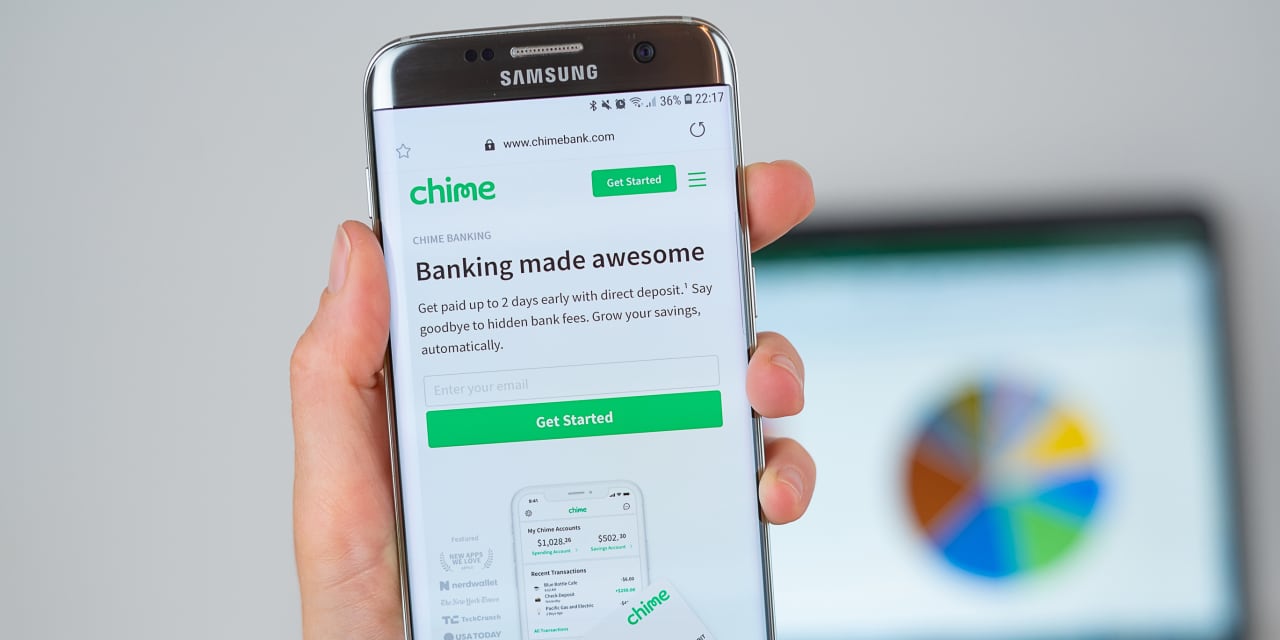

Chime IPO: A Look At The Fintech Startup's Financial Performance

Table of Contents

Chime's Revenue Model and Growth Trajectory

Chime's success hinges on its innovative, fee-free banking model, attracting millions of customers frustrated with traditional banking fees. Analyzing its revenue streams and growth trajectory is essential to predicting its future financial health.

Breakdown of Revenue Streams

Chime's primary revenue source is interchange fees, earned from debit card transactions. While they don't charge customers for standard banking services, they generate income when customers use their Chime debit cards for purchases. Additionally, Chime offers optional subscription services, such as SpotMe (an overdraft feature) and a paid credit builder product. These subscription fees contribute to an increasingly diversified revenue stream. Potential future revenue streams might include partnerships with other financial institutions or expansion into lending products. Further data on the precise breakdown of revenue from each source is crucial for a complete picture of Chime's revenue model and its future earning potential. Analyzing "Chime revenue" streams in detail will be essential for evaluating investor interest. The interplay between "interchange fees" and subscription fees directly impacts the company's financial stability.

Year-over-Year Growth Analysis

Chime has showcased impressive year-over-year growth in recent years, fueled by its strong customer acquisition strategy and the growing popularity of digital banking. While precise figures are often kept private before an IPO, publicly available information suggests significant expansion. Understanding the "Chime growth" trend helps investors gauge the sustainability of its business model. Analyzing specific growth periods, particularly those showing acceleration or deceleration, provides insights into potential underlying factors.

