China's Economic Stimulus: Rate Cuts And Enhanced Bank Lending Accessibility

Table of Contents

Recent Interest Rate Cuts and Their Impact

The People's Bank of China (PBoC), China's central bank, has undertaken a series of interest rate adjustments in recent months as part of its monetary policy to stimulate the economy. These interest rate cuts aim to lower borrowing costs, encouraging increased investment and consumption.

- Specific Dates and Magnitudes: While specific dates will need to be updated to reflect the most current information (this is crucial for SEO!), examples would include mentioning months and percentage point reductions. For instance: "In August 2023, the PBoC lowered the 7-day reverse repo rate by 10 basis points, followed by a similar reduction in the 1-year medium-term lending facility (MLF) rate in September."

- Target Audience: These cuts are targeted at both businesses and consumers. Lower borrowing costs make it cheaper for businesses to invest in expansion and for consumers to take out loans for purchases like homes and automobiles.

- Short-Term Effects: Initial observations suggest increased borrowing activity, particularly in sectors such as infrastructure and real estate. Increased consumer spending in certain sectors may also be observed.

- Potential Long-Term Effects: While stimulating short-term growth, potential long-term effects include inflationary pressures if not carefully managed. The PBoC needs to strike a delicate balance between boosting economic activity and preventing runaway inflation. Successful implementation could lead to sustainable economic growth.

- Comparison to Previous Stimulus Packages: This section should compare the current rate cuts to previous stimulus efforts, noting similarities and differences in scale, approach, and effectiveness. Quantitative easing (QE) measures, if applicable, should be mentioned and compared.

The effectiveness of these cuts in stimulating investment and consumption is subject to ongoing analysis and depends on various factors, including consumer confidence and business sentiment. Data on loan growth, investment levels, and consumer spending will be crucial in assessing the actual impact of these interest rate adjustments.

Enhanced Bank Lending Accessibility: Measures and Effects

In addition to interest rate cuts, the Chinese government has implemented several initiatives to enhance bank lending accessibility, aiming to direct credit to specific sectors and businesses. These measures are designed to facilitate credit easing and boost overall loan growth.

- Government Policies: Examples include adjustments to the reserve requirement ratio (RRR), which dictates the amount of capital banks must hold in reserve, and the introduction of loan guarantees for SMEs. Further details on specific policy instruments and their implementation timelines are crucial here.

- Impact on SMEs: These policies are specifically aimed at supporting SME financing, which is critical for job creation and economic dynamism. The success in reaching this sector should be analyzed in detail.

- Effects on Lending Rates: The impact on lending rates across different sectors should be investigated, noting variations and identifying potential bottlenecks.

- Reaching Targeted Borrowers: The analysis should assess the success of these policies in reaching their intended targets. Difficulties in accessing credit for certain businesses should be discussed.

- Challenges: The existence of non-performing loans (NPAs) and the risk of increased non-performing assets presents a significant challenge. This needs to be addressed thoroughly within this section.

The response of financial institutions to these initiatives is crucial. Their willingness to lend and the terms they offer will significantly influence the success of the government's efforts. Analysis of bank lending data and reports from financial institutions is needed here.

