China's Steel Production Cuts: Impact On Iron Ore Prices

Table of Contents

The Scale of China's Steel Production Cuts and Their Underlying Reasons

China's steel production cuts have been substantial. According to the World Steel Association, production declined by X% in [Year], following a Y% decrease in [Previous Year] (Source: Cite the World Steel Association or a reputable source with quantifiable data). This significant reduction is driven by a confluence of factors:

-

Stringent Environmental Regulations: The Chinese government has implemented increasingly strict environmental policies to meet its ambitious carbon emission reduction targets. These policies include limitations on steel production capacity in heavily polluting regions and increased scrutiny of emissions standards. This directly impacts steel mills' operational capacity and production output, significantly influencing the demand for iron ore.

-

Economic Slowdown and Weakening Domestic Demand: China's economic growth has slowed in recent years, leading to a decrease in domestic demand for steel used in construction, infrastructure projects, and manufacturing. This reduced demand directly translates into lower steel production and, consequently, reduced iron ore consumption.

-

Overcapacity Reduction Measures: The Chinese government has actively worked to curb overcapacity within its steel industry. This involves consolidating smaller, less efficient steel mills and encouraging mergers and acquisitions to streamline the sector and improve efficiency. This consolidation inevitably leads to a decrease in overall steel production. This drive to tackle the issue of steel production capacity has considerable ramifications for global iron ore markets.

Direct Impact on Iron Ore Demand and Prices

The relationship between steel production and iron ore demand is directly proportional. A reduction in steel production invariably leads to a decrease in iron ore demand. Consequently, China's steel production cuts have had a substantial impact on iron ore spot and futures prices.

-

Decreased Demand: As Chinese steel mills produce less steel, their demand for iron ore as a raw material diminishes. This reduced demand puts downward pressure on iron ore prices.

-

Price Volatility: The impact on iron ore prices has been significant, with spot and futures prices exhibiting considerable volatility. (Insert a chart or graph illustrating price fluctuations from a reputable source, such as the London Metal Exchange or a financial news website). This volatility underscores the sensitivity of the iron ore market to changes in Chinese steel production.

-

Supply-Demand Imbalance: The reduced demand from China, the world's largest steel producer and iron ore consumer, creates a supply-demand imbalance, resulting in a downward trend in iron ore prices. This imbalance affects not only the price but also the profitability of iron ore mining companies.

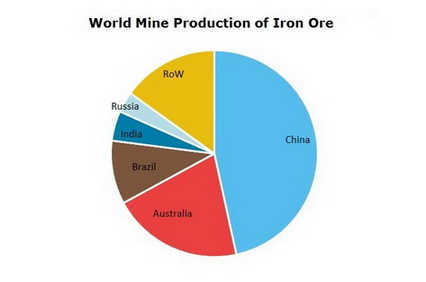

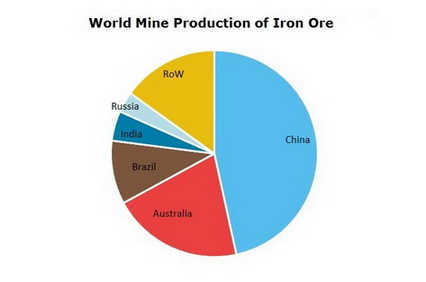

Impact on Major Iron Ore Producing Countries and Companies

The decrease in global iron ore demand directly impacts major producing countries and companies.

-

Australia and Brazil: Australia and Brazil, the world's largest iron ore exporters, have been significantly affected by the reduced demand from China. Their export volumes have decreased, impacting their economies and the profitability of their mining sectors.

-

Mining Companies' Profitability: Major mining companies, such as Rio Tinto, BHP Group, and Vale, have experienced decreased profitability due to lower iron ore prices. This has impacted their stock prices and their investment strategies.

-

Mitigation Strategies: Mining companies are adopting various strategies to mitigate the impact, including cost-cutting measures, optimizing operations, and diversifying their customer base to reduce reliance on the Chinese market.

Wider Economic Implications and Future Outlook

The consequences of China's steel production cuts extend far beyond the steel and iron ore sectors.

-

Global Economic Impact: The slowdown in Chinese steel production reflects broader economic trends within China and contributes to global economic uncertainty. The reduced demand for raw materials, including iron ore, has cascading effects throughout the global supply chain.

-

Long-Term Effects: The long-term effects on the steel and iron ore markets remain uncertain. While the current trend points towards lower prices, the future outlook depends on several factors, including China's economic recovery, global steel demand, and the pace of environmental policy implementation.

-

Market Predictions: Experts offer varied predictions regarding future iron ore prices. Some anticipate a gradual recovery, while others foresee prolonged periods of low prices. (Cite reputable sources for these predictions, such as financial analysts or commodity market forecasters). The uncertainty highlights the importance of continuous monitoring of the situation.

Conclusion: Understanding the Interplay Between China's Steel Production Cuts and Iron Ore Prices

China's steel production cuts have had a profound and multifaceted impact on global iron ore prices. The direct correlation between steel production and iron ore demand is undeniable, resulting in decreased demand, price volatility, and significant challenges for major iron ore producing countries and companies. Understanding this interplay is crucial for navigating the complexities of the global commodities market. The future outlook remains uncertain, with various factors potentially influencing iron ore prices. To stay informed about China's steel production cuts and their continuing impact on iron ore prices, subscribe to our updates or follow reputable financial news sources for regular market analysis. Further research into the specific economic policies influencing both sectors will provide a more comprehensive understanding of this dynamic market.

Featured Posts

-

Potential Hertl Absence Looms Large For Golden Knights

May 09, 2025

Potential Hertl Absence Looms Large For Golden Knights

May 09, 2025 -

Colapintos Rise Challenging Lawson For Red Bull Junior Team Spot

May 09, 2025

Colapintos Rise Challenging Lawson For Red Bull Junior Team Spot

May 09, 2025 -

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025 -

Leon Draisaitl Edmonton Oilers Hart Trophy Contender

May 09, 2025

Leon Draisaitl Edmonton Oilers Hart Trophy Contender

May 09, 2025 -

Expert Opinions Clash Is Daycare Detrimental To Child Development

May 09, 2025

Expert Opinions Clash Is Daycare Detrimental To Child Development

May 09, 2025