- Specific figures showcasing revenue growth: (Insert data if available, e.g., "X% increase in revenue from 2021 to 2022").

- Comparison to competitors' growth rates: (Insert comparisons to competitors like other neo-banks, if data is available).

- Analysis of factors contributing to growth or hindering it: (Discuss factors like marketing effectiveness, customer satisfaction, and economic conditions.)

Profitability and Key Financial Metrics

While Chime's revenue growth is impressive, examining its profitability and key financial metrics provides a clearer picture of its financial health. Profitability is critical for sustaining long-term growth and attracting investors.

Profitability Analysis

Chime's current profitability is a key point of scrutiny. While it might be currently operating at a loss, aiming for profitability is a typical path for many rapidly growing fintech companies. The trajectory towards profitability, indicated by metrics like net income, operating margin, and EBITDA, is crucial. Investors will scrutinize Chime's "Chime profitability" projections and the company's plan to achieve sustained profitability. Analyzing "EBITDA" and "operating margin" alongside "net income" gives a comprehensive view of the company's financial performance.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

The efficiency of Chime's customer acquisition strategy is critical for long-term success. A high "Customer Acquisition Cost" (CAC) relative to its "Lifetime Value" (LTV) would be a major concern for potential investors. Analyzing the balance between "Chime customer acquisition" costs and long-term customer value will illuminate the sustainability of its growth strategy.

- Discussion of Chime's spending on marketing and customer acquisition: (Analyze marketing strategies, highlighting the cost-effectiveness of its approach.)

- Analysis of the ratio between CAC and LTV: (Discuss the implications of the ratio on the company's future profitability.)

- Comparison to industry benchmarks: (Compare Chime's CAC and LTV to industry averages for similar Fintech companies.)

Risks and Challenges Facing a Chime IPO

Despite its promising growth, several risks and challenges could impact the success of a Chime IPO.

Regulatory Risks

The Fintech industry is subject to significant regulatory scrutiny. "Fintech regulation" is a constantly evolving landscape, and Chime's adherence to "Chime regulatory compliance" with evolving rules and regulations is essential. Changes in financial regulations could significantly impact Chime's operations and profitability.

Competition and Market Saturation

The digital banking space is increasingly competitive. "Chime competitors," including established banks and other fintech startups, present a significant challenge. The degree of "Fintech competition" and potential "market saturation" could limit Chime's future growth.

Economic Factors

Macroeconomic factors, like economic downturns or interest rate changes, could affect Chime's financial performance. Changes in consumer spending habits during an economic downturn, or adjustments to interest rates, can greatly influence Chime's business model and its capacity for revenue generation. Understanding how "Chime economic factors" such as "interest rate risk" and the potential for an "economic downturn" will impact the company is vital for assessing investment risks.

- Identification of major competitors and their strengths: (Identify key players and their competitive advantages.)

- Assessment of potential regulatory changes and their implications: (Discuss potential future regulations and their impact on Chime's business.)

- Discussion of macroeconomic factors that could affect Chime’s business: (Analyze various macroeconomic factors that could influence Chime's profitability.)

Conclusion: Investing in the Chime IPO: A Financial Perspective

Chime's rapid growth and innovative business model are undoubtedly attractive. However, potential investors must carefully consider the risks associated with a Chime IPO. The company's profitability, its ability to manage increasing competition, and its capacity to navigate evolving regulations all play a critical role in its long-term success. While the "Chime IPO" presents an exciting opportunity, a thorough understanding of its financial performance and associated risks is paramount.

To make an informed investment decision, it's crucial to conduct further research and analysis. Learn more about the Chime IPO by accessing independent financial reports and expert analyses. Analyze Chime's financial performance in depth, and stay informed about the Chime IPO to make the most well-considered investment decision.

