Chime's US IPO Filing: Revenue Growth And Future Prospects

Table of Contents

Chime's Revenue Growth Trajectory

Analyzing Past Performance

Chime's rapid growth in recent years has been remarkable. While precise figures may vary pending the official IPO filing, public information suggests a significant year-over-year growth rate. For example:

- 2020: Significant increase in user base and transaction volume, leading to substantial revenue growth (specific figures to be added upon IPO filing release).

- 2021: Continued expansion fueled by new product offerings and marketing initiatives, resulting in further accelerated revenue growth (specific figures to be added upon IPO filing release).

- 2022: Sustained growth despite economic headwinds, demonstrating resilience in a challenging market (specific figures to be added upon IPO filing release).

This impressive compound annual growth rate (CAGR) can be attributed to several factors, including:

- Effective user acquisition strategies targeting underserved demographics.

- Successful product expansion, introducing new financial products and services.

- Strong brand building and positive customer reviews.

Comparing Chime's growth to competitors like Robinhood or Revolut reveals a strong competitive edge, allowing Chime to capture considerable market share in the digital banking space.

Examining Revenue Streams

Chime's revenue primarily stems from:

- Interchange fees: Earned from debit card transactions processed through the Chime network. This constitutes a significant portion of Chime's current revenue.

- Subscription fees: Generated from premium membership offerings that provide additional features and benefits to users.

- Other revenue streams: Potential future revenue streams might include lending products or partnerships with other financial institutions (specific details to be added upon IPO filing release).

The profitability of each revenue stream will be crucial in determining Chime's overall financial health. The IPO filing will provide details on the revenue diversification strategy and the projected growth of each stream. A successful diversification strategy will lessen reliance on interchange revenue and enhance long-term financial stability.

Impact of Economic Factors

Macroeconomic factors will significantly impact Chime's future revenue growth. Rising inflation and interest rate hikes could affect consumer spending and potentially impact transaction volumes. However, Chime's focus on serving underserved populations might provide some economic resilience. Chime's ability to navigate inflationary pressures and interest rate sensitivity will be key to sustained growth. The IPO filing will likely address these considerations and outline strategies to mitigate potential risks.

Key Aspects of Chime's IPO Filing

Financial Highlights from the Filing

The IPO filing will reveal critical financial metrics, including:

- Detailed revenue figures for the past few years.

- Operating expenses and profitability margins.

- A clear picture of Chime's balance sheet and cash flow.

Analyzing these figures will allow investors to assess Chime's valuation and market capitalization. Understanding the company's financial statements is essential for determining its long-term viability and investment potential.

Growth Strategies and Future Plans

Chime's IPO filing will undoubtedly detail its growth strategy and future plans. These likely include:

- Expanding its product offerings to cater to a broader customer base.

- Targeting new geographic markets to increase its reach.

- Strategic acquisitions to enhance its technological capabilities or expand its service portfolio.

These plans' success will significantly influence future revenue growth. Product innovation and strategic acquisitions are key to maintaining a competitive edge and sustaining high growth.

Risk Factors and Challenges

Chime faces several potential risks and challenges, including:

- Intense competition from established banks and other fintech companies.

- Regulatory changes affecting the financial technology sector.

- Operational risks associated with managing a large and rapidly growing customer base.

- Financial risks associated with economic downturns and fluctuating interest rates.

The IPO filing will undoubtedly address these challenges and outline mitigation strategies. The company's ability to effectively manage these risks will be crucial for its long-term success.

Future Prospects and Valuation

Analyst Predictions and Market Sentiment

Following the IPO filing, analysts will issue predictions regarding Chime's future performance and stock price. Market sentiment will be heavily influenced by these predictions, alongside the company's overall financial health and growth prospects. Analyst ratings and market outlook will be closely monitored by investors.

Long-Term Growth Potential

Chime's long-term growth potential hinges on:

- Its ability to maintain its market position and attract new customers.

- Its capacity for continuous product innovation and improvement.

- Successful execution of its expansion strategies, both domestically and internationally.

