China's Steel Curbs And The Consequent Drop In Iron Ore Prices: A Comprehensive Overview

Table of Contents

China's Steel Production Curbs: The Driving Force

China's steel industry, the world's largest, has faced unprecedented regulatory pressure in recent years. These curbs are the primary driver behind the recent iron ore price plunge.

Government Regulations and Environmental Concerns

The Chinese government has implemented a series of policies aimed at reducing steel production, driven largely by environmental concerns and ambitious carbon emission reduction targets. These policies include:

- Stricter emission standards: New, more stringent regulations on air and water pollution from steel mills.

- Production quotas: Limits imposed on the total amount of steel that can be produced by individual mills and regions.

- Increased penalties for non-compliance: Heavier fines and sanctions for mills exceeding emission limits or production quotas.

- Phased closure of outdated facilities: A push to shut down older, less efficient steel plants that contribute disproportionately to pollution.

These measures reflect China's commitment to achieving its carbon neutrality goals and improving environmental sustainability. The steel industry, a significant contributor to greenhouse gas emissions, is a key target in these efforts.

Impact on Steel Mills and Production Capacity

The impact on Chinese steel mills has been substantial. The production curbs have led to:

- Reduced steel output: A significant decrease in overall steel production, affecting both large and small mills.

- Plant closures and operational cutbacks: Some steel mills have been forced to close permanently, while others have reduced operations to comply with regulations.

- Financial strain on steel companies: Reduced production and increased compliance costs have put significant financial pressure on many steel companies.

- Job losses and regional economic impact: The downturn has led to job losses in the steel industry and related sectors, impacting local economies heavily reliant on steel production.

The Ripple Effect: Iron Ore Price Decline and Market Volatility

The reduction in Chinese steel production has had a direct and immediate impact on the demand for iron ore, a crucial raw material in steelmaking.

Reduced Demand for Iron Ore

The decreased steel production has led to a significant drop in iron ore demand. This is a classic case of supply and demand:

- Correlation between steel production and iron ore prices: Data clearly shows a strong negative correlation – as steel production falls, so do iron ore prices. (Insert chart illustrating this correlation here)

- Supply exceeding demand: The reduced demand from China has created a situation of oversupply in the iron ore market, further depressing prices.

