Climate Change And Your Home Loan: Understanding The Credit Risk

Table of Contents

Increased Property Vulnerability and Loan Defaults

Climate change significantly increases the vulnerability of properties, leading to a higher likelihood of loan defaults. This risk is multifaceted and depends heavily on the property's location and its inherent resilience to various climate-related hazards.

Flood Risk and Coastal Properties

Rising sea levels and increased storm surges are significantly increasing flood risk in coastal areas. Lenders are becoming increasingly wary of properties in high-risk flood zones, often leading to higher interest rates or outright loan denials. The cost of flood insurance, a crucial consideration for borrowers in these areas, can significantly impact overall loan affordability.

- Check FEMA flood maps (or your country's equivalent) to determine your property's flood risk level. Understanding your property's risk profile is crucial for assessing Climate Change Home Loan Risk.

- Look for properties with elevated foundations or other flood mitigation features. These features can reduce your risk and potentially improve your chances of loan approval.

- Consider the long-term implications of rising sea levels and increased storm surges on your property's value.

Wildfire Risk and Inland Properties

Increased frequency and intensity of wildfires pose significant risks to properties in fire-prone regions. Damage from wildfires can lead to decreased property values and potential loan defaults, impacting the lender's ability to recover the loan amount.

- Consider the proximity of your potential property to wildlands and assess the local fire protection services. A property's distance from firebreaks and the effectiveness of local fire departments are crucial factors.

- Look for properties with fire-resistant landscaping and building materials. These features can significantly reduce the risk of damage and protect your investment.

- Inquire about the history of wildfires in the area and assess the potential for future outbreaks. This information will help you understand the Climate Change Home Loan Risk associated with a specific property.

Extreme Weather Events & Their Impact

Hurricanes, tornadoes, and heatwaves can cause substantial property damage, impacting loan repayments and increasing the likelihood of default. Lenders now assess the historical and projected frequency of extreme weather events in a given area as part of their risk assessment.

- Understanding your property's resilience to various extreme weather events is critical. Consider factors like wind resistance, roof strength, and drainage systems.

- Consider investing in property improvements to increase its resilience to extreme weather. Upgrades can mitigate potential damage and reduce Climate Change Home Loan Risk.

- Assess the potential for power outages and their impact on the property's habitability and safety.

Impact on Property Values and Appraisal

Climate change significantly impacts property values and the appraisal process, creating challenges for both borrowers and lenders.

Decreased Property Values in High-Risk Zones

Properties located in areas vulnerable to climate change impacts often experience decreased property values over time. This can affect the amount you can borrow and impact your loan-to-value ratio (LTV), potentially leading to loan denial or stricter lending terms. Appraisals will often reflect the climate-related risks, potentially reducing the appraised value.

- Thoroughly research the long-term value projections for properties in your target area. Consider consulting independent real estate experts specializing in climate-related risk assessment.

- Understand how climate change might affect future property taxes and insurance premiums.

- Factor in the potential costs of mitigating climate-related risks to your property's value.

Challenges in Obtaining Accurate Appraisals

Accurately assessing climate-related risks during appraisals is a challenge for appraisers due to the complexities of predicting future climate impacts and their influence on property values. This can lead to uncertainties and delays in the loan approval process.

- Be prepared for potential delays during the appraisal process. The increased scrutiny of climate-related risks can prolong the timeframe for loan approval.

- Gather as much data as possible regarding the property's resilience to climate change impacts to aid the appraiser's assessment.

- Work with an experienced real estate agent and lender who understands the complexities of Climate Change Home Loan Risk.