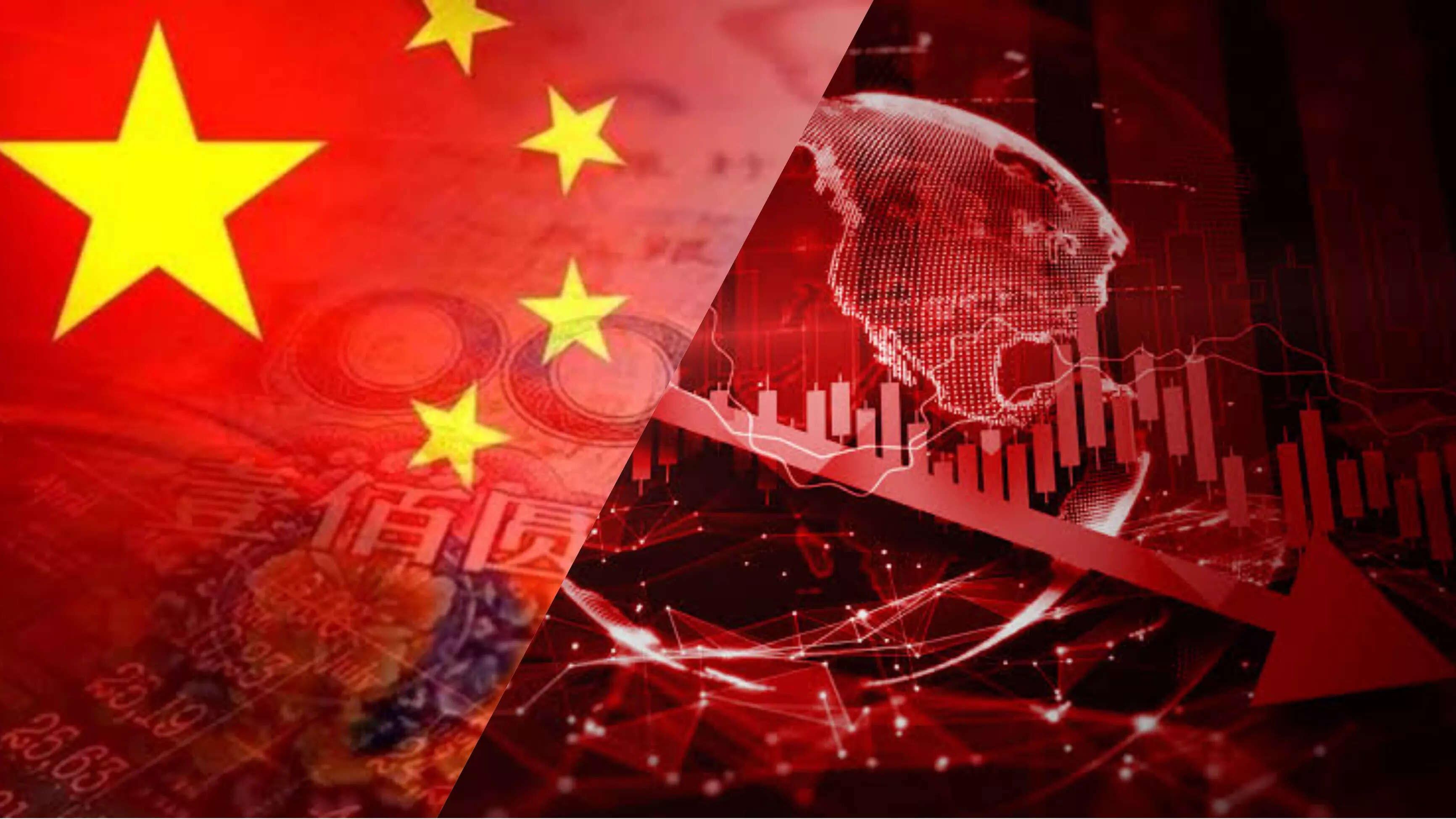

Challenges and Risks Associated with the Stimulus

While the stimulus measures aim to boost economic growth, they also carry potential risks and challenges. A thorough evaluation of these risks is crucial.

- Inflationary Pressure: The risk of inflation is a major concern. Increased money supply through credit easing can lead to rising prices, potentially undermining the positive effects of the stimulus.

- Unsustainable Debt Growth: The stimulus could lead to unsustainable levels of debt, both at the government and corporate levels. This is a significant risk to macroeconomic stability.

- Asset Bubbles: The influx of credit could create asset bubbles in certain sectors, such as real estate, with potentially disastrous consequences.

- Geopolitical Risks: External factors like trade tensions and geopolitical uncertainties could negatively impact the effectiveness of the stimulus.

- Targeting Effectiveness: The ability to effectively target specific economic sectors needing support remains a challenge and needs analysis.

The long-term sustainability of these stimulus measures is questionable if these risks are not carefully managed. Maintaining financial stability requires a balanced approach.

Conclusion

China's economic stimulus, encompassing interest rate cuts and enhanced bank lending accessibility, represents a significant effort to address economic challenges. While the initial response suggests increased borrowing activity, the long-term effectiveness remains to be seen. The potential for inflation, unsustainable debt growth, and asset bubbles presents significant risks. Careful monitoring of inflationary pressure, debt sustainability, and the effectiveness of targeting specific sectors are crucial to assess the overall success of this economic stimulus plan. Staying informed about further developments, including future interest rate adjustments and bank lending policies, is vital for understanding the long-term impacts on China's economy and the global landscape. Regularly monitor news and analysis related to China’s economic stimulus and monetary policy for the most up-to-date information.

Featured Posts

-

Bitcoin Madenciligi Karlilik Duesuesuenuen Sebepleri Ve Gelecegi

May 08, 2025

Bitcoin Madenciligi Karlilik Duesuesuenuen Sebepleri Ve Gelecegi

May 08, 2025 -

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025 -

Altcoins 5880 Price Surge Is This The Next Xrp

May 08, 2025

Altcoins 5880 Price Surge Is This The Next Xrp

May 08, 2025 -

13 More Strikeouts Plague Angels As Twins Complete Series Sweep

May 08, 2025

13 More Strikeouts Plague Angels As Twins Complete Series Sweep

May 08, 2025 -

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025