Factors that could hinder long-term success include increased competition, regulatory hurdles, and economic downturns. However, Chime's innovative approach and focus on customer needs suggest significant long-term growth potential.

Conclusion: Chime's IPO Filing: A Look at Future Growth

Chime's upcoming IPO filing offers a significant opportunity to assess its past performance, current financial health, and future prospects. The analysis of its revenue growth trajectory, coupled with the details revealed in the IPO filing, provides insights into its potential for long-term success within the rapidly evolving fintech industry. While challenges exist, Chime's strong growth and innovative approach position it favorably within the digital banking sector. Stay informed about Chime's journey and the future of digital banking by following our updates on Chime's US IPO and its revenue growth.

Featured Posts

-

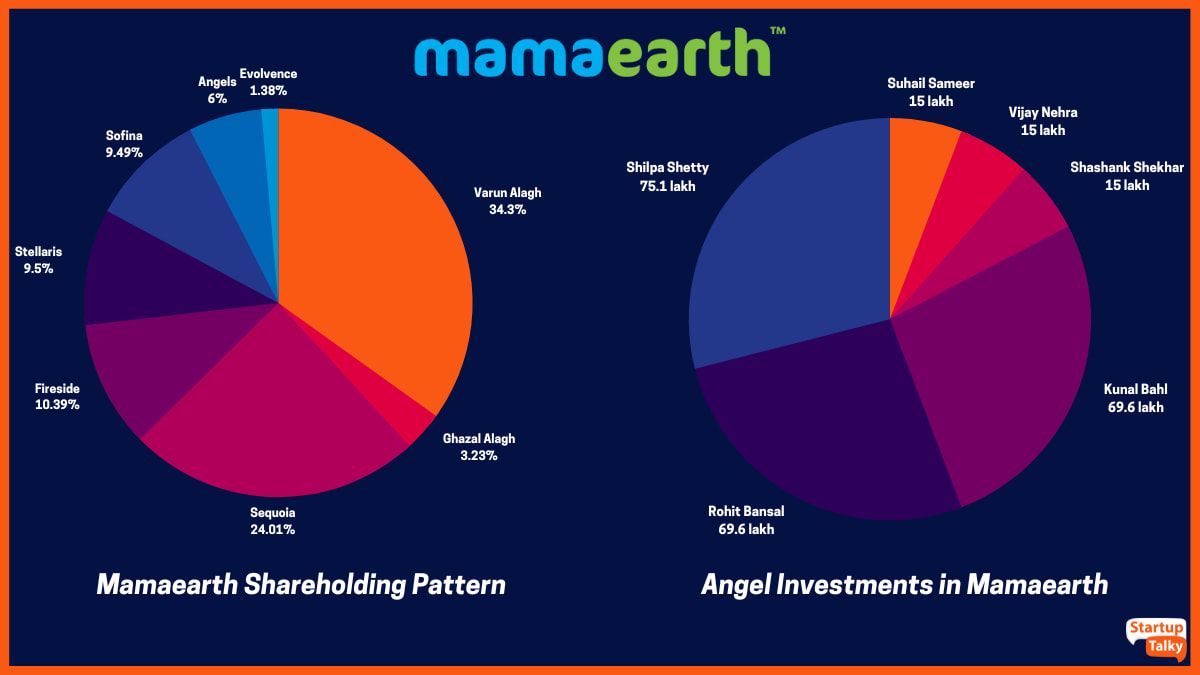

