Cenovus Prioritizes Organic Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Organic Growth Strategy: A Detailed Look

Cenovus's shift towards organic growth signals a renewed focus on maximizing value from existing assets and operational efficiencies. This strategy offers several advantages, including reduced risk and enhanced control over project execution.

Focus on Existing Assets and Operational Efficiency

Cenovus plans to unlock significant value from its extensive portfolio of oil sands and upstream assets. This involves optimizing production, improving operational efficiency, and leveraging technological advancements to reduce costs and boost profitability. The company's commitment to maximizing returns from its existing infrastructure is a cornerstone of this strategy.

- Enhanced Oil Recovery (EOR) Techniques: Implementing advanced EOR techniques in existing oil sands operations to extract more oil from mature reservoirs.

- Pipeline Optimization: Improving pipeline efficiency and capacity to minimize transportation costs and maximize throughput.

- Digitalization and Automation: Leveraging digital technologies and automation to improve operational efficiency and reduce labor costs.

- Cost Reduction Initiatives: Implementing rigorous cost-cutting measures across all operational areas to enhance margins.

Sustainable and Responsible Growth Initiatives

Cenovus is committed to integrating environmental, social, and governance (ESG) factors into its growth strategy. This commitment extends to minimizing the environmental footprint of its operations, investing in carbon reduction technologies, and engaging actively with stakeholders.

- Carbon Reduction Targets: Setting ambitious targets for reducing greenhouse gas emissions across its operations, aligning with global climate goals.

- Investment in Renewable Energy: Exploring opportunities to diversify into renewable energy sources to create a more sustainable energy portfolio.

- Community Engagement: Engaging with local communities to ensure responsible and transparent operations.

- Achieving ESG Certifications: Pursuing relevant environmental certifications to demonstrate its commitment to sustainable practices.

Capital Allocation and Investment Priorities

Cenovus’s capital allocation strategy reflects its commitment to organic growth. The company plans to prioritize investments in projects that offer the highest returns and align with its long-term sustainability goals.

- Upstream Investments: Significant capital expenditure will be directed toward enhancing existing oil sands and upstream assets.

- Debt Reduction: A portion of the capital will be allocated to reducing debt levels, strengthening the company's financial position.

- Strategic Acquisitions (smaller scale): While large-scale acquisitions like MEG are unlikely, Cenovus may pursue smaller, complementary acquisitions that enhance its existing portfolio.

- Research and Development: Investing in research and development to explore and implement innovative technologies for enhancing efficiency and reducing environmental impact.

Diminished Prospects of a MEG Energy Acquisition

The decision to prioritize organic growth has effectively diminished the likelihood of Cenovus acquiring MEG Energy. Several factors contributed to this shift.

Reasons Behind the Shift Away from MEG

Several factors contributed to Cenovus's decision to de-prioritize a potential MEG Energy bid. These include:

- Valuation Concerns: Cenovus may have deemed MEG's valuation too high, making an acquisition financially unattractive.

- Regulatory Hurdles: Potential regulatory challenges and antitrust concerns could have complicated the acquisition process.

- Strategic Realignment: Cenovus's strategic priorities have shifted towards organic growth, making a large acquisition less appealing.

- Focus on internal value creation: Cenovus recognizes the significant potential for value creation through optimizing its existing assets.