Lenders' Increasing Scrutiny and New Regulations

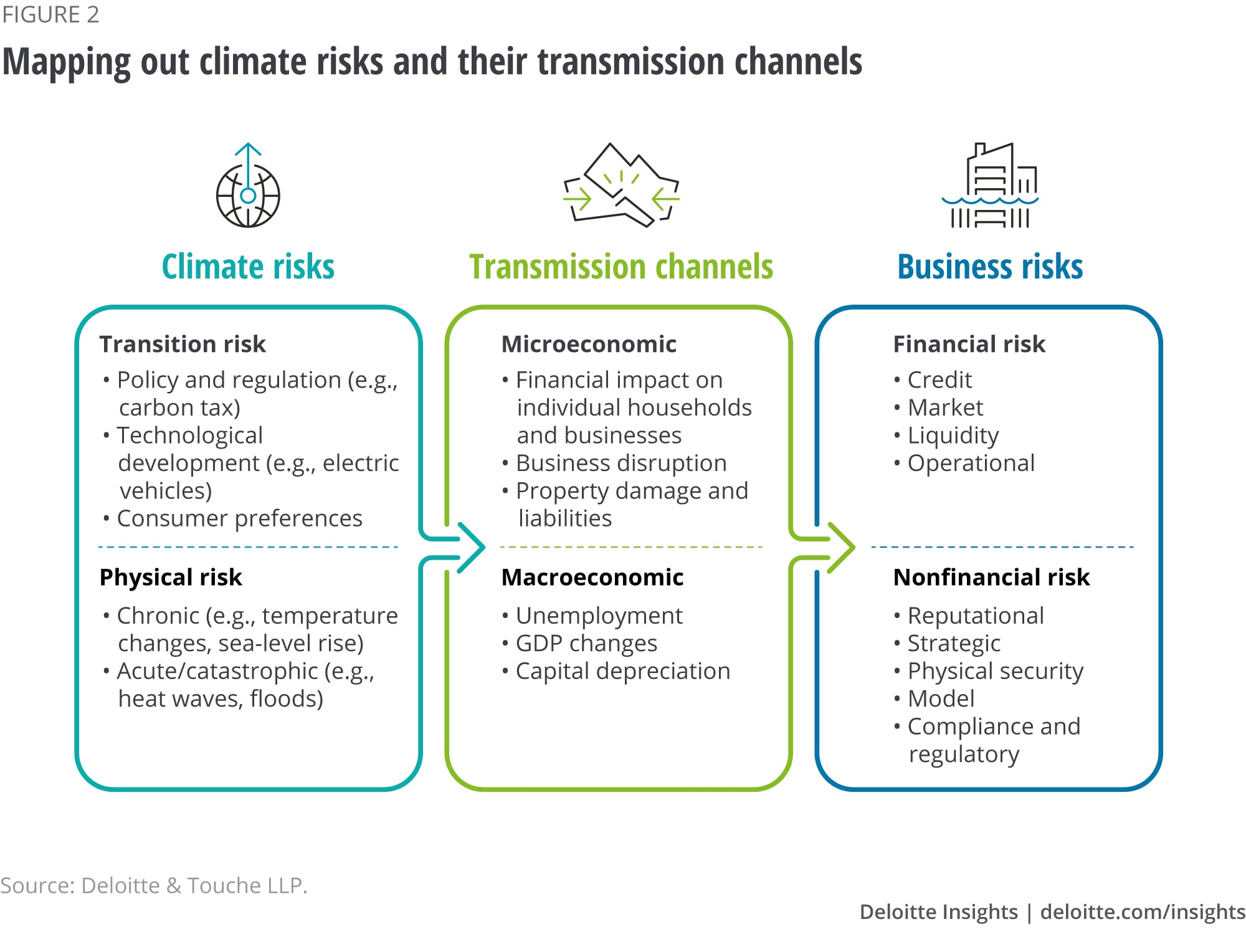

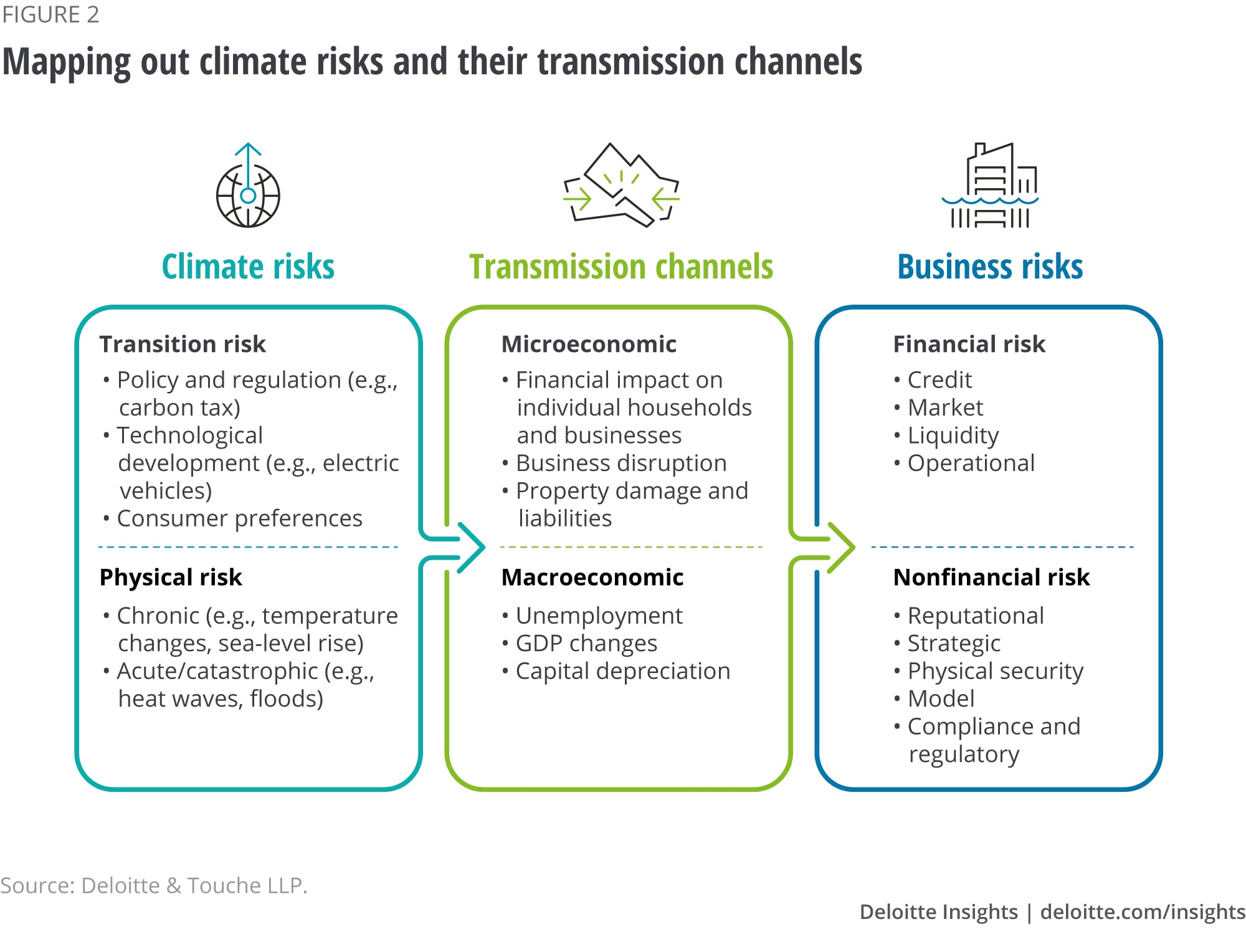

Lenders are increasingly scrutinizing loan applications, implementing stricter guidelines to account for climate change risks. This also involves the evolution of new regulations and disclosures around climate-related risks in the housing market.

Increased Due Diligence by Lenders

Lenders are implementing stricter underwriting guidelines to account for climate change risks. This includes more detailed property risk assessments and more rigorous analysis of flood and wildfire risks. Expect more questions and potentially more documentation related to climate change vulnerability.

- Be transparent with your lender regarding any known risks associated with the property. Open communication can help smooth the loan application process.

- Provide any documentation that demonstrates the property's resilience to climate change impacts.

- Engage with your lender early in the process to address any concerns they may have.

Emerging Climate-Related Regulations

New regulations and disclosures regarding climate-related risks are constantly evolving. Staying informed about these changes is crucial to understanding your responsibilities as a borrower. Local, state, and federal governments are implementing policies to address climate-related risks in the housing market.

- Keep yourself updated on relevant legislation and regulations. Check for updates from your local government and regulatory bodies.

- Seek professional advice from a mortgage broker or financial advisor who specializes in climate-related financial risks.

- Be aware that new regulations may impact your loan terms and conditions.

Conclusion