Featured Posts

-

The Traitors 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025

The Traitors 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025 -

169 Million Loss For Snow White Has Disney Reached The Tipping Point With Live Action Remakes

May 14, 2025

169 Million Loss For Snow White Has Disney Reached The Tipping Point With Live Action Remakes

May 14, 2025 -

The Unfading Legacy Of A Giants Legend

May 14, 2025

The Unfading Legacy Of A Giants Legend

May 14, 2025 -

Jake Pauls Former Opponent Dismisses Joshua Fight Talk Pauls Retort

May 14, 2025

Jake Pauls Former Opponent Dismisses Joshua Fight Talk Pauls Retort

May 14, 2025 -

Finding Banned Candles A Look At Canadian Etsy Walmart And Amazon

May 14, 2025

Finding Banned Candles A Look At Canadian Etsy Walmart And Amazon

May 14, 2025

Latest Posts

-

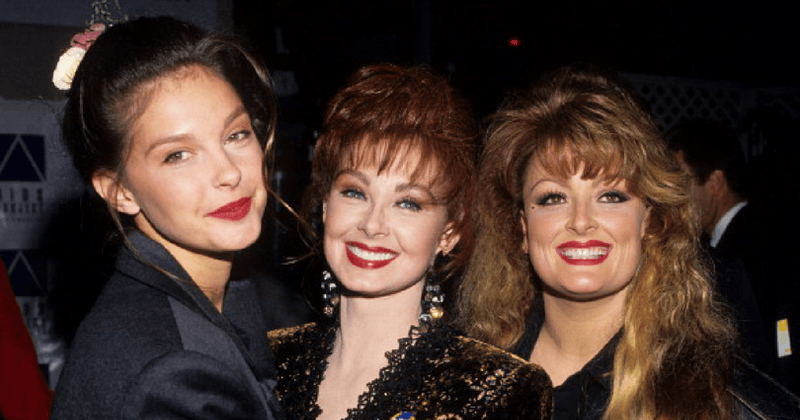

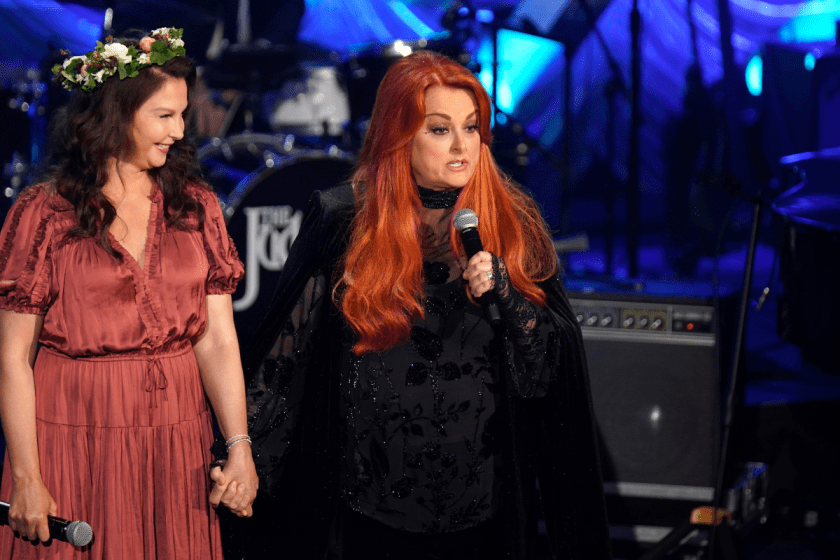

The Judd Sisters Wynonna And Ashley Share Their Familys Journey In New Documentary

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Their Familys Journey In New Documentary

May 14, 2025 -

Wynonna And Ashley Judds Docuseries Unseen Family Struggles Revealed

May 14, 2025

Wynonna And Ashley Judds Docuseries Unseen Family Struggles Revealed

May 14, 2025 -

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025 -

The Judd Sisters Wynonna And Ashley Share Intimate Family Details In New Documentary

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Intimate Family Details In New Documentary

May 14, 2025 -

Wynonna And Ashley Judd Share Family History In Revealing Docuseries

May 14, 2025

Wynonna And Ashley Judd Share Family History In Revealing Docuseries

May 14, 2025