CMOC Acquires Lumina Gold For $581 Million: A Major China Mining Deal

Table of Contents

The Chinese mining giant, CMOC (China Molybdenum Co. Ltd.), has sent shockwaves through the global mining industry with its momentous acquisition of Lumina Gold Corp for a staggering $581 million. This substantial deal represents a major shift in the global gold market and underscores China's increasingly assertive role in securing vital mineral resources. This article will dissect the details of this significant China mining deal, analyzing its implications for both CMOC and Lumina Gold, and exploring its broader impact on the global gold landscape.

H2: Deal Details and Financial Implications

H3: Acquisition Price and Structure

The $581 million acquisition price reflects a significant premium compared to Lumina Gold's market value prior to the announcement. The exact payment structure remains undisclosed, but it is likely to involve a combination of cash and potentially stock options. The deal is subject to customary closing conditions, including regulatory approvals and shareholder votes.

- Breakdown of the acquisition cost: Further details on the price per share and the overall financial breakdown are expected to be released as the transaction progresses.

- Premium Paid: The premium paid indicates CMOC's strategic urgency and its assessment of Lumina Gold's underlying value and future potential. This premium reflects the value of Lumina Gold's assets, including its exploration projects.

- Financing Methods: CMOC, with its substantial financial resources, is likely to finance the acquisition through a combination of internal resources, debt financing, and potentially strategic partnerships.

H3: CMOC's Strategic Rationale

CMOC's acquisition of Lumina Gold is a strategic move driven by several key factors. It allows CMOC to significantly expand its gold reserves and bolster its position within the global gold mining sector. Securing Lumina Gold's assets also diversifies CMOC’s portfolio, reducing its dependence on other commodities.

- CMOC's Existing Gold Operations: This acquisition complements CMOC's existing mining operations, potentially creating significant synergies in terms of operational efficiency and resource management.

- Lumina Gold's Key Assets: Lumina Gold possesses several key assets, including operating mines and promising exploration projects, all of which contribute to CMOC's strategic expansion goals within the gold mining sector.

- Synergies between CMOC and Lumina Gold: Combining expertise and resources will likely lead to increased efficiencies, reduced operating costs, and accelerated exploration and production.

H3: Impact on Lumina Gold Shareholders

The acquisition presents a significant opportunity for Lumina Gold shareholders. The offer price per share represents a considerable premium over the prevailing market price, providing immediate value to existing investors. The transaction timeline will likely involve a shareholder vote and regulatory approvals.

- Share Price Movement: Lumina Gold's share price experienced a substantial increase following the announcement, reflecting investor confidence in the acquisition.

- Shareholder Reactions and Approvals: Shareholder approval is a crucial step in finalizing the deal, and positive reactions are anticipated given the attractive offer price.

- Long-Term Benefits: While immediate gains are clear for shareholders through the acquisition, the long-term effects will depend on CMOC's management of the acquired assets and its overall success in the gold market.

H2: Geopolitical and Market Impacts

H3: China's Growing Influence in Mining

This acquisition exemplifies China's growing influence and strategic investment in the global mining sector. China's increasing demand for gold, coupled with its focus on securing strategic resources, makes this acquisition a key element of its broader economic strategy.

- China's Strategic Minerals Needs: China's rapid economic growth necessitates securing a reliable supply of strategic minerals, including gold, to support various industries.

- Investment Policies: China's outward foreign investment strategy, particularly in resource-rich countries, reflects its commitment to securing access to critical resources.

- Competition with Other Mining Nations: This acquisition highlights the intensifying competition between China and other major mining nations for control of key gold reserves and production capacity.

H3: Impact on the Global Gold Market

The CMOC acquisition has the potential to subtly reshape the global gold market. While the immediate impact on gold prices may be limited, the deal signals a shift in the power dynamics within the gold mining industry. Increased gold production from Lumina Gold’s assets, under CMOC’s management, could potentially influence market supply.

- Gold Market Analysis: Analysis of market trends before and after the acquisition will help gauge the deal's long-term effects on global gold prices and supply chains.

- Impact on Gold Production: Increased efficiency and investment under CMOC’s ownership could result in higher gold production from Lumina Gold's assets, which would impact market dynamics.

- Implications for Other Gold Mining Companies: This acquisition serves as a benchmark, influencing strategies and potentially triggering further consolidation within the gold mining industry.

H3: Regulatory Considerations

The success of this acquisition depends on navigating various regulatory hurdles. Both Chinese and international regulatory bodies will scrutinize the deal to ensure compliance with all applicable laws and regulations.

