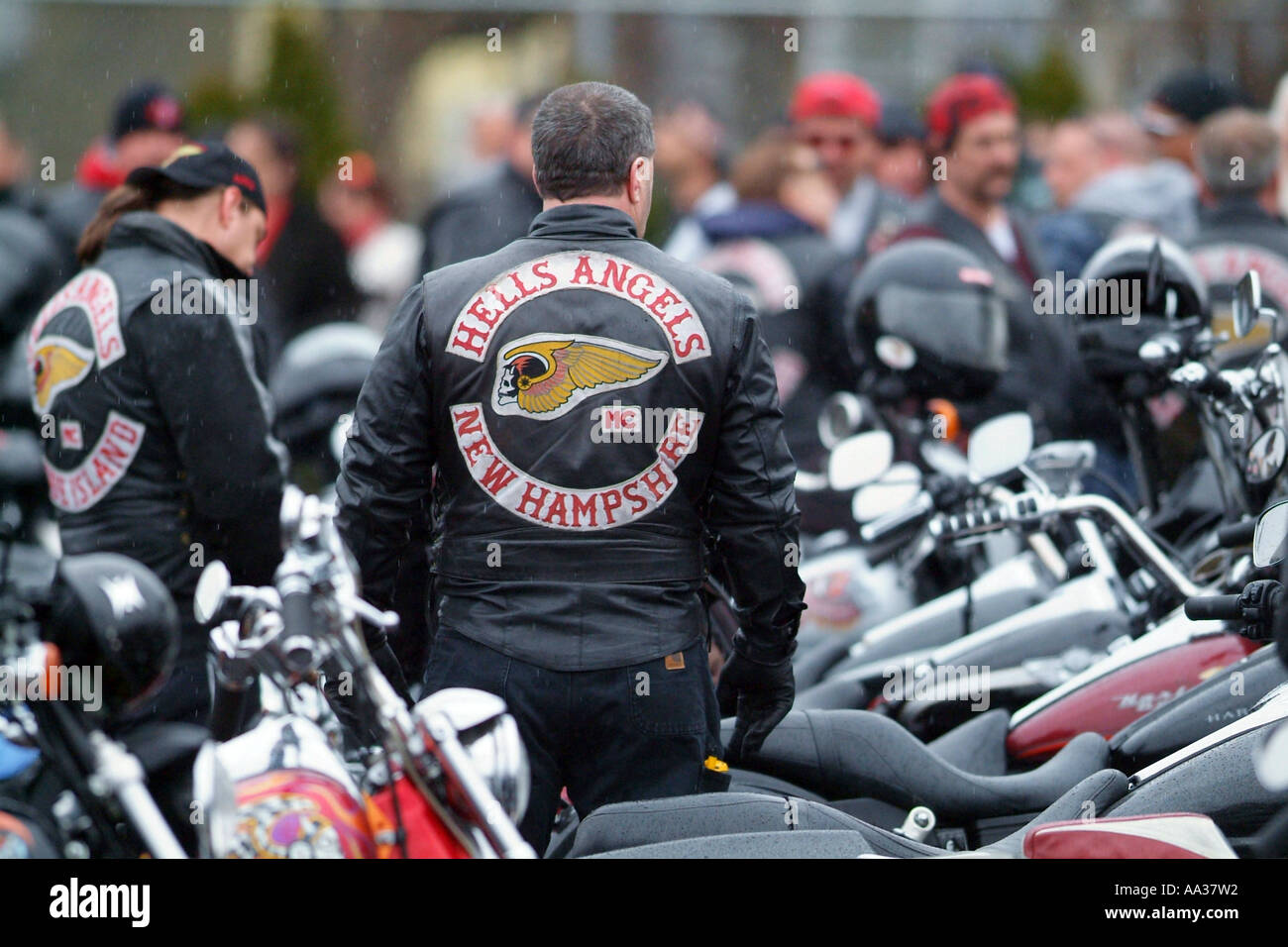

Tribute Paid At Funeral For Fallen Hells Angels Biker

May 25, 2025

Tribute Paid At Funeral For Fallen Hells Angels Biker

May 25, 2025 -

Craig Mc Ilquhams Memorial Service A Sunday Tribute

May 25, 2025

Craig Mc Ilquhams Memorial Service A Sunday Tribute

May 25, 2025 -

Funeral For Deceased Hells Angels Biker A Show Of Support

May 25, 2025

Funeral For Deceased Hells Angels Biker A Show Of Support

May 25, 2025 -

Craig Mc Ilquham Hells Angels Member Remembered At Sunday Service

May 25, 2025

Craig Mc Ilquham Hells Angels Member Remembered At Sunday Service

May 25, 2025 -

Hells Angels Members Attend Funeral After Bikers Death In Crash

May 25, 2025

Hells Angels Members Attend Funeral After Bikers Death In Crash

May 25, 2025