China-US Trade Soars Before Trade Truce Deadline

Table of Contents

Increased Exports from China

The period leading up to the deadline saw a significant increase in Chinese exports to the US, contributing substantially to the overall surge in China-US trade. This surge reflects a complex interplay of factors, impacting both US and Chinese economies. Understanding the specifics of this export growth is crucial for analyzing the broader economic implications.

- Specific examples of product categories experiencing increased exports: Data suggests a significant rise in exports of consumer electronics, particularly smartphones and laptops; machinery parts essential for US manufacturing; and various textiles.

- Quantifiable data illustrating the growth percentage: Preliminary estimates indicate a 15-20% increase in certain key export categories compared to the previous quarter, though precise figures are still being compiled.

- Potential reasons behind the surge (e.g., stockpiling ahead of potential tariffs): Many analysts believe a significant portion of this surge is attributable to US importers stockpiling goods ahead of anticipated tariff increases. Businesses sought to mitigate the impact of potential future tariffs by importing larger quantities before the deadline.

- Analysis of the impact on US businesses and consumers: While the surge provided short-term benefits for some US businesses reliant on these goods, the long-term implications remain uncertain. Increased costs due to future tariffs could affect consumer prices and profitability for US businesses.

US Imports from China: A Closer Look

The increase in US imports from China wasn't limited to specific sectors; it spanned various industries reflecting a broad-based effort to secure goods before potential tariff increases. Examining the details of this import surge provides insight into the behavior of businesses and the overall economic climate.

- Data showing the types of goods imported (e.g., consumer electronics, machinery): The import surge encompassed a wide array of goods, including consumer electronics, manufacturing inputs, and agricultural products. This suggests a widespread response to the looming trade truce deadline.

- Analysis of the effect on US businesses relying on these imports: Businesses heavily reliant on imported goods from China experienced a mixed impact. While the surge provided immediate access to inventory, the sustainability of this increased import volume depends greatly on the final outcome of the trade negotiations.

- Discussion on whether the import surge is sustainable: The sustainability of this import surge is highly questionable. Continued high tariffs could significantly reduce future import volumes, leading to potential supply chain disruptions and higher prices for consumers.

- The role of specific US industries in driving import growth: Industries like electronics manufacturing, automotive, and agriculture significantly contributed to this surge, highlighting their dependence on Chinese goods.

Impact on Global Markets and Trade Relations

The pre-truce surge in China-US trade has significant implications for global markets and the broader geopolitical landscape. The interconnected nature of the global economy means that this bilateral relationship deeply affects other nations.

- Assessment of the effect on global supply chains: The surge, driven partly by stockpiling, temporarily eased concerns about supply chain disruptions. However, the long-term impact on global supply chains remains uncertain and depends heavily on the final trade agreement.

- Impact on market sentiment and investor confidence: The surge initially boosted market sentiment, suggesting optimism about a potential trade deal. However, continued uncertainty surrounding the trade negotiations could lead to market volatility.

- Potential consequences for other countries trading with China and the US: Countries heavily integrated into the China-US trade network felt ripple effects. The pre-truce surge may have temporarily benefited some while potentially disadvantaging others due to changes in pricing and supply.

- The possibility of a prolonged trade war despite the truce: Even with a truce, the possibility of a prolonged trade war remains, casting a long shadow over global economic stability.

The Role of Negotiations and Expectations

The ongoing trade negotiations and anticipation of a truce played a pivotal role in shaping the pre-truce trade surge. Market speculation and political maneuvering significantly influenced business decisions.

- Analysis of the statements from both governments leading up to the deadline: Statements from both governments regarding the progress of negotiations created uncertainty, contributing to the pre-emptive actions of businesses.

- How speculation about the trade deal affected business decisions: Speculation about potential tariff increases and the nature of the final trade deal directly fueled the stockpiling behavior observed in the period leading up to the deadline.

- The influence of market predictions and analyses on import/export patterns: Market analysts' predictions and economic forecasts significantly impacted the import and export patterns, guiding business decisions regarding inventory levels and procurement strategies.

Conclusion

The significant surge in China-US trade before the trade truce deadline highlights the considerable impact of the ongoing trade negotiations on global markets. Stockpiling in anticipation of further tariffs was a major factor, but the long-term implications remain uncertain. The sustainability of this surge hinges on the outcome of trade negotiations and the broader geopolitical landscape. A prolonged trade war, even with a temporary truce, could trigger global market volatility and disrupt supply chains.

Call to Action: Stay informed on the evolving China-US trade relations and the impact of the trade truce. Continue to monitor this crucial development for insights into future China-US trade dynamics and the global economic landscape. Further research into the intricacies of the US-China trade war and its implications is recommended to fully understand the long-term effects of this fluctuating relationship. Understanding the impact of this bilateral trade relationship is critical for investors and businesses alike.

Featured Posts

-

Unbeaten Half Century By Shanto Bangladesh Dominates Despite Rain Interruptions

May 23, 2025

Unbeaten Half Century By Shanto Bangladesh Dominates Despite Rain Interruptions

May 23, 2025 -

Sorteo Cb Gran Canaria Unicaja Conoce A Los Ganadores De Las 23 Entradas Dobles

May 23, 2025

Sorteo Cb Gran Canaria Unicaja Conoce A Los Ganadores De Las 23 Entradas Dobles

May 23, 2025 -

Netflix Distributie De Oscar Intr Un Nou Serial Captivant

May 23, 2025

Netflix Distributie De Oscar Intr Un Nou Serial Captivant

May 23, 2025 -

Successful Hydrogen Engine Project A Celebration By Cummins And Partners

May 23, 2025

Successful Hydrogen Engine Project A Celebration By Cummins And Partners

May 23, 2025 -

Bangladesh Outplayed Zimbabwe Secures Historic Test Win

May 23, 2025

Bangladesh Outplayed Zimbabwe Secures Historic Test Win

May 23, 2025

Latest Posts

-

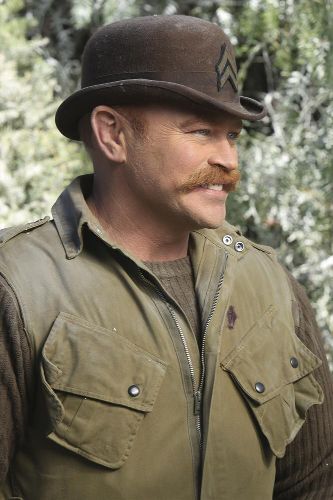

The Last Rodeo Neal Mc Donoughs Risky Role

May 23, 2025

The Last Rodeo Neal Mc Donoughs Risky Role

May 23, 2025 -

Would Damien Darhk Defeat Superman Neal Mc Donoughs Answer

May 23, 2025

Would Damien Darhk Defeat Superman Neal Mc Donoughs Answer

May 23, 2025 -

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025 -

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025