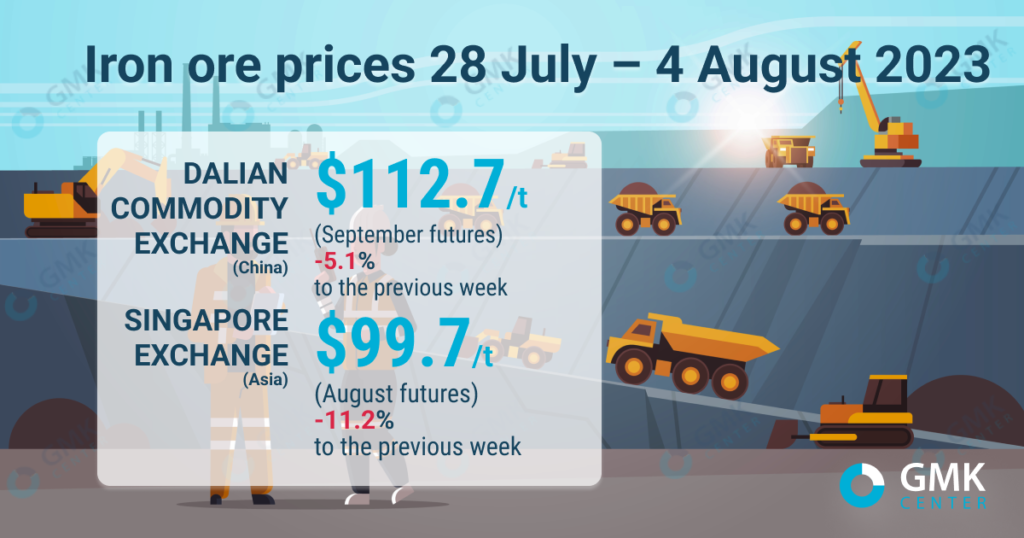

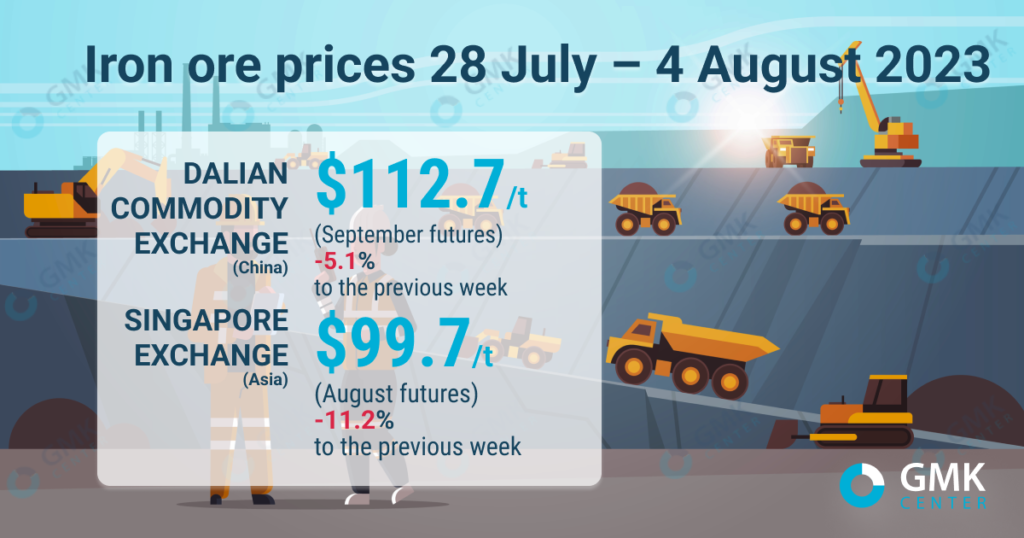

Global Market Reactions and Price Fluctuations

The price drop in iron ore has not been confined to China. The global market has experienced significant volatility:

- Sharp price decline: Iron ore prices have plummeted over the past [specific timeframe], impacting major producers and traders. (Insert chart showing price fluctuations)

- Impact on major iron ore producing countries: Australia and Brazil, major iron ore exporters, have felt the impact of reduced demand and lower prices.

- Speculative trading and market volatility: Market speculation has amplified the price fluctuations, creating further uncertainty.

Long-Term Implications and Future Outlook for Iron Ore and Steel

The long-term implications of China's steel curbs are complex and depend on several factors.

Sustainable Steel Production and Green Initiatives

China is investing heavily in sustainable steel production:

- Government initiatives and investment in green steel technologies: The government is actively promoting research and development of greener steelmaking technologies, aiming to reduce carbon emissions.

- Potential impact on future iron ore demand: The adoption of more efficient and less resource-intensive technologies could alter future iron ore demand.

Market Recovery and Price Stabilization

The future of iron ore prices remains uncertain but depends on several key factors:

- Potential scenarios and their impact on price forecasts: Various scenarios, from a rapid economic recovery to continued slow growth, could influence the future demand for steel and iron ore.

- Global economic growth and its effect on steel consumption: Global economic growth will be a critical driver of steel and, consequently, iron ore demand.

Conclusion

China's stringent policies to curb steel production have directly and significantly impacted the global iron ore market, causing a steep price drop. The strong link between China's industrial policies and commodity market volatility is undeniable. The long-term implications will depend on the success of China's green initiatives, global economic growth, and the evolution of the steel industry's sustainability efforts. To stay abreast of these crucial developments and their impact on the global economy, stay informed about China's steel curbs and their continuing effects on iron ore prices by subscribing to our newsletter, following industry news, and conducting further research on this important topic.

Featured Posts

-

Lisa Rays Air India Complaint Airline Denies Allegations

May 09, 2025

Lisa Rays Air India Complaint Airline Denies Allegations

May 09, 2025 -

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 09, 2025

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 09, 2025 -

Mans 3 000 Babysitting Complaint Leads To 3 600 Daycare Bill

May 09, 2025

Mans 3 000 Babysitting Complaint Leads To 3 600 Daycare Bill

May 09, 2025 -

Palantir And Nato A New Deal Revolutionizing Ai In The Public Sector

May 09, 2025

Palantir And Nato A New Deal Revolutionizing Ai In The Public Sector

May 09, 2025 -

Sensex 600 Nifty

May 09, 2025

Sensex 600 Nifty

May 09, 2025