Climate change is fundamentally altering the landscape of homeownership and the home loan process. Understanding the increased risks associated with climate change, from flooding and wildfires to extreme weather events, is paramount. By carefully researching property locations, assessing climate vulnerabilities, and engaging in transparent communication with your lender, you can mitigate the financial risks involved. Don’t underestimate the potential impact of climate change on your Climate Change Home Loan Risk. Proactive planning and informed decision-making are key to securing a sound and sustainable home loan. Start your research today and make informed choices to reduce your Climate Change Home Loan Risk.

Featured Posts

-

Hollywood Production Frozen The Combined Impact Of The Writers And Actors Strike

May 20, 2025

Hollywood Production Frozen The Combined Impact Of The Writers And Actors Strike

May 20, 2025 -

Republican Tax Cuts An Examination Of The Deficits Trajectory

May 20, 2025

Republican Tax Cuts An Examination Of The Deficits Trajectory

May 20, 2025 -

Nyt Mini Crossword Puzzle Answers March 22

May 20, 2025

Nyt Mini Crossword Puzzle Answers March 22

May 20, 2025 -

The Ongoing Battle Car Dealers And The Fight Against Ev Regulations

May 20, 2025

The Ongoing Battle Car Dealers And The Fight Against Ev Regulations

May 20, 2025 -

Tri Godine Sukoba Tadi Osu U E Napad Na Detsu Shmit Uti

May 20, 2025

Tri Godine Sukoba Tadi Osu U E Napad Na Detsu Shmit Uti

May 20, 2025

Latest Posts

-

Huuhkajat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025 -

Huuhkajat Kaellmanin Maalivire Tuo Uutta Uskoa

May 20, 2025

Huuhkajat Kaellmanin Maalivire Tuo Uutta Uskoa

May 20, 2025 -

Jaeaekoe Puola Kaellmanin Ja Hoskosen Tulevaisuus

May 20, 2025

Jaeaekoe Puola Kaellmanin Ja Hoskosen Tulevaisuus

May 20, 2025 -

Bauprojekt Update Architektin Legt Endgueltige Form Fest

May 20, 2025

Bauprojekt Update Architektin Legt Endgueltige Form Fest

May 20, 2025