- Regulatory Bodies Involved: Relevant agencies in both China and the countries where Lumina Gold operates will review the transaction for antitrust concerns and compliance with environmental regulations.

- Anticipated Review Timelines: The approval process may take several months, depending on the efficiency of the regulatory reviews.

- Potential Challenges: Potential challenges could arise from concerns regarding competition, environmental impact, and adherence to local regulations.

3. Conclusion

The CMOC acquisition of Lumina Gold for $581 million represents a significant development in the global mining industry and underlines China's growing influence in the gold sector. This major China mining deal carries profound implications for CMOC, former Lumina Gold shareholders, and the broader gold market. Understanding the intricate details of this deal—from its financial structure to its geopolitical and regulatory implications—is crucial for investors and industry stakeholders. To stay abreast of the latest developments in this crucial China mining deal and its ripple effects across the global gold market, continue to follow news and analyses related to CMOC and the evolving landscape of gold production. Learn more about the ongoing impact of this significant China mining deal and its implications for the future.

Featured Posts

-

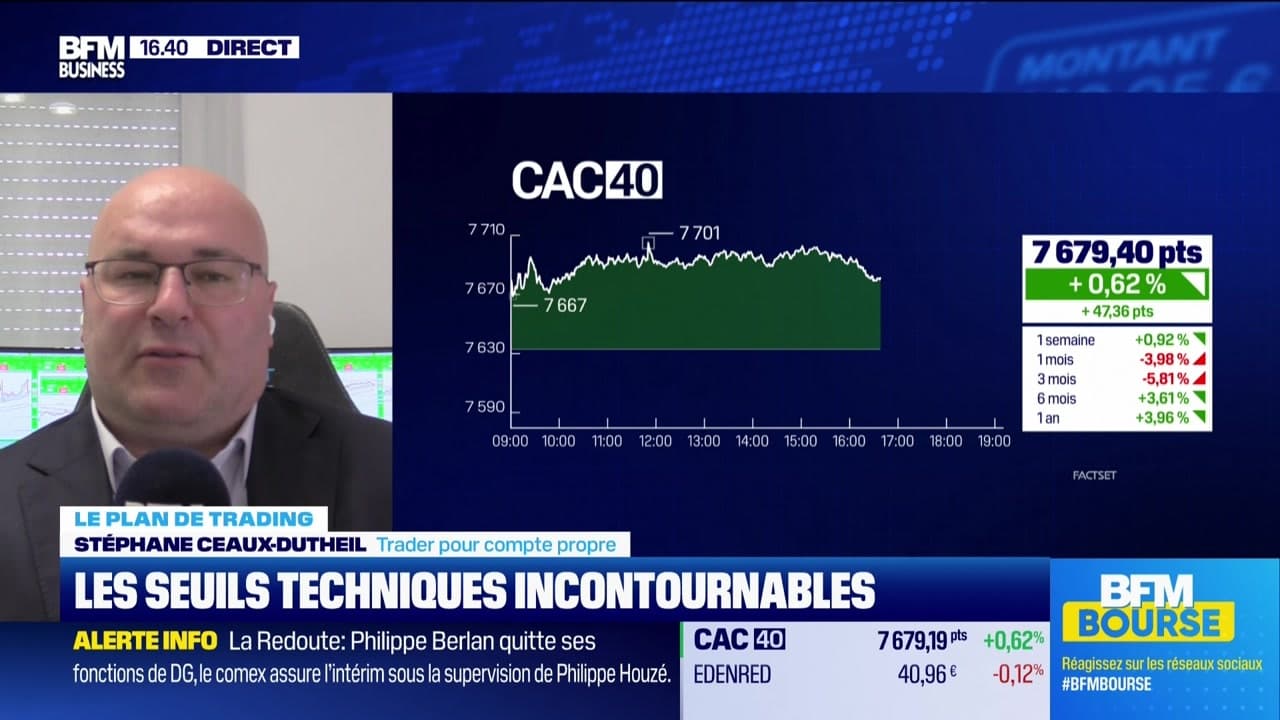

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Optimale

Apr 23, 2025

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Optimale

Apr 23, 2025 -

2 Brewers Players We Ll Miss In 2024 2 We Wont

Apr 23, 2025

2 Brewers Players We Ll Miss In 2024 2 We Wont

Apr 23, 2025 -

Thlyl Ser Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 2 2025

Apr 23, 2025

Thlyl Ser Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 2 2025

Apr 23, 2025 -

Canadian Immigration Dreams Shattered Impact Of Trump Administration Policies

Apr 23, 2025

Canadian Immigration Dreams Shattered Impact Of Trump Administration Policies

Apr 23, 2025 -

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025