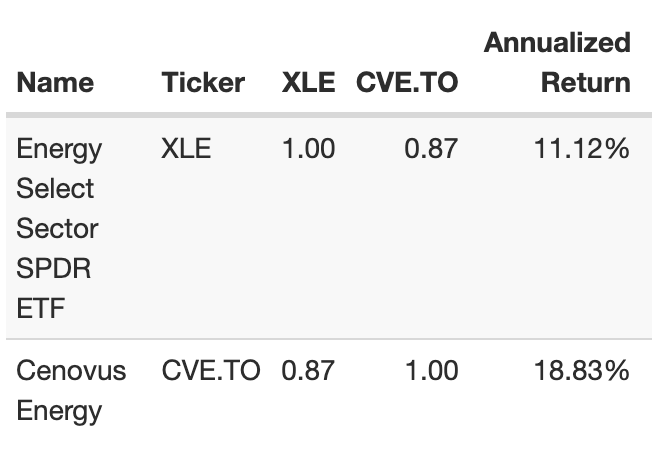

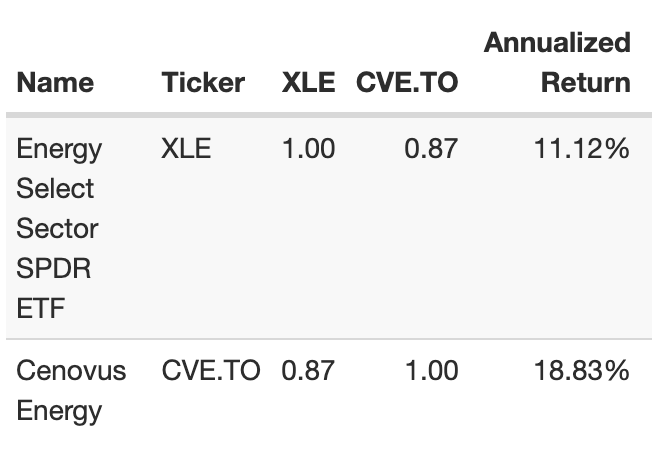

Impact on the Energy Market and Investors

Cenovus's decision to prioritize organic growth has implications for both the energy market and investors.

- Impact on MEG Energy: The reduced likelihood of a Cenovus acquisition could impact MEG Energy's stock price and future strategic direction.

- Market Reaction: The market will likely react to Cenovus’s strategic shift, potentially impacting its stock price and investor sentiment.

- Investor Sentiment: Investors will need to reassess their outlook on Cenovus, considering the implications of the altered strategic path.

Conclusion: Cenovus's Long-Term Growth Outlook

Cenovus's strategic shift towards prioritizing organic growth represents a significant change in its long-term outlook. By focusing on operational efficiency, sustainable practices, and maximizing the value of existing assets, Cenovus aims to deliver strong returns to shareholders. The decision to de-prioritize the MEG acquisition reflects a calculated risk assessment and a commitment to a more measured and sustainable growth trajectory. This focus on internal value creation positions Cenovus for long-term success in a dynamic energy landscape. Learn more about Cenovus's prioritized organic growth and stay updated on their progress to understand the full implications of this crucial strategic decision.

Featured Posts

-

Ice Cube To Write And Star In Reported Last Friday Sequel

May 27, 2025

Ice Cube To Write And Star In Reported Last Friday Sequel

May 27, 2025 -

Ujawnienie Dokumentow Ws Zamachu Na Roberta F Kennedyego Nowe Fakty I Hipotezy

May 27, 2025

Ujawnienie Dokumentow Ws Zamachu Na Roberta F Kennedyego Nowe Fakty I Hipotezy

May 27, 2025 -

Dead Reckoning Part One The Full Cast And Character Breakdown For Mission Impossible

May 27, 2025

Dead Reckoning Part One The Full Cast And Character Breakdown For Mission Impossible

May 27, 2025 -

Almanacco Del 23 Marzo Compleanni Santo Del Giorno E Proverbio

May 27, 2025

Almanacco Del 23 Marzo Compleanni Santo Del Giorno E Proverbio

May 27, 2025 -

Streaming Mob Land Season 1 Where To Watch Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Streaming Mob Land Season 1 Where To Watch Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Latest Posts

-

Dolberg Rygtes Til London Klub

May 30, 2025

Dolberg Rygtes Til London Klub

May 30, 2025 -

Caribou Poaching Suspects Arrested Following Remote Lodge Break In Rcmp Update

May 30, 2025

Caribou Poaching Suspects Arrested Following Remote Lodge Break In Rcmp Update

May 30, 2025 -

Illegal Hunting Operation Discovered At Remote Lodge Near Manitoba Nunavut Border

May 30, 2025

Illegal Hunting Operation Discovered At Remote Lodge Near Manitoba Nunavut Border

May 30, 2025 -

Manitobas Commitment To Rural Healthcare Advanced Care Paramedics

May 30, 2025

Manitobas Commitment To Rural Healthcare Advanced Care Paramedics

May 30, 2025 -

Rcmp Investigate Illegal Caribou Hunting Near Manitoba Nunavut Border

May 30, 2025

Rcmp Investigate Illegal Caribou Hunting Near Manitoba Nunavut Border

May 30, 2025