Conquering With Charizard Ex A2b 010 A Pokemon Tcg Pocket Deck And Counter Guide

May 14, 2025

Conquering With Charizard Ex A2b 010 A Pokemon Tcg Pocket Deck And Counter Guide

May 14, 2025 -

Uruguay Despide A Jose Mujica El Impacto De Su Humildad En La Politica

May 14, 2025

Uruguay Despide A Jose Mujica El Impacto De Su Humildad En La Politica

May 14, 2025 -

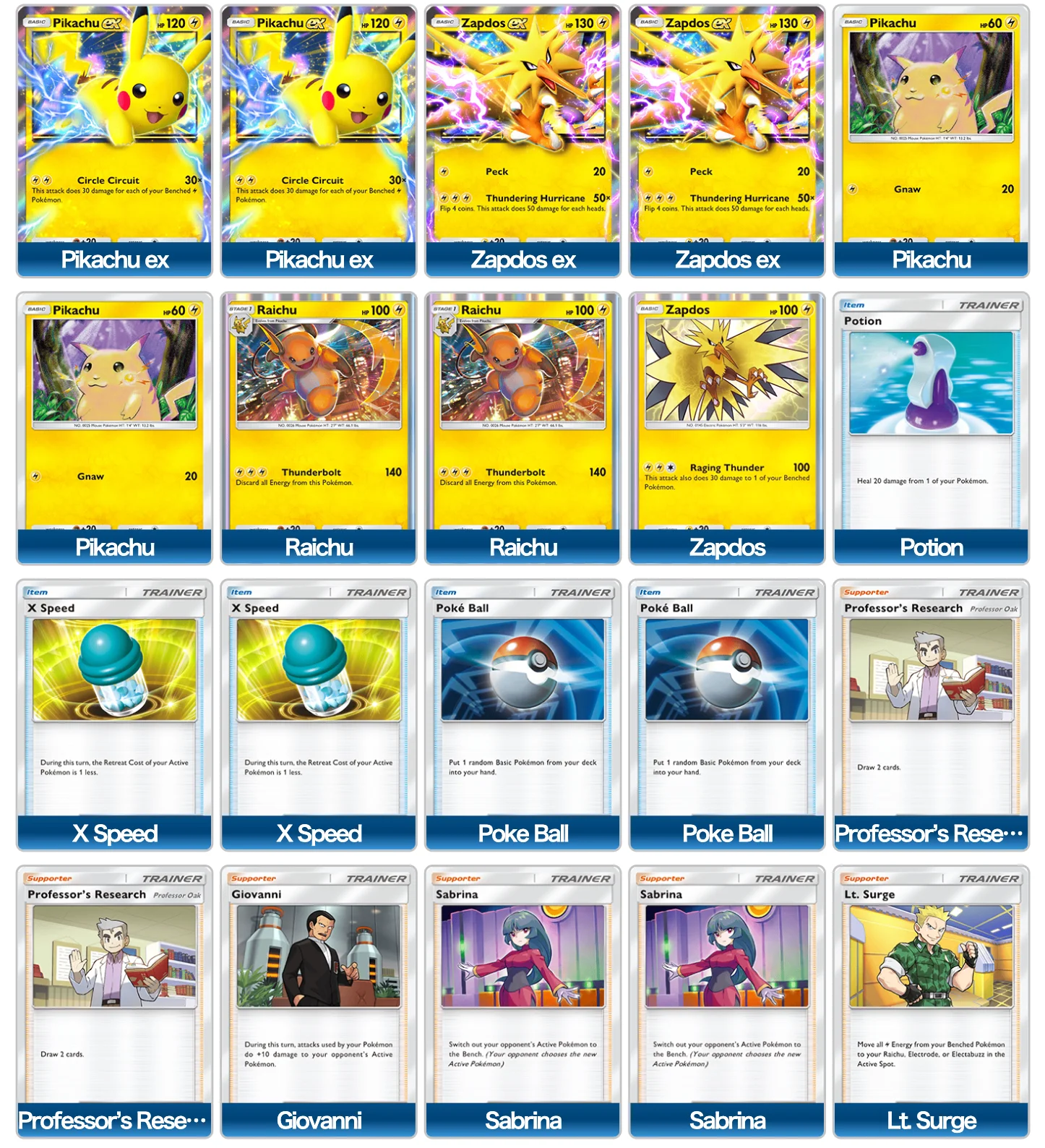

Ciclismo Programma E Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women A Imperia

May 14, 2025

Ciclismo Programma E Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women A Imperia

May 14, 2025 -

Walmart Issues Nationwide Recall Of Orvs Oysters And Electric Scooters

May 14, 2025

Walmart Issues Nationwide Recall Of Orvs Oysters And Electric Scooters

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family History And Relationships

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Relationships

May 14, 2025